Buod ng kumpanya

| BOOM Buod ng Pagsusuri | |

| Itinatag | 1997 |

| Rehistradong Bansa/Rehiyon | Hong Kong |

| Regulasyon | SFC |

| Mga Kasangkapan sa Merkado | Multi-market stocks, futures contracts, stock futures, currency futures, interest rates futures, metal futures |

| Demo Account | ❌ |

| Platform ng Paggawa ng Kalakalan | Web, mobile |

| Minimum na Deposito | 0 |

| Suporta sa Customer | Tel: +852 2255 8888 |

| Email: service@boomhq.com | |

Impormasyon ng BOOM

Ang Boom Securities ay isang online na broker na nakabase sa Hong Kong na itinatag noong 1997 at nirehistro sa pamamagitan ng Hong Kong SFC (CE Number: AEF808). Nagbibigay ito ng access sa pandaigdigang merkado ng stocks at futures sa pamamagitan ng kanilang sariling web at mobile trading platforms, nang walang bayad sa deposito o pag-withdraw.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulado ng Hong Kong SFC | Walang available na demo accounts |

| Access sa 12+ global stock & futures markets | May bayad na inactivity fee para sa mga dormant accounts |

| Walang bayad sa deposito o pag-withdraw |

Tunay ba ang BOOM?

Ang Boom Securities (H.K.) Limited ay isang lehitimong at regulated na institusyon sa pinansyal. Ito ay awtorisado ng Securities and Futures Commission (SFC) ng Hong Kong, na isang kilalang regulatory body sa industriya ng pinansya. Ang kumpanya ay may lisensiyang Dealing in futures contracts na may license number AEF808.

Ano ang Maaari Kong I-trade sa BOOM?

Nag-aalok ang Boom Securities ng iba't ibang mga instrumento sa kalakalan kabilang ang U.S. stocks, Hong Kong at global futures, na sumasaklaw sa mga index, currencies, interest rates, commodities, energies, at metals.

| Mga Tradable na Instrumento | Supported |

| Mga Currencies | ✔ |

| Mga Commodity | ✔ |

| Mga Indexes | ✔ |

| Mga Stocks | ✔ |

| Mga ETFs | ✔ |

| Mga Cryptocurrencies | ❌ |

| Mga Bonds | ❌ |

| Mga Options | ❌ |

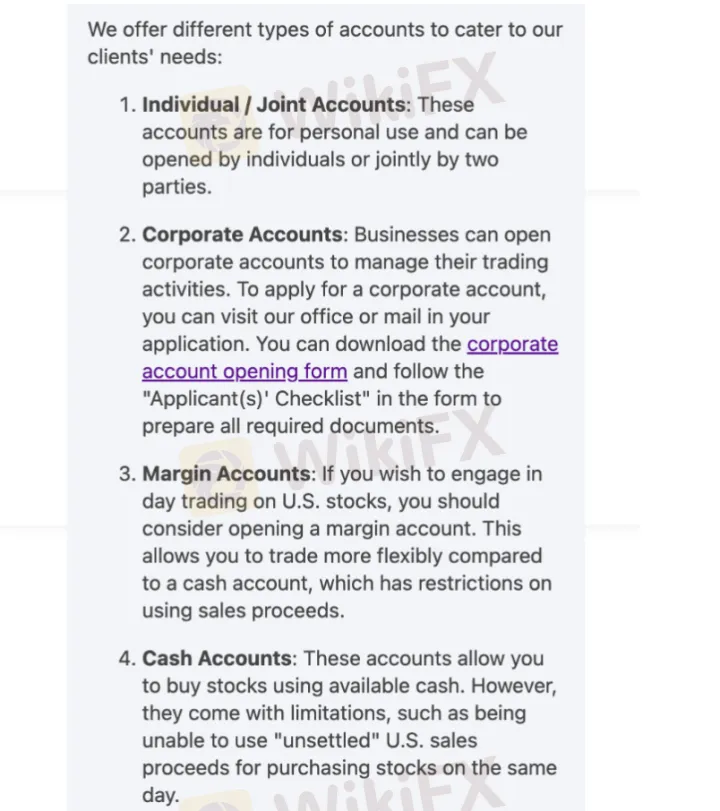

Uri ng Account

Nag-aalok ang Boom Securities ng kabuuang 4 uri ng mga live trading account: Indibidwal/Joint Accounts, Corporate Accounts, Margin Accounts, at Cash Accounts. Ang bawat account ay idinisenyo upang maisakatuparan ang iba't ibang uri ng mga mangangalakal, mula sa personal na mga mamumuhunan at korporasyon hanggang sa aktibong mga mangangalakal ng U.S. na araw-araw.

