Şirket özeti

| RHB İnceleme Özeti | |

| Kuruluş | 1983 |

| Kayıtlı Ülke/Bölge | Malezya |

| Düzenleme | SFC (İptal Edildi) |

| İşlem Ürünleri | Gelecek endeksleri, emtialar |

| Hizmetler | Pay Marjı Finansmanı, Yabancı Paylar Finansmanı, Takdiri Finansman, Çalışan Pay Opsiyon Planı (ESOS) finansmanı, Halka Arz Finansmanı |

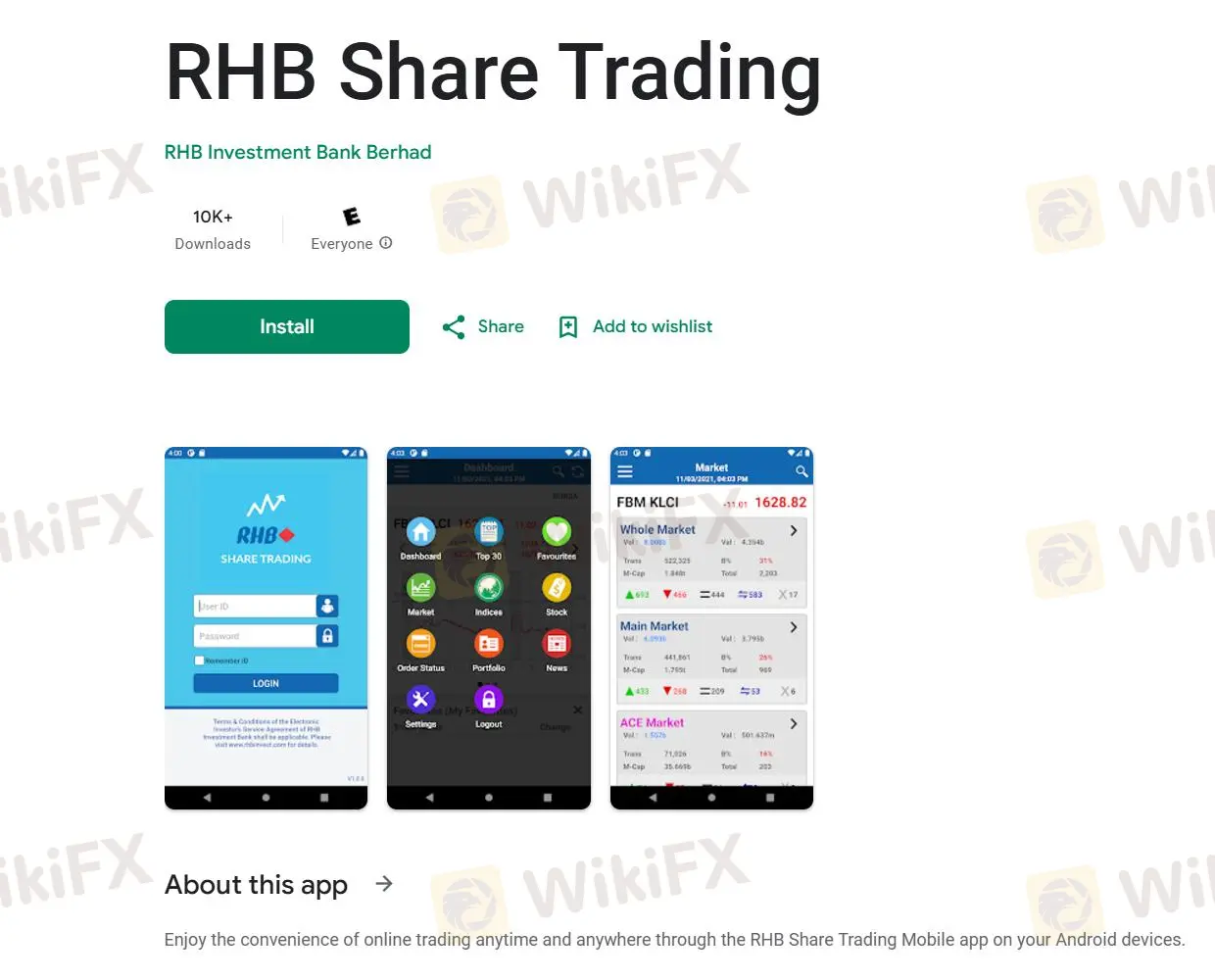

| İşlem Platformu | RHB Pay İşlemleri |

| Müşteri Desteği | Tel: 03-2113 8118; +603 – 7890 4700 |

| Faks: +603 – 7890 4670 | |

| E-posta: support@rhbgroup.com | |

| Kayıtlı adres: Level 10, Tower One, RHB Centre, Jalan Tun Razak, 50400 Kuala Lumpur, Wilayah Persekutuan, Malezya | |

| Şube iletişim bilgileri: https://www.rhbinvest.com/locate_us.html | |

RHB Bilgileri

RHB Yatırım Bankası Berhad, Malezya merkezli bir finansal kuruluştur ve ülke genelinde 50'den fazla şubesi bulunmaktadır. Müşterilere genellikle endeksler ve emtialar üzerinde vadeli işlemler ve finansman hizmetleri sunmaktadır. Şeriat kurallarına uyması gerekenler için İslami aracılık hizmetleri de mevcuttur. Ayrıca, firma, başarılı işlem yapabilmek için gerekli bilgilerle tüccarları donatmak için çeşitli konuları içeren bir video galerisi sunmaktadır.

