Perfil de la compañía

| Ebury Resumen de la reseña | |

| Establecido | 2009 |

| País registrado | Reino Unido |

| Regulación | FCA (Excedido) |

| Servicios | Pagos, gestión de riesgos de divisas, préstamos comerciales, pagos masivos, soluciones específicas por industria (comercio electrónico, ONG, marítimo, instituciones) |

| Plataforma digital | Portal en línea, aplicación móvil, API |

| Soporte al cliente | Teléfono: +44 (0) 20 3872 6670 |

| Correo electrónico: info@ebury.com | |

| Dirección: 100 Victoria Street, SW1E 5JL, Londres | |

Información de Ebury

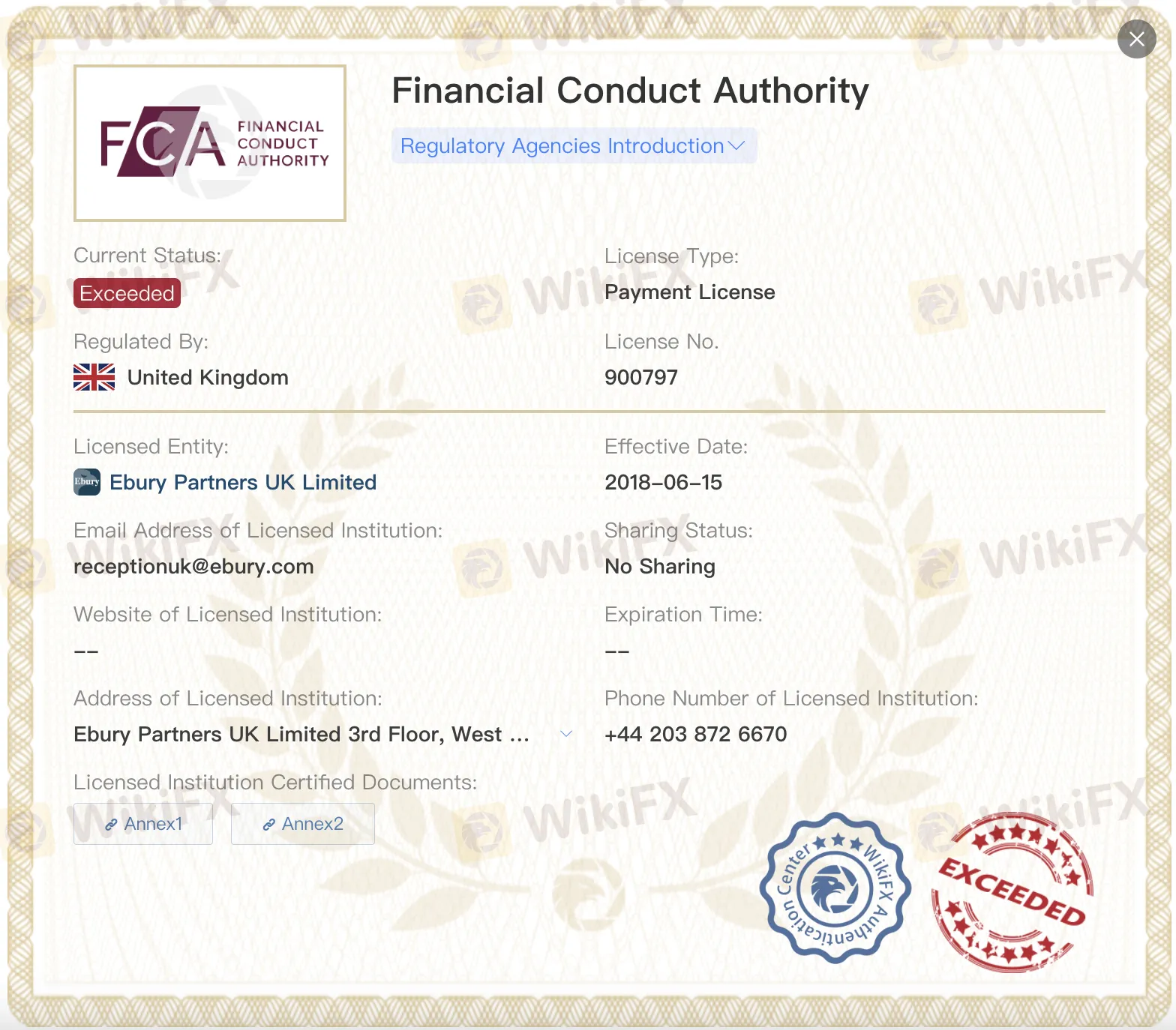

Ebury, una institución financiera regulada acreditada por la Autoridad de Conducta Financiera, se creó en el Reino Unido en 2009. Sin embargo, el estado de regulación es "Excedido". Utiliza tecnología digital para ofrecer una amplia gama de servicios a organizaciones multinacionales e inversores institucionales, como pagos transfronterizos, gestión de riesgos cambiarios y financiamiento empresarial.

Pros y contras

| Pros | Contras |

| Regulado por la FCA en el Reino Unido | Licencias "Excedido" |

| Amplia gama de servicios financieros globales | Información limitada sobre tarifas |

| Compatible con clientes corporativos e institucionales |

¿Es Ebury legítimo?

