Abstract:Scams aren’t getting smarter — they’re getting more human. Even experienced investors are losing big money. Why does this keep happening in Malaysia while Singapore takes a different path?

In todays digital landscape, scams are becoming increasingly “human.” Fraudsters no longer rely solely on crude tricks or obvious deception. Instead, they often present themselves as attentive, patient, and reassuring — sometimes appearing more caring than family members and more persuasive than close friends. What seems like warmth and professionalism can, in reality, conceal a carefully constructed financial trap. A single lapse in judgment may be enough to wipe out years of hard-earned savings.

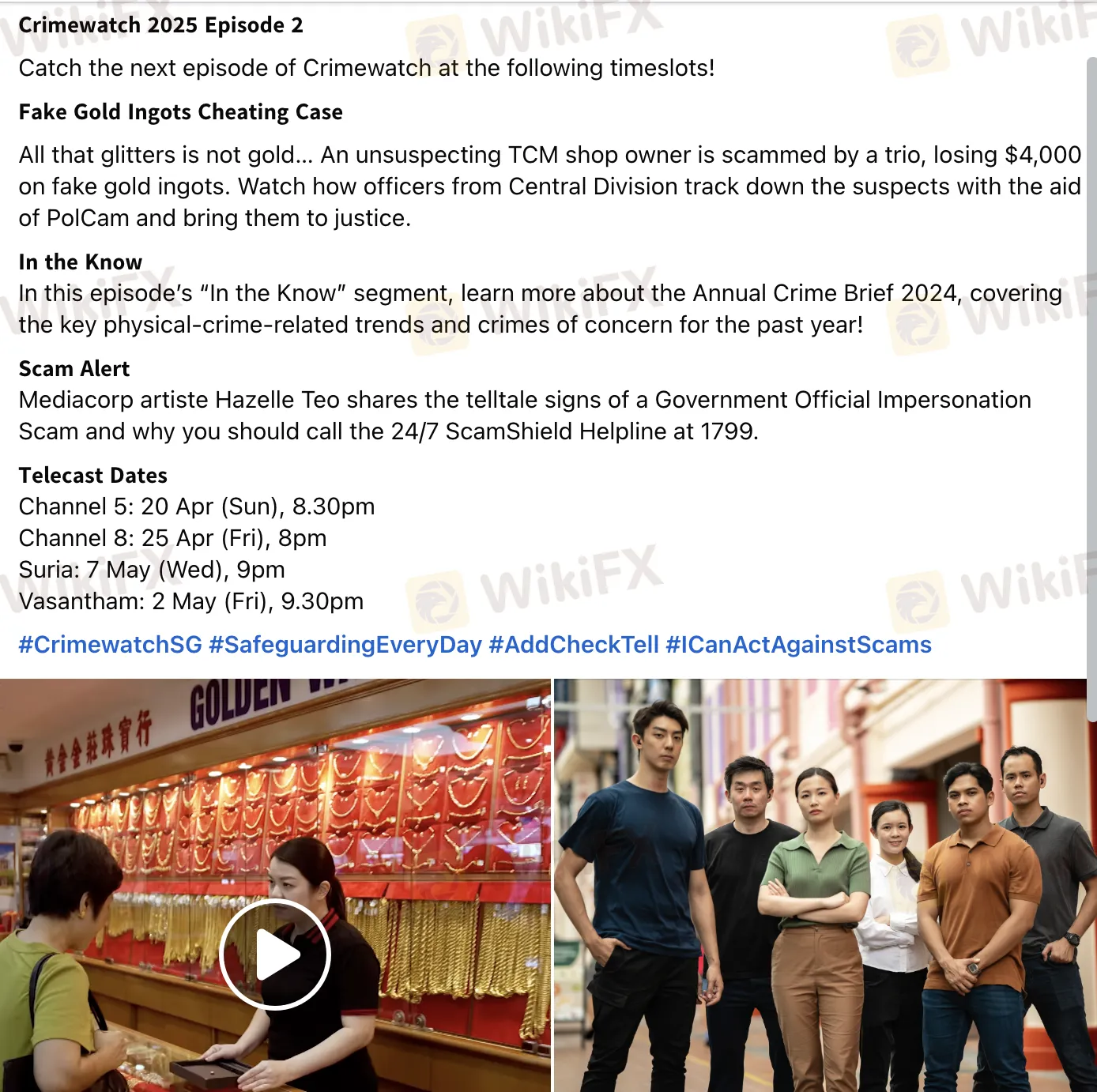

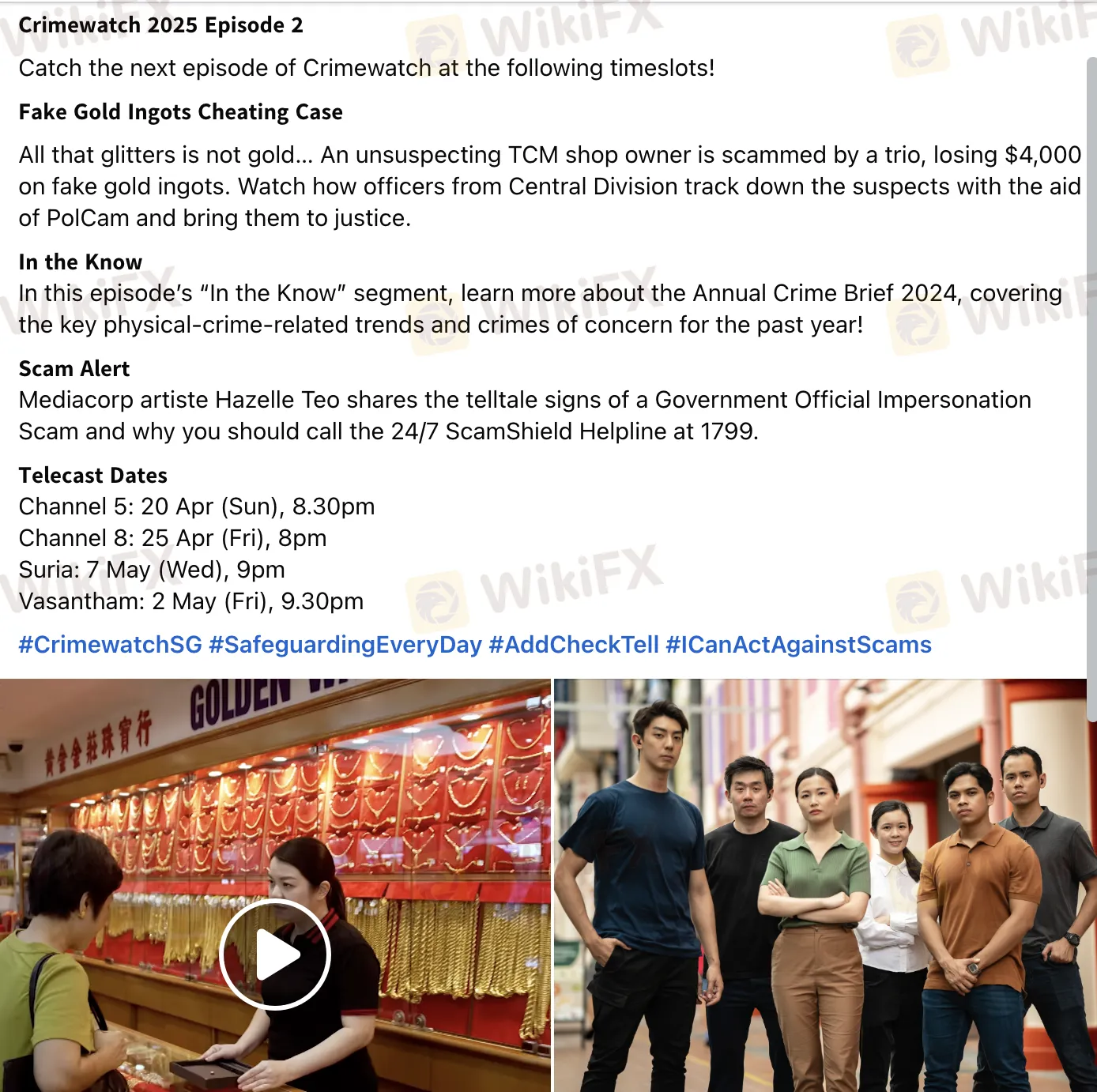

As scams continue to evolve, Singapore has taken a notably distinctive approach to public awareness. Rather than depending only on advisories or written warnings, authorities have increasingly brought real scam cases to the screen. This dramatized format resonates more naturally with modern audiences. By watching realistic portrayals, viewers gain a clearer understanding of how scam syndicates operate, how psychological tactics are applied, and why even rational individuals can be manipulated under certain circumstances.

Programmes such as Anti-Scam Force illustrate the inner workings of scam operations with striking realism. They reveal how roles are divided, how scripts are crafted, and how trust is methodically built before any money is requested. The impact of such productions lies not merely in storytelling, but in their ability to remind audiences that scams are not distant or abstract threats — they are risks embedded in everyday digital interactions.

