Abstract:Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

CMTrading Operation Details - Platform & Account Types

CMTrading, founded in 2012, has grown to become a full-fledged trading services company. It allows trading across assets such as forex, stocks, commodities, indices and crypto. To help traders, the broker offers technical and fundamental analysis, daily signals, calculators, and an economic calendar. The broker offers a host of trading platforms - MetaTrader 4 (MT4), CMTrading Webtrader, Expert Advisors, and trading apps. As a trader, you have five account options - Basic Account, Trader Account, Gold Account, Premium Account, and VIP Club Account. While the bonus amount ranges from $100 to $1,50,000 across these accounts, there is no commission on any of the accounts.

While the tradable assets and account types seem impressive, the lack of MT5, which comes with advanced trading analysis, is a negative for the broker with over a decade of operation.

Top Forex Trading Complaints Against CMTrading

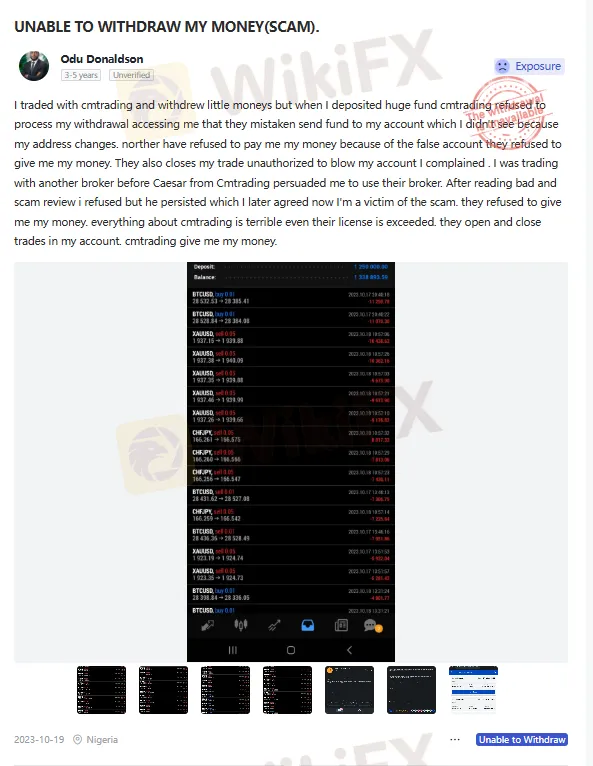

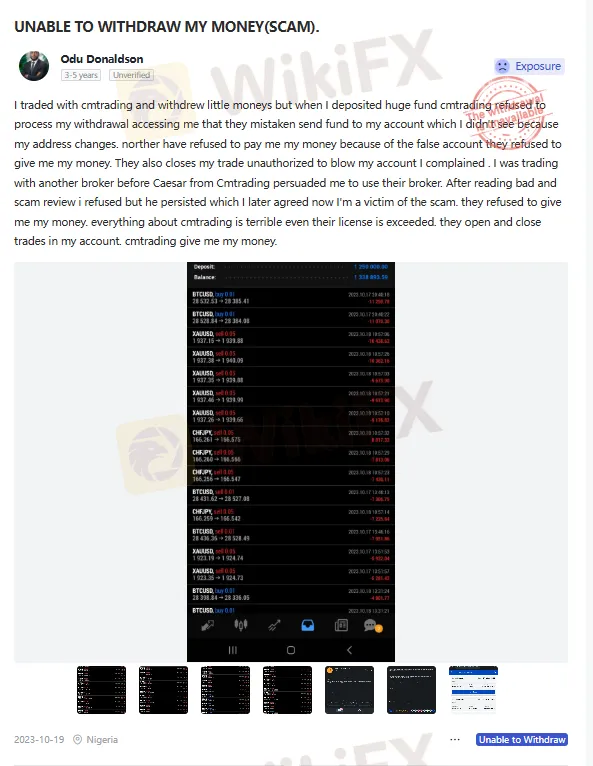

CMTrading Accused of Blocking Large Withdrawal and Unauthorized Account Activity

A trader from Nigeria alleged that CMTrading processed small withdrawals initially but refused to release funds after a significant deposit was made. The user claimed the broker cited an alleged mistaken transfer to a different account—an account the trader said did not exist due to an address change. Additionally, the complaint accused CMTrading of unauthorized trade closures that allegedly led to account losses. The trader further stated they were persuaded by a company representative to join despite prior negative reviews and now considered themselves a victim of a scam, urging the broker to return their funds. Have a look at this CMTrading review for the fund trail.

