Abstract:A 57-year-old man in Kuantan lost over RM630,000 after being lured by a Facebook investment advertisement and directed to a fake trading app that displayed fabricated profits. The scam unraveled when withdrawal attempts triggered excuses and demands for additional fees, highlighting the risks of high-return promises and unverified platforms.

A 57-year-old man has lost more than RM630,000 after falling victim to an online stock investment scam, according to the Pahang police.

Pahang police chief Datuk Seri Yahaya Othman said the Commercial Crime Investigation Division received a report from Kuantan involving a victim who was deceived into participating in a non-existent stock investment scheme promoted on social media.

The case reportedly began on November 3 last year, when the man came across a Facebook advertisement under the name “Bookmap Malaysia.” Drawn by the prospect of investment opportunities, he contacted the parties behind the advertisement via WhatsApp. The suspects then introduced what appeared to be a convincing stock trading plan, claiming that investors could earn returns of up to 30 per cent within a month, with a minimum investment of RM10,000. Believing the offer to be genuine, the victim proceeded.

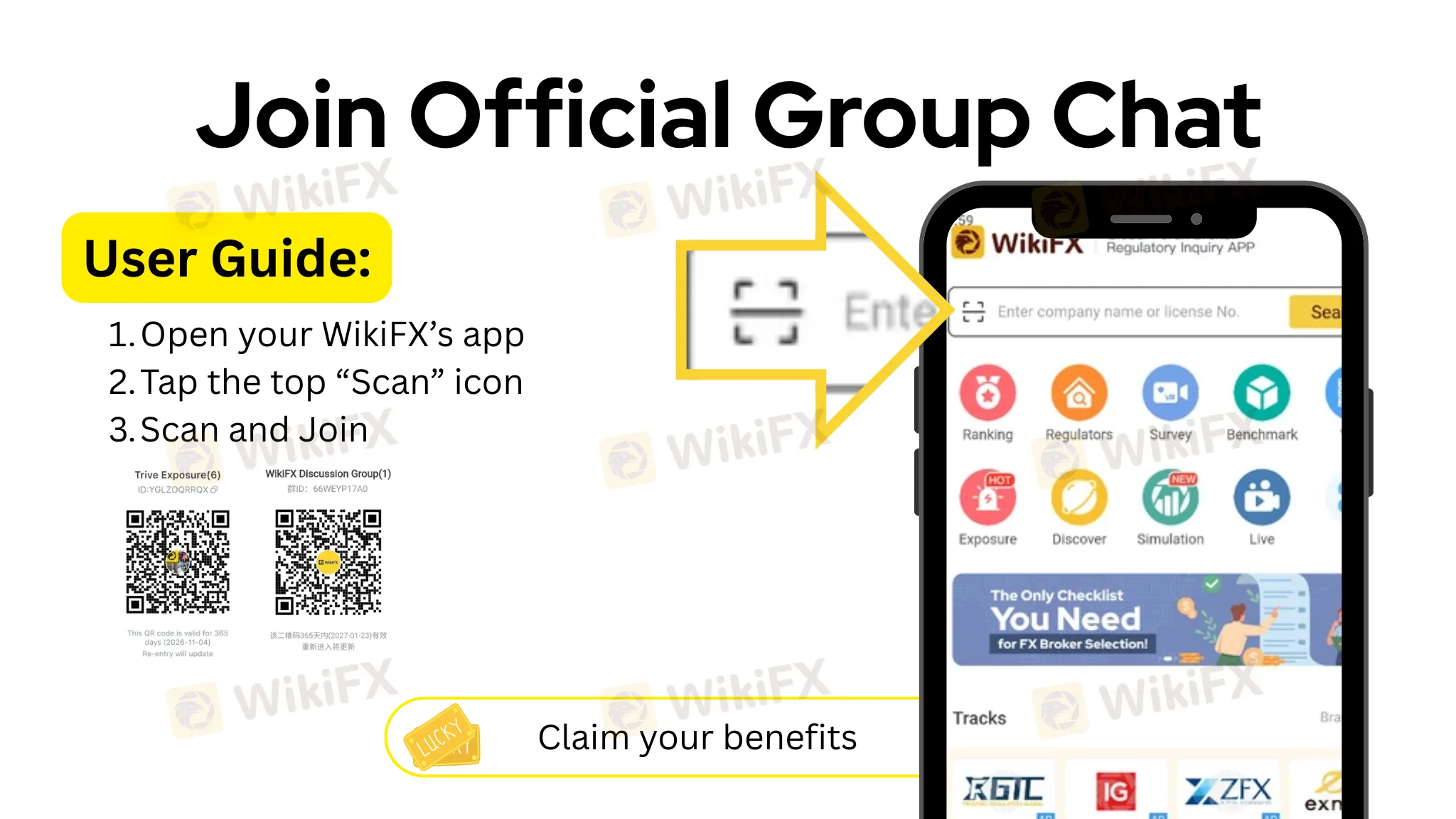

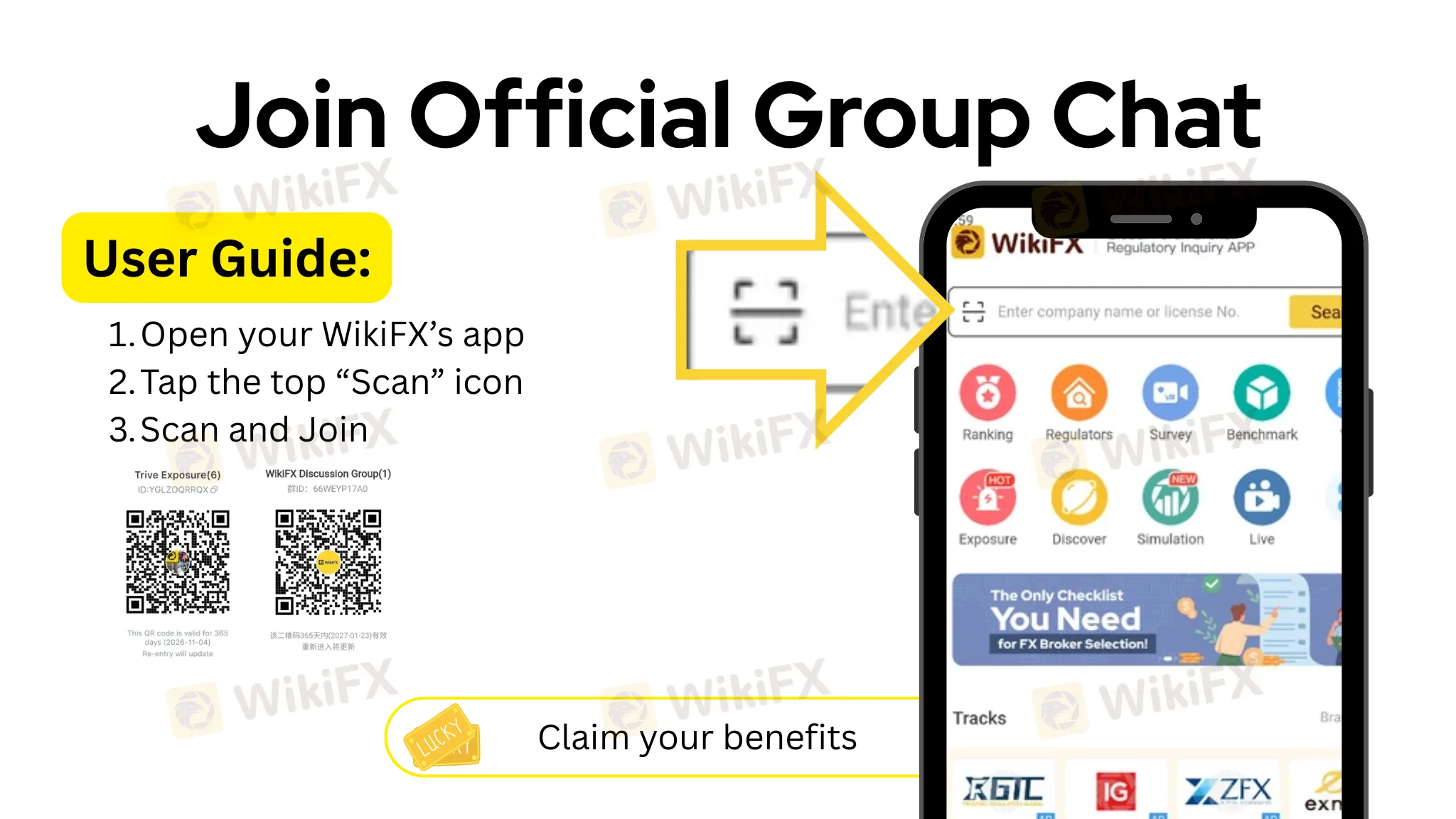

To reinforce the illusion of legitimacy, the scammers instructed the man to download an investment application known as “BM-max” through a link provided on WhatsApp. The application displayed what seemed to be real-time trading activity and steadily rising profits, giving the victim confidence that his funds were being successfully invested.

Between January 9 and February 11 this year, the man carried out four separate fund transfers into four different bank accounts as directed by the suspects. In total, he transferred RM636,123.06, using his personal savings and money borrowed from family members. Throughout this period, the application continued to show increasing returns, with the displayed balance — including purported profits and commissions — reaching approximately RM1.84 million.

However, when the victim attempted to withdraw his capital and the profits shown in the application, the situation changed. The suspects began offering various excuses for the delay and eventually demanded additional payments, claiming that further fees were required before any withdrawal could be processed. It was at this stage that the victim realised he had been deceived.

Authorities have reminded the public to exercise caution when encountering investment opportunities online, particularly those promising unusually high or guaranteed returns. The Pahang police headquarters has advised individuals to seek preliminary verification or guidance from relevant authorities before committing funds to any investment scheme, as a safeguard against financial fraud.