Perfil de la compañía

| RHB Resumen de la revisión | |

| Fundado | 1983 |

| País/Región Registrado | Malasia |

| Regulación | SFC (Revocado) |

| Productos de Trading | Índices futuros, materias primas |

| Servicios | Financiamiento de margen de acciones, Financiamiento de acciones extranjeras, Financiamiento discrecional, Esquema de opciones de acciones para empleados (ESOS), Financiamiento de Oferta Pública Inicial (IPO) |

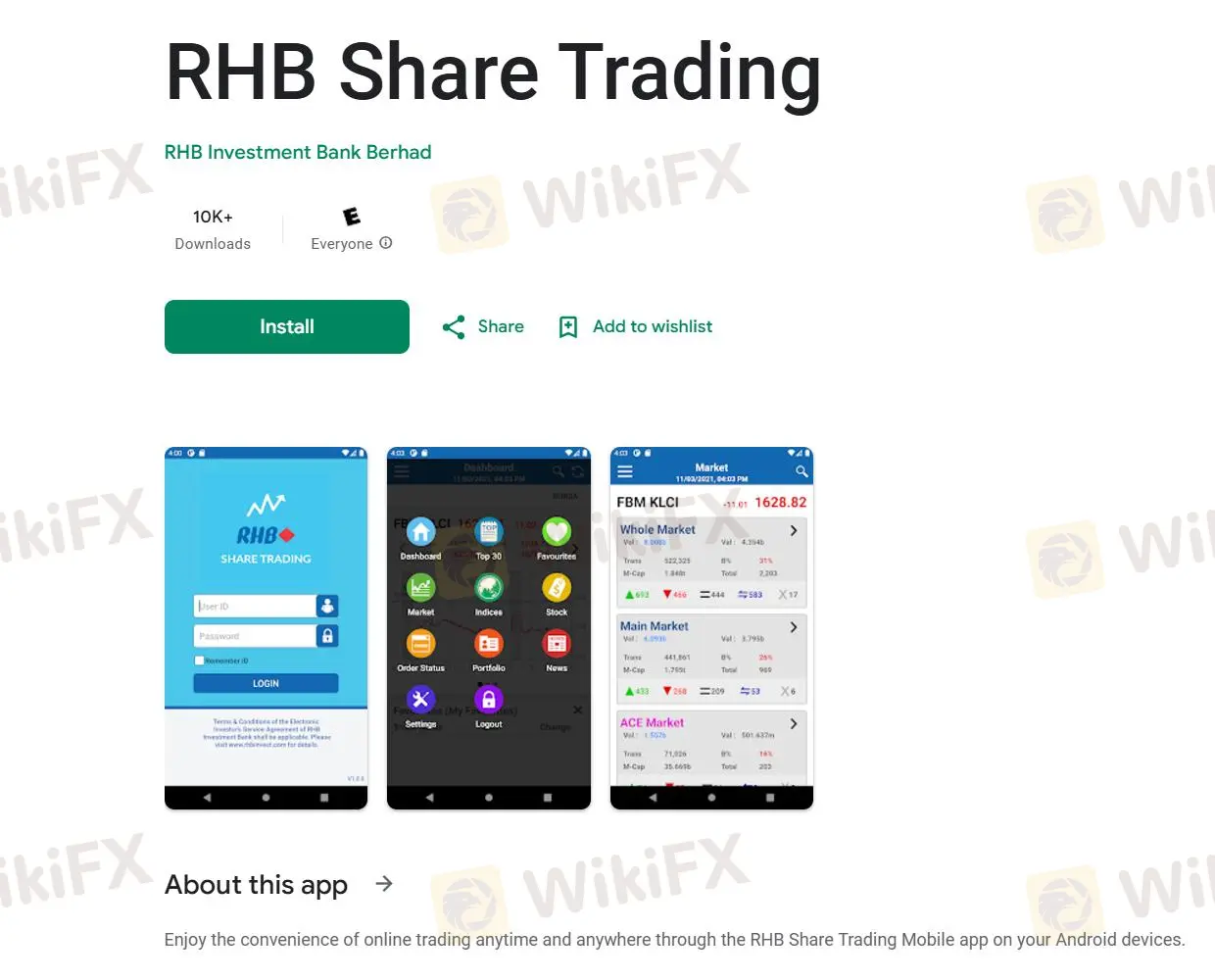

| Plataforma de Trading | RHB Trading de Acciones |

| Soporte al Cliente | Tel: 03-2113 8118; +603 – 7890 4700 |

| Fax: +603 – 7890 4670 | |

| Email: support@rhbgroup.com | |

| Dirección registrada: Nivel 10, Torre Uno, RHB Centre, Jalan Tun Razak, 50400 Kuala Lumpur, Wilayah Persekutuan, Malasia | |

| Detalles de contacto de las sucursales: https://www.rhbinvest.com/locate_us.html | |

Información de RHB

RHB Investment Bank Berhad es una entidad financiera con sede en Malasia que cuenta con más de 50 sucursales en todo el país. Ofrece principalmente operaciones de futuros en índices y materias primas, así como servicios de financiamiento a los clientes. También están disponibles servicios de intermediación islámica para aquellos que necesitan cumplir con las leyes de la Sharia. Además, la empresa ofrece una galería de videos con todo tipo de temas para equipar a los traders con los conocimientos necesarios para operar con éxito.

Sin embargo, vale la pena señalar que la empresa opera bajo el estatus regulatorio de SFC revocado, lo que indica incumplimiento con la autoridad.

Pros y Contras

| Pros | Contras |

| Muchos años de experiencia en la industria | Licencia SFC revocada |

| Diversos servicios financieros | |

| Soporte al cliente integral |

¿Es RHB Legítimo?

