WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Since the forex market is overly populated with good and lousy forex brokers, it becomes essential for investors to remain extra vigilant when making a choice. No matter how well you know the market, shabby brokers like LexaTrade can have various tactics to make you believe them to be a legitimate company.

Overview

LexaTrade is a brand name of Swissone Group Ltd based in St. Vincent and Grenadines. The company claims to have been regulated by International Financial Market Relations Regulation Centre (IFMRRC) under license number RU 0395 AA V0189. The broker provides trading services across multiple asset classes, including forex, shares, indices, and commodities. Besides offering lucrative bonus offers, the company entices clients with insurance protection on deposits of up to 5000 U.S Dollars.

Regulatory Status

LexaTrade is a non-regulated brokerage firm. Being an unregulated entity, it is not safe for trading. That means funds deposited with the company don't have legal protection if the company becomes bankrupt.

Clientele Feedback

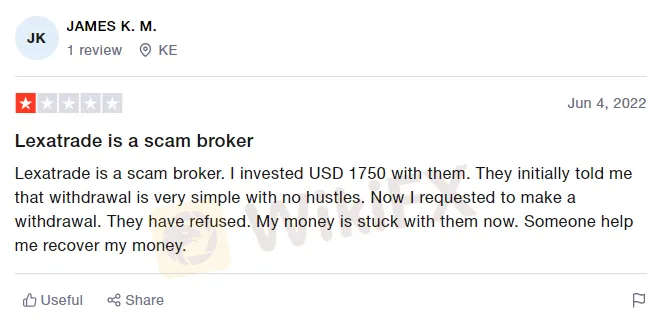

LexaTrade is one of the poorly rated brokers available around. While the company's existing clients provide negative feedback for its malpractices, its formal customers do not have different opinions either. Ranging from withdrawal issues to trade execution and customer support, the company always make people suffer. We witnessed clients have reported multiple incidents of the broker refusing to process withdrawals on different platforms, including BrokersView. Let us share some screenshots as a piece of evidence.

What Makes LexaTrade A Scam Setup?

First, the company is headquartered on an offshore island, with no legal supervisory authority except for the SVGFSA to oversee financial intermediaries. However, the SVGFSA neither regulates nor issues licenses to brokers dealing in forex and binary options trading. Instead, it only registers non-forex companies operating within St. Vincent and Grenadines.

Second, the company claims to be holding regulations from the IFMRRC, which itself is a non-governmental self-regulatory organization with no track record of being endorsed by any reputable regulatory authority.

Further, the company has been denounced in various jurisdictions by concerned supervisory authorities like Polish Financial Supervision Authority (KNF). According to KNF, the broker is not registered in Poland. It further states that clients should avoid trading with LexaTrade since it operates without the required permission.

How LexaTrade Trap Clients?

LexaTrade customer service agents keep pushing clients via phone calls and emails, asking them to fund their accounts. However, they become less concerned after receiving funds from clients and don't even bother to respond to your concerns and queries. Their only motive is to steal investors money by any means.

What to do If I've deposited my funds with LexaTrade?

Unfortunately, there isn't much you can do. Nevertheless, consider placing a withdrawal request with your broker immediately. There is no point in continuing trading with a company known to be ditching clients repeatedly. Essentially, it hurts you more when you aren't able even to file a case against it.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.