简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

BitPania Review 2026: Is this Broker Safe?

Abstract:BitPania is an unregulated brokerage established in 2024 in Saint Lucia, currently holding a high-risk safety score of 1.22. This audit highlights critical concerns regarding withdrawal refusals, aggressive sales tactics, and lack of valid licensure.

Executive Summary

In this in-depth review, we analyze the key metrics and operational history of BitPania to determine its viability for traders. The broker was established in 2024 and is registered in Saint Lucia. Despite claims of offering digital trading services, the entity suffers from a critically low safety score of 1.22 out of 10.

Our analysis reveals that BitPania operates as a broker entity primarily targeting clients in Colombia and the UK, with support available in Spanish and Portuguese. While the firm advertises multiple account types and EA support, the lack of regulatory oversight presents significant risks. This review aims to dissect the discrepancy between their marketing claims and the actual user experience observed over the last year.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation operates under. According to official data, BitPania does not hold a valid license from any major financial regulator such as the FCA (UK) or ASIC (Australia). Instead, it is domiciled in Saint Lucia, a jurisdiction often used for registration purposes but lacking a rigorous supervisory framework for FX trading.

Investors must understand that regulation safeguards are non-existent here. There is no evidence of segregated client funds or compensation schemes. Consequently, if the brokerage faces insolvency, client capital is at total risk. The absence of a recognized regulatory body overseeing their operations is a primary factor contributing to their definitive “D” influence rank.

2. Forex Trading Conditions

For traders focusing on Forex instruments, BitPania offers conditions that require careful scrutiny. The firm provides a leverage ratio of up to 1:200, which, while standard for offshore entities, amplifies risk significantly without negative balance protection.

Does Forex pricing compete with top-tier providers? Our audit found that the entry barriers are unusually high. The “Basic” account requires a minimum deposit of $5,000, while the “Savings” account demands an exorbitant $150,000. These thresholds are far above the industry standard, where regulated brokers often allow entry for under $100. Furthermore, while the broker claims to support Expert Advisors (EAs), the trading environment's true cost remains opaque as spread data is not transparently verified.

3. User Feedback & Complaints

We have analyzed specific complaints filed by users, particularly from late 2025, which paint a concerning picture. Translating recent reports from Spanish to English reveals a pattern of “recovery scams” and withdrawal blocks.

