Company Summary

| GMO CLICK Review Summary | |

| Founded | 2005 |

| Registered Country | Japan |

| Regulation | FSA |

| Trading Products | Stocks, investment trusts, forex, CFDs, stock indexes, bonds |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | 13 platforms (GMO Click FX, Hatchu-kun FX Plus, PLATINUM CHART, etc.) |

| Minimum Deposit | / |

| Customer Support | Landline: 0120-727-930 |

| Mobile: 03-6221-0190 | |

GMO CLICK Information

Founded in 2005, GMO Click Securities is a licensed and controlled financial services firm under Japan's FSA. Among its many investing options are FX, equities, CFDs, and tax-advantaged NISA accounts. The firm runs several trading systems designed for anyone from novices to experienced traders.

Pros and Cons

| Pros | Cons |

| Regulated by Japan FSA | Some platform details scattered |

| Very low trading fees, especially for FX and CFDs | Foreign currency withdrawal fee applies |

| Free account management & no inactivity fee | |

| Long operation time | |

| Various trading platforms |

Is GMO CLICK Legit?

Yes, GMO CLICK is a legal, regulated financial institution. It is authorized by the Financial Services Agency (FSA) of Japan with a Retail Forex License, under license number 関東財務局長(金商)第77号, effective since September 30, 2007.

