公司简介

| 万里汇 评论摘要 | |

| 成立时间 | 2004 |

| 注册国家/地区 | 澳大利亚 |

| 监管 | ASIC(受监管);FCA(已超出) |

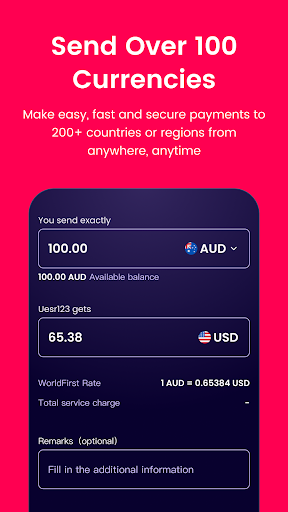

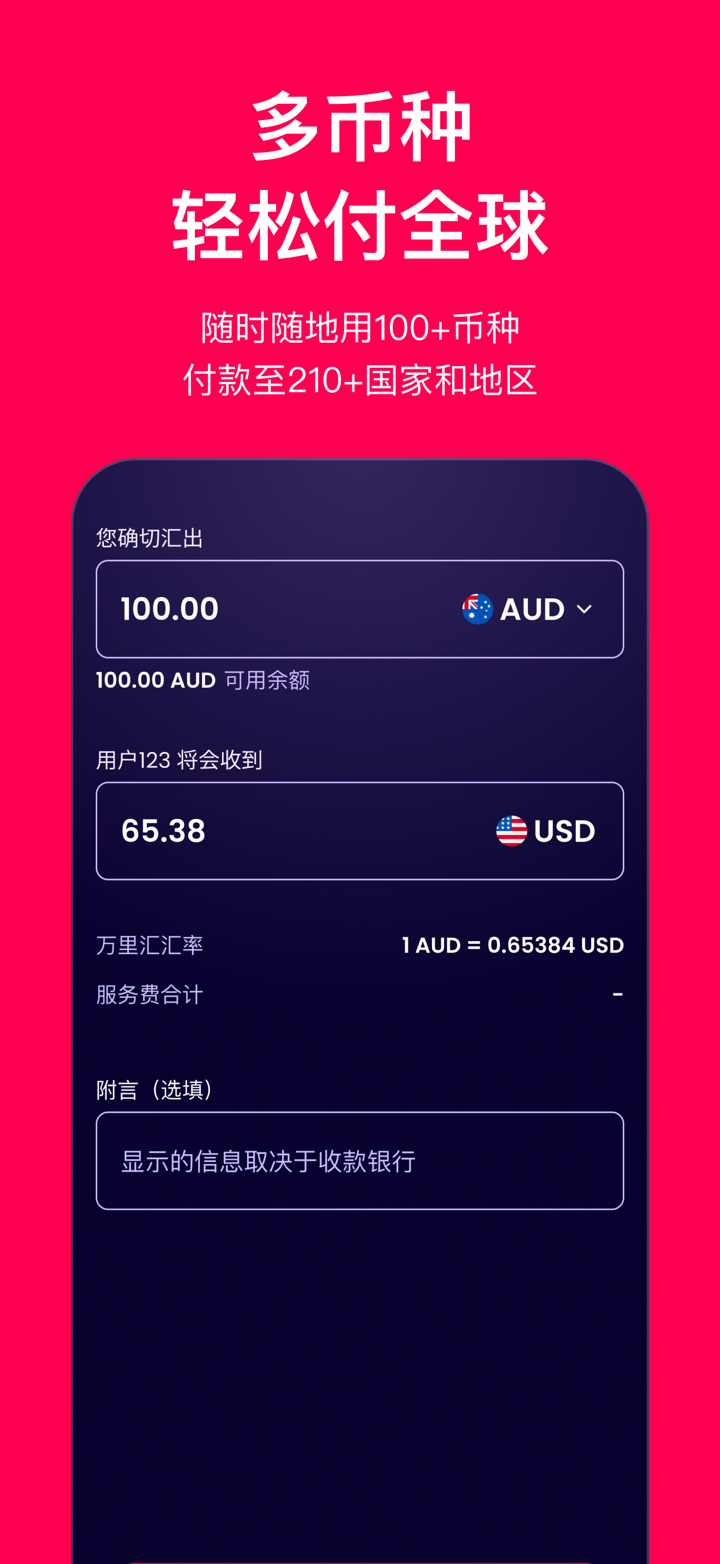

| 产品与服务 | 货币交易所,国际支付,多币种账户,虚拟借记卡,大额支付,远期合同 |

| 客户支持 | 电话(澳大利亚):1800 326 667 |

| 电话(新西兰):0800 666 114 | |

| 电话(国际):+61 2 8298 4990 | |

| 电子邮件:media@worldfirst.com | |

万里汇 信息

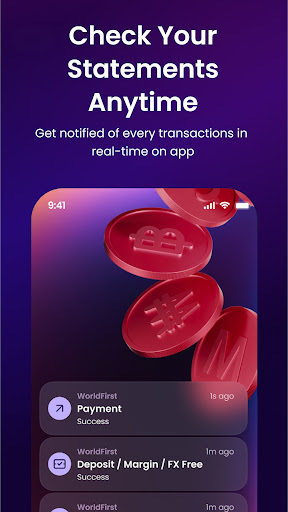

万里汇,成立于2004年,是一家总部位于澳大利亚的ASIC监管的金融服务机构,专注于全球商业支付和货币兑换。其主要特点包括多币种账户,外汇交易所解决方案和虚拟借记卡,所有这些都没有持续维护手续费,适用于电子商务和中小企业。

优点和缺点

| 优点 | 缺点 |

| ASIC监管 | 主要面向企业,而非个人 |

| 免费多币种账户和当日转账 | |

| 透明且限制外汇兑换费用 | |

| 悠久的运营历史 |

万里汇 是否合法?

