Şirket özeti

| GMO CLICK İnceleme Özeti | |

| Kuruluş Yılı | 2005 |

| Kayıtlı Ülke | Japonya |

| Düzenleme | FSA |

| Piyasa Araçları | Hisse senetleri, yatırım fonları, forex, CFD'ler, hisse senedi endeksleri, tahviller |

| Deneme Hesabı | / |

| Kaldıraç | / |

| Spread | / |

| İşlem Platformu | 13 platform (GMO Click FX, Hatchu-kun FX Plus, PLATINUM CHART, vb.) |

| Minimum Yatırım | / |

| Müşteri Desteği | Sabit hat: 0120-727-930 |

| Mobil: 03-6221-0190 | |

GMO CLICK Bilgileri

2005 yılında kurulan GMO Click Securities, Japonya FSA denetimi altında lisanslı ve kontrol edilen bir finansal hizmetler firmasıdır. Birçok yatırım seçeneği arasında FX, hisse senetleri, CFD'ler ve vergi avantajlı NISA hesapları bulunmaktadır. Şirket, acemilerden deneyimli işlemcilere kadar herkes için tasarlanmış birkaç işlem sistemi işletmektedir.

Artıları ve Eksileri

| Artılar | Eksiler |

| Japonya FSA tarafından düzenlenmektedir | Bazı platform detayları dağınık |

| Özellikle FX ve CFD'ler için çok düşük işlem ücretleri | Yabancı para çekme ücreti uygulanır |

| Ücretsiz hesap yönetimi ve hareketsizlik ücreti yok | |

| Uzun işlem süresi | |

| Çeşitli işlem platformları |

GMO CLICK Güvenilir mi?

Evet, GMO CLICK yasal, düzenlenmiş bir finansal kuruluştur. Japonya Finansal Hizmetler Ajansı (FSA) tarafından 2007 yılı 30 Eylül tarihinden itibaren geçerli olan Perakende Forex Lisansı ile yetkilendirilmiştir.

GMO CLICK Üzerinde Ne İşlem Yapabilirim?