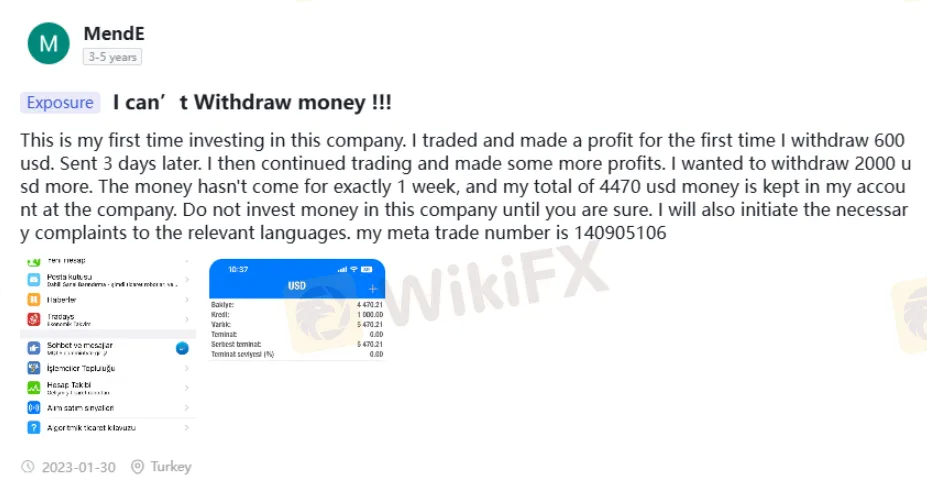

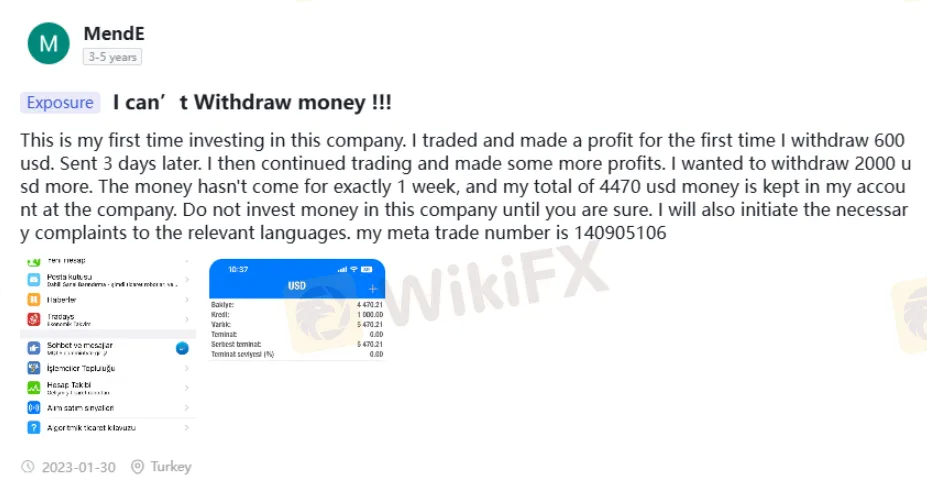

Another Large Sum Withdrawal Denial Accusation Against CMTrading

A similar allegation was made by a Turkey-based trader, who recounted an incident involving a seamless withdrawal of USD 600 at the beginning, before it went all wrong. The trader made consistent profits as found on the CMTrading login. As the trader requested withdrawal of USD 2,000, the broker denied, the complaint added. As per the trader, his entire USD 4,470 is lying in the trading account. Affected by the overall trading experience, the trader shared this negative CMTrading review.

A Painful Profit Withholding Allegation Against CMTrading

Another Turkey-based trader blamed CMTrading for foul play by not allowing profit withdrawals. Felt painful given the massive effort put in to earn profits and failing to withdraw the same, the trader was allegedly prompted to share this negative review concerning the CMTrading withdrawal process.

