Resumo da empresa

| RHB Resumo da Revisão | |

| Fundado | 1983 |

| País/Região Registrado | Malásia |

| Regulação | SFC (Revogado) |

| Produtos de Negociação | Índices futuros, commodities |

| Serviços | Financiamento de Margem de Ações, Financiamento de Ações Estrangeiras, Financiamento Discricionário, Financiamento do Esquema de Opção de Compra de Ações de Funcionários (ESOS), Financiamento de Oferta Pública Inicial (IPO) |

| Plataforma de Negociação | RHB Negociação de Ações |

| Suporte ao Cliente | Tel: 03-2113 8118; +603 – 7890 4700 |

| Fax: +603 – 7890 4670 | |

| Email: support@rhbgroup.com | |

| Endereço registrado: Nível 10, Torre Um, RHB Centre, Jalan Tun Razak, 50400 Kuala Lumpur, Wilayah Persekutuan, Malásia | |

| Detalhes de contato para escritórios filiais: https://www.rhbinvest.com/locate_us.html | |

Informações sobre RHB

RHB Investment Bank Berhad é uma entidade financeira sediada na Malásia que possui mais de 50 filiais em todo o país. Oferece principalmente negociação de futuros em índices e commodities, bem como serviços de financiamento aos clientes. Serviços de corretagem islâmica também estão disponíveis para aqueles que precisam cumprir as leis da Sharia. Além disso, a empresa oferece uma galeria de vídeos com diversos temas para equipar os traders com o conhecimento necessário para uma negociação bem-sucedida.

No entanto, vale ressaltar que a empresa opera sob o status regulatório de SFC revogado, indicando não conformidade com a autoridade.

Prós e Contras

| Prós | Contras |

| Experiência na indústria por muitos anos | Licença SFC revogada |

| Serviços financeiros diversos | |

| Suporte abrangente ao cliente |

É RHB Legítimo?

RHB afirma ser regulado pela SFC (Comissão de Valores Mobiliários e Futuros de Hong Kong) com licenças numeradas como AMF103. No entanto, o status da licença é "Revogado", indicando que a corretora pode ter violado as regras das instituições ou não atendido aos requisitos regulatórios. Isso lança dúvidas sobre sua credibilidade e legitimidade.

| País Regulado | Regulador | Status Atual | Entidade Regulada | Tipo de Licença | Número da Licença |

| SFC | Revogado | RHB Futures Hong Kong Limited | Negociação de contratos futuros | AMF103 |

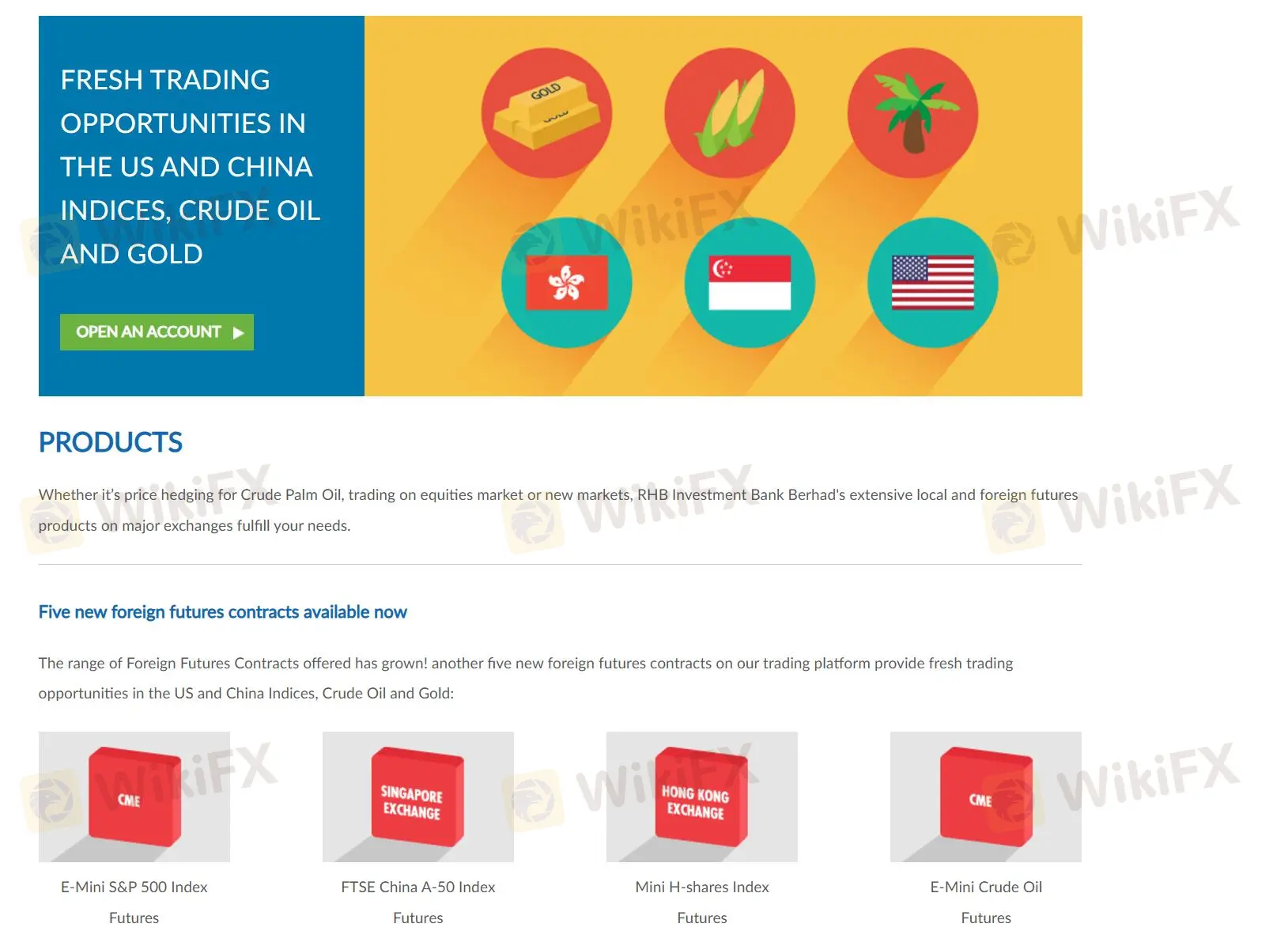

Produtos de Negociação

A carteira de produtos da RHB inclui derivativos da Bursa Malaysia, como Futuros de Óleo de Palma Bruto e Futuros de Ouro, juntamente com uma variedade crescente de contratos futuros estrangeiros, como E-Mini S&P 500, Índice FTSE China A-50 e Futuros de Petróleo Bruto E-Mini.

Taxas/Taxas de Juros

| Serviço | Taxa de Instalação | Taxa de Juros |

| Financiamento de Margem de Ações | ❌ | Específico do pacote; sem taxas de rolagem |

| Financiamento de Ações Estrangeiras | ≥ 0,50% do Limite da Instalação (pagável antecipadamente) | SBR (3,00%) + 2,30%, mínimo de 4,55% a.a. |

| Financiamento Discricionário | Personalizado | Personalizado com base na carteira e estratégias |

Plataforma de Negociação

RHB oferece uma plataforma de negociação baseada na web chamada "RHB Share Trading", com versão de aplicativo disponível em telefones iOS e Android para negociar em qualquer lugar, até mesmo em movimento.