mohdfazlan

1-2年

Can you outline the main advantages GOLDTRUST FUTURES offers in terms of its available trading instruments and how its fee structure benefits traders?

As a trader who has evaluated multiple brokers, I consider GOLDTRUST FUTURES to be very focused and specialized when it comes to trading instruments. In my experience, their main advantage lies in being a regulated firm under the China Financial Futures Exchange (CFFEX), offering true futures trading. This narrow specialization may appeal to those who specifically seek access to futures, especially within the Chinese market, but for anyone looking for forex, commodities, or other global asset classes, GOLDTRUST does not provide those options. This limitation means I’ve turned to them only when my strategy was specifically centered around futures rather than broader portfolio diversification.

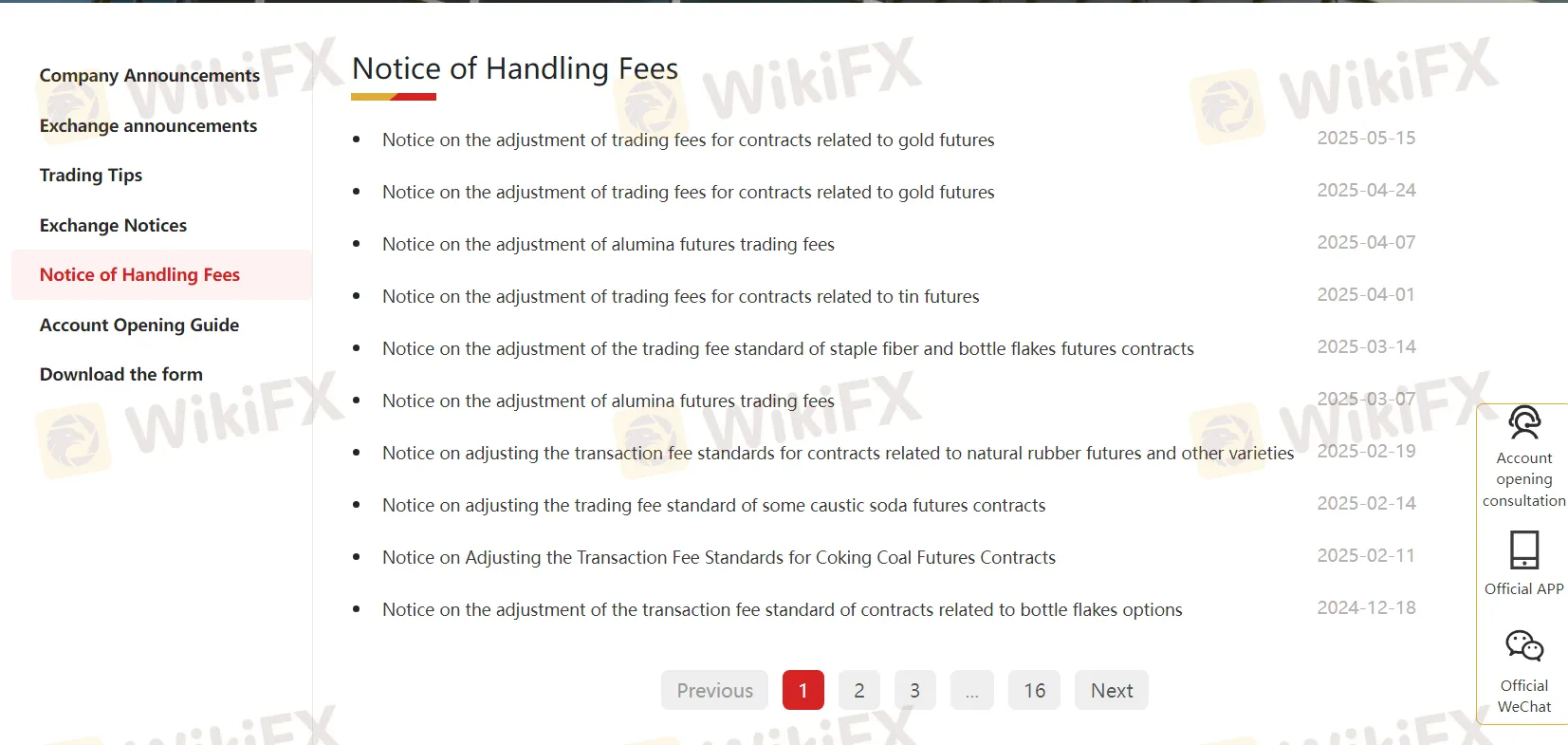

When considering their fee structure, I was careful to note that, while they charge handling fees (as is standard with futures brokers), they do not publicly disclose detailed rates for each commodity. For a cautious trader like myself, this lack of transparent pricing information makes fee comparison and cost planning more difficult. However, I do appreciate that different commodities have different cost structures, which can sometimes offer more competitive rates for active futures traders, depending on the instruments chosen. Still, in my view, the absence of clarity may hinder effective risk and cost management.

Overall, GOLDTRUST FUTURES stands out for regulated futures trading in China, but its advantages are strictly suited for a niche segment of traders. For me, this broker is a fit only when my trades align with its focused instrument offering and my due diligence satisfies their fee structure, despite its limited transparency.

