Hassett praises Trump's pick of Warsh to lead Fed, says he has his 'dream job' already

The NEC director, once considered a clear frontrunner for the next Fed chair, said he is fine with his current role.

The NEC director, once considered a clear frontrunner for the next Fed chair, said he is fine with his current role.

Oil prices slip to $64 on supply gluts, while Gold suffers a severe correction despite strong physical demand from Asia.

Tokyo CPI cooled to 2.0% in January, complicating the Bank of Japan's rate hike path. Meanwhile, Ministry of Finance officials are employing 'tactical silence' to support the Yen without spending reserves.

Markets brace for Japan's Tokyo CPI data amid US Treasury claims that the Yuan is undervalued, adding friction to the USD/Asia complex.

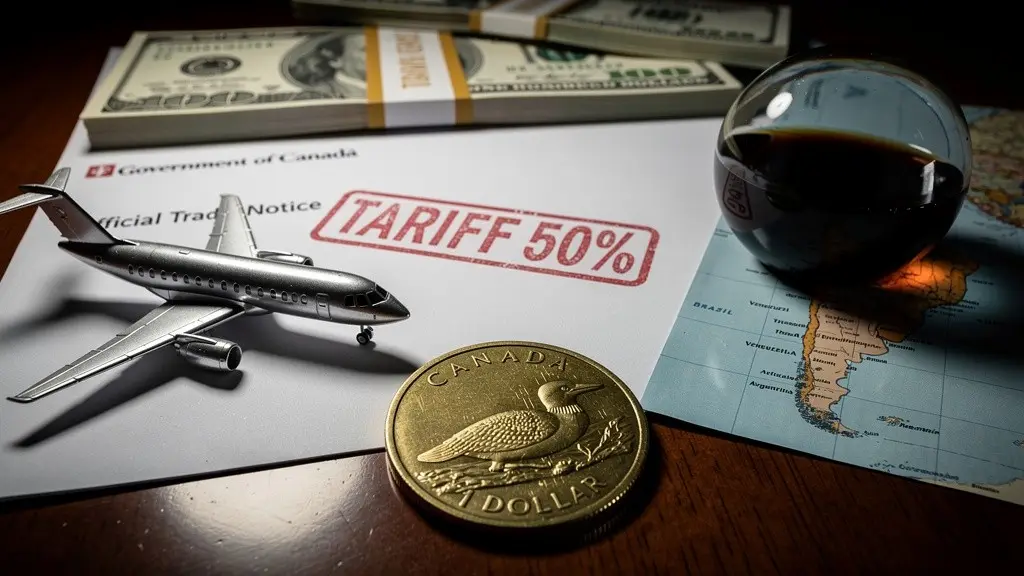

Geopolitical tensions flare as Trump threatens Canada with 50% tariffs on aircraft and sanctions Cuba, while simultaneously easing oil restrictions on Venezuela.

Apple reported a record-breaking quarter driven by a 38% revenue surge in China, signaling resilient consumer demand and boosting risk sentiment across global markets.

The US trade deficit nearly doubled in November, surging 95% to $56.8 billion as the goods gap with the European Union widened. The data complicates the narrative around the administration's tariff policies.

US allies are quietly accelerating efforts to diversify trade away from Washington, striking new deals to insulate their economies from looming protectionist tariffs.

Heightened volatility has returned to Forex markets, with the influential AUD rejecting fresh highs and the Yen gaining ground as risk flows retreat.

A historic session of volatility saw Copper and Gold surrender massive intra-day gains, as analysts warn that speculative mania has completely decoupled from worsening fundamentals.

Robinhood is reinventing stock trading with tokenized, 24/7 equities on the blockchain—ending settlement delays and redefining how markets move.

Gold prices retreated as markets priced in the potential for a more hawkish Federal Reserve leadership, despite the metal remaining on track for its strongest monthly performance in over four decades.

The Nigerian Naira extended its significant rally against the US Dollar, breaking below the 1,400 threshold as broad dollar weakness offered relief to emerging market currencies.

Let’s be real for a second. You spend hours analyzing charts. You stress over support levels, calculate your risk-to-reward ratio down to the pip, and worry about the NFP report spiking your stop loss. You treat your trading strategy like a business.

Analysis underscores that social stability in the mining sector is increasingly acting as a leading indicator for long-term capital flows into resource-dependent emerging markets.

This JustMarkets review provides an objective examination of the regulatory status, licensing framework and WikiScore of the JustMarkets broker.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

S&P Global has assigned an 'A' long-term credit rating to the Africa Finance Corporation (AFC), a move expected to lower borrowing costs and bolster infrastructure investment across the continent.

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Fitch Ratings has downgraded Afreximbank’s credit rating to "junk" status (BB+) from investment grade (BBB-) and subsequently withdrew its ratings following a dispute. The move raises concerns regarding the multilateral lender's access to capital markets and broader African credit sentiment.