| Uri ng Account | Tampok | Angkop para sa |

| Indibidwal/Joint | Para sa indibidwal na paggamit o pag-aari nang magkasama ng dalawang tao | Personal na mga mamumuhunan |

| Korporasyon | Idinisenyo para sa mga kumpanya upang pamahalaan ang mga operasyon sa trading | Mga negosyo o institusyon |

| Margin | Nagbibigay-daan sa malikhaing trading na may kakayahan na gumamit ng hindi pa natatapos na pondo | Aktibong o araw-araw na mga mangangalakal sa mga stocks ng U.S. |

| Cash | Nagtetrading lamang gamit ang natapos nang pera; hindi maaaring gamitin ang margin o hindi pa natatapos na kita | Konservatibo o pangmatagalang mga mamumuhunan |

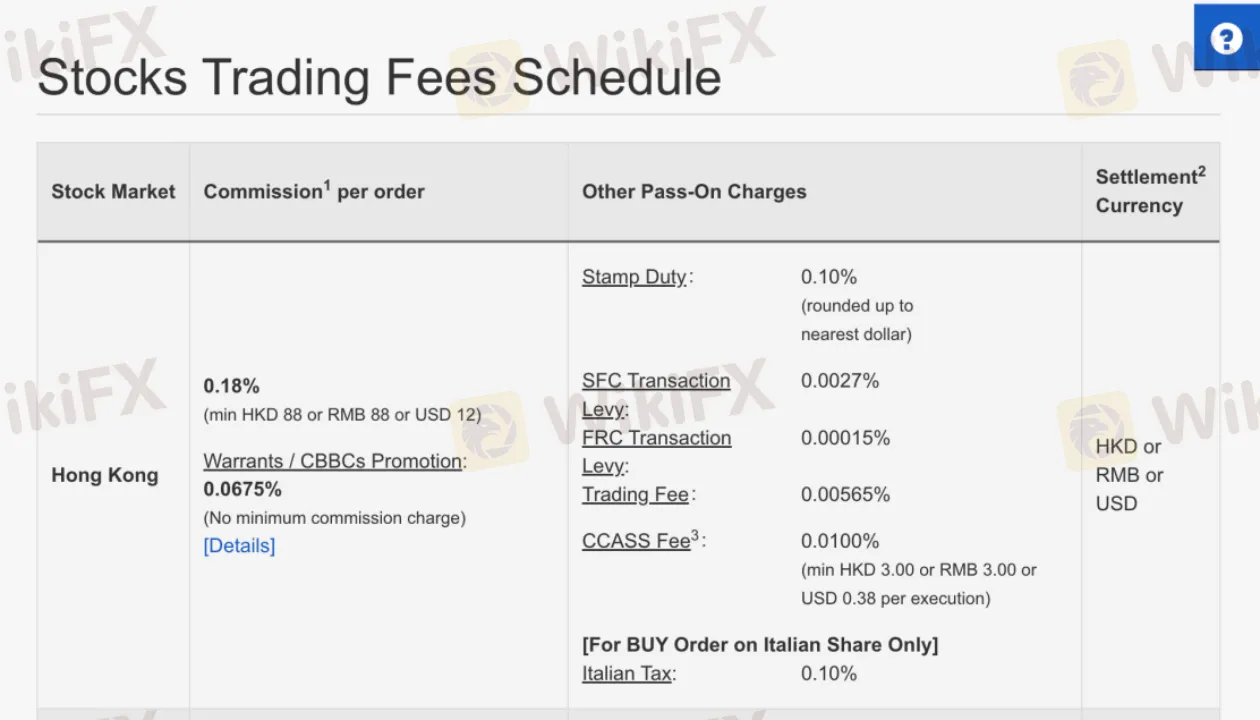

Mga Bayad ng BOOM

Ang istraktura ng bayad ng Boom Securities ay transparent at karaniwang kompetitibo kumpara sa pamantayan ng industriya. Hindi nagpapataw ang broker ng mga nakatagong spread o mataas na bayad sa platform, at maraming mahahalagang serbisyo (tulad ng mga deposito, pag-withdraw, at mga pahayag) ay libre. Gayunpaman, maaaring magdulot ng katamtamang bayad ang ilang real-time data at korporasyon na mga serbisyo.