edgeisedge

1-2年

How do GOLDTRUST FUTURES' overnight financing (swap) fees stack up against those offered by other brokers?

As someone with extensive trading experience, I always examine broker fee structures with caution, especially when it comes to overnight financing (swap) charges, since these costs can significantly impact profitability over time. For GOLDTRUST FUTURES, the issue is that, although they are a regulated Chinese broker with a futures license from CFFEX and have been operating for several years, they do not publicly disclose the specific fee standards for their products, including any potential overnight financing or swap-related fees.

This lack of transparency puts me on alert. In my experience, the inability to easily compare these charges with those of other brokers—especially internationally recognized names that tend to offer clear, published swap rates—makes it difficult for a trader to accurately assess the full cost of trading with GOLDTRUST FUTURES. It is possible that their fee structure is competitive, but without published details, I am hesitant to assume so. Transparency around fees is also an important indicator of a broker’s client-centric approach; opaque pricing can sometimes bring unwelcome surprises for active or leveraged traders.

Therefore, for me, the absence of specific, readily available overnight financing fee information means I cannot reliably compare GOLDTRUST FUTURES to other brokers on this point, and I would seek this clarity before committing any significant trading capital.

Broker Issues

Fees and Spreads

sweetosh

1-2年

Does GOLDTRUST FUTURES offer a swap-free Islamic account option for its traders?

