简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is Stonefort Legit Company? Understanding the Risks

Abstract:When traders look up terms like "Is Stonefort Legit" or "Stonefort Scam", they want a clear answer to an important question: is my money safe? This article provides a fact-based look into Stonefort Securities Limited, using reliable information from regulatory tracking websites like WikiFX. Our research shows a broker that sends mixed signals. While Stonefort does have a license, it also has serious warning signs that any careful trader should think about. We will give you an honest, detailed breakdown of the facts, examining the broker's regulatory status, customer feedback, and business setup. This thorough review goes beyond marketing promises to give you the information you need to understand the real risks and make a smart decision.

When traders look up terms like “Is Stonefort Legit” or “Stonefort Scam”, they want a clear answer to an important question: is my money safe? This article provides a fact-based look into Stonefort Securities Limited, using reliable information from regulatory tracking websites like WikiFX. Our research shows a broker that sends mixed signals. While Stonefort does have a license, it also has serious warning signs that any careful trader should think about. We will give you an honest, detailed breakdown of the facts, examining the broker's regulatory status, customer feedback, and business setup. This thorough review goes beyond marketing promises to give you the information you need to understand the real risks and make a smart decision.

The Quick Answer- Is Stonefort Legit?

For traders who need a fast assessment, the following facts provide a basic overview of Stonefort's business profile and the risks involved. This summary covers the most important measures that show how reliable a broker is.

Quick Facts & Risk

The information below gives you an immediate understanding of where the broker stands in the industry. Each point includes an explanation of what it means for you as a trader.

| Metric | Data | Expert Interpretation |

| Broker Name | Stonefort Securities Limited | Standard business name. |

| Operating Since | 1-2 years | A fairly new broker that doesn't have a long history of operations, which is important for proving reliability and stability. |

| Main Regulation | Mauritius FSC (GB24202921) | This is an offshore license. It offers much weaker client protection and oversight compared to top-level regulators. |

| WikiFX Score | 5.95 / 10 | An average score that falls below what is considered a safe and reliable broker. It shows potential risks. |

| Customer Reviews | 12 Positive (All “Unverified”) | This is a major warning sign. Having no verified reviews suggests the feedback may be fake or manipulated. |

| Platform | MT5 (Full License) | A good sign. Using a fully licensed MT5 platform shows investment in standard, reliable industry technology. |

First Conclusion

The initial information shows a high-risk situation. Stonefort is a licensed company, which means it isn't completely fake. However, its weak offshore regulation, low industry trust score, and questionable customer reviews create a profile that should worry any serious trader. So when evaluating the question Is Stonefort legit, the answer is not simple—it requires deeper investigation.

These facts provide only a surface-level snapshot. To properly decide Is Stonefort Legit, traders must examine regulation, transparency, and independent verification sources. You can review Stoneforts full and updated profile on WikiFX to make your own informed judgment before committing funds.

Understanding Offshore Regulation

A broker's legitimacy depends on its regulation. When traders ask, Is Stonefort Legit, what they are really asking is whether its regulation provides strong enough protection. Understanding the difference between regulatory locations is not just a technical detail; it is the most important part of managing risk. Top-level regulators, such as the UK's FCA or Australia's ASIC, have strict rules to protect clients. Offshore regulators, like the Mauritius FSC that oversees Stonefort, work under a different, much less strict system.

Common problems with offshore regulation include:

• Lower Money Requirements: Brokers don't need to hold as much money, increasing the risk of going bankrupt during market changes.

• Weak Oversight: Audits and reporting standards are less frequent and thorough, allowing potential wrongdoing to go unnoticed.

• No Protection Programs: If the broker fails, there is typically no investor protection fund to help clients get their money back.

Understanding these structural differences is essential when deciding Is Stonefort Legit from a risk-management perspective.

Stonefort's Regulatory Profile

The information shows a complex and worrying regulatory structure.

• Fact: Stonefort Securities Ltd is regulated by the Mauritius Financial Services Commission (FSC) with Securities Trading License (EP) number GB24202921.

• Fact: The company is also connected to a registered location in the United Arab Emirates and an entity in Saint Vincent and the Grenadines. The latter is a location with no forex regulation at all.

This layered structure can create confusion. When clients ask Is Stonefort Legit, they must also ask which legal entity they are signing with and what protections actually apply to their funds.

The Real-World Risks

As expert analysts, we see these regulatory choices as clear signs of risk. For a trader, the consequences are real and serious.

