Buod ng kumpanya

| RHB Buod ng Pagsusuri | |

| Itinatag | 1983 |

| Rehistradong Bansa/Rehiyon | Malaysia |

| Regulasyon | SFC (Nawawala) |

| Mga Produkto sa Pagkalakalan | Mga indeks ng hinaharap, mga komoditi |

| Mga Serbisyo | Share Margin Financing, Foreign Shares Financing, Descretionary Financing, Employee Share Option Scheme (ESOS) financing, Initial Public Offering (IPO) Financing |

| Platform ng Pagkalakalan | RHB Share Trading |

| Suporta sa Customer | Tel: 03-2113 8118; +603 – 7890 4700 |

| Fax: +603 – 7890 4670 | |

| Email: support@rhbgroup.com | |

| Nakarehistrong address: Antas 10, Tower One, RHB Centre, Jalan Tun Razak, 50400 Kuala Lumpur, Wilayah Persekutuan, Malaysia | |

| Mga detalye ng contact para sa mga sangay: https://www.rhbinvest.com/locate_us.html | |

Impormasyon tungkol sa RHB

Ang RHB Investment Bank Berhad ay isang kumpanyang pinansyal na nakabase sa Malaysia na may higit sa 50 sangay sa buong bansa. Nag-aalok ito ng mga kalakal sa hinaharap lalo na sa mga indeks at komoditi, pati na rin sa mga serbisyong pautang sa mga kliyente. Mayroon din mga serbisyong pang-Islamikong pagkalakalan para sa mga nangangailangan na sumunod sa mga batas ng Sharia. Bukod dito, nag-aalok ang kumpanya ng isang video gallery na may iba't ibang mga paksa upang bigyan ang mga mangangalakal ng kinakailangang kaalaman para sa matagumpay na pagkalakal.

Gayunpaman, isang bagay na dapat pansinin ay ang kumpanya ay nag-ooperate sa ilalim ng regulatory status ng SFC na nawawala, na nagpapahiwatig ng hindi pagsunod sa awtoridad.

Mga Kapakinabangan at Kadahilanan

| Kapakinabangan | Kadahilanan |

| Maraming taon ng karanasan sa industriya | Nawawalang lisensya ng SFC |

| Iba't ibang mga serbisyong pinansyal | |

| Kumpletong suporta sa customer |

Tunay ba ang RHB?

Ang RHB ay nagmamalaki na regulated ng SFC (Securities and Futures Commission ng Hong Kong) na may mga lisensya na may bilang na AMF103. Gayunpaman, ang status ng lisensya ay "Nawawala", na nagpapahiwatig na maaaring nilabag ng broker ang mga patakaran ng institusyon o hindi natugunan ang mga kinakailangang regulasyon. Ito ay nagdudulot ng pagdududa sa kredibilidad at katumpakan nito.

| Rehistradong Bansa | Regulator | Kasalukuyang Katayuan | Rehistradong Entidad | Uri ng Lisensya | Numero ng Lisensya |

| SFC | Nawawala | RHB Futures Hong Kong Limited | Pagsasangkot sa mga kontrata sa hinaharap | AMF103 |