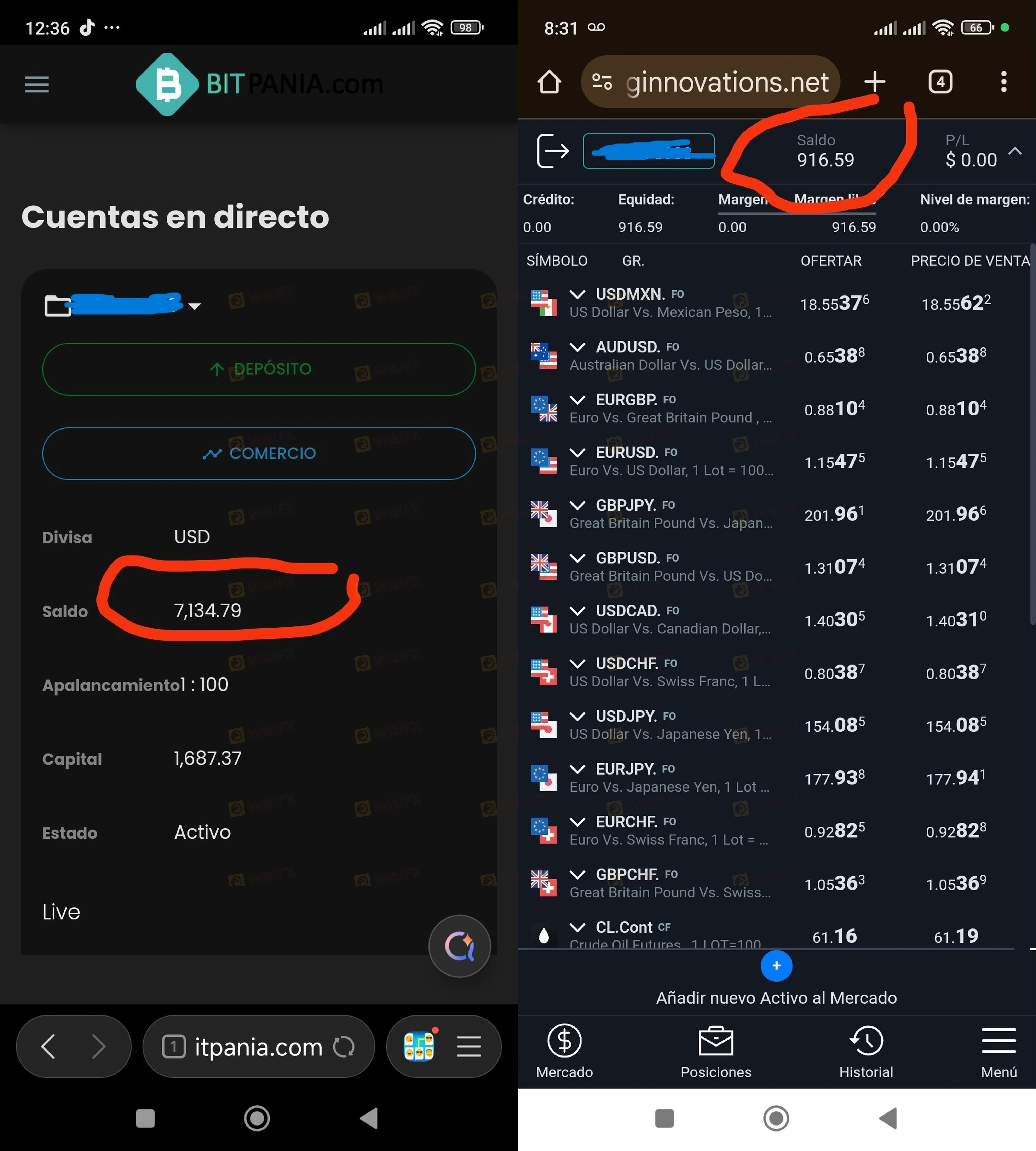

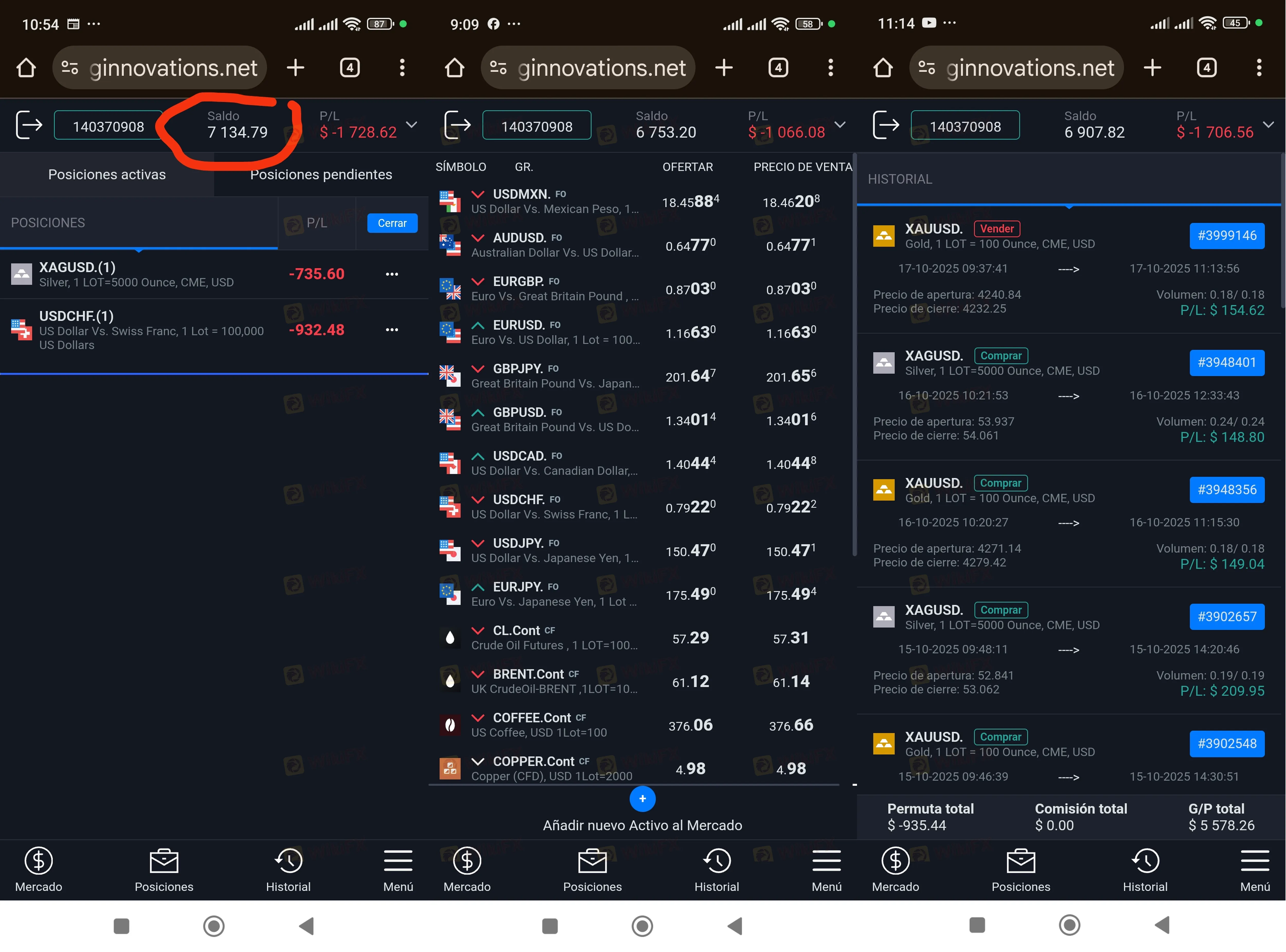

- Case 1 (November 2025): A user reported that after their account balance reached over $7,000, the account was blocked. An “analyst” then demanded an additional deposit of over $2,000 to “recover” the funds. When the user refused, the remaining balance was withheld.

- Case 2 (October 2025): A client started with a small investment but was pressured to add $2,000 more. After accumulating profits, the advisor evaded withdrawal requests, and the user eventually faced issues with their login stability and account access, resulting in a total lock-out.