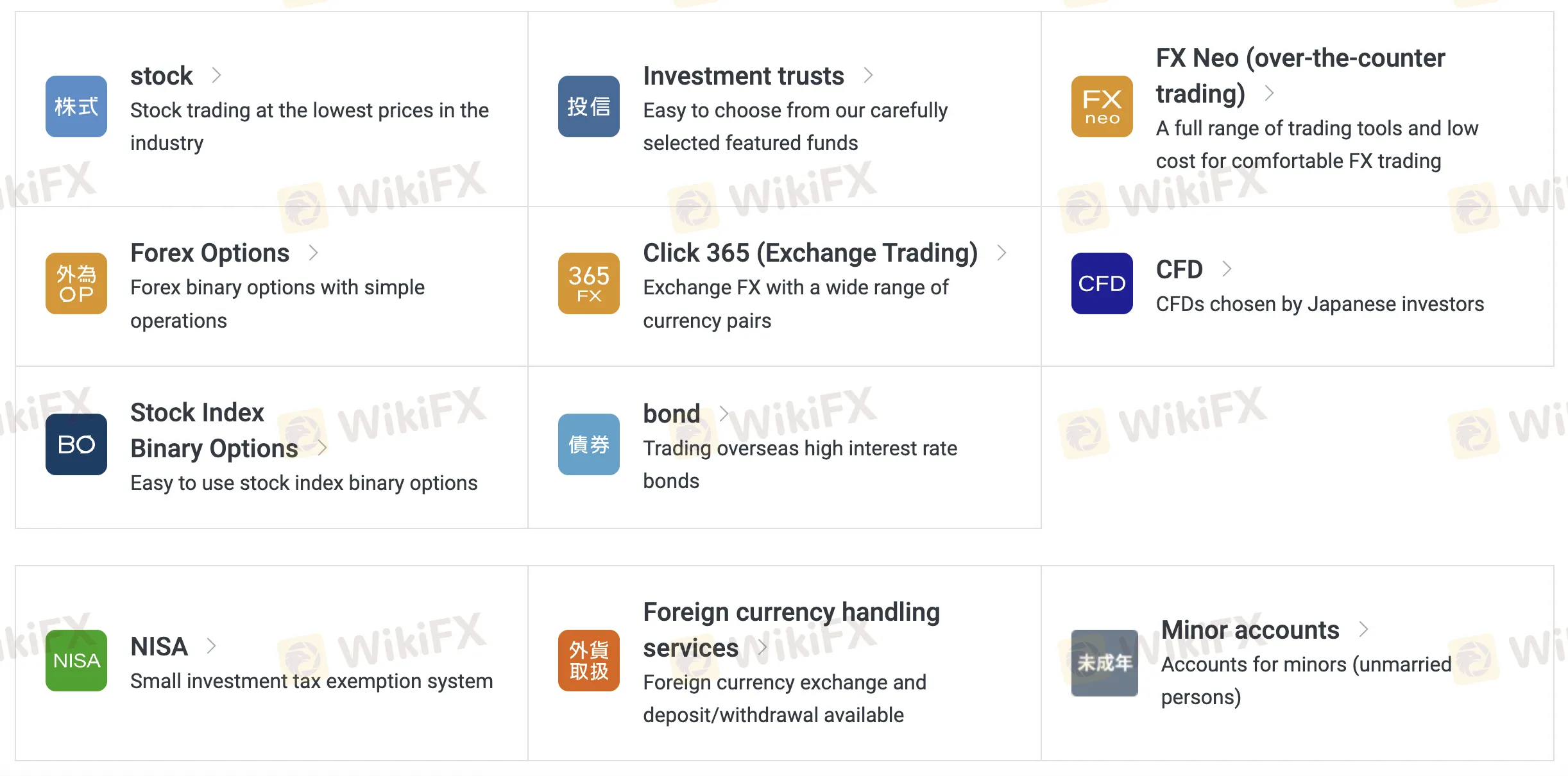

Birçok yatırım ve işlem aracı arasında GMO Click Securities, hisse senetleri, FX, opsiyonlar, CFD'ler, tahviller ve diğerlerini sunmaktadır. Ürünleri, sıradan yatırımcılar için uygun olduğu gibi vergi avantajlarına sahip mütevazı hesaplar arayanlar için de uygundur.

| İşlem Araçları | Desteklenen |

| Hisse Senetleri | ✔ |

| Yatırım Fonları | ✔ |

| Forex | ✔ |

| CFD'ler | ✔ |

| Hisse Senedi Endeksleri | ✔ |

| Tahviller | ✔ |

| Opsiyonlar | ❌ |

| ETF'ler | ❌ |

GMO CLICK Ücretler

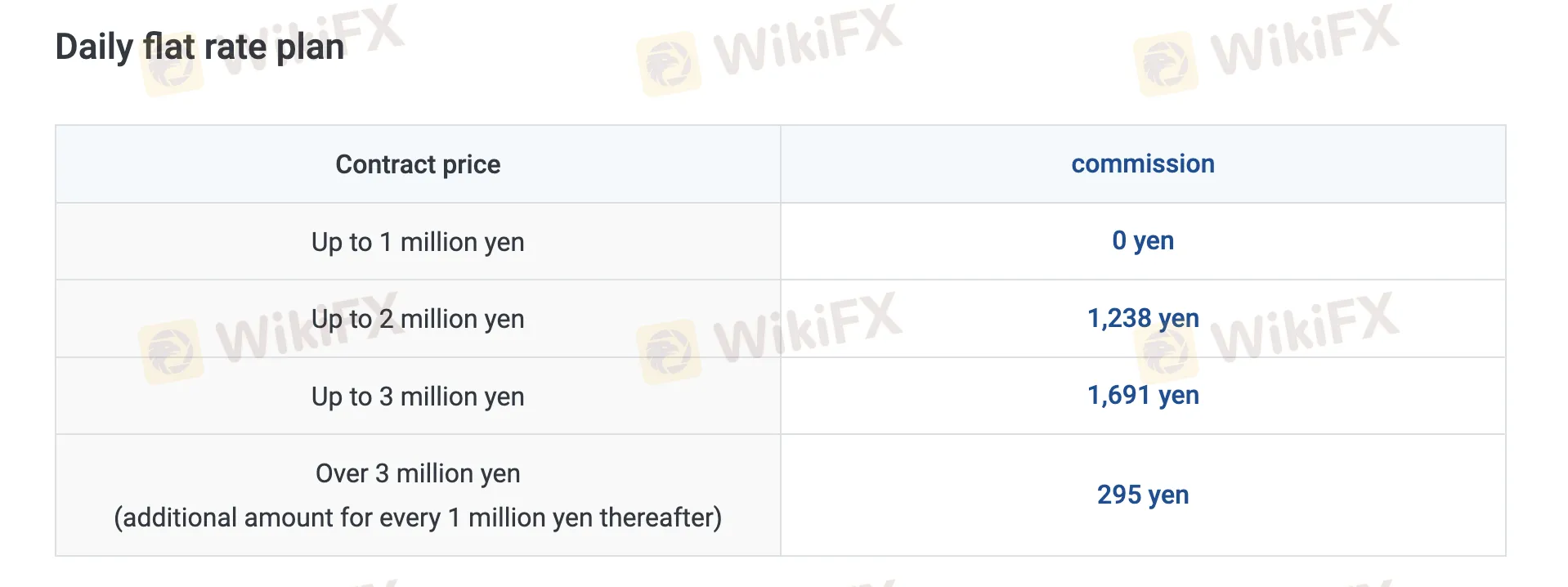

GMO Click, özellikle FX, CFD ve hisse senedi ticareti için, birçok üründe sıfır komisyon ve düşük spreadler ile endüstride en düşük ücretlerden bazılarını sunmasıyla tanınır.

