公司簡介

| GMO CLICK 評論摘要 | |

| 成立年份 | 2005 |

| 註冊國家 | 日本 |

| 監管機構 | FSA |

| 市場工具 | 股票、投資信託、外匯、差價合約、股票指數、債券 |

| 模擬帳戶 | / |

| 槓桿 | / |

| 點差 | / |

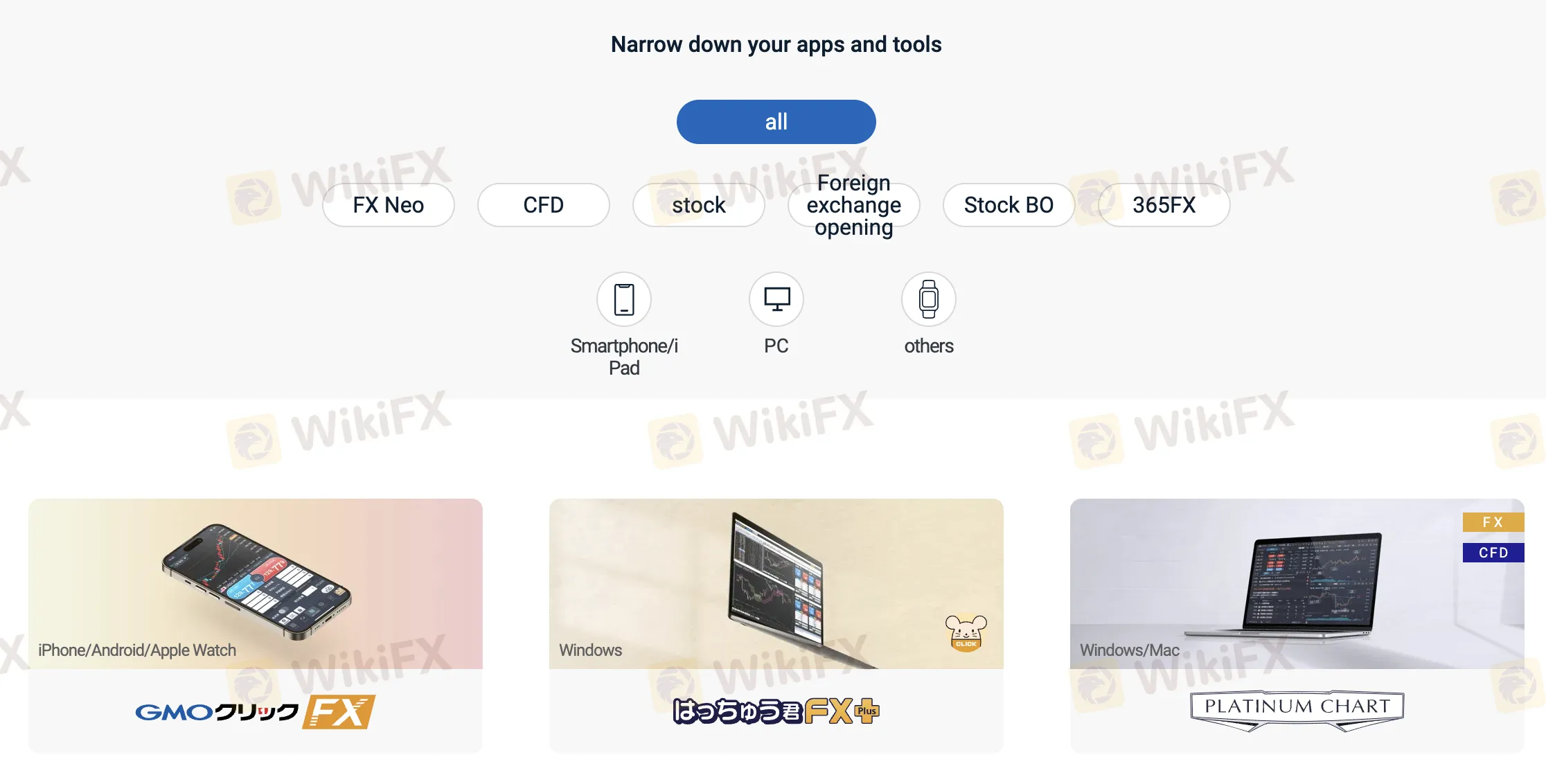

| 交易平台 | 13個平台(GMO Click FX、Hatchu-kun FX Plus、PLATINUM CHART等) |

| 最低存款 | / |

| 客戶支援 | 座機:0120-727-930 |

| 手機:03-6221-0190 | |

GMO CLICK 資訊

GMO Click Securities成立於2005年,是一家在日本FSA監管下的持牌金融服務公司。除了外匯、股票、差價合約和享有稅收優惠的NISA帳戶等眾多投資選擇外,該公司還運營幾個針對從新手到經驗豐富交易者的交易系統。

優缺點

| 優點 | 缺點 |

| 受日本FSA監管 | 部分平台細節分散 |

| 交易費用非常低,特別是外匯和差價合約 | 外幣提款費用適用 |

| 免費帳戶管理和無閒置費 | |

| 長時間運作 | |

| 多個交易平台 |

GMO CLICK 是否合法?

是的,GMO CLICK是一家合法的、受監管的金融機構。它由日本金融廳(FSA)授權,憑藉零售外匯牌照,牌照號碼為關東財務局長(金商)第77號,自2007年9月30日起生效。

我可以在GMO CLICK上交易什麼?

