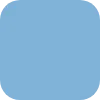

公司簡介

| TopstepFX 評論摘要 | |

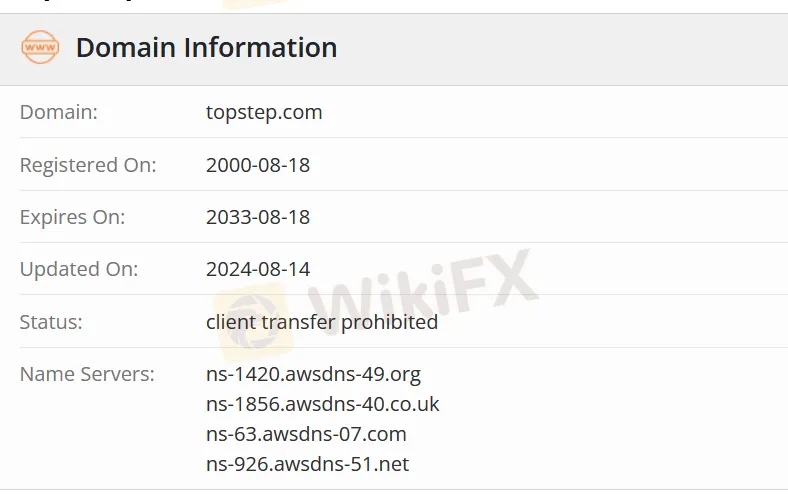

| 成立年份 | 2000 |

| 註冊國家/地區 | 美國 |

| 監管 | 無監管 |

| 市場工具 | 期貨 |

| 模擬帳戶 | ❌ |

| 交易平台 | TopstepX |

| 客戶支援 | 24/5 在線聊天 |

| 電話:1-888-407-1611 | |

| 地址:芝加哥期貨交易所大廈 141 W Jackson Blvd#4240 芝加哥,IL 60604 | |

TopstepFX 資訊

TopstepFX 是一家專注於為用戶提供期貨體驗學習和評估計劃的公司。該公司於2000年在美國註冊,但目前未受監管。

優缺點

| 優點 | 缺點 |

| 歷史悠久 | 無監管 |

| 期貨計劃專家 | 服務範圍有限 |

| 在線聊天支援 | 費用結構不清晰 |

| 沒有存取和提款資訊 |

TopstepFX 是否合法?

不。TopstepFX 目前沒有受到監管。請注意風險!

我可以在 TopstepFX 交易什麼?

IFX 只專注於為用戶提供期貨交易服務。

| 可交易工具 | 支援 |

| 期貨 | ✔ |

| 外匯 | ❌ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 股票 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| ETF | ❌ |

交易平台

TopstepFX 提供了他們自己的應用程式 TopstepX。

| 交易平台 | 支援 | 可用設備 |

| TopstepX | ✔ | MAC, PC |