公司簡介

| Ebury 評論摘要 | |

| 成立年份 | 2009 |

| 註冊國家 | 英國 |

| 監管 | FCA(超出) |

| 服務 | 支付、外匯風險管理、企業貸款、大宗支付、行業特定解決方案(電子商務、非政府組織、海事、機構) |

| 數字平台 | 在線門戶、移動應用程式、API |

| 客戶支援 | 電話:+44 (0) 20 3872 6670 |

| 電郵:info@ebury.com | |

| 地址:倫敦 SW1E 5JL 維多利亞街 100 號 | |

Ebury 資訊

Ebury 是一家經金融行為監管局認可的受監管金融機構,成立於2009年,位於英國。然而,監管狀態為「超出」。它利用數字技術為跨國組織和機構投資者提供廣泛的服務,如跨境支付、貨幣風險管理和企業融資。

優點與缺點

| 優點 | 缺點 |

| 在英國受FCA監管 | 牌照「超出」 |

| 提供廣泛的全球金融服務 | 有關費用的信息有限 |

| 支持企業和機構客戶 |

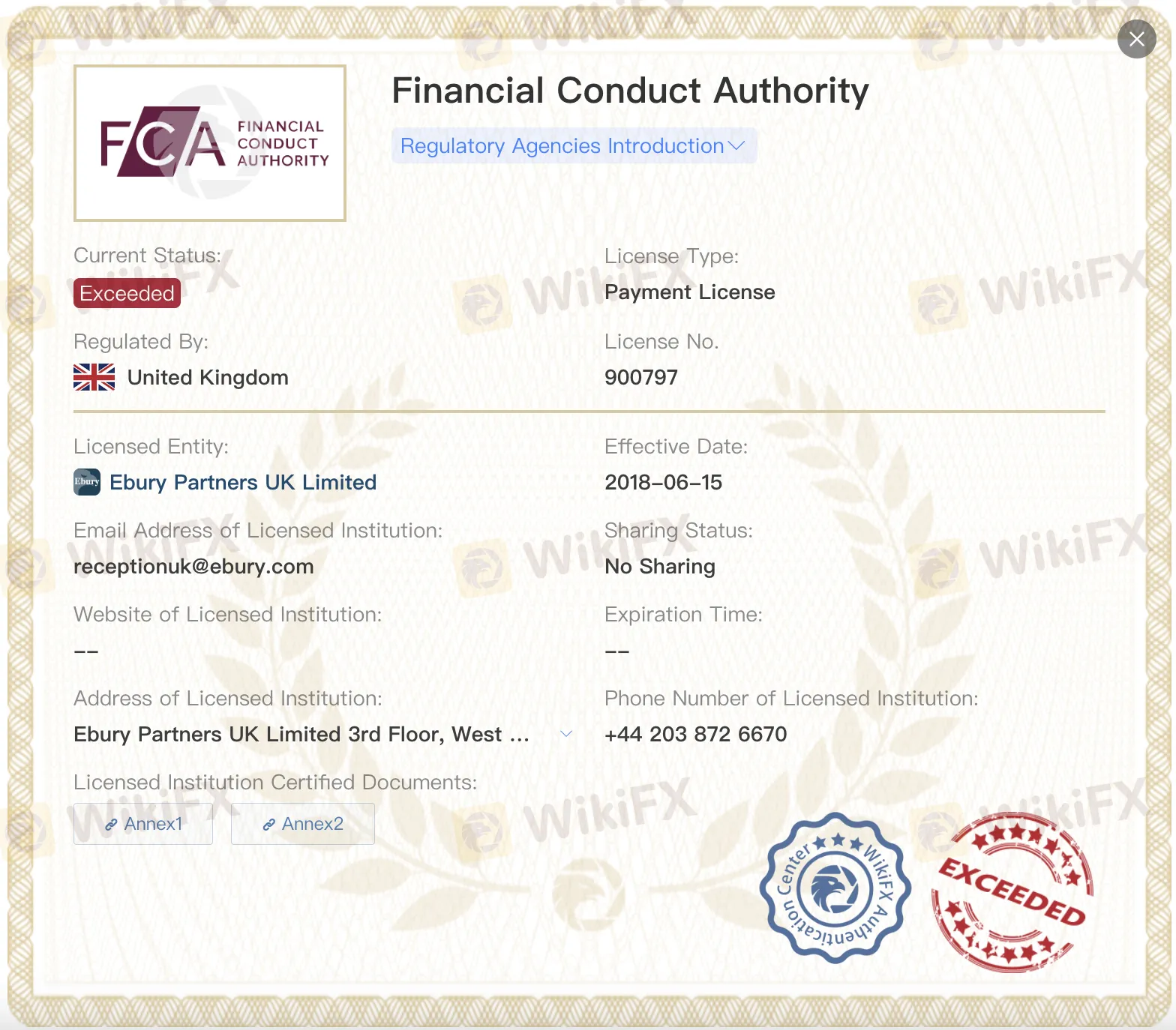

Ebury 是否合法?