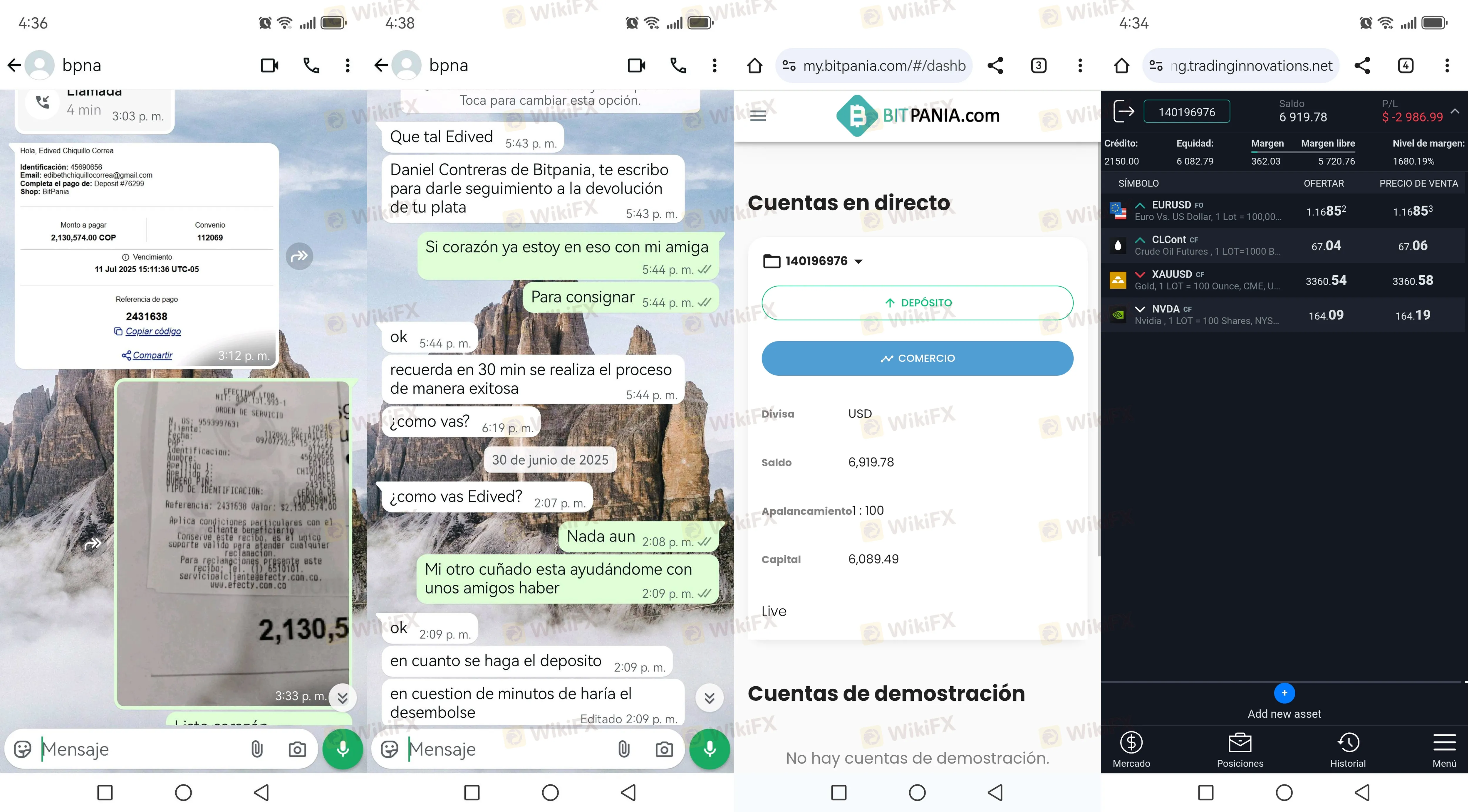

- Case 3 (July 2025): This report details a “tax fraud” scheme where the broker demanded external deposits via Binance to pay bogus taxes before releasing funds—a classic warning sign of illegitimate operations.

4. Software & Access

BitPania promotes a digitalized account opening process, yet specifics regarding the trading software (such as MT4 or MT5) are notably absent from their primary highlights.

To access the platform, traders must complete the login security steps, but given the user reports, the reliability of this portal is questionable. Several users noted that once a withdrawal is requested, the login process often becomes “buggy” or credentials effectively stop working, preventing clients from managing their assets. Securing your login credentials is standard advice, but it cannot protect against server-side blocks potentially imposed by the broker.

Final Verdict

BitPania presents a high-risk profile characterized by zero regulation, excessive minimum deposit requirements ($5,000+), and a trail of severe client complaints regarding fund withholding. The repeated patterns of blocking accounts and demanding “tax fees” are red flags.

Pros:

- Multiple account tiers (though expensive).

- High leverage available (1:200).

Cons:

- Unregulated (Score 1.22).

- High entry barrier.

- Verified reports of withdrawal denial.

For real-time updates on regulation status or to verify the official login page, consult the WikiFX App immediately before depositing funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Promised 30% Returns, Lost RM630,000 Instead

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Effective Stop Loss Trading Strategies

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Hits Q4 Growth

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Slams Growth

BitPania Review 2026: Is this Broker Safe?

Currency Calculator