基礎資訊

中國

中國天眼評分

中國

|

5-10年

|

中國

|

5-10年

| https://www.jinxinqh.com/

官方網址

評分指數

影響力

C

影響力指數 NO.1

香港 2.81

香港 2.81 監管資訊

監管資訊持牌機構:金信期货有限公司

監管證號:0227

中國

中國 jinxinqh.com

jinxinqh.com hnjxqh.com

hnjxqh.com

| GOLDTRUST評論摘要 | |

| 成立年份 | 2019 |

| 註冊國家/地區 | 中國 |

| 監管 | 由CFFEX監管 |

| 市場工具 | 期貨 |

| 模擬帳戶 | / |

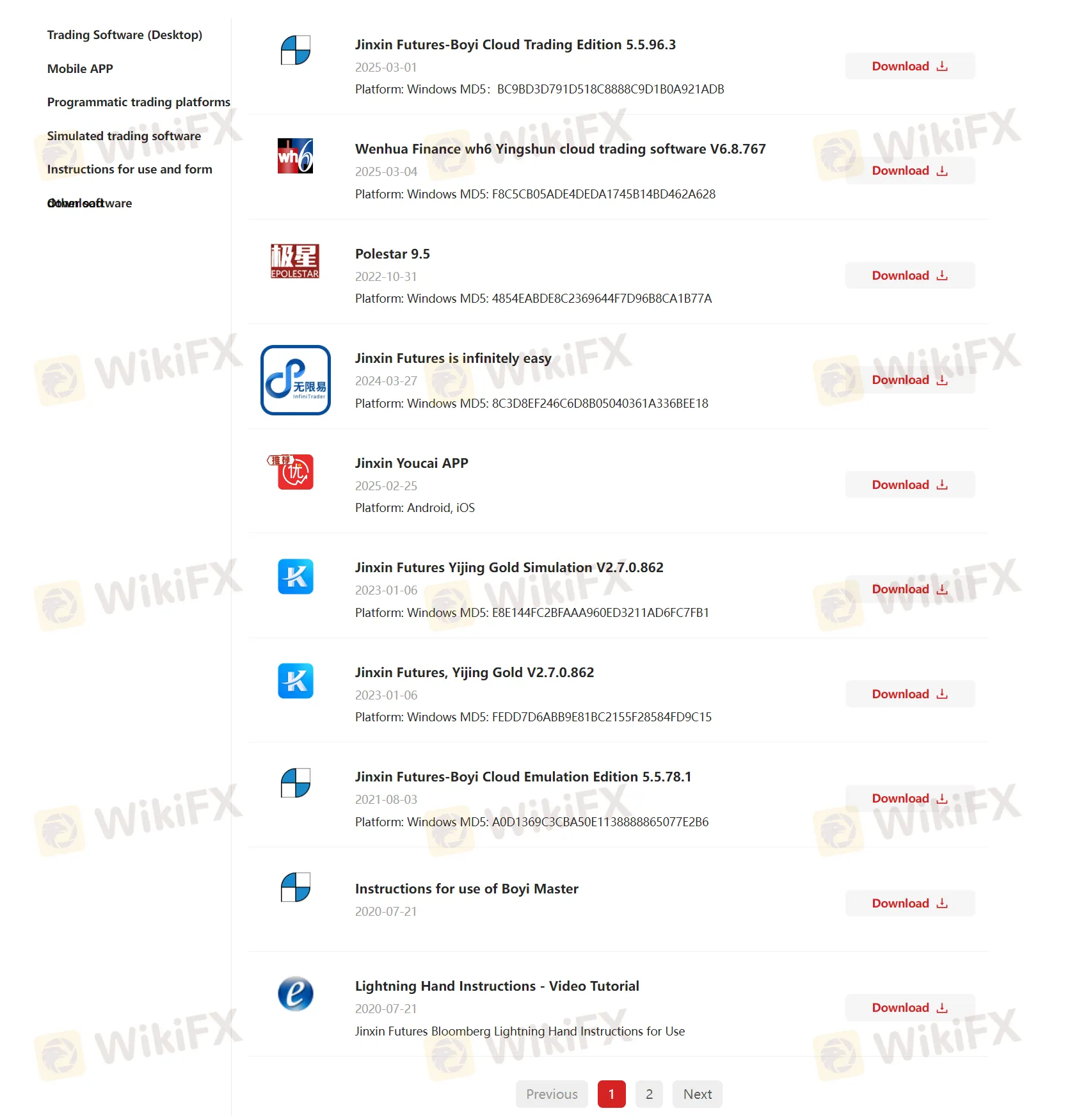

| 交易平台 | 博易雲、英順雲、極星等 |

| 客戶支援 | 微信 |

| 電話:400-0988-278 | |

| 電郵:kefu@jinxinqh.com | |

GOLDTRUST是一家受監管的經紀商,提供商品交割經紀、金融期貨經紀、期貨投資諮詢、資產管理等產品和服務。該經紀商有多種交易選項。不同商品有不同的費用規定。

| 優點 | 缺點 |

| 受中國金融期貨交易所監管 | 收取手續費 |

| 提供多種金融服務 | 帳戶類型選擇有限 |

| 多種聯絡渠道 |

是的。GOLDTRUST是中國的一家受監管金融機構,根據CFFEX發放的期貨牌照0227號提供服務。

| 受監管國家 | 監管機構 | 當前狀態 | 受監管實體 | 牌照類型 | 牌照號碼 |

| 中國 | CFFEX | 受監管 | 金信期货有限公司 | 期貨牌照 | 0227 |

GOLDTRUST 提供多元化的市場工具,包括商品交割經紀、金融期貨經紀、期貨投資諮詢、資產管理等。

| 交易工具 | 支援 |

| 期貨 | ✔ |

| 外匯 | ❌ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 股票 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| ETF | ❌ |

