WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

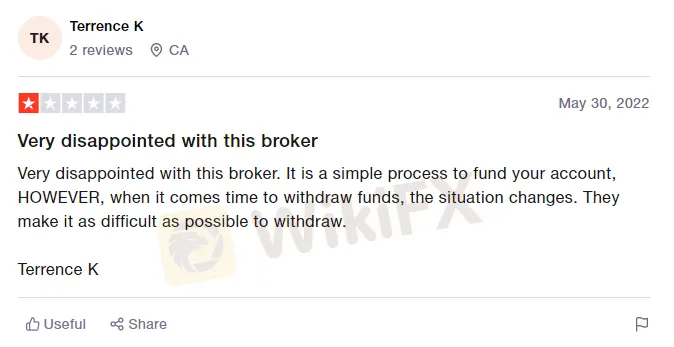

Abstract:When referring to the world's most liquid forex market, you can't resist quoting it as scammers' most potential target. Further, one might not be surprised after hearing that people have been losing money to Ponzi schemes. However, getting ditched by a well-regulated broker can be heart-wrenching. Forex.com is one of the unfortunate brokers people have reported for its lousy conduct amid delayed withdrawals, account closures, wider spreads and price manipulation.

Overview

Founded in 1999, Forex.com is a brand name of StoneX Financial Limited. Headquartered in the United States, the forex broker operates through its regional offices worldwide. The company offers a rich product portfolio, enabling clients to trade various financial instruments across major asset classes like forex, commodities, shares, indices and metals. With easy-to-use trading platforms, flexible account types, and multiple payment methods, the broker entices retail and institutional investors to sign up with it.

Regulatory Status

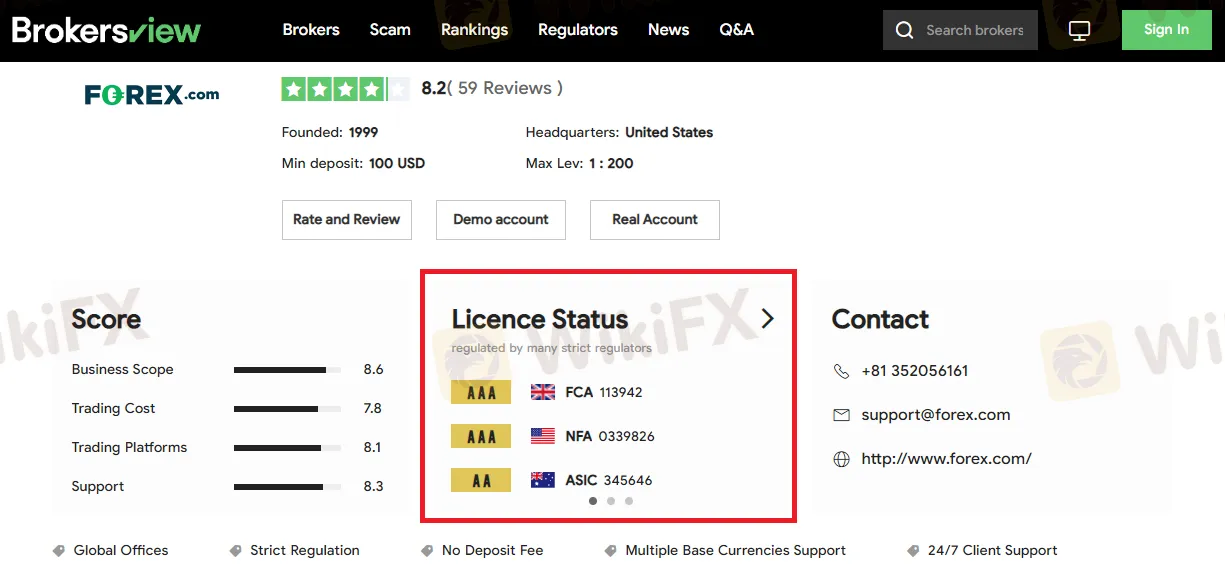

Forex.com holds multiple regulations from top-tier regulatory institutions worldwide, including but not limited to NFA, FCA, ASIC, IIROC, and CySEC. The broker claims to keep clients' investments in segregated bank accounts and abides by all the AML guidelines.

