Profil perusahaan

| BOOM Ringkasan Ulasan | |

| Dibentuk | 1997 |

| Negara/Daerah Terdaftar | Hong Kong |

| Regulasi | SFC |

| Instrumen Pasar | Saham multi-pasar, kontrak berjangka, saham berjangka, kontrak berjangka mata uang, kontrak berjangka suku bunga, kontrak berjangka logam |

| Akun Demo | ❌ |

| Platform Perdagangan | Web, seluler |

| Deposit Minimum | 0 |

| Dukungan Pelanggan | Tel: +852 2255 8888 |

| Email: service@boomhq.com | |

Informasi BOOM

Boom Securities adalah broker online berbasis Hong Kong yang didirikan pada tahun 1997 dan diatur oleh SFC Hong Kong (Nomor CE: AEF808). Ini menawarkan akses ke pasar saham dan berjangka global melalui platform perdagangan web dan seluler miliknya, tanpa biaya deposit atau penarikan.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh SFC Hong Kong | Tidak ada akun demo yang tersedia |

| Akses ke 12+ pasar saham & berjangka global | Biaya ketidakaktifan dikenakan untuk akun yang tidak aktif |

| Tidak ada biaya deposit atau penarikan |

Apakah BOOM Legal?

Boom Securities (H.K.) Limited adalah lembaga keuangan yang sah dan diatur. Itu diotorisasi oleh Komisi Sekuritas dan Berjangka (SFC) Hong Kong, yang merupakan badan regulasi yang dihormati dalam industri keuangan. Perusahaan ini memiliki lisensi Perdagangan kontrak berjangka dengan nomor lisensi AEF808.

Apa yang Bisa Saya Perdagangkan di BOOM?

Boom Securities menawarkan berbagai instrumen perdagangan termasuk saham AS, berjangka Hong Kong dan global, yang mencakup indeks, mata uang, suku bunga, komoditas, energi, dan logam.

| Instrumen Perdagangan | Didukung |

| Mata Uang | ✔ |

| Komoditas | ✔ |

| Indeks | ✔ |

| Saham | ✔ |

| ETF | ✔ |

| Kripto | ❌ |

| Obligasi | ❌ |

| Opsi | ❌ |

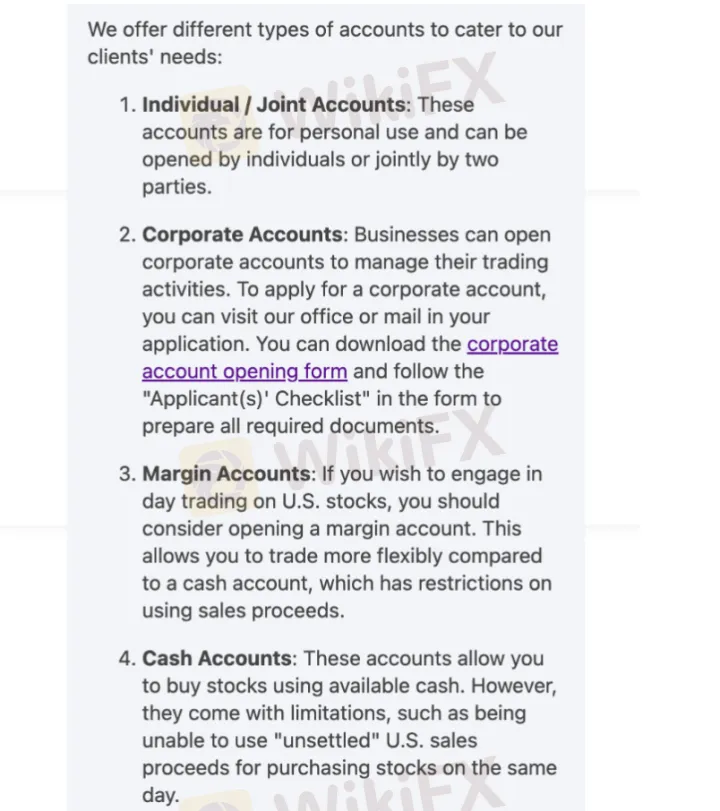

Jenis Akun

Boom Securities menawarkan total 4 jenis akun trading live: Akun Individu/Bersama, Akun Korporat, Akun Margin, dan Akun Tunai. Setiap akun dirancang untuk cocok dengan berbagai jenis trader, mulai dari investor pribadi dan entitas korporat hingga trader aktif di pasar saham AS.