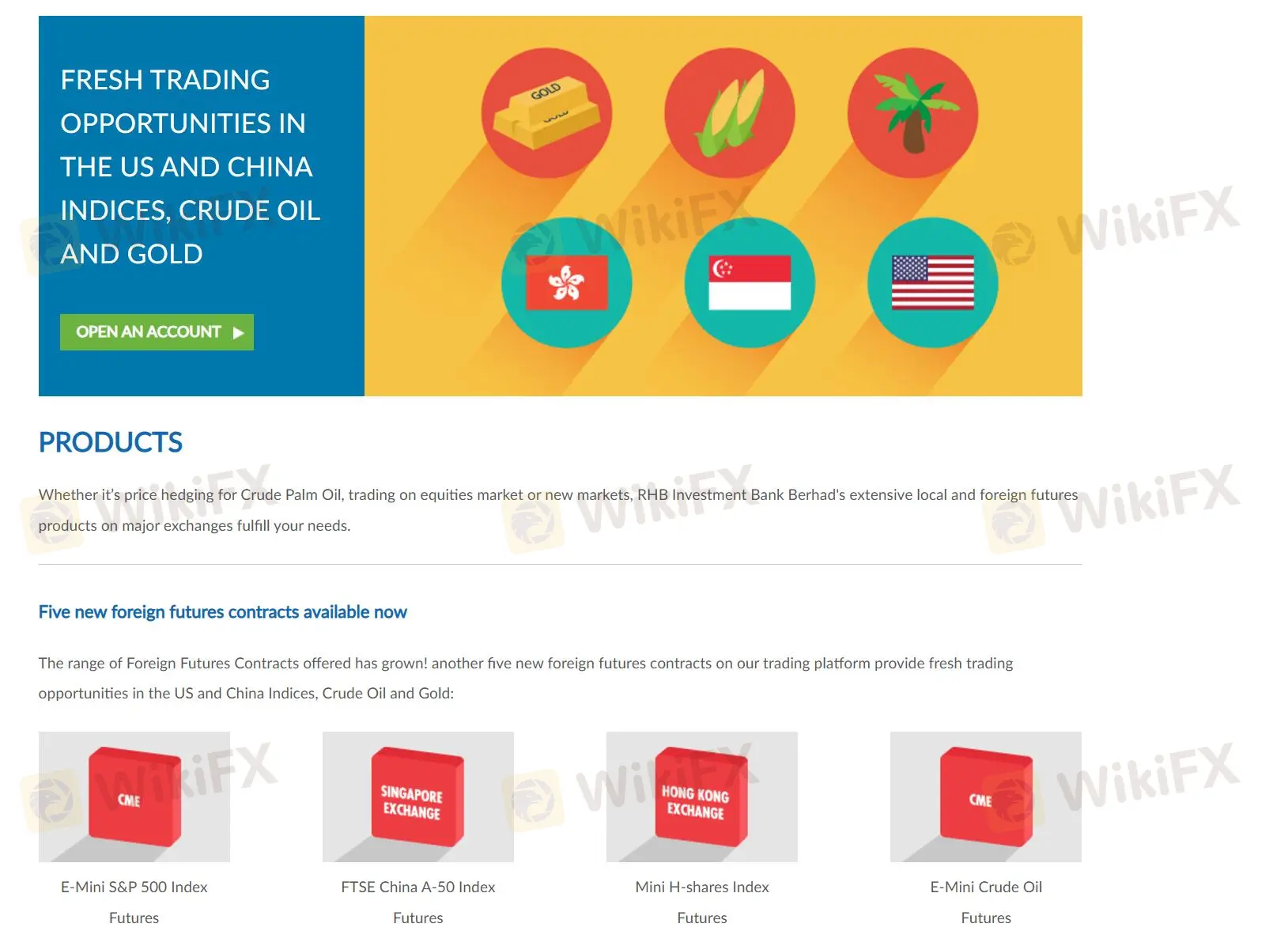

Mga Produkto sa Pagkalakalan

Ang portfolio ng mga produkto ni RHB ay kasama ang mga derivatives sa Bursa Malaysia tulad ng Crude Palm Oil Futures at Gold Futures, kasama ang lumalawak na hanay ng mga foreign futures contracts tulad ng E-Mini S&P 500, FTSE China A-50 Index, at E-Mini Crude Oil Futures.

Mga Bayarin/Tasa ng Interes

| Serbisyo | Bayad sa Pasilidad | Tasa ng Interes |

| Share Margin Financing | ❌ | Package-specific; walang rollover fees |

| Foreign Shares Financing | ≥ 0.50% ng Facility Limit (babayaran nang buo) | SBR (3.00%) + 2.30%, min 4.55% p.a. |

| Discretionary Financing | Customised | Customised base sa portfolio at mga estratehiya |