RHB afirma estar regulado por SFC (Comisión de Valores y Futuros de Hong Kong) con licencias numeradas como AMF103. Sin embargo, el estado de la licencia es "Revocado", lo que indica que el bróker podría haber violado las normas de las instituciones o no haber cumplido con los requisitos regulatorios. Esto arroja dudas sobre su credibilidad y legitimidad.

| País Regulado | Regulador | Estado Actual | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| SFC | Revocado | RHB Futures Hong Kong Limited | Operaciones de contratos de futuros | AMF103 |

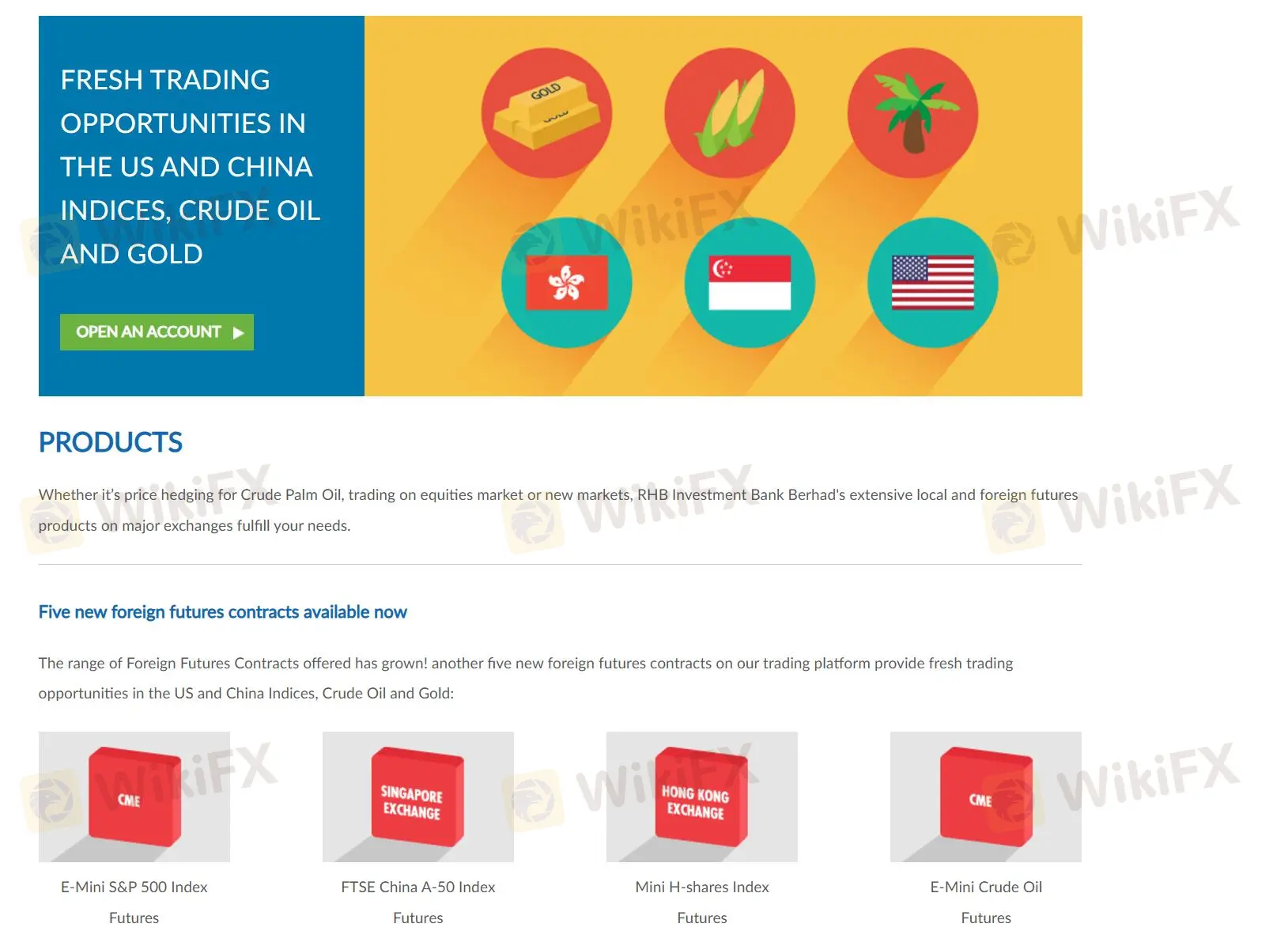

Productos de Trading

La cartera de productos de RHB incluye derivados de Bursa Malaysia como Futuros de Aceite de Palma Crudo y Futuros de Oro, junto con una amplia gama de contratos de futuros extranjeros como E-Mini S&P 500, Índice FTSE China A-50 y Futuros de Petróleo Crudo E-Mini.

Tarifas/Tasas de Interés

| Servicio | Tarifa de Instalaciones | Tasa de Interés |

| Financiamiento de Margen de Acciones | ❌ | Específico del paquete; sin tarifas de renovación |

| Financiamiento de Acciones Extranjeras | ≥ 0.50% del Límite de Instalaciones (pagadero por adelantado) | SBR (3.00%) + 2.30%, mínimo 4.55% anual |

| Financiamiento Discrecional | Personalizado | Personalizado según la cartera y las estrategias |

Plataforma de Trading

RHB ofrece una plataforma de trading basada en web llamada "RHB Share Trading", con versión de aplicación disponible en teléfonos iOS y Android para operar en cualquier lugar, incluso sobre la marcha.