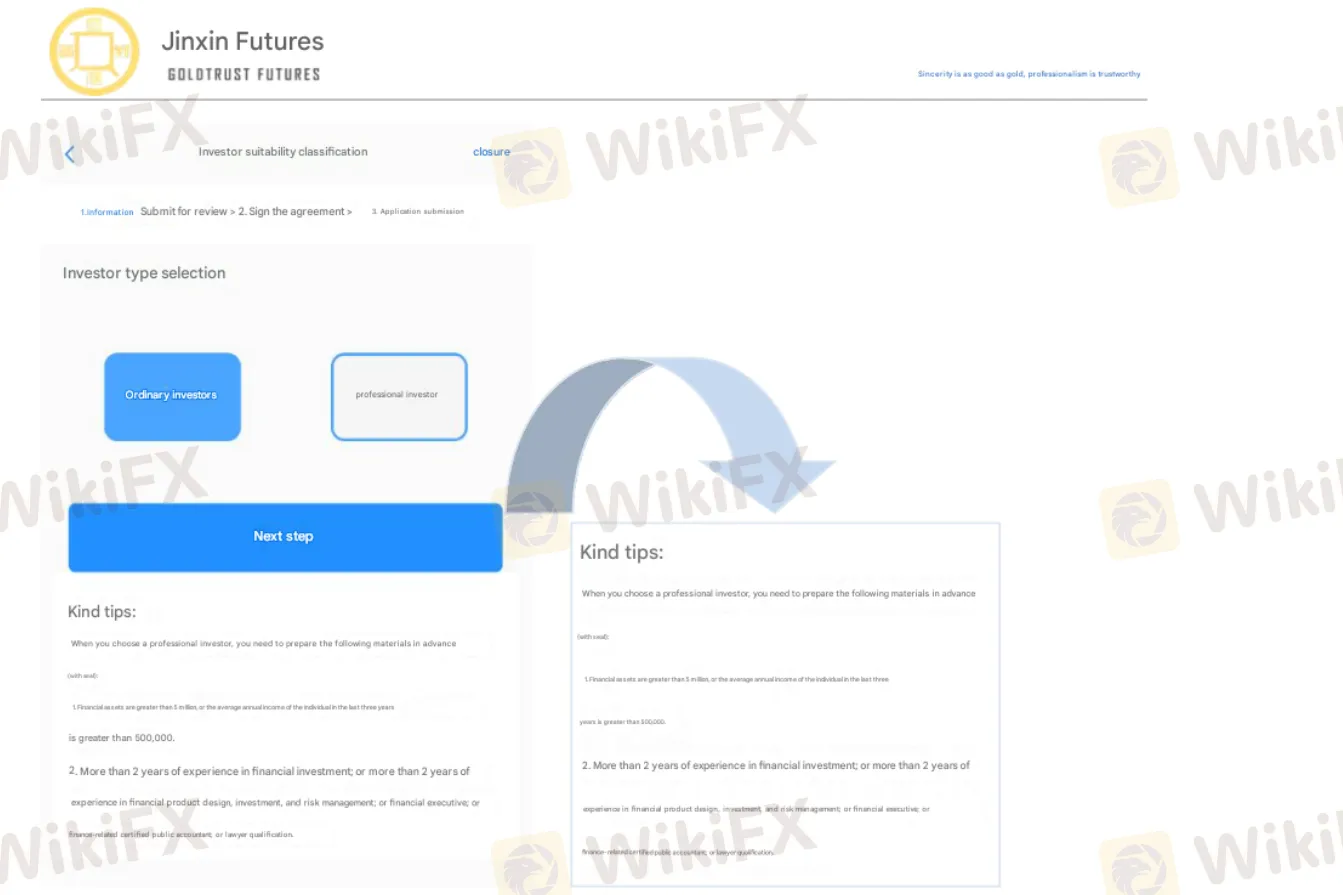

Based on my careful review of GOLDTRUST FUTURES and the information available from official sources, I can confirm that the broker primarily focuses on offering futures products and related services under regulation in China. As someone who often considers the needs of traders with specific account requirements—such as those who follow Islamic finance principles—it's notable that GOLDTRUST FUTURES primarily lists regular and professional accounts, with no mention or evidence of a swap-free or Islamic account option.

From an experienced trader’s perspective, the absence of any detail about swap-free provisions is significant. Many brokers that do cater to Shariah-compliant traders will explicitly advertise such features due to their importance. Here, GOLDTRUST’s account types appear limited and, based on what’s disclosed, do not address the particular needs of Islamic traders who must avoid interest-based transactions. In my opinion, this indicates that GOLDTRUST is currently not suitable for clients seeking a verified Islamic trading environment.

Furthermore, without public specifics about the fee structure or any alternative to swaps, I would advise anyone needing an Islamic account to seek additional clarity directly from the broker before opening an account. For now, I do not see credible evidence that GOLDTRUST FUTURES offers swap-free or Islamic accounts. For ethical, financial, and regulatory reasons, caution and further inquiry are warranted for traders with such requirements.

Broker Issues

Platform

Account

Instruments

Leverage

J Forex Trader

1-2年

Can you tell me what the typical spread is for EUR/USD on a standard account with GOLDTRUST FUTURES?