Ancak, dikkate değer bir nokta, şirketin SFC iptal edilmiş düzenleme durumu altında faaliyet göstermesidir, bu da otoriteye uyumsuzluğu göstermektedir.

Artıları ve Eksileri

| Artılar | Eksiler |

| Çok yıllık sektör deneyimi | İptal edilmiş SFC lisansı |

| Çeşitli finansal hizmetler | |

| Kapsamlı müşteri desteği |

RHB Güvenilir mi?

RHB, SFC (Hong Kong Menkul Kıymetler ve Vadeli İşlemler Komisyonu) tarafından AMF103 lisans numaralarıyla düzenlendiğini iddia etmektedir. Ancak, lisans durumu "İptal Edildi" olarak belirtilmiştir, bu da aracı kurumun kurumun kurallarını ihlal etmiş olabileceğini veya düzenleyici gereksinimleri karşılayamamış olabileceğini göstermektedir. Bu, itibar ve meşruiyetine gölge düşürmektedir.

| Düzenlenen Ülke | Düzenleyici | Mevcut Durum | Düzenlenen Kuruluş | Lisans Türü | Lisans Numarası |

| SFC | İptal Edildi | RHB Futures Hong Kong Limited | Vadeli işlem sözleşmeleriyle uğraşma | AMF103 |