Similarly, long-running crime awareness shows like Crimewatch emphasize education through real cases. While the tone may be more serious, the lessons are direct and memorable. By repeatedly exposing common fraud patterns — from fake investments to money mule schemes — these programmes reinforce a crucial message: scams succeed not because victims are careless, but because deception is often sophisticated and emotionally convincing.

Beyond public education, Singapore has also strengthened its institutional safeguards. Legislative tools such as the Protection from Scams Act enable authorities, under specific conditions, to intervene before financial losses escalate. Where credible risk is identified, temporary banking restrictions may be imposed to prevent suspicious transfers. The philosophy behind such measures is preventive rather than punitive, designed to protect individuals at moments when they may not yet recognize the danger themselves.

Malaysia, by contrast, presents a more complex picture. Public familiarity with scams is relatively high, and many individuals believe they can identify fraudulent schemes. Yet reported cases and financial losses continue to rise, particularly in the investment sector. This contrast highlights a persistent gap between awareness and actual vulnerability.

Throughout 2025, investment-related scams emerged as one of the fastest-growing categories of fraud in Malaysia. Social media advertisements, messaging app invitations, proprietary trading platforms, and cryptocurrency-linked opportunities have become common entry points. Victims frequently include individuals with professional backgrounds and prior exposure to financial markets, underscoring that experience alone does not guarantee protection.

This trend reflects a broader shift in scam tactics. Modern fraud operations increasingly exploit psychology rather than technology alone. Trust-building, perceived exclusivity, and urgency are carefully engineered to influence decision-making. Simply knowing that scams exist does not necessarily prevent someone from falling victim when emotional triggers and persuasive narratives are involved.

Malaysian authorities and financial institutions have intensified their responses, expanding reporting channels and inter-agency cooperation. Mechanisms such as the National Scam Response Centre have improved the speed of incident reporting and fund interception. However, recovery rates remain modest relative to the scale of losses, and funds transferred to fraudulent accounts are often difficult to reclaim.

From a regional perspective, the comparison between Singapore and Malaysia raises important considerations. Combating scams is not solely about disseminating information; it also involves shaping behaviour and reinforcing systemic protections. When fraudulent decisions can occur within minutes, the effectiveness of preventive frameworks becomes as critical as public education.

Ultimately, regardless of jurisdiction, the fundamental principles of avoiding investment scams remain consistent. Offers promising unusually high or guaranteed returns warrant careful scrutiny. Proposals that demand rapid commitment, emphasize privileged access, or rely heavily on emotional persuasion should be approached with caution.

