Company Summary

| TopstepFX Review Summary | |

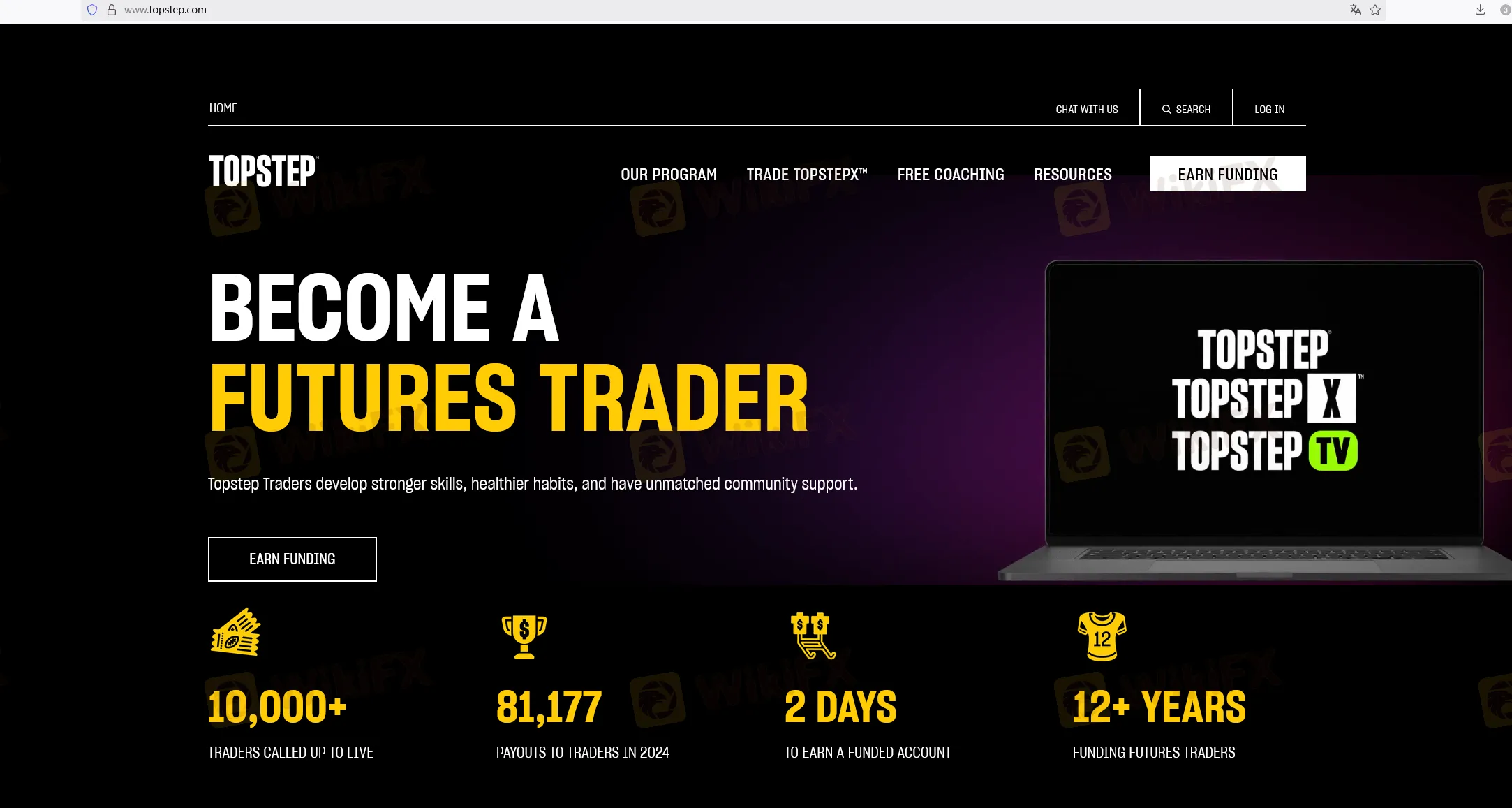

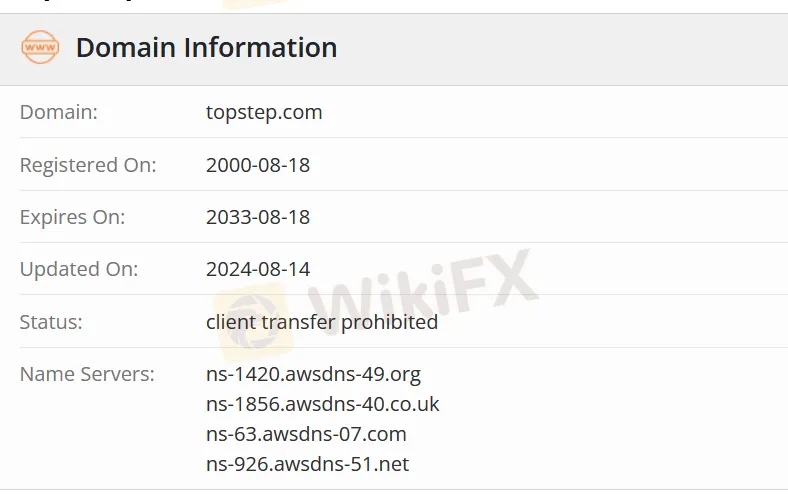

| Founded | 2000 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instrument | Futures |