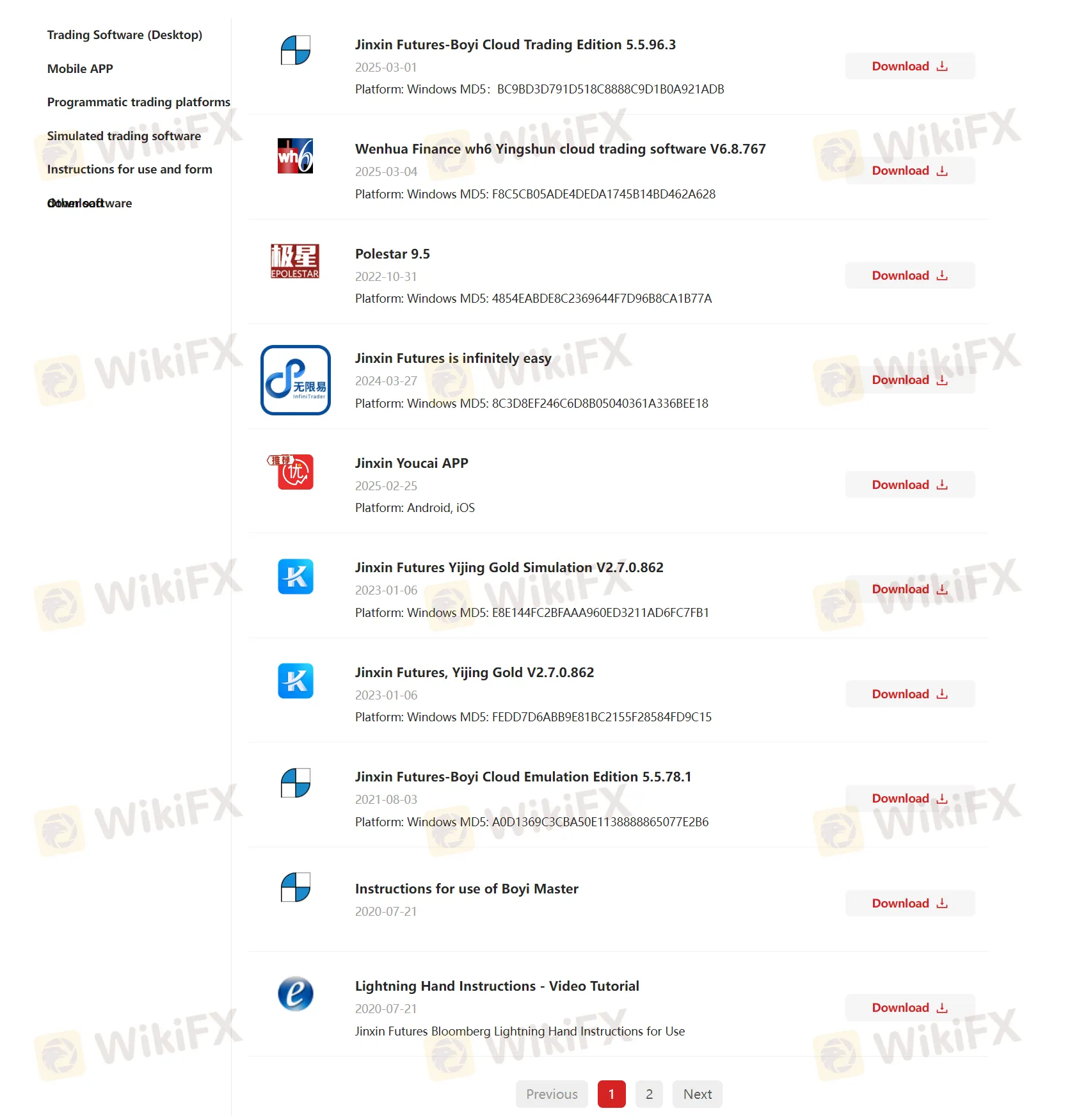

As someone with years of independent trading experience, I always want clear information on costs like spreads before committing to a broker. Unfortunately, with GOLDTRUST FUTURES, I have not found specific public details regarding spreads for EUR/USD, or any forex pairs for that matter, because this broker is not focused on the spot forex market. The factual documentation shows GOLDTRUST holds a futures license from CFFEX in China and offers services centered around commodity delivery brokerage, financial futures brokerage, investment consulting, and asset management, rather than forex trading.

For me, the noticeable absence of forex products—including EUR/USD—means that spread information is not applicable. I also noted that while they mention undisclosed handling fees for different commodities, there’s no mention of standard or variable spreads as most forex brokers would display. My approach is to work only with transparent brokers who provide detailed information upfront; in GOLDTRUST’s case, I cannot verify their competitiveness for forex because this is not in their scope. If currency trading is your focus, I would advise confirming a broker’s product lineup and cost structure directly—choosing entities regulated and specialized for your specific market. Caution and thorough research are always my priorities before opening an account.

Broker Issues

Fees and Spreads