• Limited Money Protection: If Stonefort were to go bankrupt, your money would likely be lost. Unlike with top-level regulators, there is no protection program in Mauritius to act as a safety net. Your money is completely at risk.

• Dispute Resolution Problems: If you have a disagreement over a trade execution, a withdrawal, or any other issue, your options are very limited. Pursuing a legal complaint against a company based in Mauritius is a complex, expensive, and often hopeless process for an international client.

• Lower Operating Standards: Offshore regulators do not enforce strict best practices for price transparency, order execution, or preventing conflicts of interest. These practical realities are critical when evaluating Is Stonefort Legit in terms of client safety rather than simply registration status.

Looking at Reviews and Information

Online reviews can offer insight—but also manipulation. A balanced evaluation of Is Stonefort Legit must consider both testimonial patterns and objective data.

The “Unverified” Warning Sign

First, we note the presence of 12 positive reviews on platforms like WikiFX. They mention “fast payouts” and “good support.” However, a critical detail completely undermines their credibility.

• 100% of the reviews are “Unverified.” This means the platform could not confirm that the person leaving the review is a real client of Stonefort. For an established broker, a healthy mix of verified and unverified reviews is normal. Having 100% unverified reviews is unusual and a major sign of fake reviews.

• Future-dated reviews. The most obvious sign of fabrication is reviews dated for the future. As of early 2025, there are reviews posted with dates in September and October 2025. This is impossible and serves as solid proof that these testimonials are fake.

Contradictory Website Traffic

The positive reviews show a popular and active broker. The website traffic information tells a completely different story.

• Total Monthly Visits: About 2,286. This is an extremely low number for a broker supposedly operating worldwide.

• Average Visit Time: About 6.6 seconds. This number is exceptionally low. It suggests that most visitors land on the site and leave almost immediately, common behavior when a site appears untrustworthy or fails to meet user expectations.

• Bounce Rate: 44%. While not terrible, this rate, combined with the low visit time, reinforces the idea that the site is not engaging real, potential traders.

This contradiction further complicates the answer to Is Stonefort Legit, as operational popularity does not align with promotional claims.

A Look at Infrastructure

Beyond regulation, a broker's trading infrastructure and cost structure provide insight into its professionalism and viability. Here, we objectively evaluate Stonefort's offerings.

Trading Platform: MT5

Stonefort offers the industry-standard MetaTrader 5 (MT5) platform. Importantly, data from WikiFX identifies this as a “Full License.” This is a positive technical point. It shows that the broker has made a significant financial investment in a legitimate, full-featured platform infrastructure, rather than using a cheaper, less reliable “white label” solution. From a technical standpoint, this is a positive sign. However, traders must remember that having MT5 does not automatically resolve concerns surrounding Is Stonefort Legit, since platform quality does not replace regulatory strength.

Account Types and Deposits

Transparency in account structure is another factor to examine when asking Is Stonefort Legit.

| Account Type | Minimum Deposit | Spreads (Starting From) |

| Starter | $50 | From 1.3 |

| Advanced | $3,000 | from 1.0 |

| Elite | $10,000 | From 0.1 |

The lack of transparency for the Starter and Advanced tiers is unhelpful. More importantly, requiring a $10,000 minimum deposit for the Elite account—the only one with specified competitive spreads—is a major warning sign. This is a major consideration in evaluating Is Stonefort Legit for risk-conscious traders.

Funding and Withdrawals

How money moves is a crucial test of a broker's integrity. Stonefort's stated methods are:

• Available Methods: State Bank of Mauritius, First Abu Dhabi Bank, Wire Transfer.

• Deposits: Claimed to be 0 commission.

• Withdrawals: The stated fee is “shared with the beneficiary/client.” This is deliberately unclear language. It provides no clarity on the actual cost you will pay and could be a way to add unexpected and high fees.

• Processing Times: Stated as 24-48 hours for international transfers and up to 3-5 working days for wire transfers to credit.

Transparent fee disclosure is another key factor in determining Is Stonefort Legit from a compliance and trust standpoint.

Conclusion: A Risk Not Worth Taking

We return to the original question: Is Stonefort legit? While Stonefort holds an offshore license and operates a real website—meaning it is not completely “fake” in the technical sense—our investigation reveals overwhelming evidence that it is an unreliable and potentially unsafe trading partner. The signs point not to a legitimate business, but to a high-risk operation that careful traders should avoid.

Summary of Key Risks

The decision to avoid this broker is based on multiple, serious warning signs.