| Merkado | Mga Bayad ng Komisyon |

| U.S. Equities | USD 20 bawat trade |

| Mga Stocks sa Hong Kong | 0.18% bawat trade |

| Global Markets | 0.50% o mas mababa bawat trade |

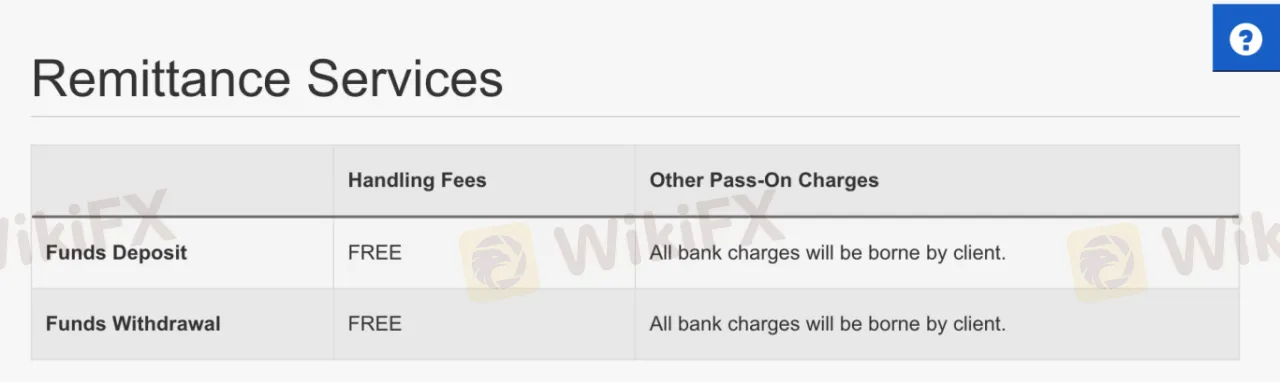

Mga Bayad na Hindi Kaugnay sa Trading

| Mga Bayad na Hindi Kaugnay sa Trading | Halaga |

| Bayad sa Pagdedeposito | 0 |

| Bayad sa Pagwiwithdraw | 0 |

| Bayad sa Hindi Paggalaw | HKD 200 (Indibidwal/Joint) HKD 1,000 (Korporasyon) |

Platform ng Trading

| Platform ng Trading | Supported | Available Devices |

| Web Trading Platform | ✔ | Desktop / Web Browser |

| Mobile Trading App | ✔ | iOS & Android devices |

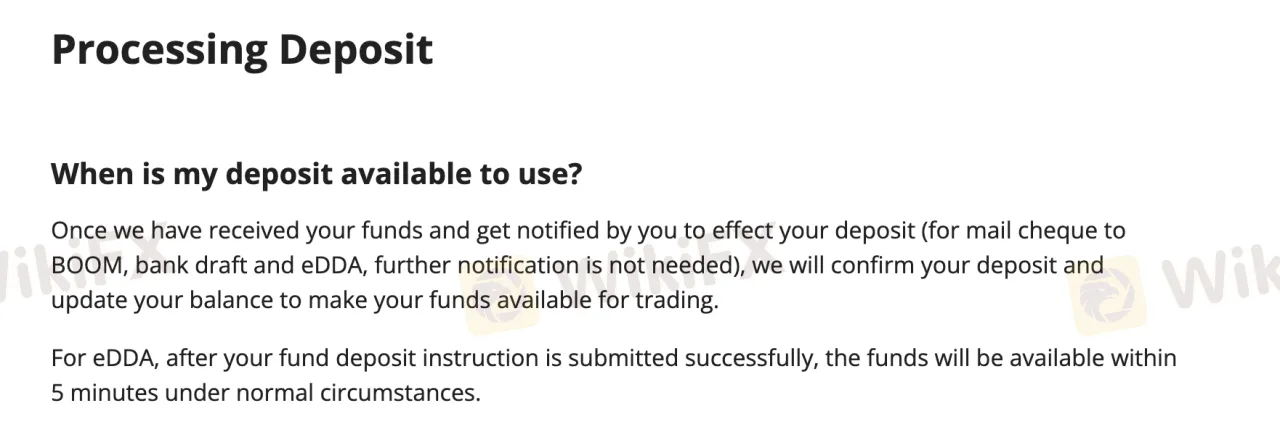

Pagdedeposito at Pagwiwithdraw

Boom Securities ay hindi naniningil ng anumang bayad para sa mga deposito o pag-withdraw. Walang minimum na halaga ng deposito o withdrawal, maliban sa mga eDDA deposits, na may minimum na HKD 200.

Mga Pagpipilian sa Pag-Deposito

| Mga Pagpipilian sa Pag-Deposito | Minimum na Deposito | Mga Bayad sa Deposito | Oras ng Paghahandog ng Deposito |

| eDDA (Electronic Direct Debit) | HKD 200 | 0 | Sa loob ng 5 minuto (sa normal na kalagayan) |

| FPS / Internet / Phone Banking / ATM | 0 | Sa parehong araw sa oras ng negosyo | |

| Bank Transfer / Telegraphic Transfer | Nag-iiba depende sa bangko | ||

| Cheque / Bank Draft | / |

Mga Pagpipilian sa Pag-Wiwithdraw

| Mga Pagpipilian sa Pag-Wiwithdraw | Minimum na Wiwithdraw | Mga Bayad sa Wiwithdraw | Oras ng Paghahandog ng Wiwithdraw |

| Sa Itinakdang Bank Account | 0 | 0 | Sa parehong araw kung bago ang 12:00 PM oras sa HK |

| Wiwithdraw sa Pamamagitan ng Cheque | Sa parehong araw | ||

| Transfer sa Iba pang Bank Accounts | Naiproseso pagkatapos ng pagsang-ayon ng tagubilin |

FX6022430072

Hong Kong

