Şirket özeti

| Ebury İnceleme Özeti | |

| Kuruluş | 2009 |

| Kayıtlı Ülke | Birleşik Krallık |

| Düzenleme | FCA (Aşıldı) |

| Hizmetler | Ödemeler, döviz kuru yönetimi, iş kredileri, toplu ödemeler, sektöre özgü çözümler (e-ticaret, STK'lar, denizcilik, kurumlar) |

| Dijital Platform | Çevrimiçi Portal, Mobil Uygulama, API |

| Müşteri Desteği | Telefon: +44 (0) 20 3872 6670 |

| E-posta: info@ebury.com | |

| Adres: 100 Victoria Street, SW1E 5JL, Londra | |

Ebury Bilgileri

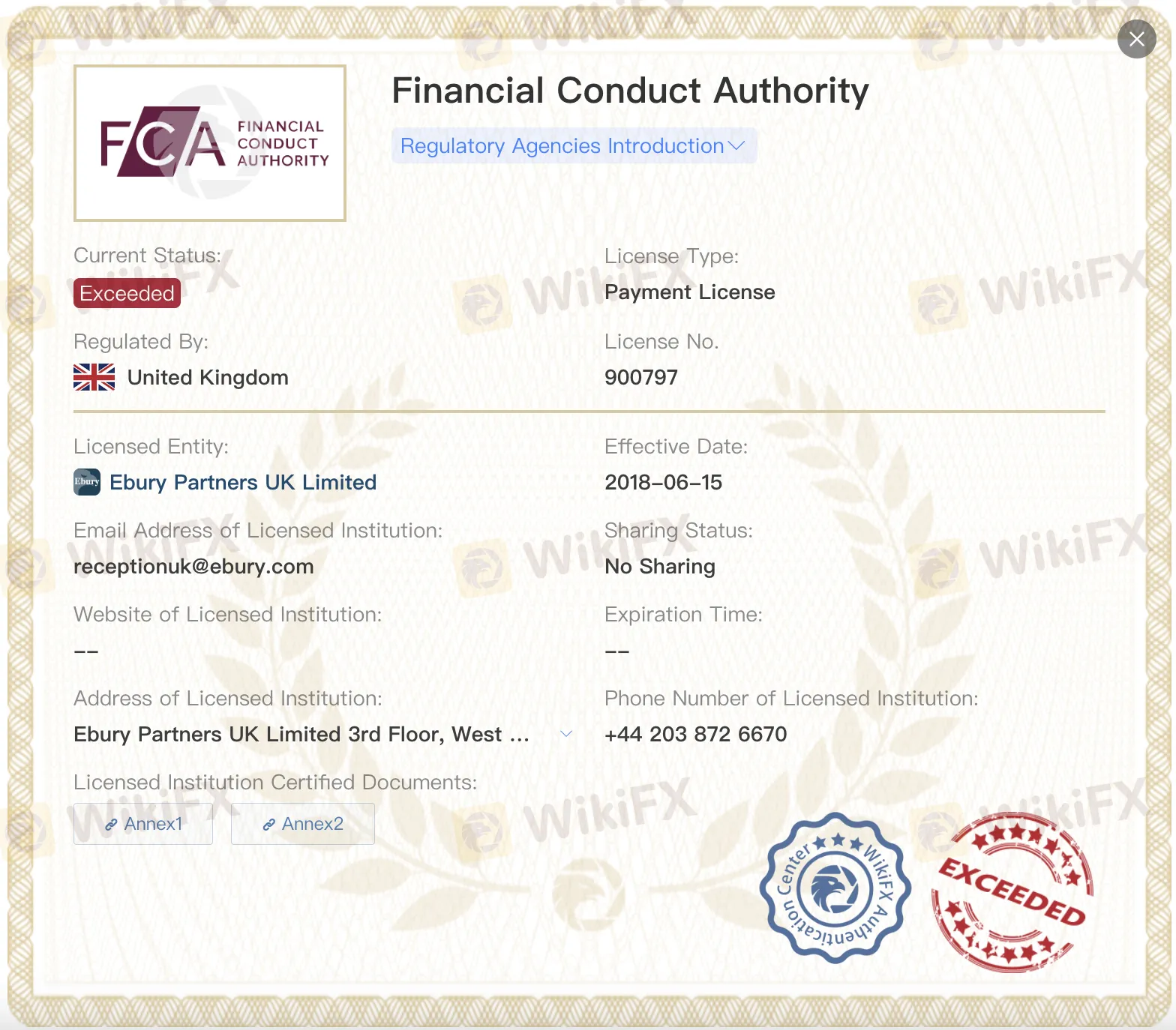

Ebury, 2009 yılında Birleşik Krallık'ta kurulmuş ve Finansal Davranış Otoritesi tarafından akredite edilmiş düzenlenmiş bir finansal kuruluştur. Ancak düzenlemenin durumu "Aşıldı" olarak belirtilmektedir. Çapraz sınır ödemeleri, döviz kuru yönetimi ve iş finansmanı gibi çok çeşitli hizmetleri çok uluslu kuruluşlara ve kurumsal yatırımcılara sunmak için dijital teknolojiyi kullanmaktadır.

Artıları ve Eksileri

| Artılar | Eksiler |

| İngiltere'de FCA tarafından düzenlenir | Lisanslar "Aşıldı" |

| Geniş yelpazede küresel finansal hizmetler | Ücretlerle ilgili sınırlı bilgi |

| Hem kurumsal hem de kurumsal müşterilere destek sağlar |

Ebury Güvenilir mi?