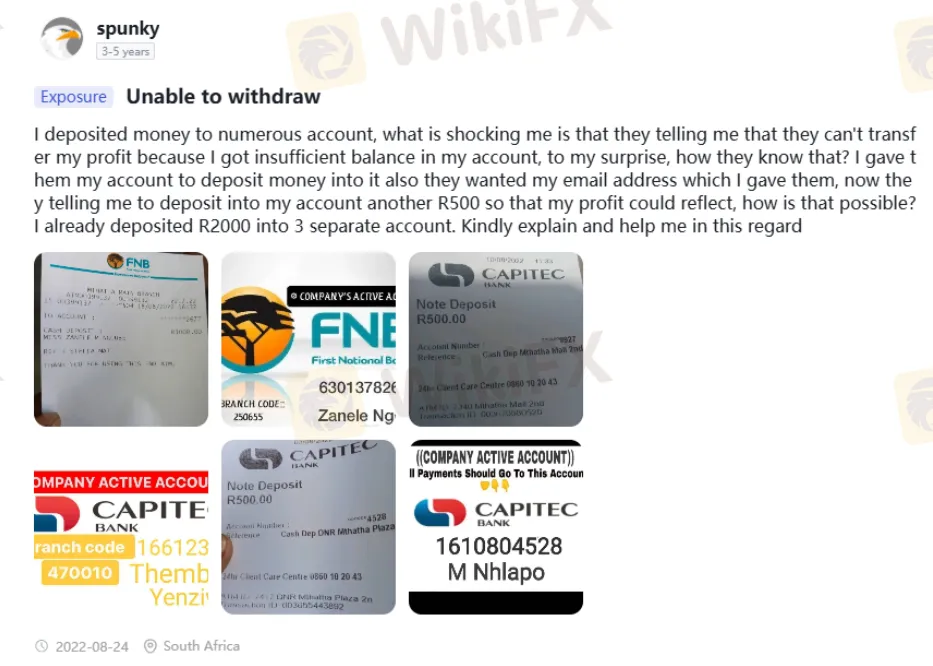

Funds Deposited in Different Trading Accounts, But No Profit Transfer

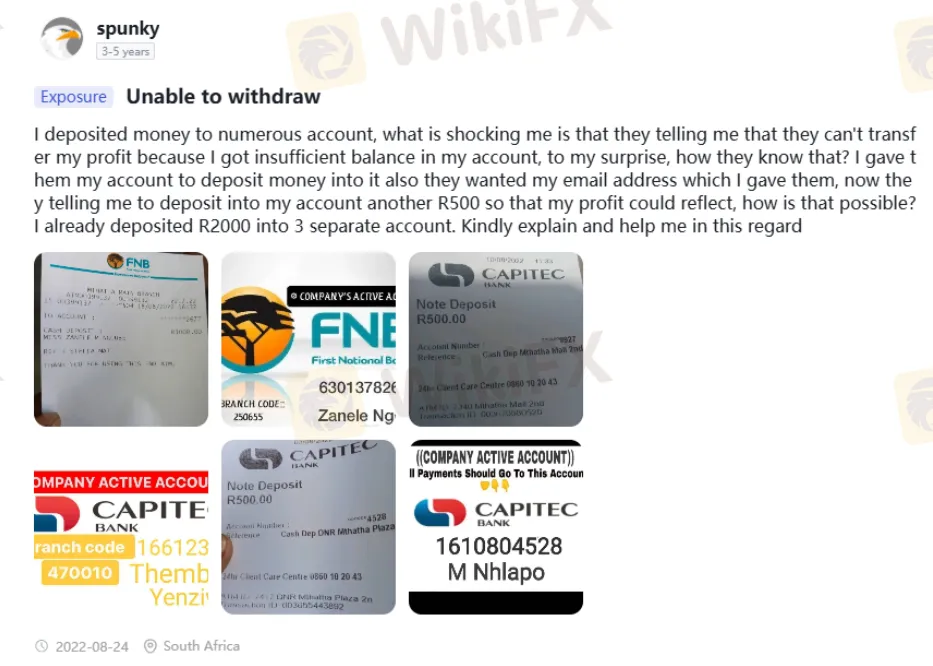

A trader from South Africa expressed shock over the lack of profit transfer by CMTrading, which cited the lack of sufficient balance in the trading account. This claim, according to the trader, is false. The trader admitted having deposited R2000 in three separate accounts and was asked to deposit a further R500 for the profit to reflect on the CMTrading login. Worried by the seemingly horrible trading experience, the trader submitted transaction screenshots through this CMTrading review. Take a look!