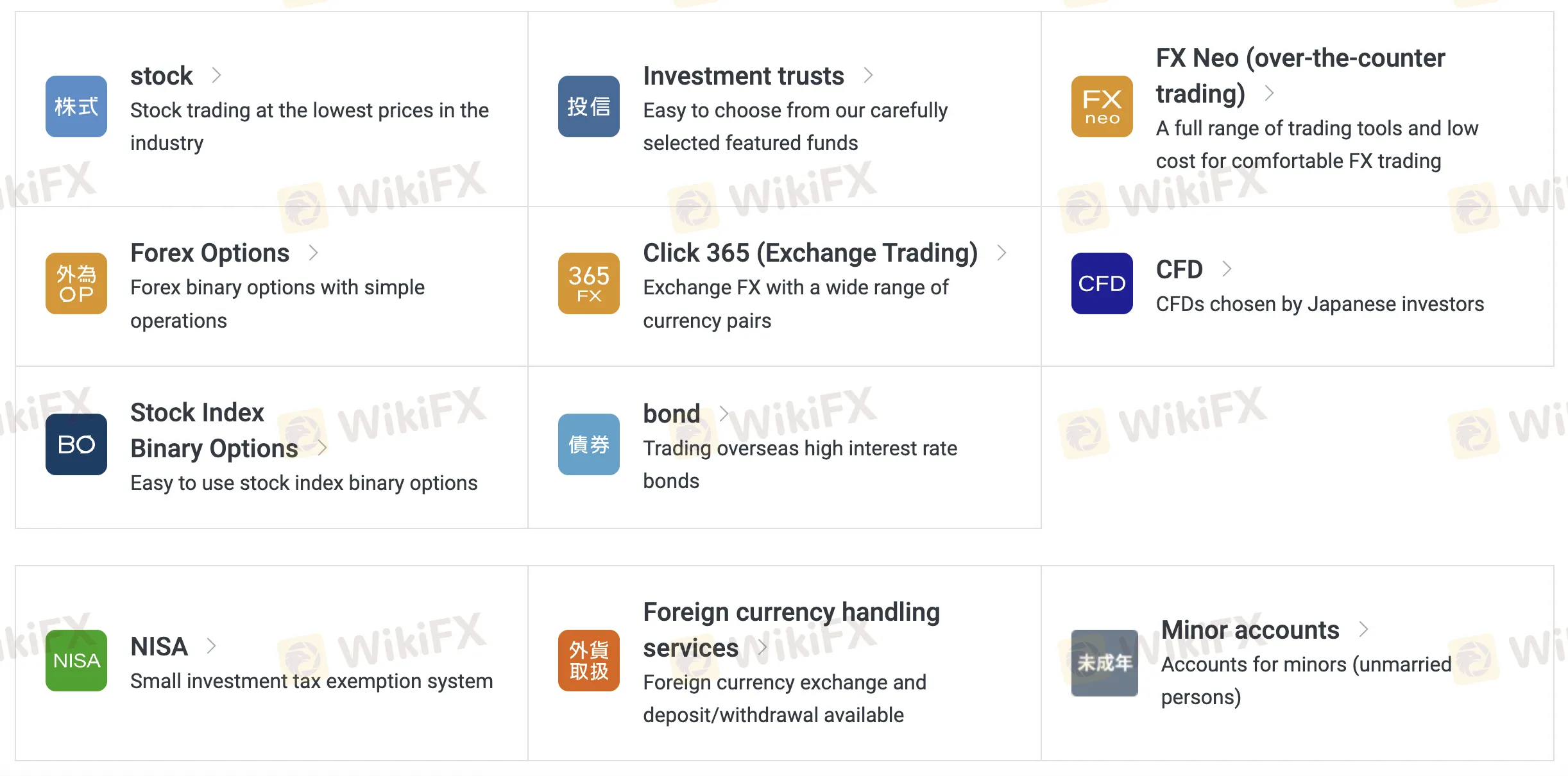

在眾多投資和交易工具中,GMO Click Securities提供股票、外匯、期權、差價合約、債券等產品。其產品適合普通投資者以及尋求具有稅收優惠的小型帳戶的人。