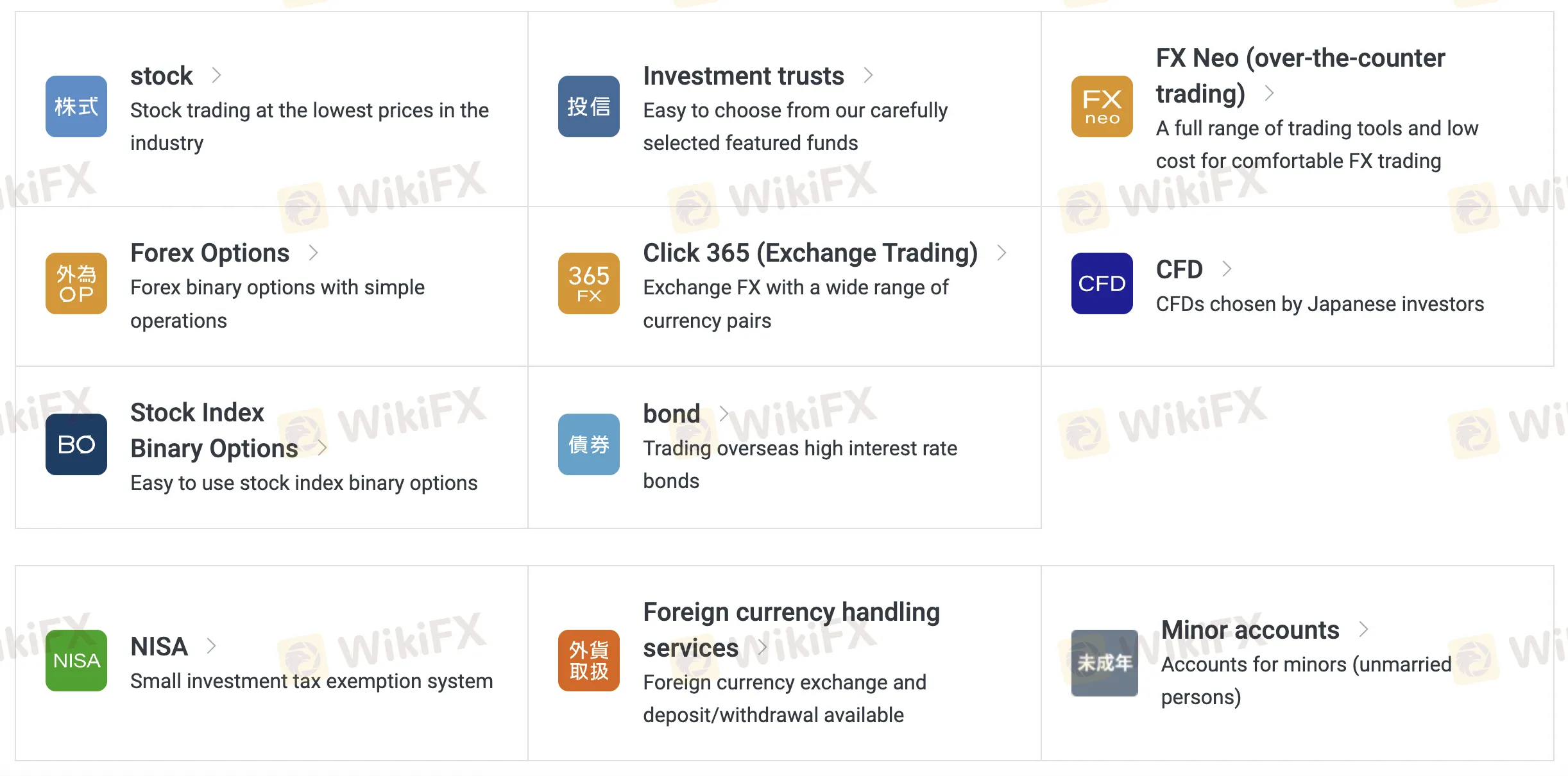

What Can I Trade on GMO CLICK?

Among its many investment and trading tools, GMO Click Securities provides stocks, FX, options, CFDs, bonds, and others. Its products are suited for ordinary investors as well as those looking for modest accounts with tax benefits.