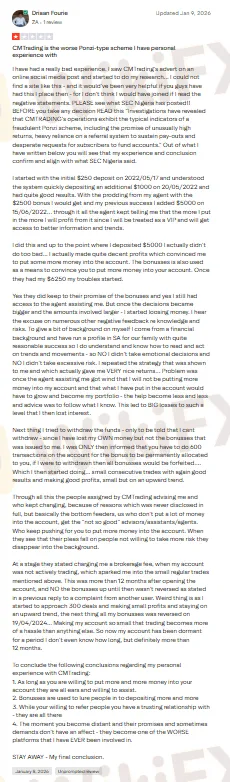

CMTrading Accused of Bonus Manipulation, Withdrawal Restrictions, and Ponzi-Like Practices

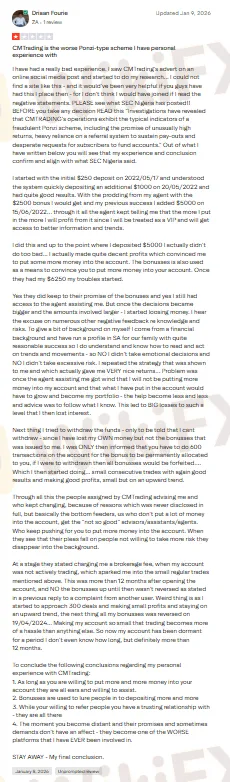

The complainant alleged that CMTrading lured him through social media advertising and encouraged increasing deposits with promises of bonuses, VIP treatment, and higher profits. After starting with $250 and eventually depositing a total of $6,250, the trader initially saw profits, which reinforced his confidence in the platform. However, once the trader stopped adding more funds, the level of support reportedly declined, and trading losses increased significantly. The trader claimed bonuses were used as leverage to push further deposits and were tied to strict trading volume requirements that were not clearly disclosed upfront.

When attempting to withdraw funds, the trader shared having been informed that withdrawals were restricted due to unmet bonus conditions requiring 600 transactions. Despite working toward the target through small trades, the bonuses were allegedly reversed in April 2024, significantly reducing the account balance. The complainant also accused CMTrading of charging unexpected brokerage fees during periods of inactivity. Additionally, the trader claimed that account managers frequently changed and primarily focused on pressuring clients to deposit more.

To know about this trading incident in greater detail, check this full-length CMTrading review.

Misleading Profit Promises and Refund Delays

The complainant alleged that a CMTrading agent deducted R5,000 from his account without properly explaining the selected product while promising a guaranteed daily profit of 10%. However, after contacting customer support, the trader was informed that profits were not guaranteed and that losses were possible. Feeling misled, the user decided to close the account and request a withdrawal. The trader claimed to have been told that the refund would take 2–3 days, but the payment did not happen. The trader expressed frustration over the delay and believed the issue resulted from the companys misleading communication rather than his own actions.

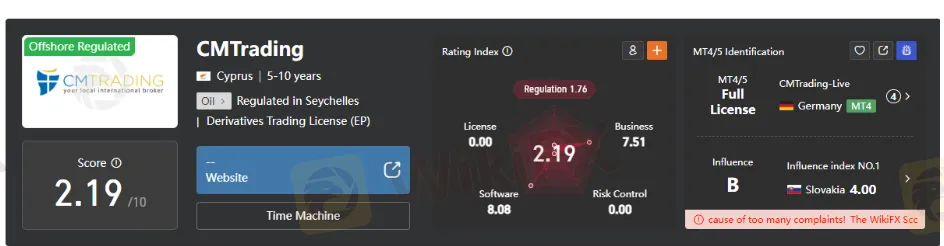

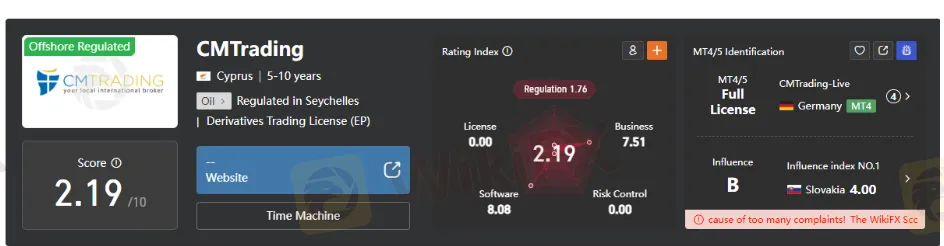

CMTrading Real or Fake: Find Out in This WikiFX Review

After thoroughly checking the complaints, the WikiFX team conducted a thorough inquiry into the CMTrading regulation. The findings revealed that the broker was regulated in Seychelles. However, the offshore regulation granted to it does not protect investors the way they can be when trading via entities regulated by top-tier regulators such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). Considering the loosely regulated framework, the WikiFX team gave CMTrading a score of 2.19 out of 10.