| 交易工具 | 支援 |

| 股票 | ✔ |

| 投資信託 | ✔ |

| 外匯 | ✔ |

| 差價合約 | ✔ |

| 股票指數 | ✔ |

| 債券 | ✔ |

| 期權 | ❌ |

| ETFs | ❌ |

GMO CLICK 費用

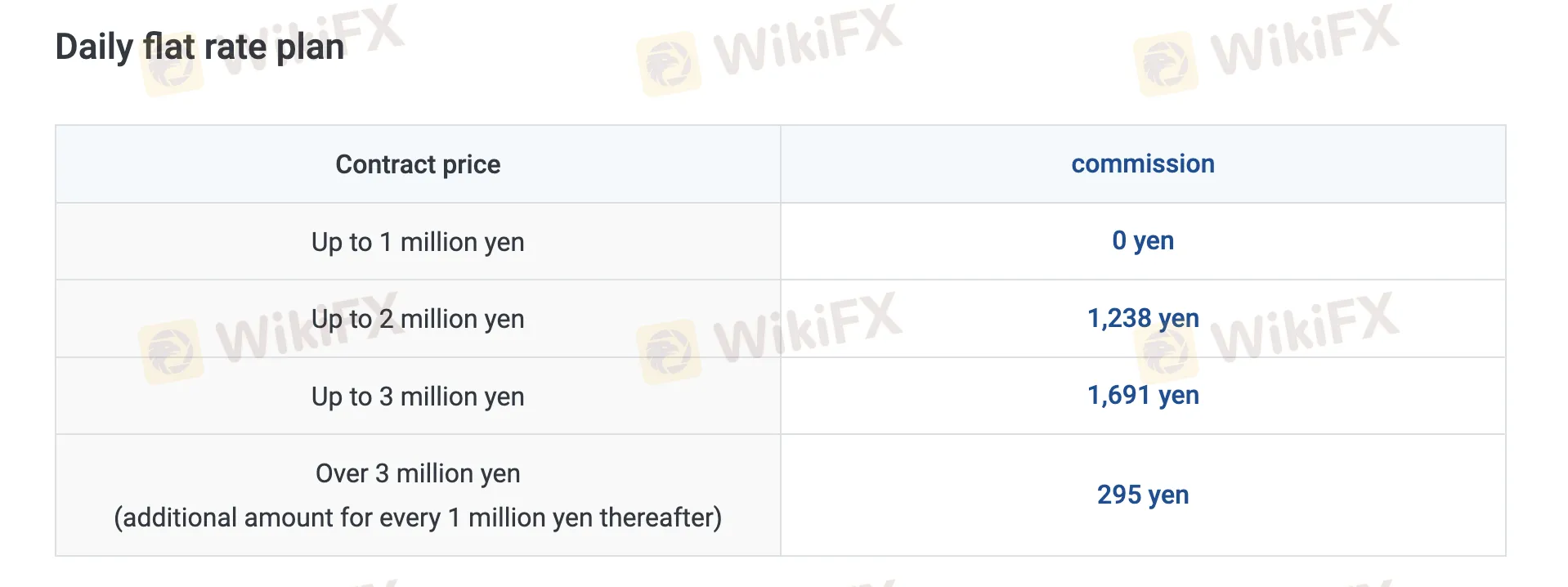

GMO Click 以提供業內最低的費用之一而聞名,特別是在外匯、差價合約和股票交易方面,許多產品甚至零佣金,並提供緊密的價差。

| 交易產品 | 費用 |

| 現貨股票 | 每日固定計劃:¥0(每日最高¥1百萬),然後按比例 |

| 每筆交易計劃:由¥50起 | |

| 保證金股票 | 固定計劃:¥0(最高¥1百萬),然後按比例 |

| 每筆交易計劃:由¥97起 | |

| FX Neo | 0,適用價差 |

| 外匯期權 | 0 |

| Click365 | 標準合約為0;Click365 Large 每張票¥770–990 |

| 差價合約 | 0 |

| 股指二元期權 | 0 |

| 債券 | 0 |

掉期利率

| 類型 | 年利率 |

| 買方利息(一般) | 2.00% |

| 賣方利息 | 0.00% |

| 股票借貸費(一般信貸 - 短期) | 3.85% |

| VIP 計劃(機構買家) | 1.80% |

非交易費用

| 費用類型 | 金額 |

| 存款費 | 0(即時存款);ATM/銀行收取費用 |

| 提款費 | 0(JPY)¥1,500 用於外匯提款 |

| 閒置費 | 0 |

| 呼叫中心訂單費 | 交易金額的0.11%(最低¥3,520,最高¥220,000) |

| 部分股份銷售 | 合約價格的2.2% |

| 零股購買費 | ¥1,100/品牌 |

