Buod ng kumpanya

| C&SReview Summary | |

| Itinatag | 2008 |

| Rehistradong Bansa/Rehiyon | Argentina |

| Regulasyon | Walang regulasyon |

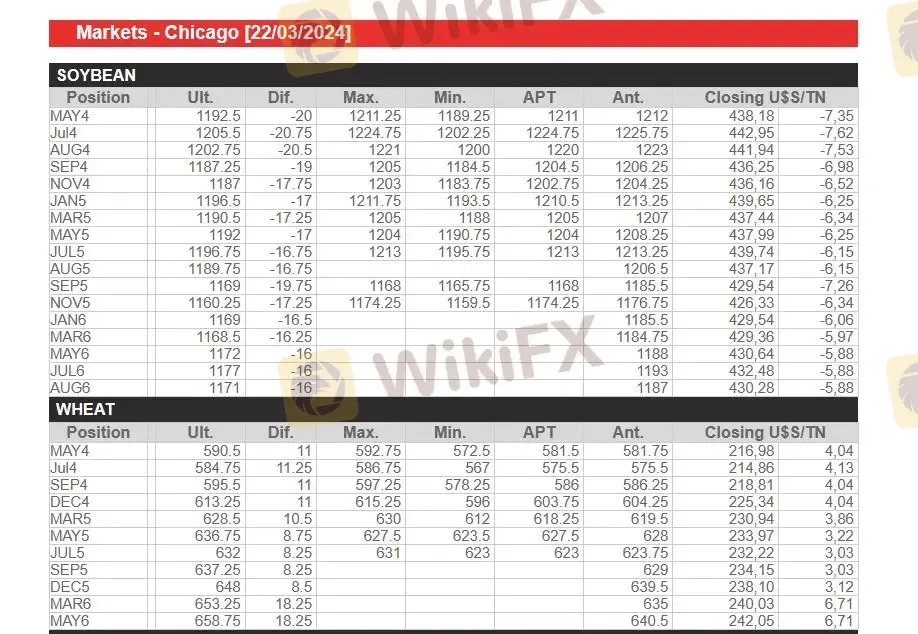

| Mga Instrumento sa Merkado | Mga Kalakal |

| Demo Account | ❌ |

| Plataforma ng Pagkalakalan | / |

| Min Deposit | / |

| Suporta sa Customer | Telepono: (+54.341) 426-0226 / 426-7201 |

| Email: contacto@cysargentina.com | |

| Address: Entre Rios 729 - P.11 - Rosario, Santa Fe, Argentina | |

| Twitter: https://twitter.com/cysargentina | |

| Facebook: https://www.facebook.com/home.php?#!/profile.php?id=100001769530055 | |

Impormasyon ng C&S

Itinatag noong 2008, ang C&S ay isang hindi reguladong tagapagbigay ng mga serbisyong pinansyal na rehistrado sa Argentina, na nag-aalok ng pagkalakal sa mga kalakal.

Mga Kalamangan at Disadvantage

| Mga Kalamangan | Mga Disadvantage |

| Maraming mga paraan ng pakikipag-ugnayan | Walang regulasyon |

| Walang mga demo account | |

| Limitadong mga produkto sa pagkalakal |

Totoo ba ang C&S?

Hindi. Ang C&S ay rehistrado sa Argentina. Sa kasalukuyan, wala itong mga balidong regulasyon.

Ano ang Maaari Kong Ikalakal sa C&S?

| Mga Ikalakal na Instrumento | Supported |

| Mga Kalakal | ✔ |

| Forex | ❌ |

| Mga Stocks | ❌ |

| Mga Indeks | ❌ |

| Mga Cryptos | ❌ |