Clientele Feedback

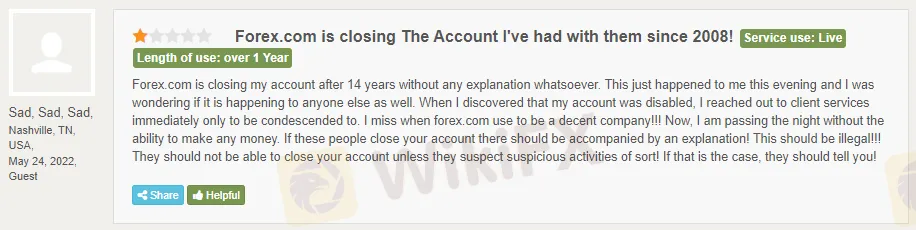

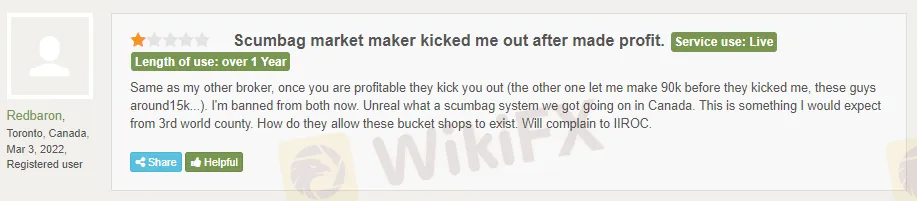

Forex.com clients have consistently reported the broker's malpractices on various digital and social media platforms like BrokersView. Let us share some screenshots below.

Further, the broker receives critics for delaying withdrawal requests for no reason.

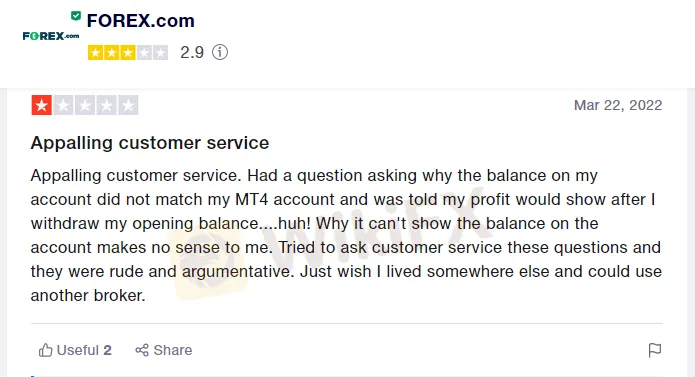

The situation worsens when you experience awful customer service from a broker licensed in more than seven jurisdictions in the world.

Why would a multi-regulated broker make people have bad experiences with it?

You might agree about possible reasons for a well-reputed broker to behave weirdly. First of all, when a broker is heavily regulated, it tends to be more cautious. For example, it might restrict access to your account upon determining a logging attempt from an unknown IP address, mitigating the intrusion risk.

Secondly, an AML compliant broker makes every effort to avoid legal violations. For instance, processing withdrawal requests of an unverified account might appear offensive to anti-money laundering agencies.

To cut it short, regulated brokers wouldn't want to face implications for breaching the code of conduct, such as financial penalties and license cancellation.

What to do if forex.com mistreats you?

If you feel intimidated by the broker, reaching out to its customer support is the best approach. However, owing to humanly limitations, you could experience a pathetic response from the customer support staff. Reasons might vary, including inexperienced support agents, lack of product knowledge or linguistic barriers.

Try requesting them to connect you with upper managerial staff and explain your issue in detail. If things don't work as anticipated, placing a withdrawal request and sidelining might be best. Since the broker doesn't have a good reputation for releasing clients' funds, you could also face the same issue.

Lastly, consider escalating your problems to the concerned regulatory authority like FCA, ASIC, CySEC, etc. Do not forget to provide complete case details, such as the account number, transaction amounts, screenshots of relevant correspondence with the company, etc. Hopefully, regulators will help you get your issue resolved.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.