Company Summary

| QNB FINANSINVEST Review Summary | |

| Founded | 2016 |

| Registered Country/Region | Turkey |

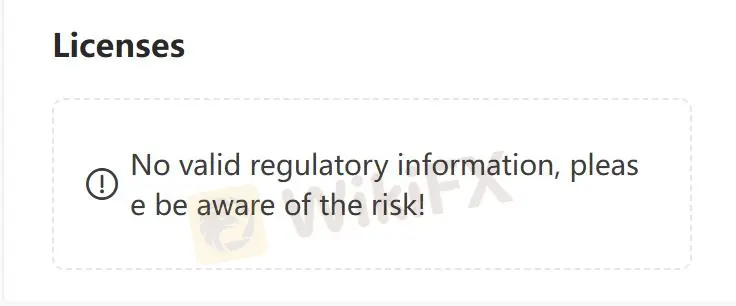

| Regulation | Unregulated |

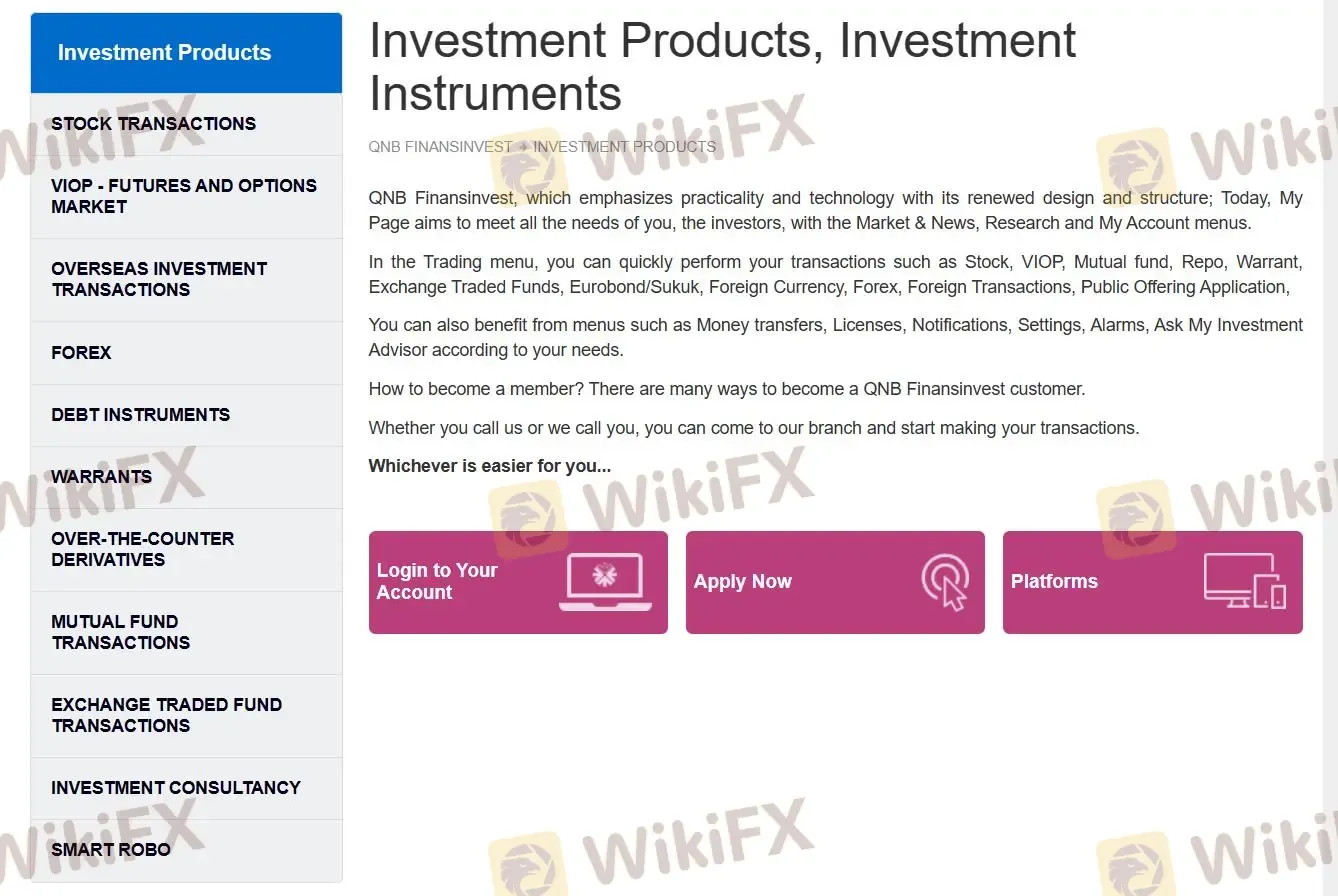

| Products & Services | Investment products, stock transactions, forex, Overseas investment transactions, VIOP, debt instruments, warrants, over-the-country derivatives, mutual fund transactions, exchange traded fund transactions and investment consultancy |

