公司简介

| 兴业金融 Review Summary | |

| 成立时间 | 1983 |

| 注册国家/地区 | 马来西亚 |

| 监管 | SFC(已撤销) |

| 交易产品 | 期货指数、商品 |

| 服务 | 股票保证金融资、外国股票融资、自由融资、员工股票期权计划(ESOS)融资、首次公开募股(IPO)融资 |

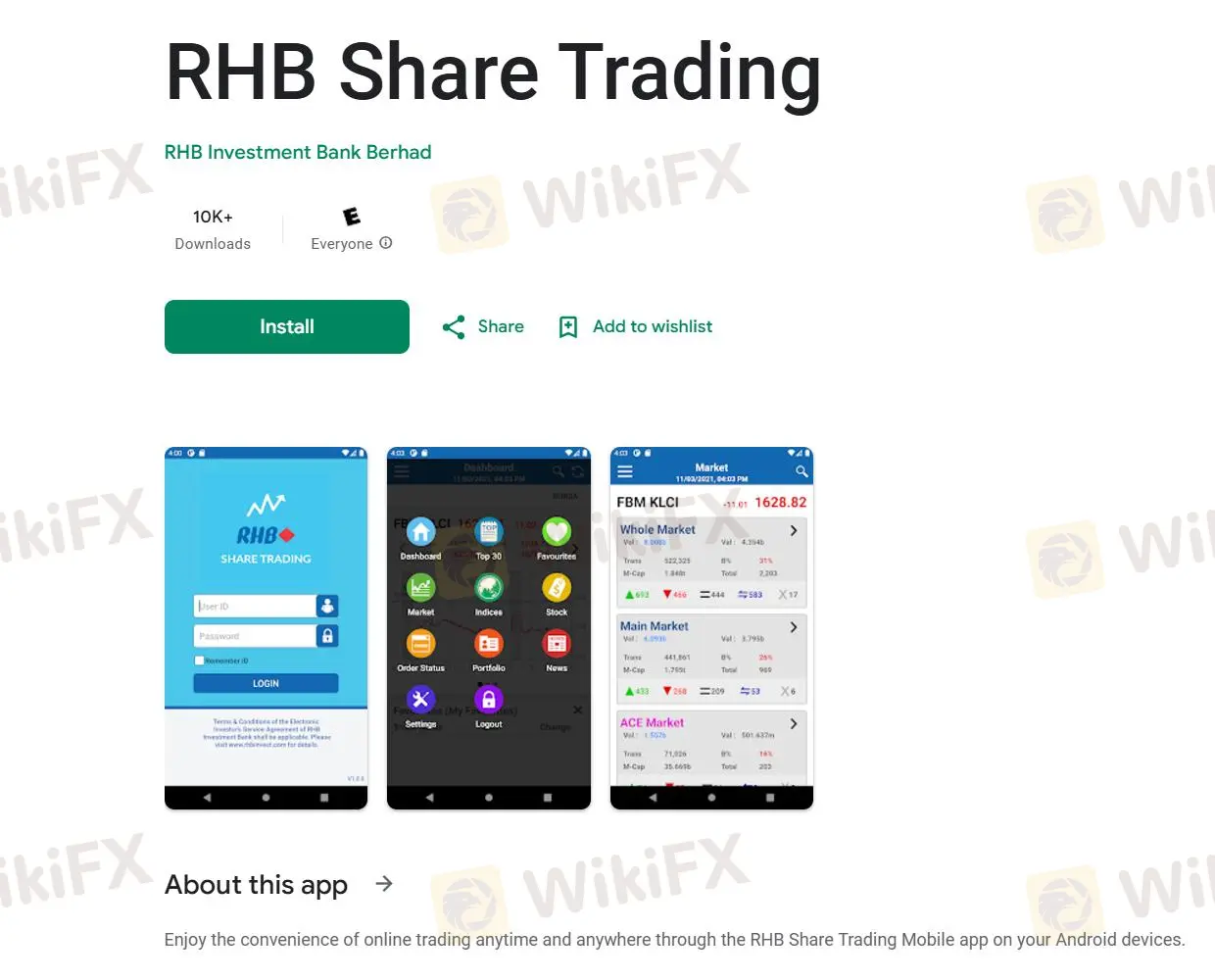

| 交易平台 | 兴业金融 股票交易 |

| 客户支持 | 电话:03-2113 8118;+603 – 7890 4700 |

| 传真:+603 – 7890 4670 | |

| 电子邮件:support@rhbgroup.com | |

| 注册地址:吉隆坡图拉曼大道兴业金融中心一座10楼,邮编50400,马来西亚联邦领地 | |

| 分支机构联系方式:https://www.rhbinvest.com/locate_us.html | |

兴业金融 信息

兴业金融 投资银行有限公司是一家总部位于马来西亚的金融机构,在全国范围内拥有50多家分支机构。它主要提供指数和商品的期货交易,以及向客户提供融资服务。还提供伊斯兰经纪服务,以满足需要遵守伊斯兰教法的客户。此外,该公司还提供视频库,涵盖各种主题,为交易者提供成功交易所需的知识。

然而,值得注意的是,该公司在SFC撤销的监管状态下运营,表明其不符合监管机构的要求。

优点和缺点

| 优点 | 缺点 |

| 多年的行业经验 | 被撤销的SFC许可证 |

| 多样化的金融服务 | |

| 全面的客户支持 |

兴业金融 是否合法?

