Company Summary

| Ebury Review Summary | |

| Founded | 2009 |

| Registered Country | United Kingdom |

| Regulation | FCA (Exceed) |

| Services | Payments, FX risk management, business lending, mass payments, industry-specific solutions (e-commerce, NGOs, maritime, institutions) |

| Digital Platform | Online Portal, Mobile App, API |

| Customer Support | Phone: +44 (0) 20 3872 6670 |

| Email: info@ebury.com | |

| Address: 100 Victoria Street, SW1E 5JL, London | |

Ebury Information

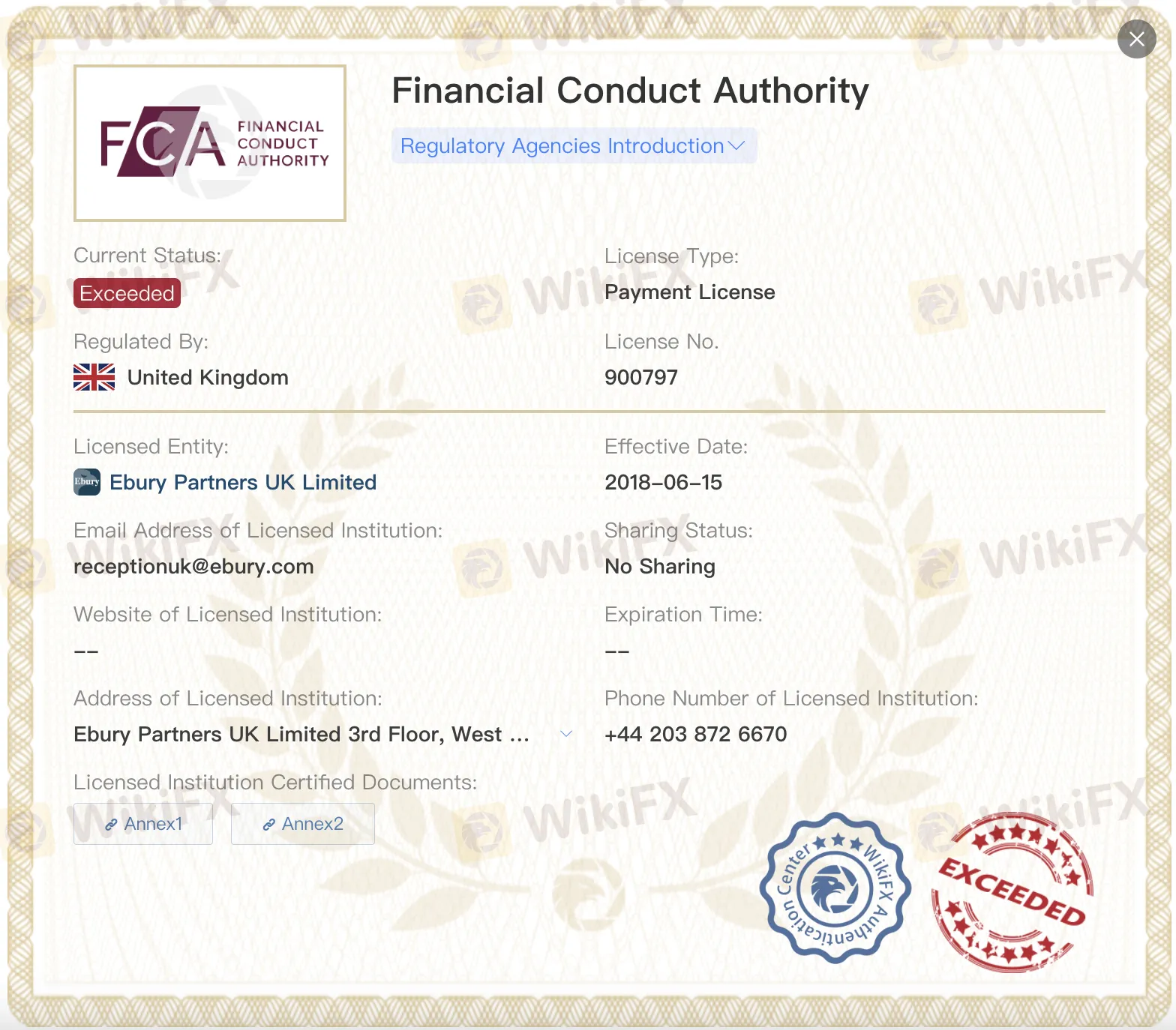

Ebury, a regulated financial institution accredited by the Financial Conduct Authority, was created in the United Kingdom in 2009. However, the regulation's status is “Exceeded”. It uses digital technology to provide a wide range of services to multinational organizations and institutional investors, such as cross-border payments, currency risk management, and business financing.

Pros and Cons

| Pros | Cons |

| Regulated by FCA in the UK | Licenses“Exceeded” |

| Wide range of global financial services | Limited information about fees |

| Supports both corporate and institutional clients |

Is Ebury Legit?

Yes, it is regulated by the UK Financial Conduct Authority (FCA) under two licences: a Payment License (No. 900797) and an Investment Advisory License (No. 784063). However, both licenses are listed “Exceeded”.

Products and Services

Ebury provides global financial solutions, including payments, FX risk management, and corporate loans. It also offers specialist services in fields such as e-commerce, charity, and marine.

| Segment | Category | Service |

| Corporates | Products | Payments & Collections |

| FX Risk Management | ||

| Business Lending | ||

| Mass Payments | ||

| Industry Solutions | E-commerce | |

| Charities and NGOs | ||

| Maritime (New) | ||

| Institutions | Institutional | Ebury Institutional Solutions |

| Global Accounts | ||

| Risk Management | ||

| Global Payments | ||

| Fund Financing Matching (New) |

Digital Platform

Through its website, mobile app, and API connections, Ebury provides a safe and easy-to-use digital platform. Companies of all sizes can use these tools to do business around the world, keep track of their money, and automate tasks.

| Platform | Key Features |

| Ebury Online | Simple interface, enhanced reporting, secure global payments, expert support |

| Mobile App | Manage cash flows on the go, track transactions, two-factor authentication |

| API | Fast integration, automate admin tasks, extend product offerings, scalable tools |