• Weak Offshore Regulation: The Mauritius FSC license offers minimal client protection, no fund compensation, and weak oversight.

• Low Industry Trust Score: A WikiFX score of 5.95/10 is a clear warning sign that the broker fails to meet basic industry standards for safety and reliability.

• Fake Customer Reviews: The use of 100% unverified, future-dated positive reviews is a deceptive practice and a major warning sign for a potential Stonefort scam.

• High Money at Risk: The demand for a $10,000 deposit to access reasonable trading conditions is not justified given the broker's high-risk profile.

The Final Recommendation

The basic principle of successful trading is not chasing profits, but managing risk. Based on the evidence, the operational, regulatory, and reputation risks associated with Stonefort far outweigh any potential benefits offered by its MT5 platform or stated spreads. The question should change from “Is Stonefort Legit?” to “Is Stonefort a safe place for my money?” Our analysis concludes that it is not.

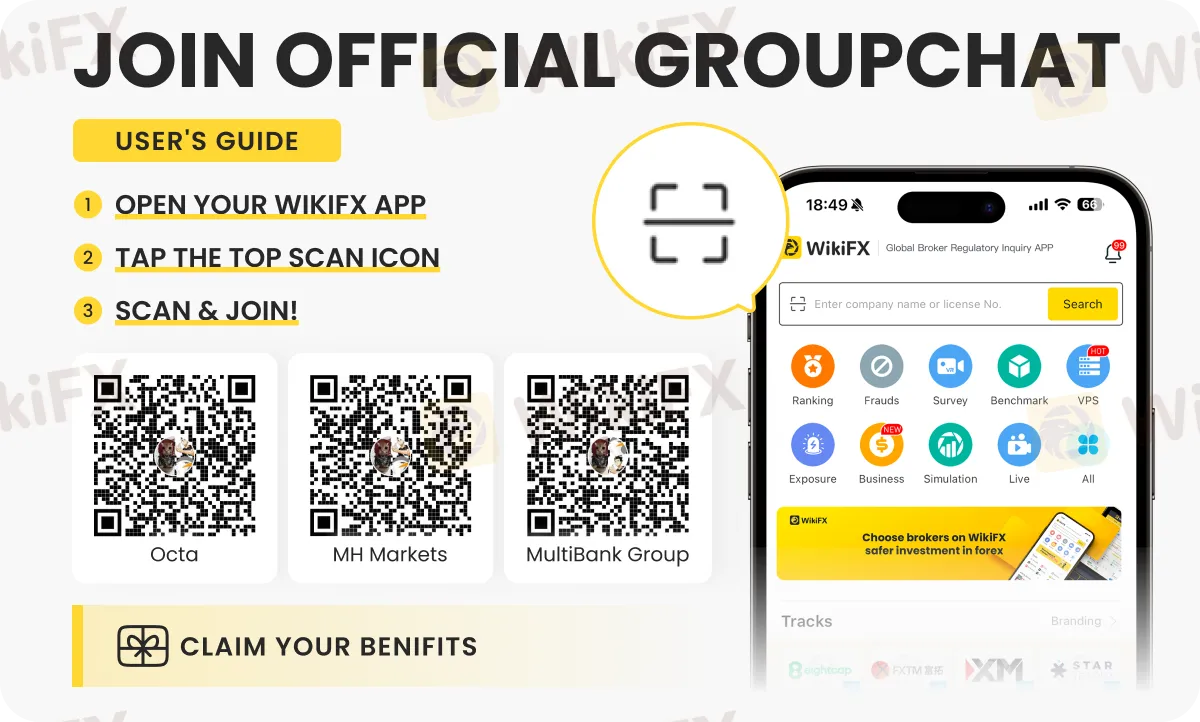

Your money is your most important tool. Before depositing funds with *any* broker, take five minutes to do your own check. Use a comprehensive broker research tool like WikiFX to verify regulatory licenses, check for user complaints, and see objective information. This simple step is the best defense against potential scams and unreliable partners.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

9Cents Review 2026: Is this Broker Safe?

Titan Capital Markets Review 2026: Comprehensive Safety Assessment

Plus500 Scam Alert: Withdrawal Issues Exposed

PXBT Review: A Seychelles-Based Trap for Your Capital

Here are the five key takeaways from the January jobs report

Is Alpari safe or scam? What You Need to Know

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

Japanese Yen Surges as Political Stability Lures Foreign Capital

Global Capital Rotation Batters Greenback; USD/JPY Pierces 156

Currency Calculator