| Demo Account | ❌ |

| Trading Platform | TopstepX |

| Customer Support | 24/5 live chat |

| Phone: 1-888-407-1611 | |

| Address: Chicago Board of Trade Building 141 W Jackson Blvd #4240 Chicago, IL 60604 | |

TopstepFX Information

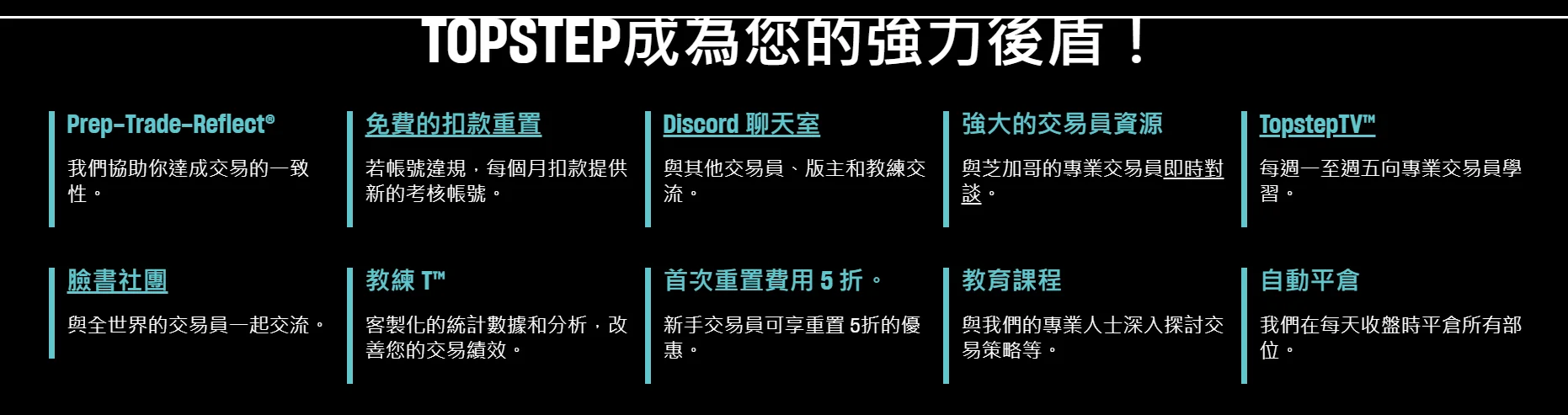

TopstepFX is a company that focuses on providing users with futures experiential learning and evaluation programs. It was registered in the US in 2000, but it's unregulated now.

Pros and Cons

| Pros | Cons |

| Long history | No regulation |

| Expert in futures programs | Limited scope of services |

| Live chat support | Unclear fee structure |

| No info on deposit and withdrawal |

Is TopstepFX Legit?

No. TopstepFX has no regulations currently. Please be aware of the risk!

What can I Trade on TopstepFX?

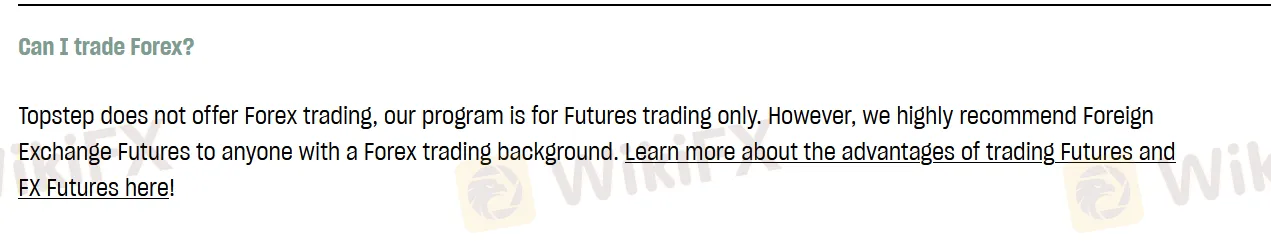

IFX only focuses on providing users with futures trading services.

| Tradable Instruments | Supported |

| Futures | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Trading Platform

TopstepFX offers their own application named TopstepX.

| Trading Platform | Supported | Available Devices |

| TopstepX | ✔ | MAC, PC |