Evet, İngiltere Finansal Davranış Otoritesi (FCA) tarafından iki lisans altında düzenlenmektedir: Bir Ödeme Lisansı (No. 900797) ve Bir Yatırım Danışmanlığı Lisansı (No. 784063). Ancak her iki lisans da "Aşıldı" olarak listelenmektedir.

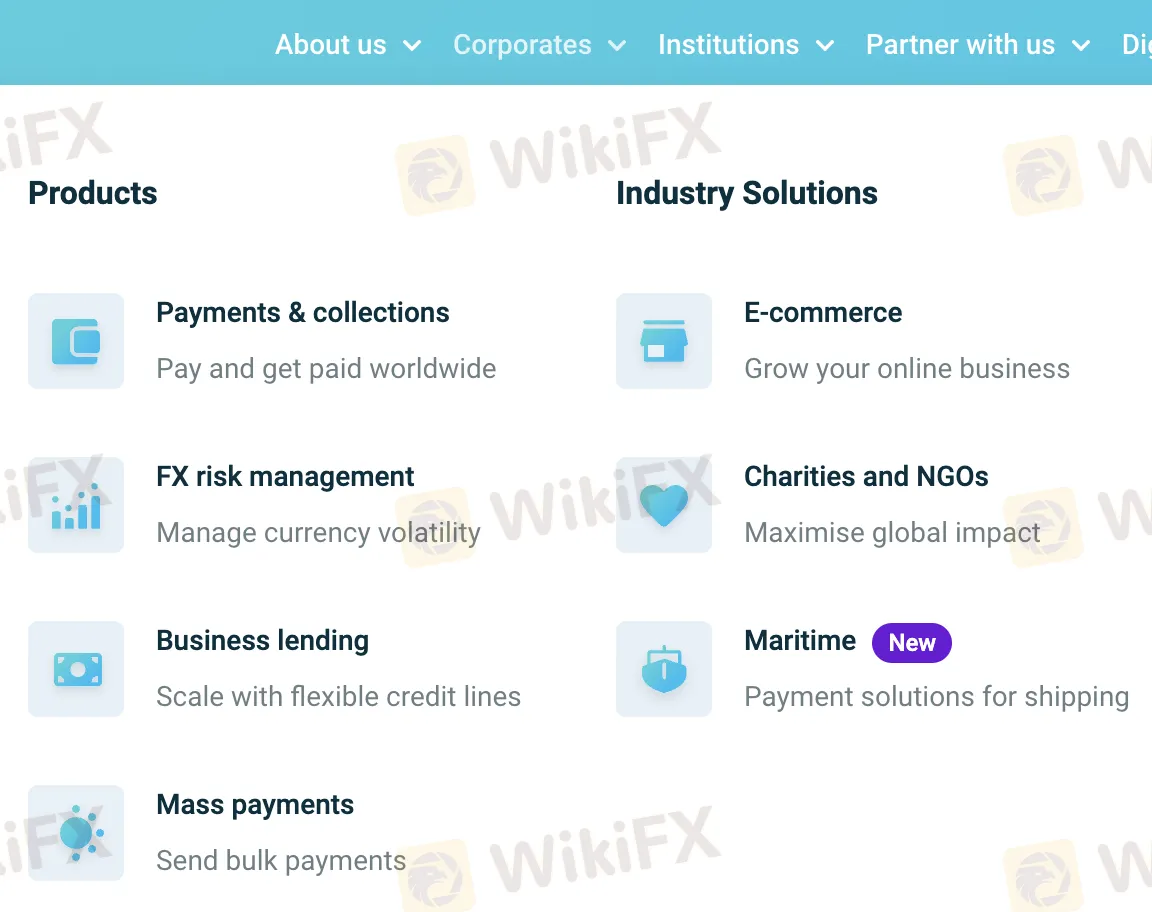

Ürünler ve Hizmetler

Ebury, ödemeler, döviz kuru yönetimi ve kurumsal krediler de dahil olmak üzere küresel finansal çözümler sunmaktadır. Ayrıca e-ticaret, hayır kurumları ve denizcilik gibi alanlarda uzmanlaşmış hizmetler sunmaktadır.

| Segment | Kategori | Hizmet |

| Kurumsal | Ürünler | Ödemeler ve Tahsilatlar |

| Döviz Kuru Yönetimi | ||

| İş Kredileri | ||

| Toplu Ödemeler | ||

| Sektöre Özgü Çözümler | E-ticaret | |

| Hayır Kurumları ve STK'lar | ||

| Denizcilik (Yeni) | ||

| Kurumlar | Kurumsal | Ebury Kurumsal Çözümler |

| Global Hesaplar | ||

| Risk Yönetimi | ||

| Global Ödemeler | ||

| Fon Finansman Eşleştirme (Yeni) |

Dijital Platform

Web sitesi, mobil uygulama ve API bağlantıları aracılığıyla, Ebury güvenli ve kullanımı kolay dijital bir platform sunmaktadır. Tüm büyüklükteki şirketler, bu araçları dünya çapında iş yapmak, paralarını takip etmek ve görevleri otomatikleştirmek için kullanabilirler.

| Platform | Temel Özellikler |

| Ebury Çevrimiçi | Basit arayüz, gelişmiş raporlama, güvenli küresel ödemeler, uzman destek |

| Mobil Uygulama | Hareket halindeyken nakit akışlarını yönetme, işlemleri takip etme, iki faktörlü kimlik doğrulama |

| API | Hızlı entegrasyon, yönetici görevlerini otomatikleştirme, ürün tekliflerini genişletme, ölçeklenebilir araçlar |