| Jenis Akun | Fitur | Cocok untuk |

| Individu/Bersama | Untuk pengguna individu atau dimiliki bersama oleh dua orang | Investor pribadi |

| Korporat | Dirancang untuk perusahaan untuk mengelola operasi perdagangan | Perusahaan atau institusi |

| Margin | Memungkinkan perdagangan fleksibel dengan kemampuan menggunakan dana yang belum diselesaikan | Trader aktif atau harian di saham AS |

| Tunai | Bertransaksi hanya dengan uang tunai yang sudah diselesaikan; tidak ada margin atau hasil yang belum diselesaikan yang dapat digunakan | Investor konservatif atau jangka panjang |

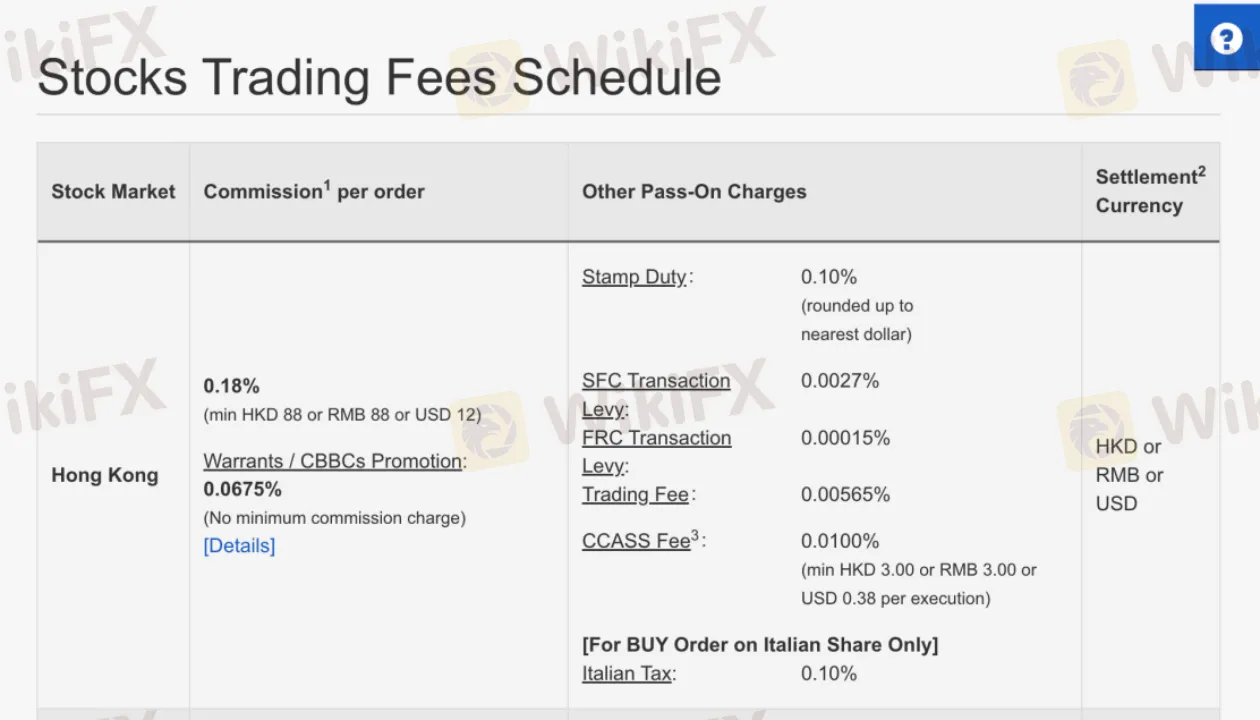

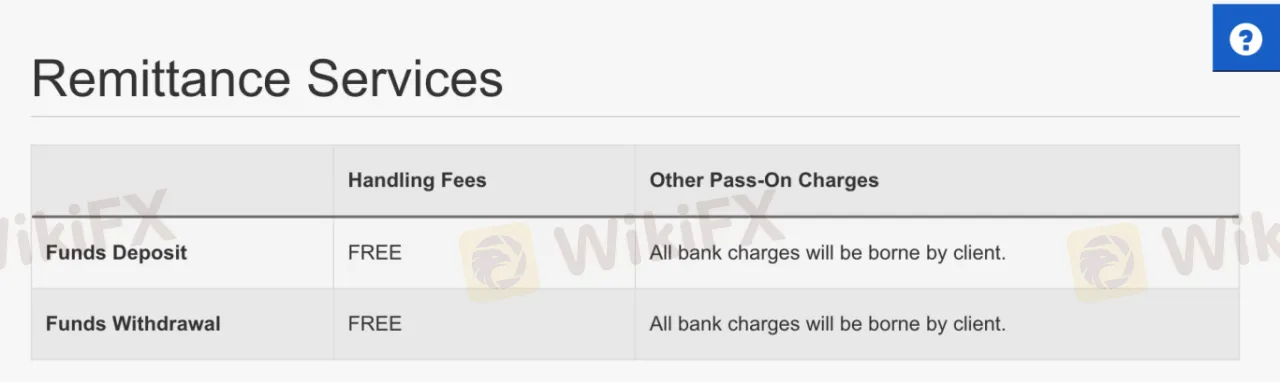

Biaya BOOM

Struktur biaya Boom Securities transparan dan umumnya kompetitif dibandingkan standar industri. Pialang ini tidak mengenakan spread tersembunyi atau biaya platform tinggi, dan banyak layanan penting (seperti deposit, penarikan, dan laporan) tidak dikenakan biaya. Namun, beberapa data real-time dan layanan korporat mungkin dikenakan biaya sedang.

