Présentation de l'entreprise

| TopstepFX Résumé de l'examen | |

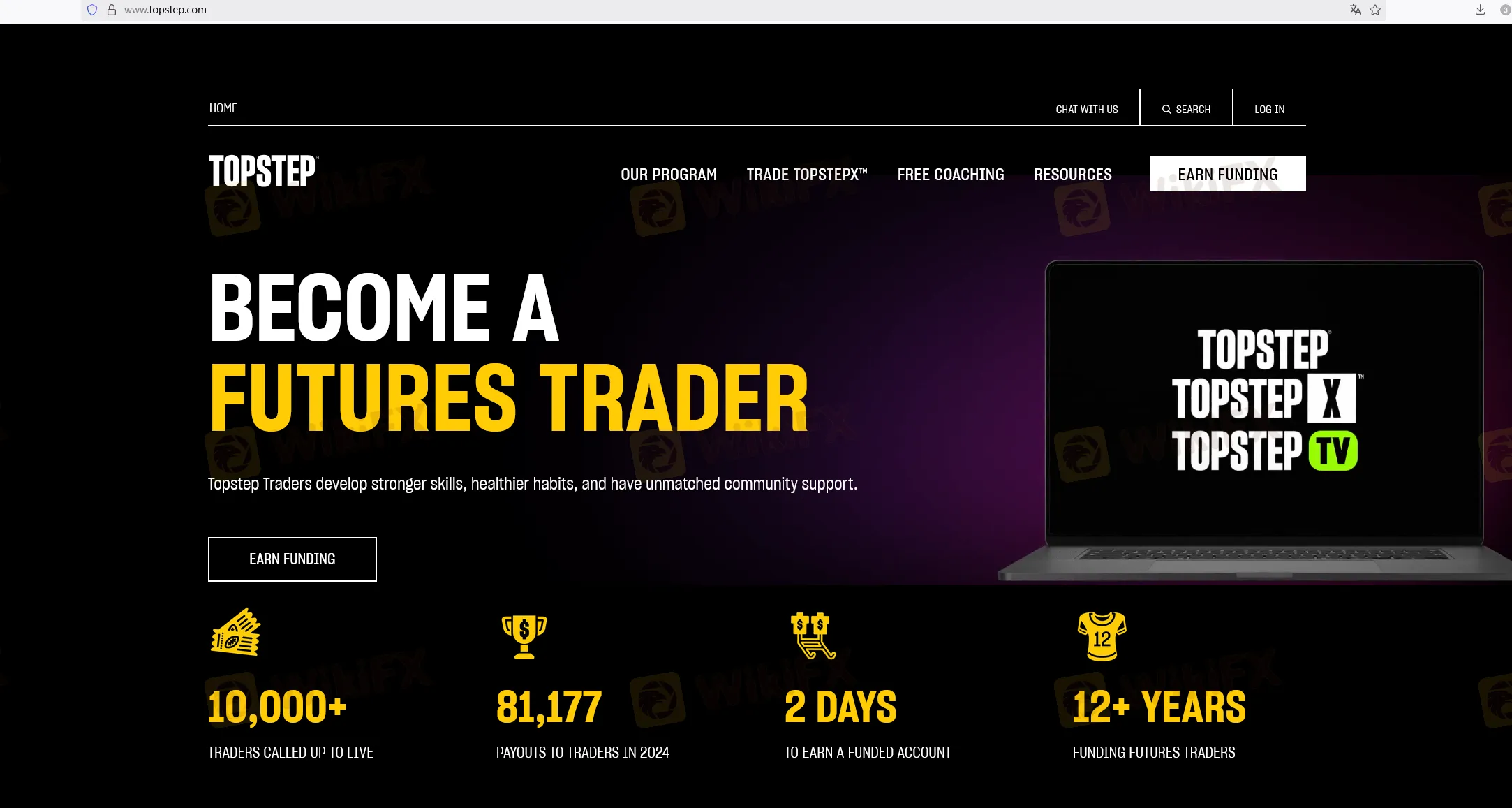

| Fondé | 2000 |

| Pays/Région d'enregistrement | États-Unis |

| Régulation | Pas de régulation |

| Instrument de marché | Futures |

| Compte de démonstration | ❌ |

| Plateforme de trading | TopstepX |

| Support client | Chat en direct 24/5 |

| Téléphone : 1-888-407-1611 | |

| Adresse : Chicago Board of Trade Building 141 W Jackson Blvd #4240 Chicago, IL 60604 | |

Informations sur TopstepFX

TopstepFX est une entreprise qui se concentre sur la fourniture aux utilisateurs de programmes d'apprentissage expérientiel et d'évaluation des contrats à terme. Elle a été enregistrée aux États-Unis en 2000, mais n'est actuellement pas réglementée.

Avantages et inconvénients

| Avantages | Inconvénients |

| Longue histoire | Pas de régulation |

| Expert en programmes de contrats à terme | Gamme de services limitée |

| Support par chat en direct | Structure tarifaire peu claire |

| Pas d'informations sur les dépôts et les retraits |

TopstepFX est-il légitime ?

Non. TopstepFX n'a actuellement aucune régulation. Veuillez être conscient du risque !

Sur quoi puis-je trader sur TopstepFX ?

IFX se concentre uniquement sur la fourniture de services de trading de contrats à terme aux utilisateurs.

| Instruments négociables | Pris en charge |

| Contrats à terme | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptos | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Plateforme de trading

TopstepFX propose leur propre application appelée TopstepX.

| Plateforme de trading | Pris en charge | Appareils disponibles |

| TopstepX | ✔ | MAC, PC |