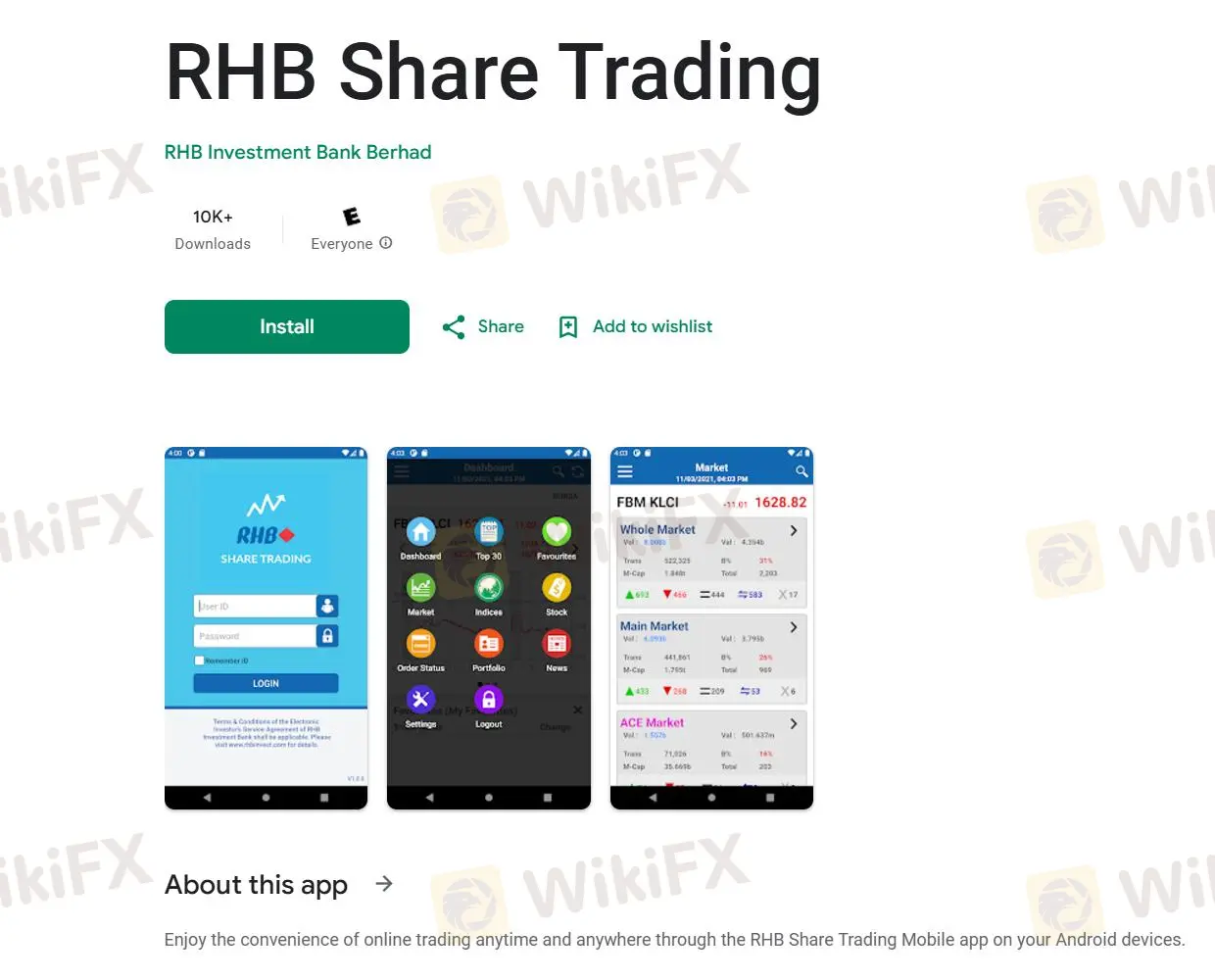

Plataporma ng Pagtitinda

Nag-aalok si RHB ng isang web-based na plataporma ng pagtitinda na tinatawag na “RHB Share Trading”, na mayroong bersyon ng app na available sa parehong iOS at Android phones para makapag-trade kahit saan, kahit nasa paglalakbay.