| İşlem Ürünü | Ücretler |

| Spot Hisse Senedi | Günlük Sabit Plan: ¥0 (günlük ¥1M'ye kadar), daha sonra ölçeklendirilir |

| Her İşlem Planı: ¥50'den başlayarak | |

| Marjinli Hisse Senedi | Sabit Plan: ¥0 (¥1M'ye kadar), daha sonra ölçeklendirilir |

| Her İşlem Planı: ¥97'den başlayarak | |

| FX Neo | 0, spreadler uygulanır |

| Forex Opsiyonları | 0 |

| Click365 | Standart sözleşmeler için 0; Click365 Large için ¥770–990/bilet |

| CFD | 0 |

| Hisse Senedi Endeksli İkili Opsiyonlar | 0 |

| Bono | 0 |

Takas Oranları

| Tür | Yıllık Oran |

| Alıcı'nın Faizi (Genel) | 2.00% |

| Satıcı'nın Faizi | 0.00% |

| Hisse Senedi Ödünç Verme Ücreti (Genel Kredi - Kısa Vadeli) | 3.85% |

| VIP Planı (Kurumsal Alıcı) | 1.80% |

İşlem Dışı Ücretler

| Ücret Türü | Tutar |

| Yatırma Ücreti | 0 (Anlık yatırımlar); ATM/banka ücretleri geçerlidir |

| Çekme Ücreti | 0 (JPY) FX yabancı para çekimleri için ¥1,500 |

| Etkinlik Dışı Ücreti | 0 |

| Çağrı Merkezi Sipariş Ücreti | İşlem tutarının %0.11'i (min ¥3,520, maks ¥220,000) |

| Kesirli Hisse Satışları | Sözleşme fiyatının %2.2'si |

| Tekil Lot Satın Alma Ücreti | ¥1,100/marka |

| Hesap Yönetim Ücretleri | 0 |

| Belge Düzenleme Ücreti | ¥1,100 (raporlar, kişisel veriler, vb.) |

İşlem Platformu

| Platform/Uygulama | Desteklenen | Mevcut Cihazlar | Uygun Kullanıcılar |

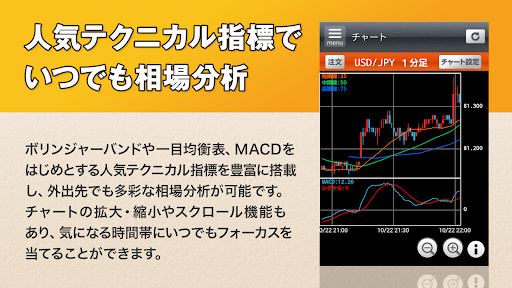

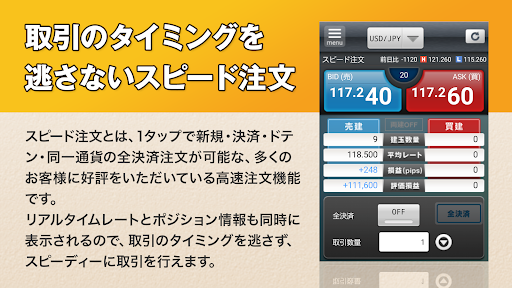

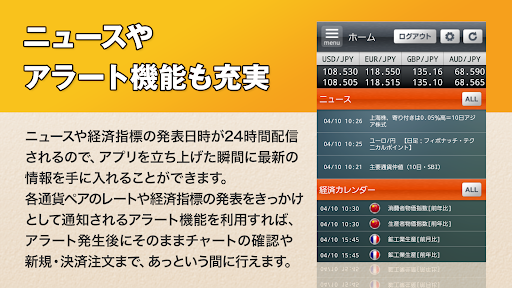

| GMO Click FX | ✔ | iPhone / Android / Apple Watch | FX işlemcileri (tüm seviyeler) |

| Hatchu-kun FX Plus | ✔ | Windows | Gelişmiş işlevlere ihtiyaç duyan FX işlemcileri |

| PLATINUM CHART | ✔ | Windows / Mac | FX ve CFD teknik grafik kullanıcıları |

| FX Watch! | ✔ | Wear OS | Akıllı saatlerde FX uyarıları |

| GMO Click CFD | ✔ | iPhone / Android / Apple Watch | CFD işlemcileri |

| Hatchu-kun CFD | ✔ | Windows / Mac | PC tabanlı araçlara ihtiyaç duyan CFD işlemcileri |

| GMO Click Stock | ✔ | iPhone / Android | Hisse senedi işlemcileri (mobil erişim) |

| GMO Click Stocks for iPad | ✔ | iPad / Mac | Tablet tercih eden hisse senedi işlemcileri |

| Süper Hatchu-kun | ✔ | Windows | Masaüstü işlem gerektiren hisse senedi işlemcileri |

| iClick Forex | ✔ | iPhone / Android | FX başlangıç seviyesi veya hareket halindeki işlemciler |

| GMO Click Stock BO | ✔ | iPhone / Android | Hisse Senedi İkili Opsiyon işlemcileri |

| iClickFX365 | ✔ | iPhone | FX365 işlemcileri (mobil) |

| FXroid365 | ✔ | Android | FX365 işlemcileri (mobil) |