| Pasar | Biaya Komisi |

| Ekuitas AS | USD 20 per transaksi |

| Saham Hong Kong | 0,18% per transaksi |

| Pasar Global | 0,50% atau lebih rendah per transaksi |

Biaya Non-Trading

| Biaya Non-Trading | Jumlah |

| Biaya Deposit | 0 |

| Biaya Penarikan | 0 |

| Biaya Ketidakaktifan | HKD 200 (Individu/Bersama) HKD 1.000 (Korporat) |

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat Tersedia |

| Platform Perdagangan Web | ✔ | Desktop / Browser Web |

| Aplikasi Perdagangan Seluler | ✔ | Perangkat iOS & Android |

Deposit dan Penarikan

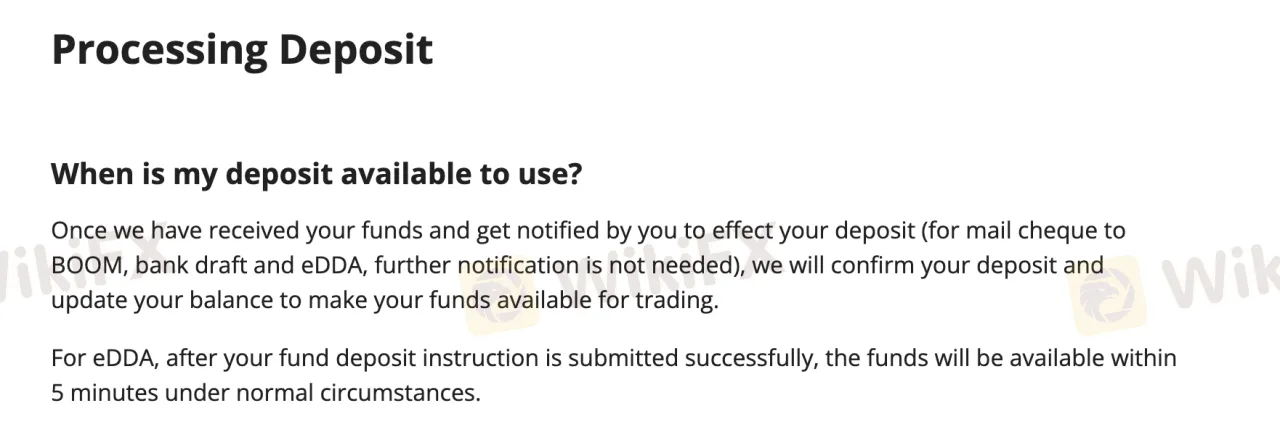

Boom Securities tidak mengenakan biaya apa pun untuk deposit atau penarikan. Tidak ada jumlah deposit atau penarikan minimum, kecuali untuk deposit eDDA, yang memiliki minimum HKD 200.

Opsi Deposit

| Opsi Deposit | Deposit Minimum | Biaya Deposit | Waktu Pemrosesan Deposit |

| eDDA (Debit Langsung Elektronik) | HKD 200 | 0 | Dalam 5 menit (di bawah kondisi normal) |

| FPS / Internet / Perbankan Telepon / ATM | 0 | Sama hari selama jam kerja | |

| Transfer Bank / Transfer Telegrafis | Bervariasi menurut bank | ||

| Cek / Wesel Bank | / |

Opsi Penarikan

| Opsi Penarikan | Penarikan Minimum | Biaya Penarikan | Waktu Pemrosesan Penarikan |

| Ke Rekening Bank yang Ditentukan | 0 | 0 | Sama hari jika sebelum pukul 12:00 siang waktu HK |

| Penarikan dengan Cek | Sama hari | ||

| Transfer ke Rekening Bank Lain | Diproses setelah persetujuan instruksi |

FX6022430072

Hong Kong