| Trading Instruments | Supported |

| Stocks | ✔ |

| Investment Trusts | ✔ |

| Forex | ✔ |

| CFDs | ✔ |

| Stock Indexes | ✔ |

| Bonds | ✔ |

| Options | ❌ |

| ETFs | ❌ |

GMO CLICK Fees

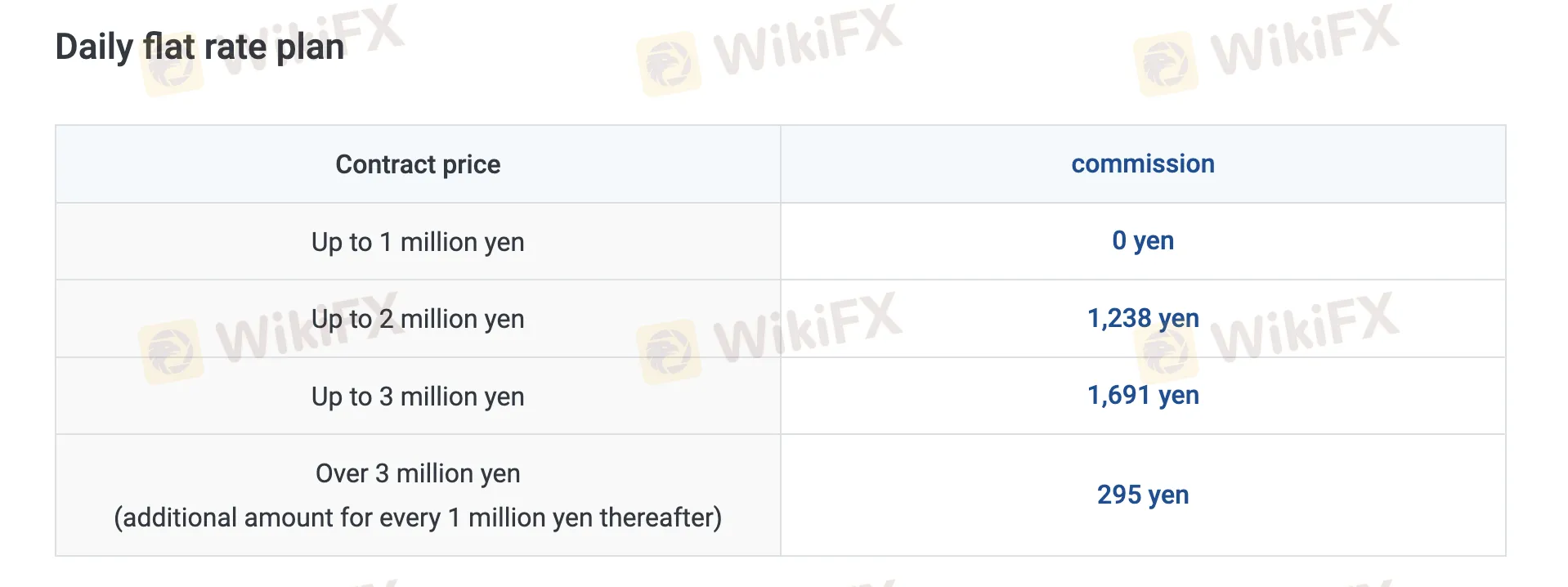

GMO Click is known for offering some of the lowest fees in the industry, especially for FX, CFD, and stock trading, with zero commissions on many products and tight spreads.

| Trading Product | Fees |

| Spot Stock | Daily Flat Plan: ¥0 (up to ¥1M/day), then scaled |

| Per Trade Plan: From ¥50 | |

| Margin Stock | Flat Plan: ¥0 (up to ¥1M), then scaled |

| Per Trade Plan: From ¥97 | |

| FX Neo | 0, spreads apply |

| Forex Options | 0 |

| Click365 | 0 for standard contracts; ¥770–990/ticket for Click365 Large |

| CFD | 0 |

| Stock Index Binary Options | 0 |

| Bonds | 0 |

Swap Rates

| Type | Annual Rate |

| Buyer's Interest (General) | 2.00% |

| Seller's Interest | 0.00% |

| Stock Lending Fee (General Credit - Short Term) | 3.85% |

| VIP Plan (Institutional Buyer) | 1.80% |

Non-Trading Fees

| Fee Type | Amount |

| Deposit Fee | 0 (Instant deposits); ATM/bank fees apply |

| Withdrawal Fee | 0 (JPY) ¥1,500 for FX foreign currency withdrawals |

| Inactivity Fee | 0 |

| Call Center Order Fee | 0.11% of trade amount (min ¥3,520, max ¥220,000) |

| Fractional Share Sales | 2.2% of contract price |

| Odd Lot Purchase Fee | ¥1,100/brand |

| Account Management Fees | 0 |

| Document Issuance Fee | ¥1,100 (reports, personal data, etc.) |

Trading Platform

| Platform/App | Supported | Available Devices | Suitable for |

| GMO Click FX | ✔ | iPhone / Android / Apple Watch | FX traders (all levels) |

| Hatchu-kun FX Plus | ✔ | Windows | FX traders needing advanced functions |

| PLATINUM CHART | ✔ | Windows / Mac | FX & CFD technical chart users |

| FX Watch! | ✔ | Wear OS | FX alerts on smartwatches |

| GMO Click CFD | ✔ | iPhone / Android / Apple Watch | CFD traders |

| Hatchu-kun CFD | ✔ | Windows / Mac | CFD traders needing PC-based tools |

| GMO Click Stock | ✔ | iPhone / Android | Stock traders (mobile access) |

| GMO Click Stocks for iPad | ✔ | iPad / Mac | Stock traders preferring tablets |

| Super Hatchu-kun | ✔ | Windows | Stock traders requiring desktop trading |

| iClick Forex | ✔ | iPhone / Android | FX beginners or on-the-go traders |

| GMO Click Stock BO | ✔ | iPhone / Android | Stock Binary Options traders |

| iClickFX365 | ✔ | iPhone | FX365 traders (mobile) |

| FXroid365 | ✔ | Android | FX365 traders (mobile) |