万里汇 是一家受监管的金融机构。澳大利亚证券与投资委员会(ASIC)已批准World First Pty Ltd为做市商。该许可证是有效的。

此外,英国金融行为监管局(FCA)授予其支付服务许可。然而,其当前FCA状态为“已超出”,这意味着许可证可能不再有效或符合要求。

| 监管机构 | 当前状态 | 受监管国家 | 许可证类型 | 许可证号码 |

| 澳大利亚证券与投资委员会(ASIC) | 受监管 | 澳大利亚 | 做市商(MM) | 000331945 |

| 金融行为监管局(FCA) | 已超出 | 英国 | 支付许可证 | 900508 |

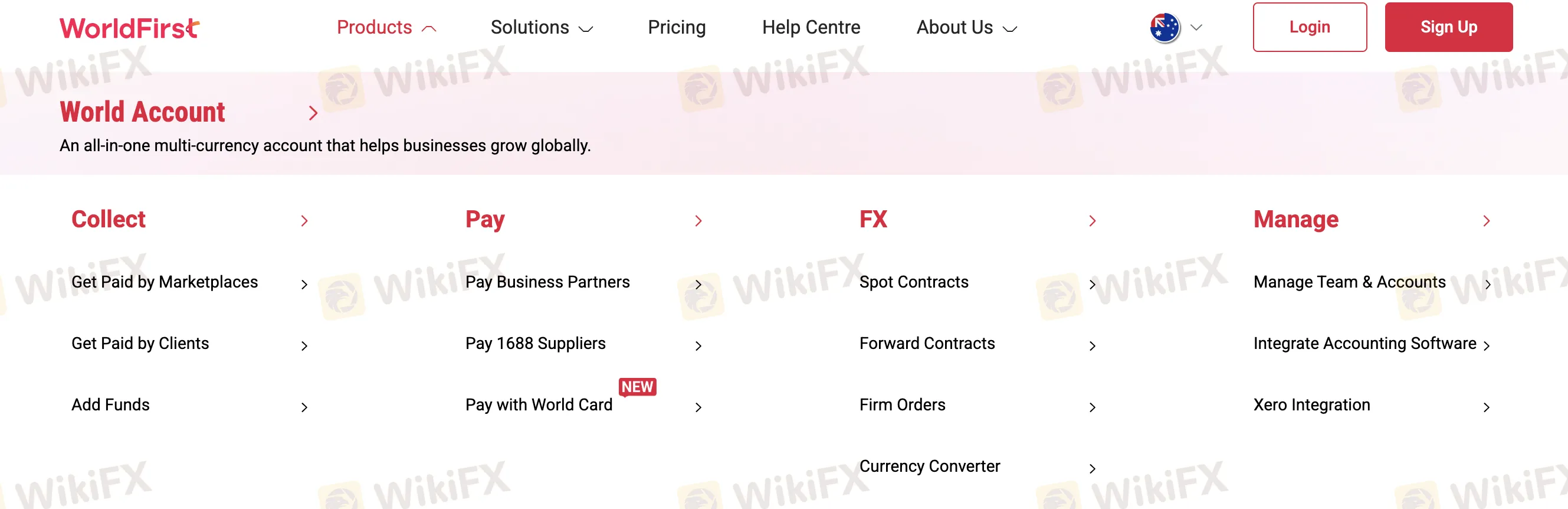

产品与服务