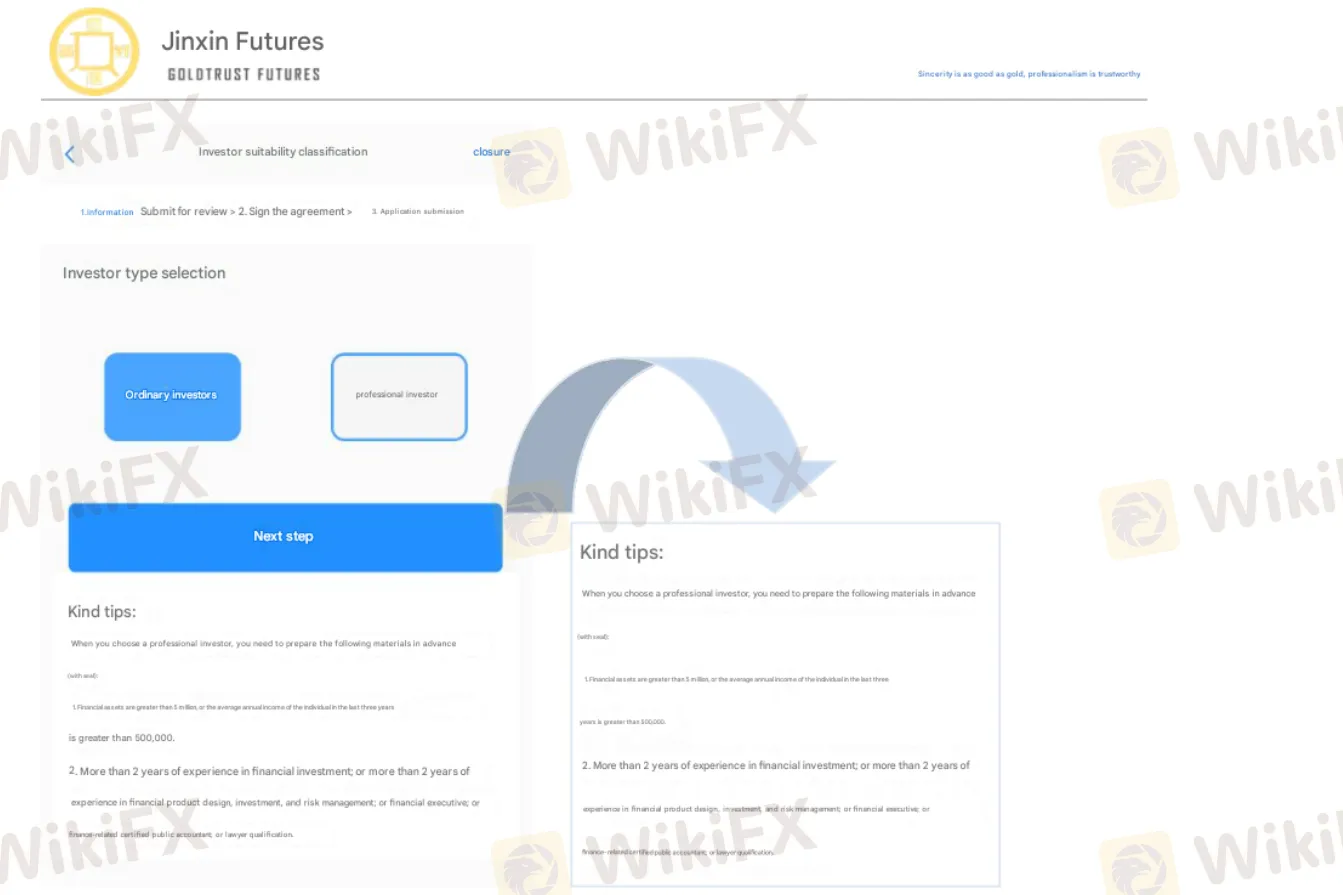

金信期貨 向客戶提供兩種類型的帳戶,分為普通帳戶和專業帳戶。

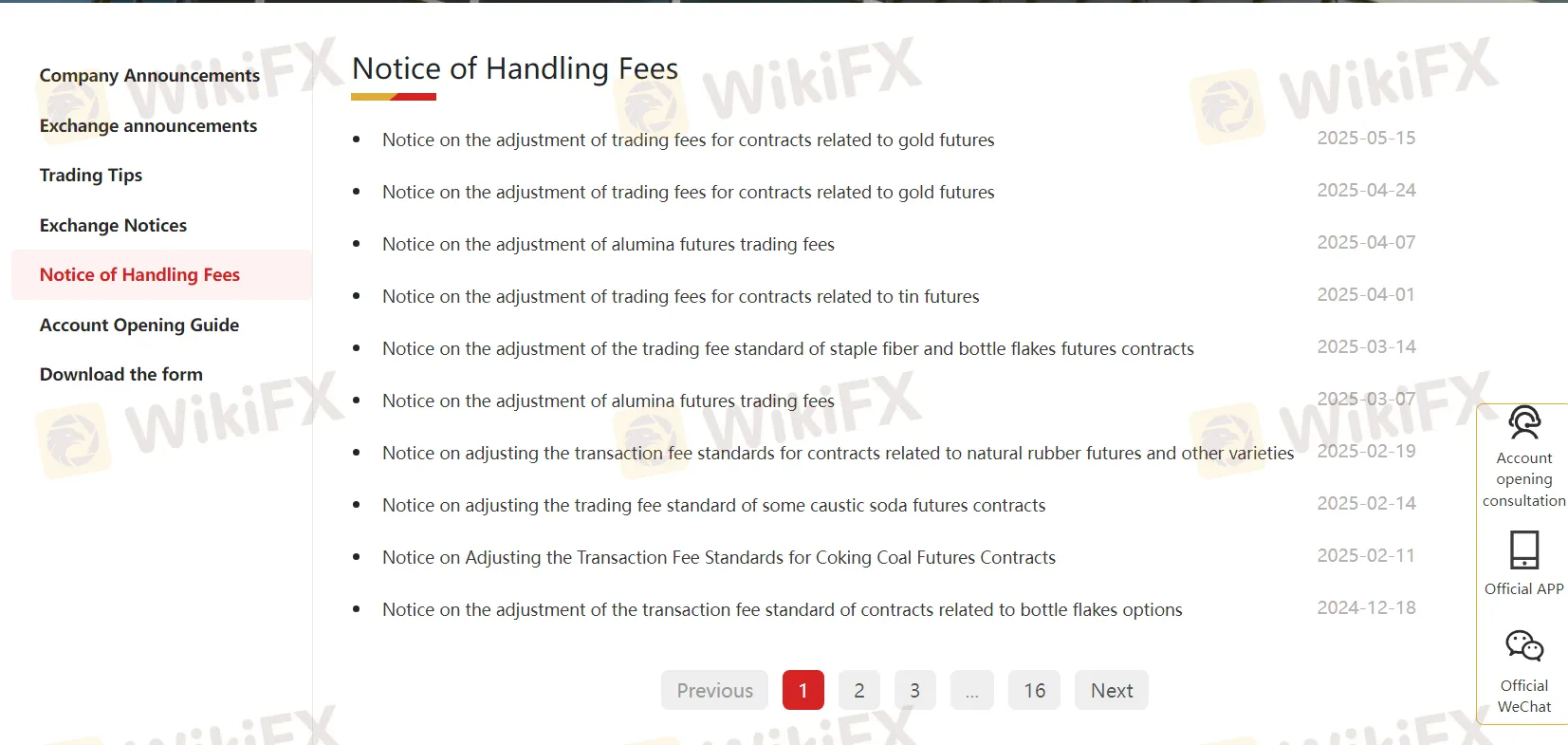

不同商品有不同的費用規定,但經紀商並未公開具體的費用標準。

GOLDTRUST 提供多種交易平台,如博易雲、盈順雲、極星等。

GOLDTRUST 僅接受銀行電匯支付。

As a trader who has evaluated multiple brokers, I consider GOLDTRUST FUTURES to be very focused and specialized when it comes to trading instruments. In my experience, their main advantage lies in being a regulated firm under the China Financial Futures Exchange (CFFEX), offering true futures trading. This narrow specialization may appeal to those who specifically seek access to futures, especially within the Chinese market, but for anyone looking for forex, commodities, or other global asset classes, GOLDTRUST does not provide those options. This limitation means I’ve turned to them only when my strategy was specifically centered around futures rather than broader portfolio diversification. When considering their fee structure, I was careful to note that, while they charge handling fees (as is standard with futures brokers), they do not publicly disclose detailed rates for each commodity. For a cautious trader like myself, this lack of transparent pricing information makes fee comparison and cost planning more difficult. However, I do appreciate that different commodities have different cost structures, which can sometimes offer more competitive rates for active futures traders, depending on the instruments chosen. Still, in my view, the absence of clarity may hinder effective risk and cost management. Overall, GOLDTRUST FUTURES stands out for regulated futures trading in China, but its advantages are strictly suited for a niche segment of traders. For me, this broker is a fit only when my trades align with its focused instrument offering and my due diligence satisfies their fee structure, despite its limited transparency.

