WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Has your broker scammed you? If so, you are not alone. While there are many legitimate financial intermediaries in the forex market, scammers also exist in abundance. Today, we discuss FXGiants to help you know if it is worth signing up?

Overview

FXGiants says it is a brand name of Notesco UK Limited. Founded in 2016, the broker offers retail trading services across multiple asset classes, including forex, stocks, and indices. FXGiants other services include PAMM accounts, social trading and VPS hosting.

FXGiants serves clients via two domains - www.fxgiants.co.uk and www.fxgiants.com. Here is the thing: www.fxgiants.co.uk claims to be regulated by the FCA under license No. 585561. After our check, we found the FCA license No. 585561 belongs to a company named NOTESCO UK LIMITED, who has a registered email address - compliance@ironfx.co.uk, and a registered website - www.ironfx.co.uk. We contacted the official online customer service of www.ironfx.co.uk for verification, and got a reply: www.fxgiants.co.uk and www.fxgiants.com both belong to www.ironfx.co.uk. However, please note that www.ironfx.co.uk has been reported a wide range of withdrawal issues in 2015. Therefore, you should be careful to trade with it and its connected companies and pay attention to the risks!

Is FXGiants Regulated?

As we mentioned in the last paragraph, you should pay attention to and verify the company's regulatory status in the financial authority.

You should be aware that even if your broker is regulated, it can still take your money and run away.

The biggest difference between regulated and non-regulated entities is that the finances of regulated companies are monitored by regulators, who can assist you in claiming some of your financial losses, especially in the event of misconducts. For instance, brokers under FCA regulations typically allow UK-based clients to seek compensation of up to £85000 in registration with IFSC.

Clientele Feedback

Unfortunately, clients have had many issues with the firm, including but not limited to delayed withdrawals, latency and slippage problems, and poor customer support. However, withdrawal issues have been the most prevalent.

Clients also accuse the broker of price manipulation. FXGiants' customers believe that the company trades against them. The company also receives critics for unjustified account closures. Clients have reported several times that the company blocks access to their accounts as soon as they start accumulating profits.

Warnings Issued by Regulators

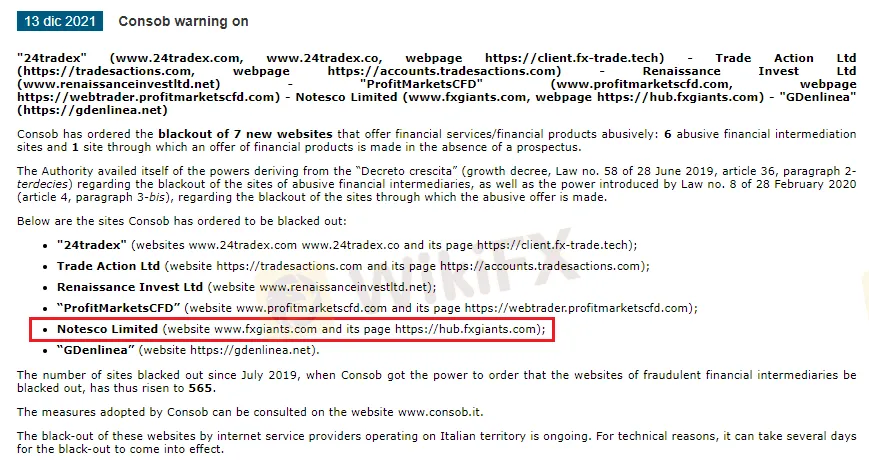

FXGiants makes it abundantly clear on its website that its services are “not geared at EU residents and fall outside the European & MiFID II legal framework.” The Italian financial authority CONSOB, on the other hand, did not believe that this was sufficient and has lately placed FXGiants on a blacklist.

How to spot if your broker could potentially be a scam entity?

Almost all scam entities operate more or less in a similar manner. For instance, they might restrict your access to your trading account, delay withdrawal requests, ask for more deposits, etc. Further, your company might not respond to your queries and concerns. If you observe a few or all of the listed signs in your brokerage firm, there might be an increased risk of losing your money.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.