Ako ay isang mainland Chinese na nagtatrabaho sa Hong Kong, dati ay ginagamit ko ang Futu at maganda ang interface nito, ngunit sa mahabang panahon, napakamahal ng mga bayarin. Inirerekomenda ng kaibigan ko ang paggamit ng BOOM, ito ay mayroong lumang estilo ng Hong Kong na interface, sa simula ay hindi ako sanay, ngunit kapag nasanay na ako, maganda ang paggamit nito para sa mga transaksyon, ang pinakamahalaga ay mas mura ang mga bayarin kaysa sa iba, minsan ay nagtetrade ako ng mga Japanese stocks. Naririnig ko na maaari silang mag-trade ng mga stocks sa 16 na sikat na merkado.

Positibo

Henry 王超

New Zealand

Ang website ng BOOM ay mukhang kakaiba ang laki at ang aking karanasan sa pagba-browse ay hindi maganda. At wala silang mga regulatory license, paano sila nag-operate ng mahigit labinlimang taon?

Positibo

FX1153144384

Singapore

Sa hindi maipaliwanag na paraan, hindi mabubuksan ang website ng kumpanya, at wala akong nakitang anumang mga lisensya sa regulasyon. Ngunit wala akong makitang sinuman sa Internet na nagsasabing ito ay isang scam! Pansamantalang down yata ang website? Titingnan ko ito bukas

Positibo

荒47706

Thailand

Sa katunayan, ang kumpanyang ito ay inirekomenda sa akin ng aking kaibigan. Pagkatapos subukan ito ng ilang buwan, sa tingin ko ito ay talagang mabuti. Ang MONEX BOOM ay naitatag ng halos 20 taon, huwag masyadong maaasahan! Bagama't ang kanilang trading platform ay hindi ang karaniwang MT4 o MT5, ito ay tiyak na sulit na subukan at ito ay napakadaling gamitin.

Positibo

FX1036206024

Argentina

Matagal na akong nakikipagkalakalan sa kumpanyang ito at masaya ako dito at magpapatuloy sa pangangalakal. Pero nabasa ko sa wikifx website na hindi ito regulated at medyo na-intimidate ako. Maaari bang sabihin sa akin ng sinuman kung ito ay isang mapagkakatiwalaang kumpanya pagkatapos ng lahat?

Positibo