万里汇 明确定位为B2B(企业对企业)解决方案,重点关注跨境支付、外汇服务和全球贸易的账户管理。

| 产品/服务 | 特点 | 支持 |

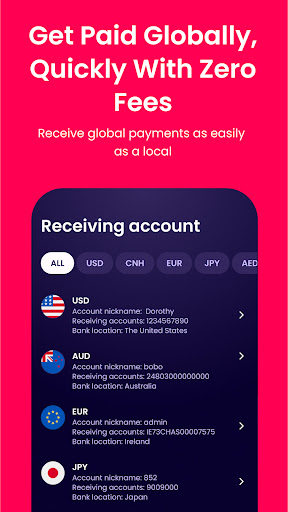

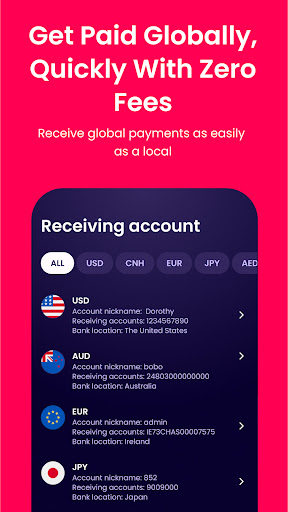

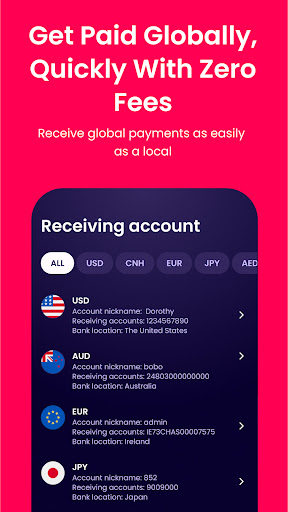

| 多币种账户 | 全球业务需求的World Account | ✔ |

| 市场收款 | 从亚马逊、Etsy、Shopify等收款 | ✔ |

| 客户开票 | 直接从客户处收款 | ✔ |

| 资金转账 | 向商业伙伴或供应商汇款 | ✔ |

| 外汇服务 | 即期合约、远期合约、确定订单 | ✔ |