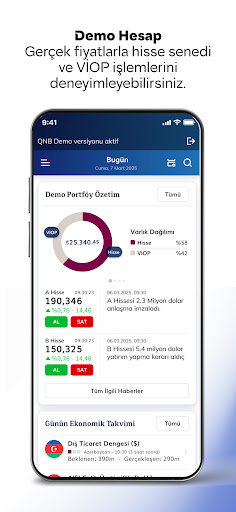

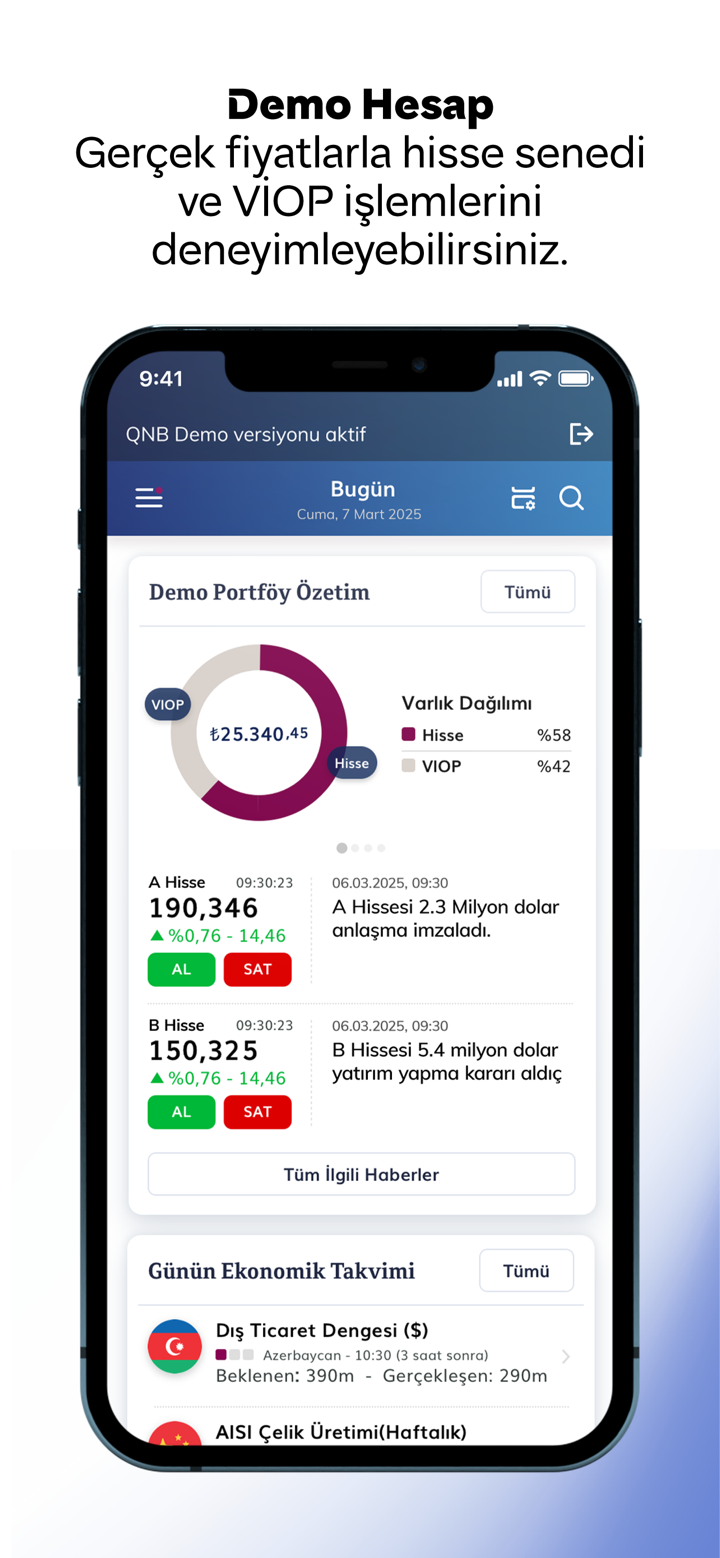

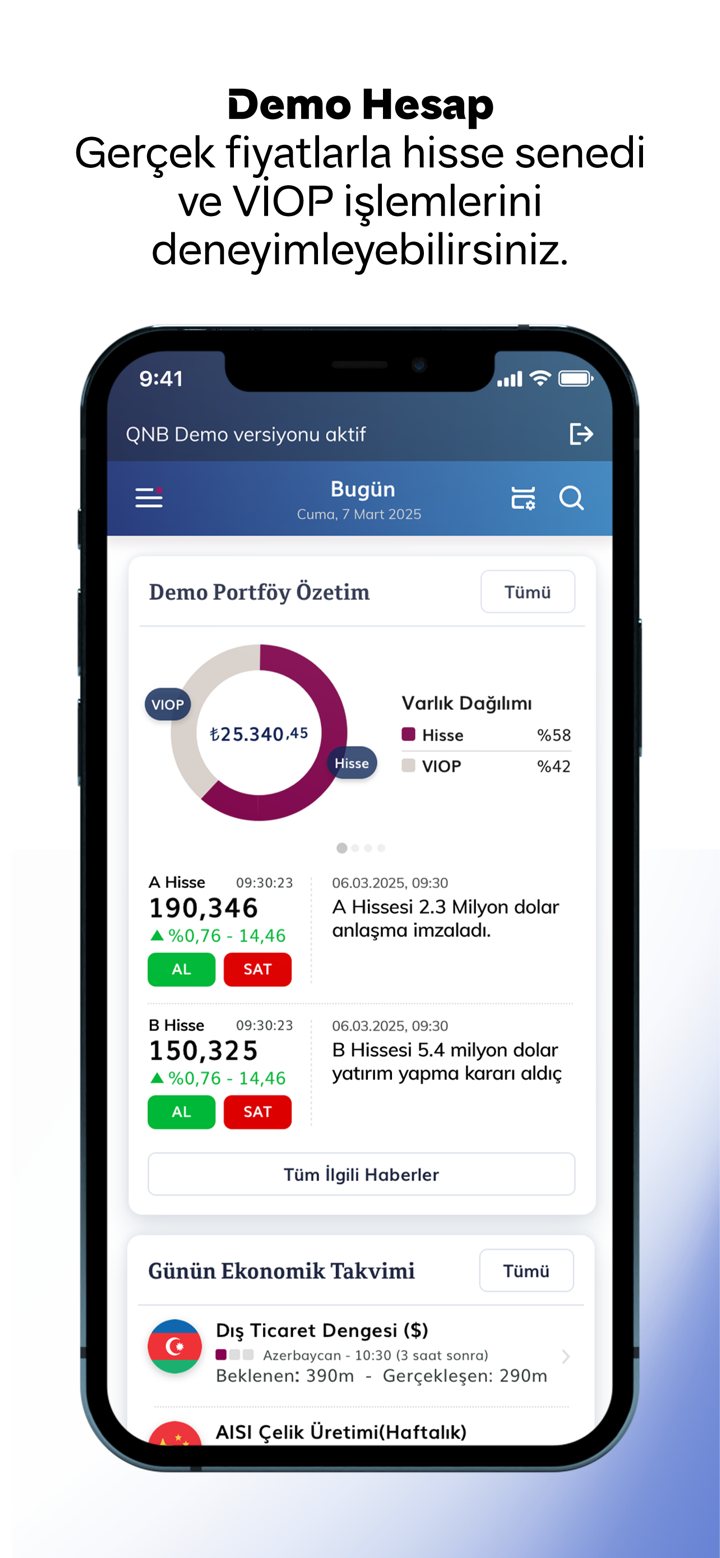

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | QNB Invest |

| Min Deposit | / |

| Customer Support | Live chat |

| Tel: +90 212 336 7373 | |

| Email: webinfo@qnbfi.com | |

| Twitter, Facebook, Instagram, YouTube and Linkedin | |

| Esentepe Mah. Büyükdere Cad. Kristal Kule Binası No: 215 Kat: 6-7 34394 Şişli / İstanbul | |