Sí, está regulado por la Autoridad de Conducta Financiera del Reino Unido (FCA) bajo dos licencias: una Licencia de Pagos (N.º 900797) y una Licencia de Asesoramiento en Inversiones (N.º 784063). Sin embargo, ambas licencias están listadas como "Excedido".

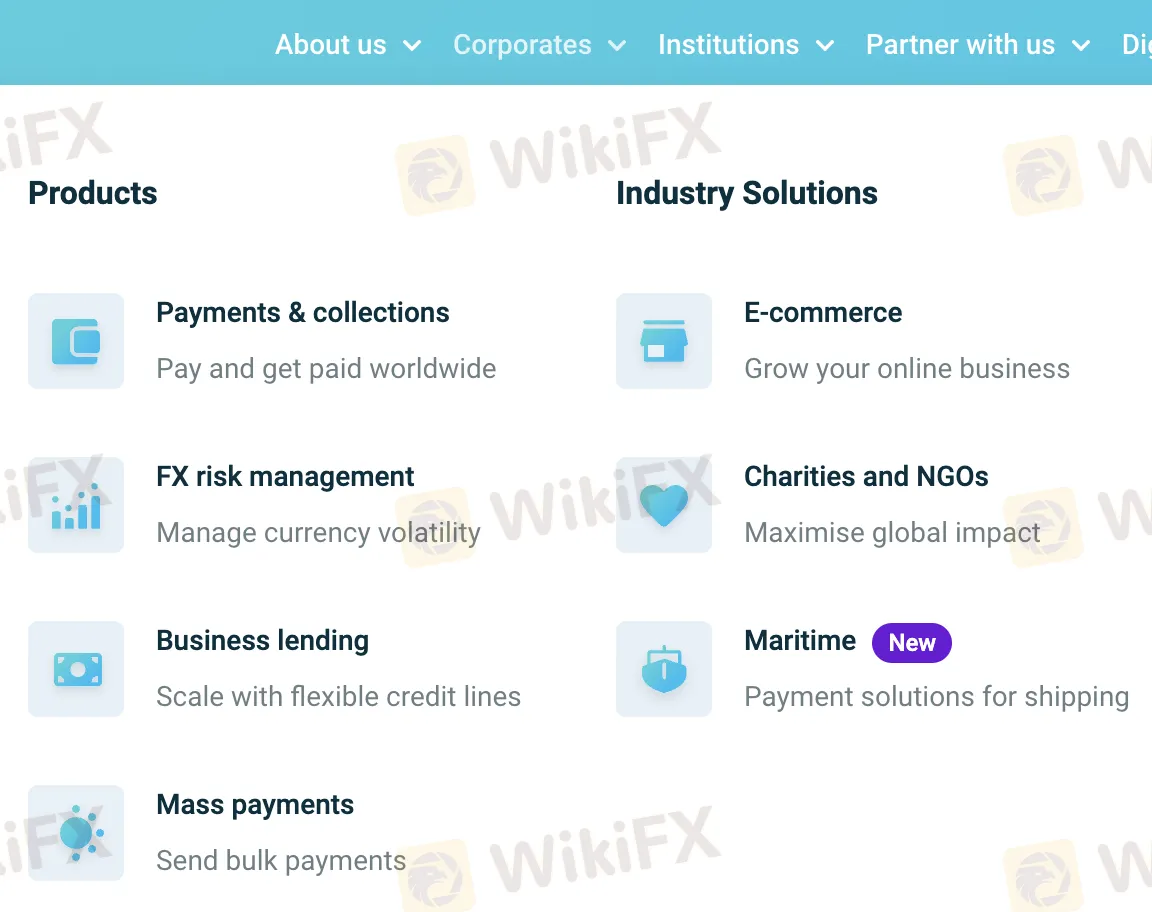

Productos y servicios

Ebury ofrece soluciones financieras globales, incluidos pagos, gestión de riesgos cambiarios y préstamos corporativos. También ofrece servicios especializados en campos como comercio electrónico, caridad y marítimo.

| Segmento | Categoría | Servicio |

| Corporativos | Productos | Pagos y Cobros |

| Gestión de Riesgos de Divisas | ||

| Préstamos Comerciales | ||

| Pagos Masivos | ||

| Soluciones Industriales | Comercio Electrónico | |

| Caridades y ONG | ||

| Marítimo (Nuevo) | ||

| Instituciones | Institucional | Soluciones Institucionales de Ebury |

| Cuentas Globales | ||

| Gestión de Riesgos | ||

| Pagos Globales | ||

| Emparejamiento de Financiamiento de Fondos (Nuevo) |

Plataforma digital

A través de su sitio web, aplicación móvil y conexiones API, Ebury proporciona una plataforma digital segura y fácil de usar. Empresas de todos los tamaños pueden utilizar estas herramientas para hacer negocios en todo el mundo, realizar un seguimiento de su dinero y automatizar tareas.

| Plataforma | Características Clave |

| Ebury en línea | Interfaz sencilla, informes mejorados, pagos globales seguros, soporte experto |

| Aplicación móvil | Gestione flujos de efectivo sobre la marcha, realice un seguimiento de transacciones, autenticación de dos factores |

| API | Integración rápida, automatización de tareas administrativas, ampliación de ofertas de productos, herramientas escalables |