| World Card支付 | 使用World Card支付 | ✔ |

| 企业支付 | 进口商/出口商的解决方案 | ✔ |

| 中国支付 | 直接支付至中国 | ✔ |

| 团队和账户管理 | 内部团队的管理工具 | ✔ |

| 软件集成 | 与Xero等会计系统集成 | ✔ |

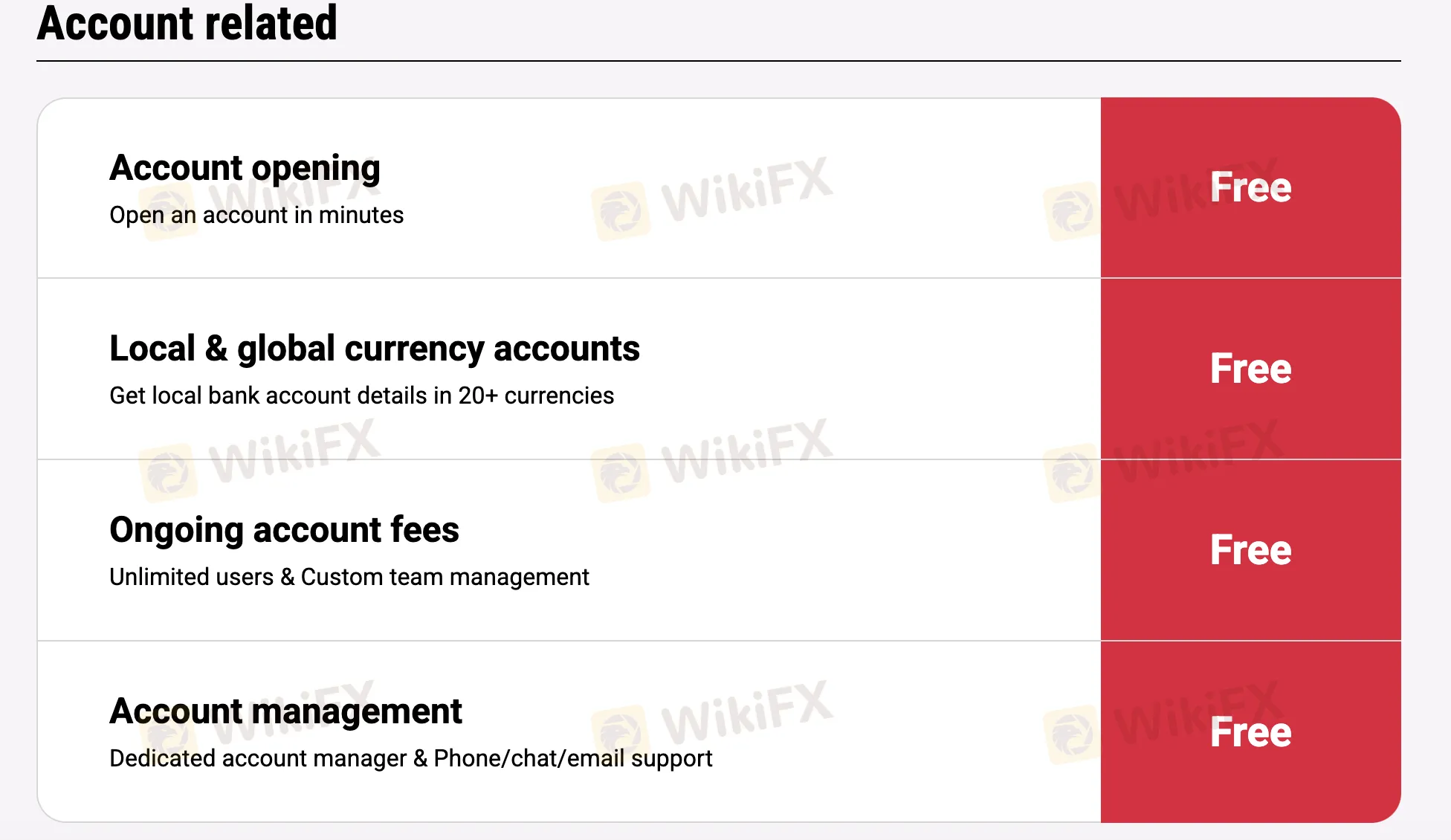

万里汇 费用

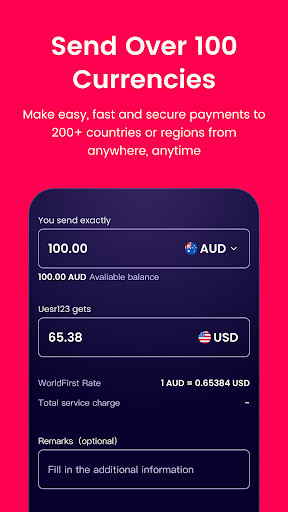

万里汇 的费率通常低于行业标准,特别适用于处理跨境支付和外汇的机构。大多数基本服务是免费的,而对于需要支付费用的地方(例如货币交易所),费用明确限制在最低百分比。