是的,它受英國金融行為監管局監管,持有兩個牌照:支付牌照(編號900797)和投資諮詢牌照(編號784063)。然而,兩個牌照均列為「超出」。

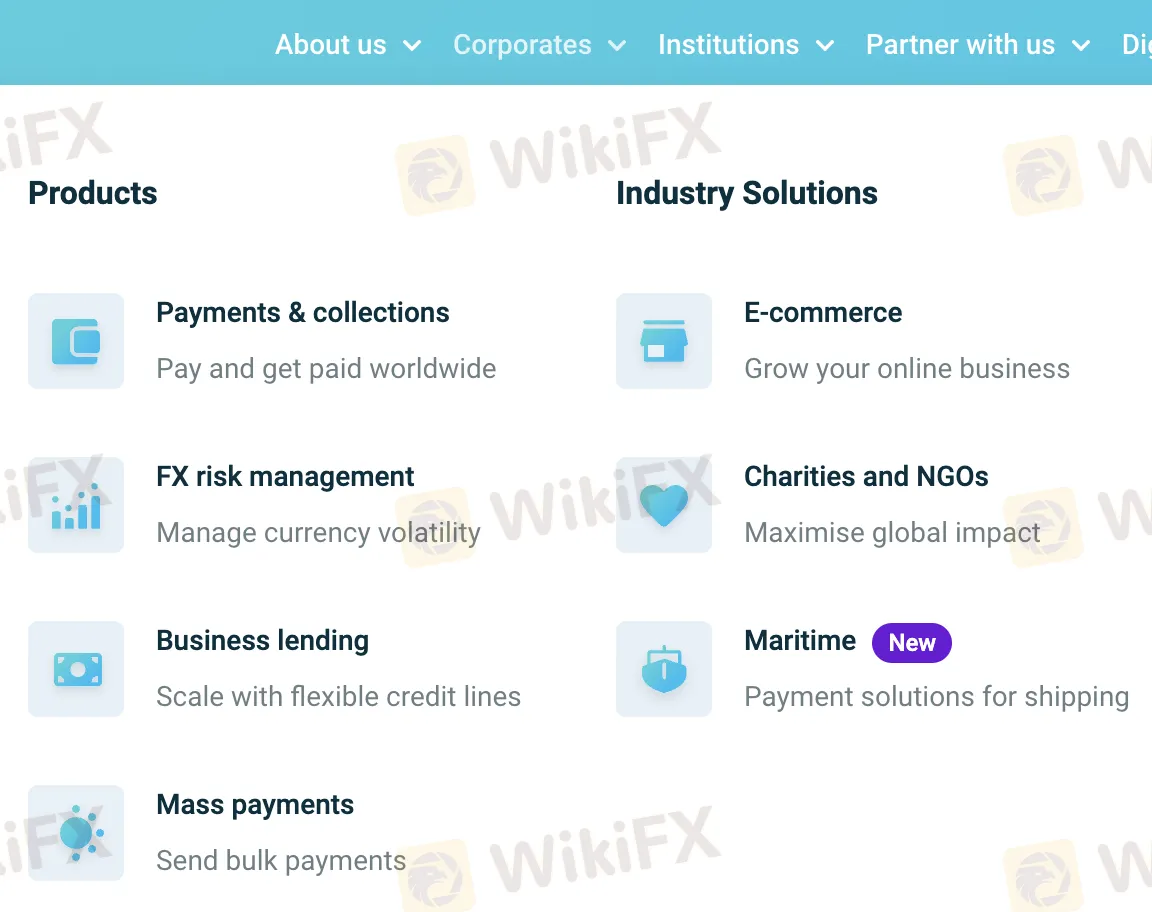

產品與服務

Ebury 提供全球金融解決方案,包括支付、外匯風險管理和企業貸款。它還提供電子商務、慈善和海事等領域的專業服務。

| 部門 | 類別 | 服務 |

| 企業 | 產品 | 支付和收款 |

| 外匯風險管理 | ||

| 企業貸款 | ||

| 大宗支付 | ||

| 行業解決方案 | 電子商務 | |

| 慈善機構和非政府組織 | ||

| 海事(新) | ||

| 機構 | 機構 | Ebury 機構解決方案 |

| 全球帳戶 | ||

| 風險管理 | ||

| 全球支付 | ||

| 基金融資配對(新) |

數字平台

透過其網站、手機應用程式和 API 連接,Ebury 提供一個安全且易於使用的數位平台。各種規模的公司可以使用這些工具在全球進行業務,追蹤資金狀況並自動化任務。

| 平台 | 主要功能 |

| Ebury 在線 | 簡單介面、增強報告、安全的全球支付、專家支援 |

| 手機應用程式 | 隨時管理現金流、追蹤交易、雙因素認證 |

| API | 快速整合、自動化管理任務、擴展產品供應、可擴展工具 |