Saya adalah orang daratan yang bekerja di Hong Kong. Sebelumnya saya menggunakan Futu dan merasa antarmuka yang bagus, tetapi biaya transaksi jangka panjang terlalu mahal. Teman saya merekomendasikan BOOM, yang memiliki antarmuka gaya lama Hong Kong. Pada awalnya saya tidak terbiasa, tetapi setelah terbiasa, saya bisa melakukan perdagangan dengan baik menggunakan BOOM. Yang paling penting adalah biaya transaksinya lebih murah daripada yang lain, kadang-kadang saya berdagang saham Jepang. Saya mendengar bahwa mereka dapat berdagang saham di 16 pasar populer.

Baik

Henry 王超

Selandia Baru

Situs web BOOM terlihat berukuran aneh dan pengalaman menjelajah saya buruk. Dan mereka tidak memiliki izin resmi, bagaimana mereka beroperasi selama lebih dari lima belas tahun?

Baik

FX1153144384

Singapura

Entah kenapa, situs web perusahaan tidak dapat dibuka, dan saya belum melihat lisensi peraturan apa pun. Tapi saya tidak bisa melihat siapa pun di Internet mengatakan itu scam! Saya kira situs web sementara mati? Saya akan memeriksanya besok

Baik

荒47706

Thailand

Sebenarnya, perusahaan ini direkomendasikan kepada saya oleh teman saya. Setelah mencobanya selama beberapa bulan, saya pikir ini sangat bagus. MONEX BOOM sudah berdiri hampir 20 tahun, jangan terlalu diandalkan! Meskipun platform trading mereka bukan MT4 atau MT5 biasa, platform ini patut dicoba dan sangat mudah digunakan.

Baik

FX1036206024

Argentina

Saya telah berdagang dengan perusahaan ini untuk sementara waktu dan senang dengannya dan akan terus berdagang. Tapi saya membaca di situs wikifx bahwa itu tidak diatur dan saya sedikit terintimidasi. Adakah yang bisa memberi tahu saya jika itu adalah perusahaan yang dapat dipercaya?

Baik