兴业金融 声称受到SFC(香港证券期货事务监察委员会)监管,许可证编号为AMF103。然而,许可证状态为“已撤销”,表明该经纪商可能违反了机构规定或未能满足监管要求。这对其信誉和合法性造成了负面影响。

| 监管国家 | 监管机构 | 当前状态 | 受监管实体 | 许可证类型 | 许可证编号 |

| SFC | 已撤销 | 兴业金融 期货香港有限公司 | 期货合约交易 | AMF103 |

交易产品

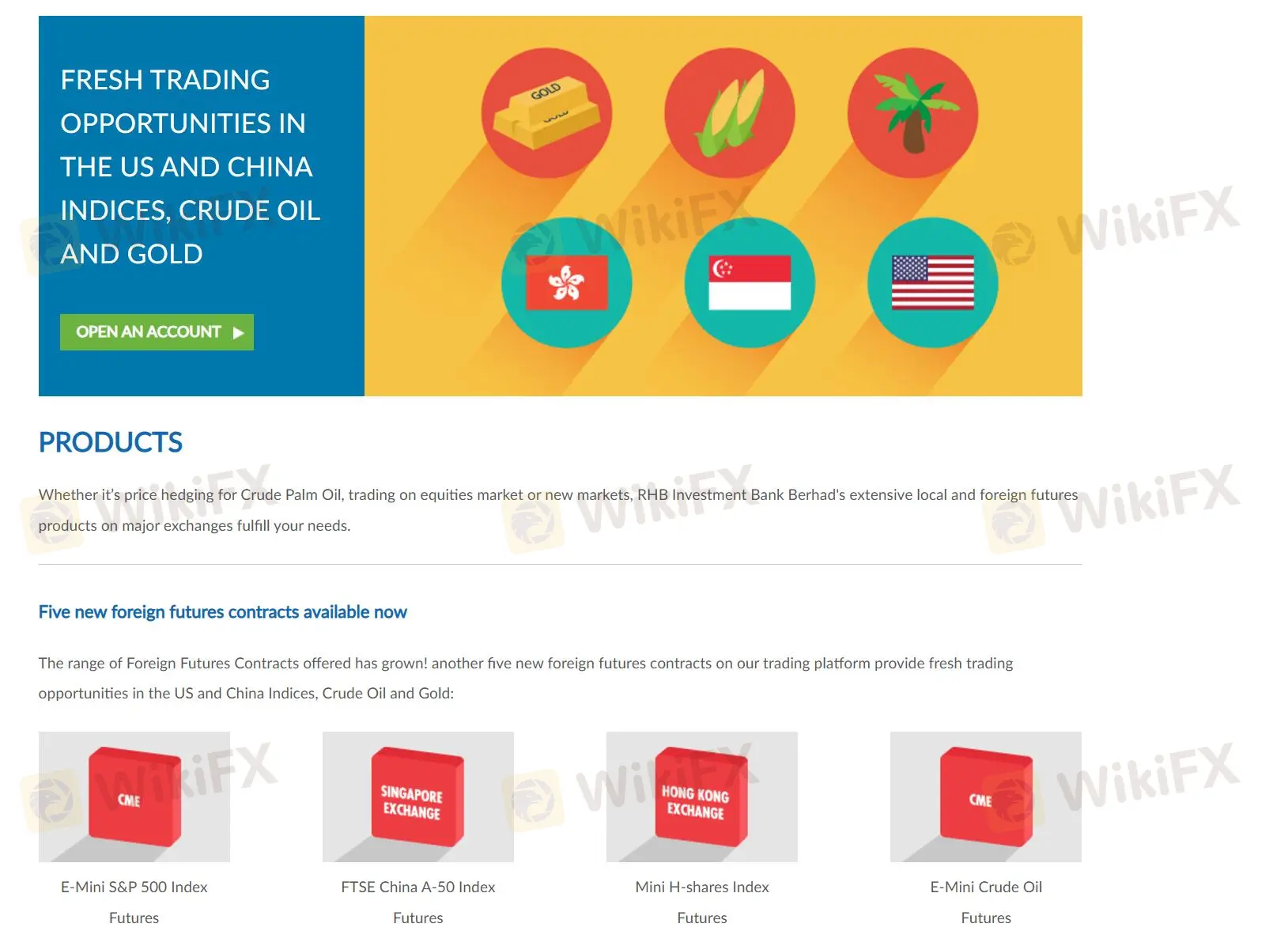

兴业金融的产品组合包括Bursa Malaysia的衍生品,如原油期货和黄金期货,以及一系列不断扩大的外国期货合约,如E-Mini S&P 500、富时中国A-50指数和E-Mini原油期货。

费用/利率

| 服务 | 设施费 | 利率 |

| 股票保证金融资 | ❌ | 按套餐收费;不滚动手续费 |

| 外国股票融资 | ≥ 融资额度的0.50%(一次性支付) | SBR(3.00%)+ 2.30%,最低4.55%年化 |

| 自由融资 | 定制 | 根据投资组合和策略定制 |

交易平台

兴业金融提供基于Web的交易平台“兴业金融 Share Trading”,并提供iOS和Android手机的应用程序版本,可以随时随地进行交易。