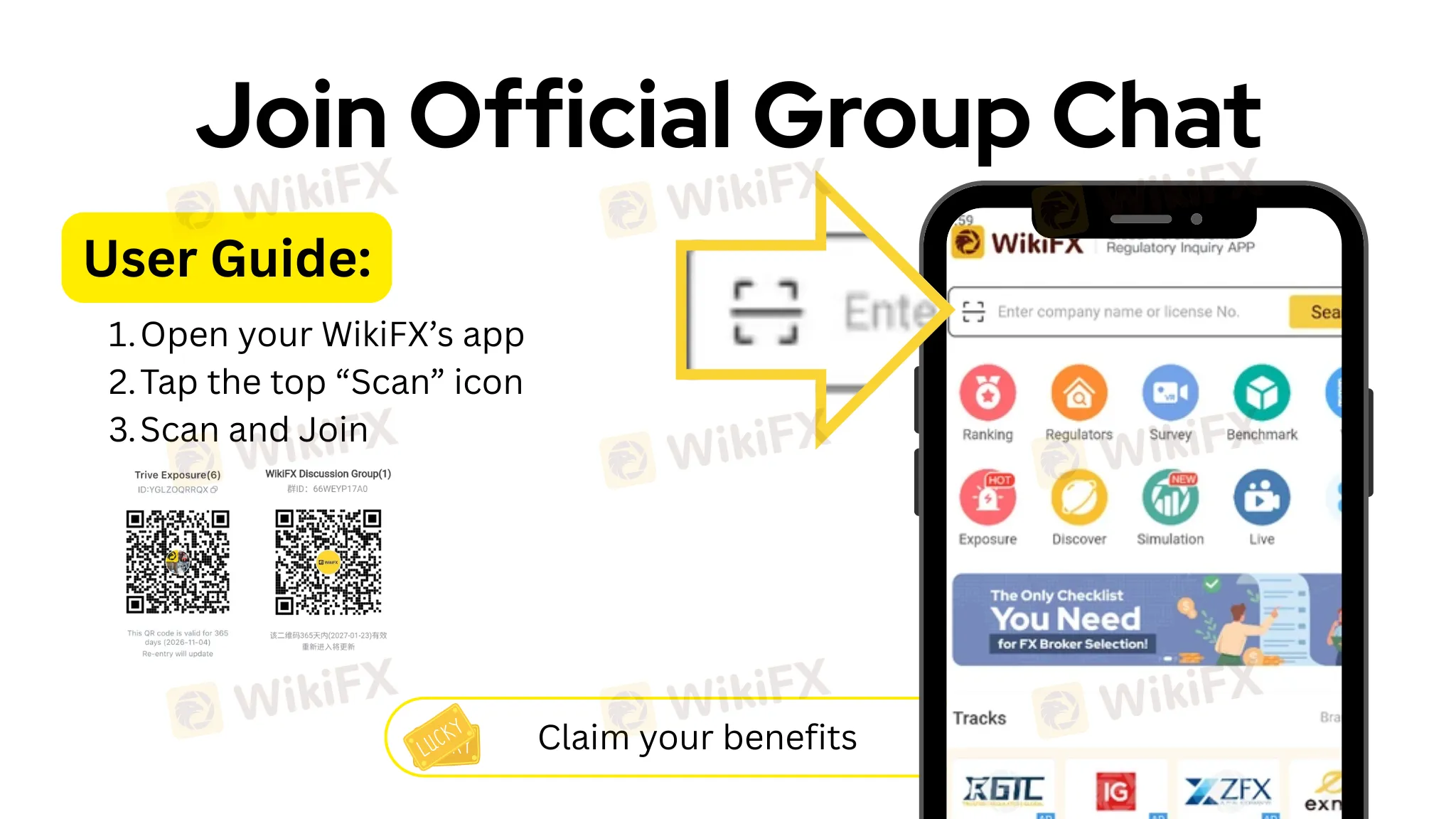

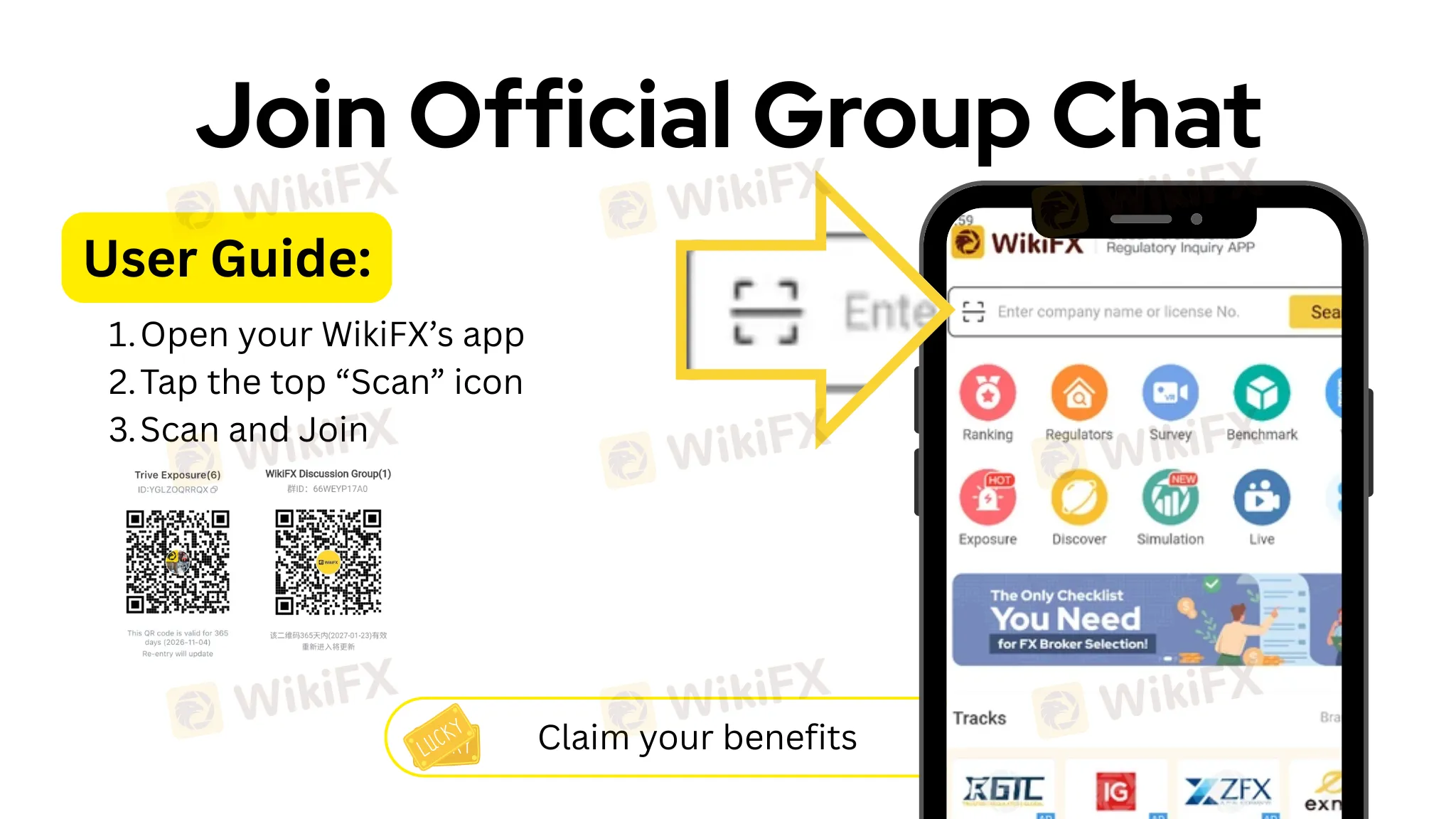

Even for those interested in legitimate financial activities such as foreign exchange trading, due diligence is essential. Investors should take the time to research brokers thoroughly, verify regulatory standing, and review independent user feedback. Platforms like WikiFX, for instance, allow individuals to check a brokers compliance status, read trader reviews, and follow industry developments. Gaining a comprehensive understanding of a trading provider before committing funds can significantly reduce exposure to fraudulent schemes.

In financial markets, genuine opportunities tend to withstand verification and the passage of time. They are rarely dependent on pressure, secrecy, or promises of effortless profit. As scam methods grow more refined, the most reliable form of protection remains unchanged: calm judgment, careful verification, and a willingness to question anything that appears excessively attractive.