QNB Finansinvest, established in 2016 and headquartered in Turkey, is a financial institution that offers a diverse range of services and products to its customers. As a subsidiary of the QNB Group, one of the leading financial institutions in the Middle East and Africa with over $150 billion in assets, QNB Finansinvest benefits from the strength and stability of its parent company.

With a focus on portfolio management, investment advisory, wealth management, investment banking, fixed income, securities, and mutual funds, QNB Finansinvest caters to both individual and corporate clients. Since its inception in 1996, the company has accumulated over 25 years of experience in capital market activities.

Pros and Cons

| Pros | Cons |

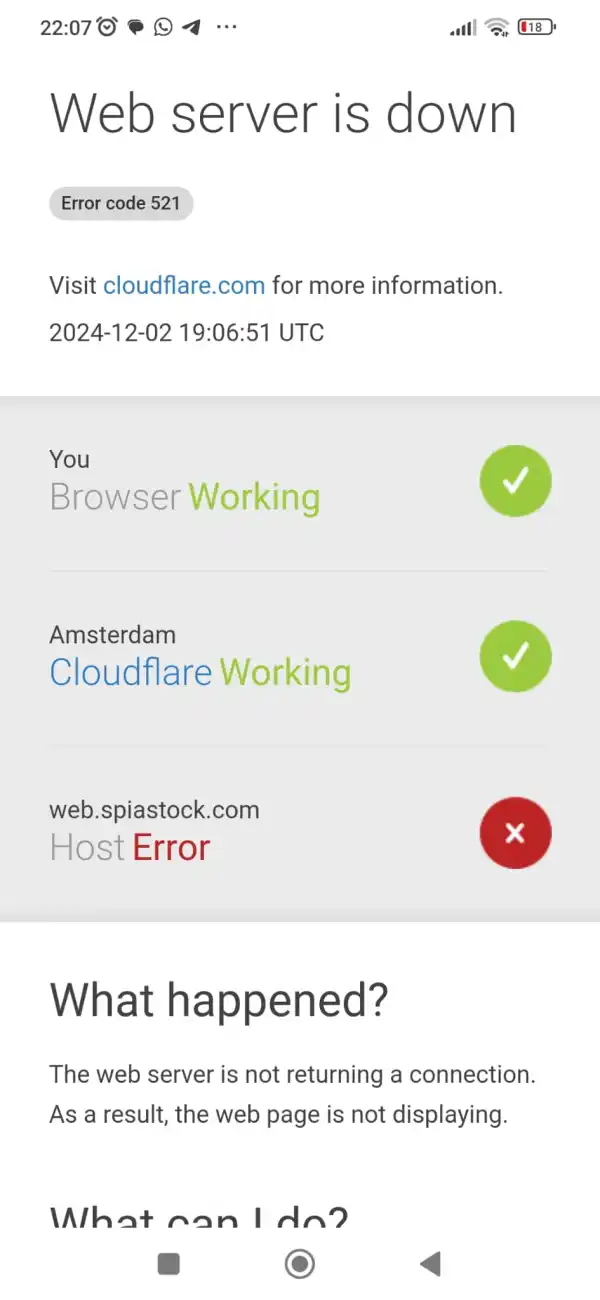

| Various products and services | Inaccessible website |

| Live chat support | Not regulated |

| No demo accounts | |

| Limited info on trading conditions | |

| No MT4/5 supported |

Is QNB FINANSINVEST Legit?

