Resumo da empresa

| Ebury Resumo da Revisão | |

| Fundação | 2009 |

| País Registrado | Reino Unido |

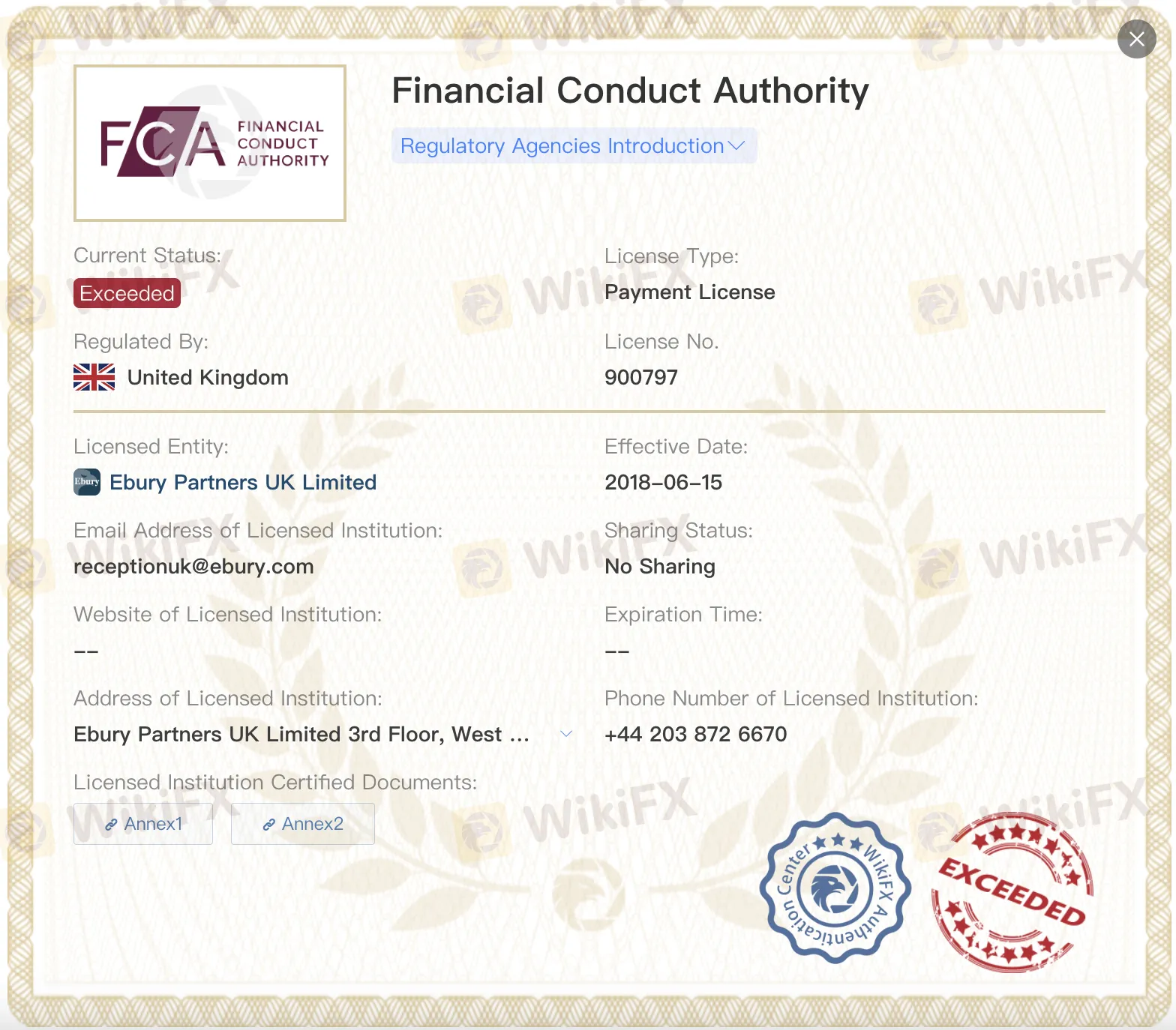

| Regulação | FCA (Excedido) |

| Serviços | Pagamentos, gestão de riscos cambiais, empréstimos comerciais, pagamentos em massa, soluções específicas por setor (comércio eletrônico, ONGs, marítimo, instituições) |

| Plataforma Digital | Portal Online, Aplicativo Móvel, API |

| Suporte ao Cliente | Telefone: +44 (0) 20 3872 6670 |

| E-mail: info@ebury.com | |

| Endereço: 100 Victoria Street, SW1E 5JL, Londres | |

Informações sobre Ebury

Ebury, uma instituição financeira regulamentada credenciada pela Autoridade de Conduta Financeira, foi criada no Reino Unido em 2009. No entanto, o status de regulação é "Excedido". Utiliza tecnologia digital para fornecer uma ampla gama de serviços a organizações multinacionais e investidores institucionais, como pagamentos transfronteiriços, gestão de riscos cambiais e financiamento empresarial.

Prós e Contras

| Prós | Contras |

| Regulado pela FCA no Reino Unido | Licenças "Excedido" |

| Ampla gama de serviços financeiros globais | Informações limitadas sobre taxas |

| Suporta clientes corporativos e institucionais |

Ebury é Legítimo?

Sim, é regulamentado pela Autoridade de Conduta Financeira do Reino Unido (FCA) sob duas licenças: uma Licença de Pagamento (Nº 900797) e uma Licença de Consultoria de Investimentos (Nº 784063). No entanto, ambas as licenças estão listadas como "Excedido".

Produtos e Serviços

Ebury oferece soluções financeiras globais, incluindo pagamentos, gestão de riscos cambiais e empréstimos corporativos. Também oferece serviços especializados em áreas como comércio eletrônico, caridade e marítimo.

| Segmento | Categoria | Serviço |

| Corporativos | Produtos | Pagamentos e Cobranças |

| Gestão de Riscos Cambiais | ||

| Empréstimos Comerciais | ||

| Pagamentos em Massa | ||

| Soluções por Setor | Comércio Eletrônico | |

| Caridades e ONGs | ||

| Marítimo (Novo) | ||

| Instituições | Institucional | Soluções Institucionais Ebury |

| Contas Globais | ||

| Gestão de Riscos | ||

| Pagamentos Globais | ||

| Correspondência de Financiamento de Fundos (Novo) |

Plataforma Digital

Através do seu site, aplicativo móvel e conexões de API, Ebury fornece uma plataforma digital segura e fácil de usar. Empresas de todos os tamanhos podem usar essas ferramentas para fazer negócios em todo o mundo, controlar seu dinheiro e automatizar tarefas.

| Plataforma | Recursos Principais |

| Ebury Online | Interface simples, relatórios aprimorados, pagamentos globais seguros, suporte especializado |

| Aplicativo Móvel | Gerencie fluxos de caixa em movimento, acompanhe transações, autenticação de dois fatores |

| API | Integração rápida, automatize tarefas administrativas, amplie ofertas de produtos, ferramentas escaláveis |