As someone with extensive trading experience, I always examine broker fee structures with caution, especially when it comes to overnight financing (swap) charges, since these costs can significantly impact profitability over time. For GOLDTRUST FUTURES, the issue is that, although they are a regulated Chinese broker with a futures license from CFFEX and have been operating for several years, they do not publicly disclose the specific fee standards for their products, including any potential overnight financing or swap-related fees. This lack of transparency puts me on alert. In my experience, the inability to easily compare these charges with those of other brokers—especially internationally recognized names that tend to offer clear, published swap rates—makes it difficult for a trader to accurately assess the full cost of trading with GOLDTRUST FUTURES. It is possible that their fee structure is competitive, but without published details, I am hesitant to assume so. Transparency around fees is also an important indicator of a broker’s client-centric approach; opaque pricing can sometimes bring unwelcome surprises for active or leveraged traders. Therefore, for me, the absence of specific, readily available overnight financing fee information means I cannot reliably compare GOLDTRUST FUTURES to other brokers on this point, and I would seek this clarity before committing any significant trading capital.

Based on my careful review of GOLDTRUST FUTURES and the information available from official sources, I can confirm that the broker primarily focuses on offering futures products and related services under regulation in China. As someone who often considers the needs of traders with specific account requirements—such as those who follow Islamic finance principles—it's notable that GOLDTRUST FUTURES primarily lists regular and professional accounts, with no mention or evidence of a swap-free or Islamic account option. From an experienced trader’s perspective, the absence of any detail about swap-free provisions is significant. Many brokers that do cater to Shariah-compliant traders will explicitly advertise such features due to their importance. Here, GOLDTRUST’s account types appear limited and, based on what’s