| 帳戶管理費 | 0 |

| 文件發行費 | ¥1,100(報告、個人資料等) |

交易平台

| 平台/應用程式 | 支援 | 可用設備 | 適合對象 |

| GMO Click FX | ✔ | iPhone / Android / Apple Watch | 外匯交易者(各級別) |

| Hatchu-kun FX Plus | ✔ | Windows | 需要高級功能的外匯交易者 |

| PLATINUM CHART | ✔ | Windows / Mac | 外匯和差價合約技術圖表使用者 |

| FX Watch! | ✔ | Wear OS | 智能手錶上的外匯警報 |

| GMO Click CFD | ✔ | iPhone / Android / Apple Watch | 差價合約交易者 |

| Hatchu-kun CFD | ✔ | Windows / Mac | 需要基於PC的工具的差價合約交易者 |

| GMO Click Stock | ✔ | iPhone / Android | 股票交易者(可通過手機訪問) |

| GMO Click Stocks for iPad | ✔ | iPad / Mac | 偏好平板電腦的股票交易者 |

| Super Hatchu-kun | ✔ | Windows | 需要桌面交易的股票交易者 |

| iClick Forex | ✔ | iPhone / Android | 外匯初學者或在外出交易者 |

| GMO Click Stock BO | ✔ | iPhone / Android | 股票二元期權交易者 |

| iClickFX365 | ✔ | iPhone | FX365交易者(手機) |

| FXroid365 | ✔ | Android | FX365交易者(手機) |