İşlem Ürünleri

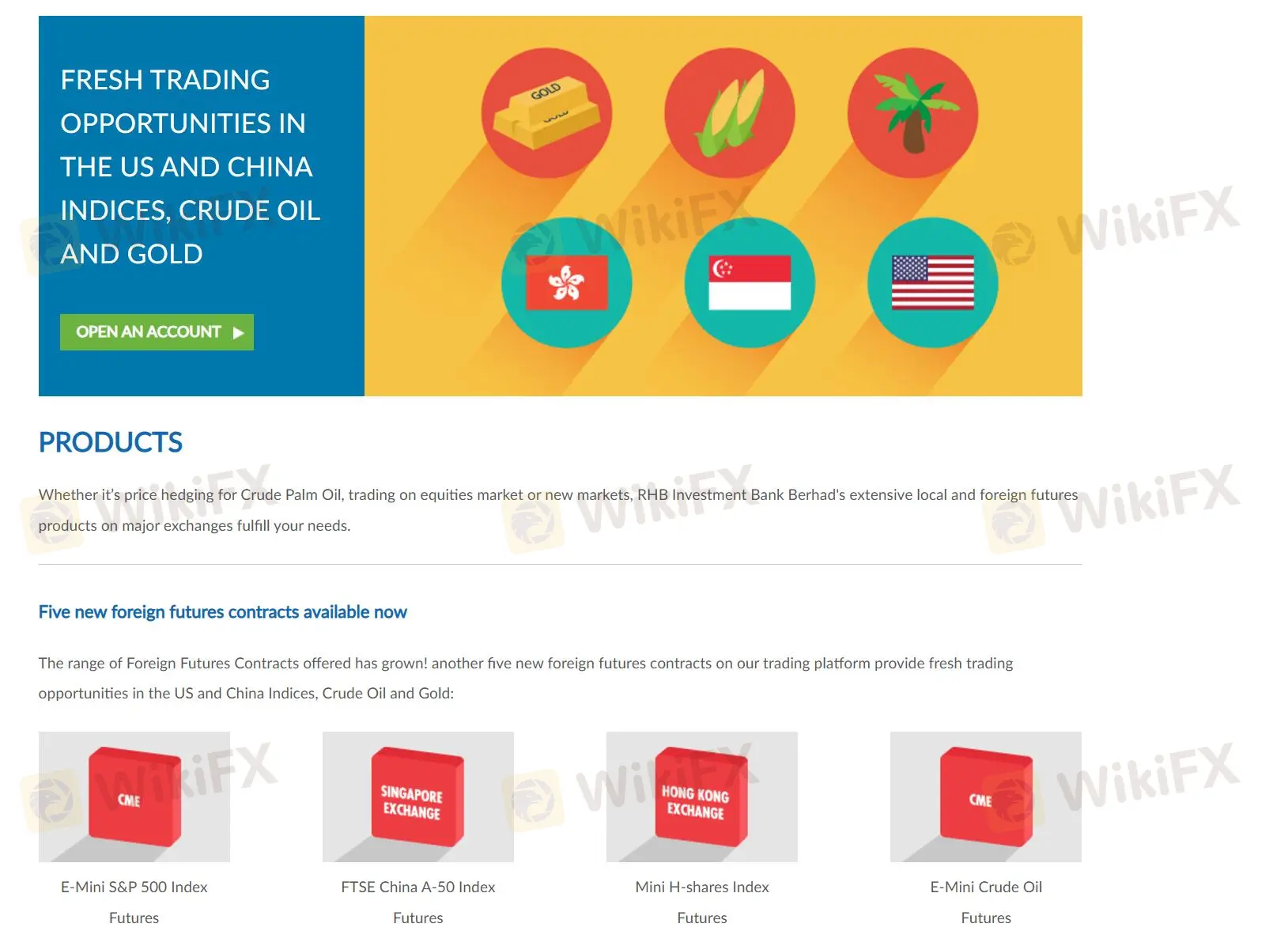

RHB'nin ürün portföyü, Ham Palm Yağı Vadeli İşlemleri ve Altın Vadeli İşlemleri gibi Bursa Malaysia türevleri ile birlikte E-Mini S&P 500, FTSE China A-50 Endeksi ve E-Mini Ham Petrol Vadeli İşlemleri gibi genişleyen bir dizi yabancı vadeli işlem sözleşmesi içermektedir.

Ücretler/Faiz Oranları

| Hizmet | Tesis Ücreti | Faiz Oranı |

| Pay Marjı Finansmanı | ❌ | Paket özel; yeniden değerleme ücreti yok |

| Yabancı Paylar Finansmanı | ≥ Tesis Limitinin %0.50'si (peşin ödenir) | SBR (3.00%) + 2.30%, min 4.55% yıllık |

| Tercihli Finansman | Özelleştirilmiş | Portföye ve stratejilere dayalı olarak özelleştirilmiş |

İşlem Platformu

RHB, her yerde hatta hareket halindeyken bile işlem yapmak için iOS ve Android telefonlarda kullanılabilen bir web tabanlı işlem platformu olan “RHB Pay İşlemleri”ni sunmaktadır.