disclosed, do not address the particular needs of Islamic traders who must avoid interest-based transactions. In my opinion, this indicates that GOLDTRUST is currently not suitable for clients seeking a verified Islamic trading environment. Furthermore, without public specifics about the fee structure or any alternative to swaps, I would advise anyone needing an Islamic account to seek additional clarity directly from the broker before opening an account. For now, I do not see credible evidence that GOLDTRUST FUTURES offers swap-free or Islamic accounts. For ethical, financial, and regulatory reasons, caution and further inquiry are warranted for traders with such requirements.

As someone with years of independent trading experience, I always want clear information on costs like spreads before committing to a broker. Unfortunately, with GOLDTRUST FUTURES, I have not found specific public details regarding spreads for EUR/USD, or any forex pairs for that matter, because this broker is not focused on the spot forex market. The factual documentation shows GOLDTRUST holds a futures license from CFFEX in China and offers services centered around commodity delivery brokerage, financial futures brokerage, investment consulting, and asset management, rather than forex trading. For me, the noticeable absence of forex products—including EUR/USD—means that spread information is not applicable. I also noted that while they mention undisclosed handling fees for different commodities, there’s no mention of standard or variable spreads as most forex brokers would display. My approach is to work only with transparent brokers who provide detailed information upfront; in GOLDTRUST’s case, I cannot verify their competitiveness for forex because this is not in their scope. If currency trading is your focus, I would advise confirming a broker’s product lineup and cost structure directly—choosing entities regulated and specialized for your specific market. Caution and thorough research are always my priorities before opening an account.

請輸入...