| 服务类别 | 详情 | 费用 |

| 账户开立和维护 | 开立和维护World Account | 0 |

| 本地和全球货币账户 | 20+种货币 | |

| 持续账户费用 | 无限用户,团队管理 | |

| 专属支持 | 电话、聊天和电子邮件支持 | |

| 收款和持有支付 | 从市场/客户处收款 | |

| 资金存入账户 | 从个人或企业账户 | |

| 持有资金 | 最多20+种货币 | |

| 支付和货币兑换 | 本地AUD/NZD支付 | |

| 其他货币支付 | 本地/跨境(非AUD/NZD) | 从0.4%,限额为AUD 15 |

| 向其他World账户支付 | 任何地方,即时 | 0 |

| 向1688支付 | 即时支付给供应商 | 最高0.8% |

| 主要货币的外汇 | USD、EUR、GBP、AUD、CAD、JPY | 最高0.6% |

| 次要货币的外汇 | 40+种货币 | 从0.67% |

| 远期合约 | 风险管理解决方案 | 最高0.2%/月 |

| 全额转账(FVT)- 美国/英国/欧洲经济区 | 确保全额收到 | 0 |

| FVT - 其他国家 | 固定AUD 25 | |

| World Card(借记卡) | 申请、25个用户、使用 | 0 |

| 未持有余额的货币 | 在万里汇或万事达卡处进行外汇兑换 | 最高1.5% |

| 工具和集成 | 批量支付、Xero、NetSuite集成 | 0 |

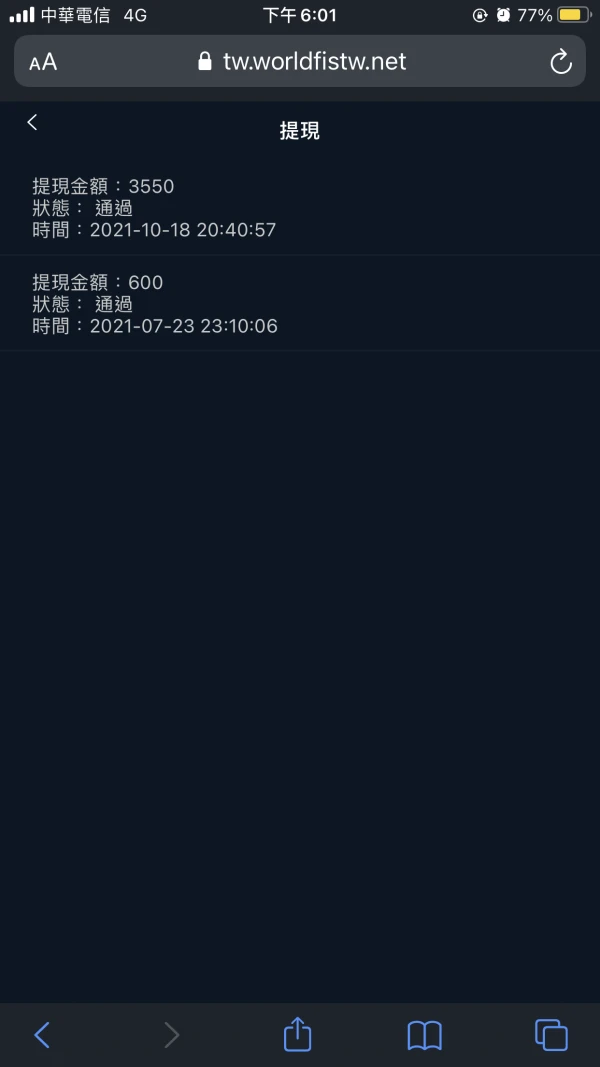

蘇義盛

台湾

客服回覆留言您須繳納1萬美金 才能解凍保證金 因金融監管機關對帳號及資產安全要求比較嚴格 需繳納保證金會比較多 平台上面沒有明確的規定 這好像不合理吧 提領 解凍保證金要1萬美金 是合理嗎?

曝光

蘇義盛

台湾

問了 客服 您好公司通知 因技術部門檢測到您的平台帳號存在異常問題 這是安全問題 涉及到帳戶被盜用的可能性 所以您審覆無法通過 您需要解除您的帳號異常問題才能正常提款 公司要求您需繳5千美金風險金 您解除異常後才能給你帳號出款 請問我沒有異常操作 提款20572美金 不出金 客服 還要求我要繳5千美 說我操作部當? 為什麼要在儲5千美金 風險金 這是合理的嗎?

曝光

蘇義盛

台湾

這個平台 提領 不出金 還要求你帳號異常在儲5千美金 說是風險金 這沒道理 我們都只是投資者 沒能力操控平台上的提領跟存款 我合理懷疑這平台有詐騙的行為 只有官方客服在回覆 沒電話 這是公司嗎?我帳號裡面還有25124美金 他不讓我提領 這是我遇過最離譜的事情 而且這平台四處去交友網站 找投資者下手 會用釣魚的方式 請大家小心謹慎!

曝光

FX1485573802

菲律宾

WorldFirst一直是我进行国际转账的首选。让人放心的是,他们受ASIC监管并在AUSTRAC注册。转账非常方便,他们对任何费用都非常清楚。

好评

Alfred

印尼

老实说,WorldFirst 可以给 5 颗星,但我的资金直到现在才到,因为已经五天了。我在等待的时候写这篇评论......

好评

葉翰隆

台湾

我因為外匯交易平台 提現的帳號輸入錯誤被平台凍結 平台需要我繳納5千美金的保證金 但我唯一聯絡的方式只有line 我也不確定保證金拿的回來

曝光