QNB Finansinvest claims it offers security measures. They emphasize the superiority of their 128-bit encrypted security program over the standard SSL-40 bit encryption used by other players in the e-business market, highlighting its widespread adoption by major brokerage houses in Turkey. This encryption technology is touted as the industry standard, providing enhanced protection for sensitive information exchanged on their platform.

However, a notable concern arises from the absence of valid regulation governing QNB Finansinvest's operations. Without government or financial authority oversight, investors face inherent risks. The lack of regulatory oversight means there's no external body ensuring compliance with industry standards, best practices, and legal requirements. Consequently, investors are exposed to potential exploitation, as the absence of regulation leaves room for malpractices and fraudulent activities.

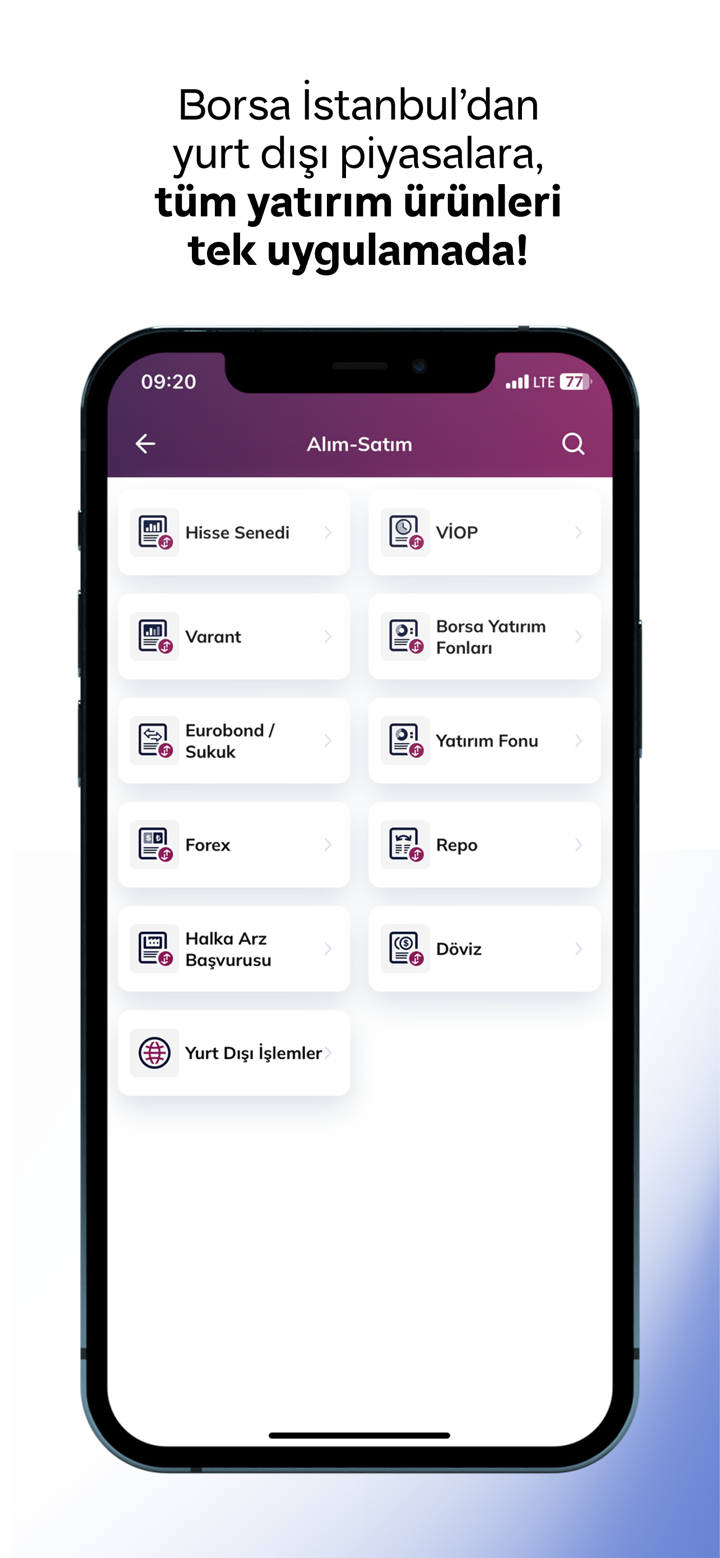

Products and Services

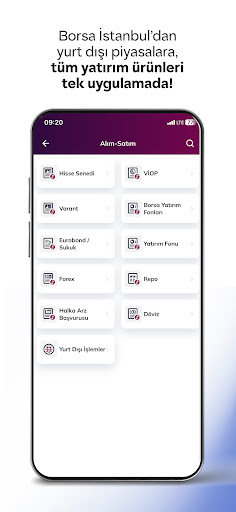

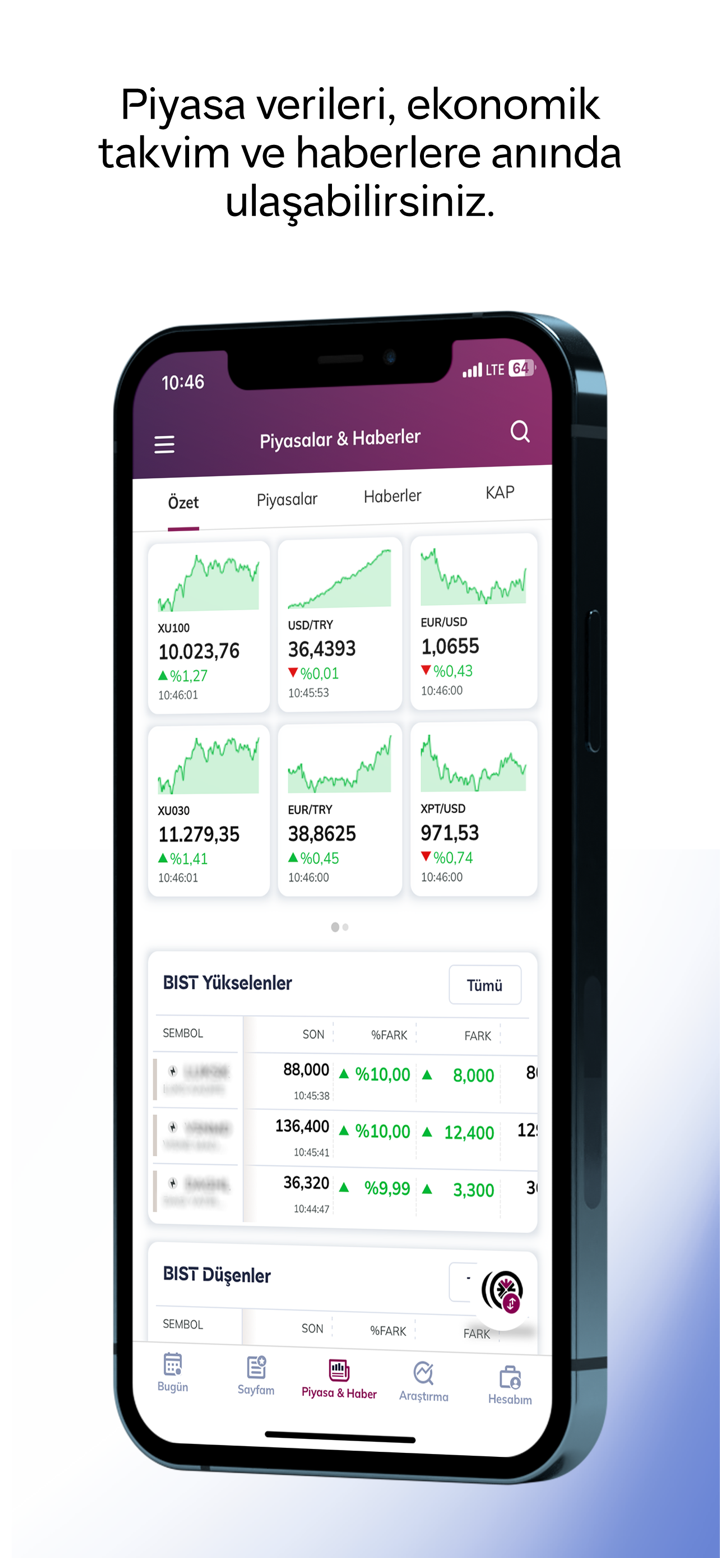

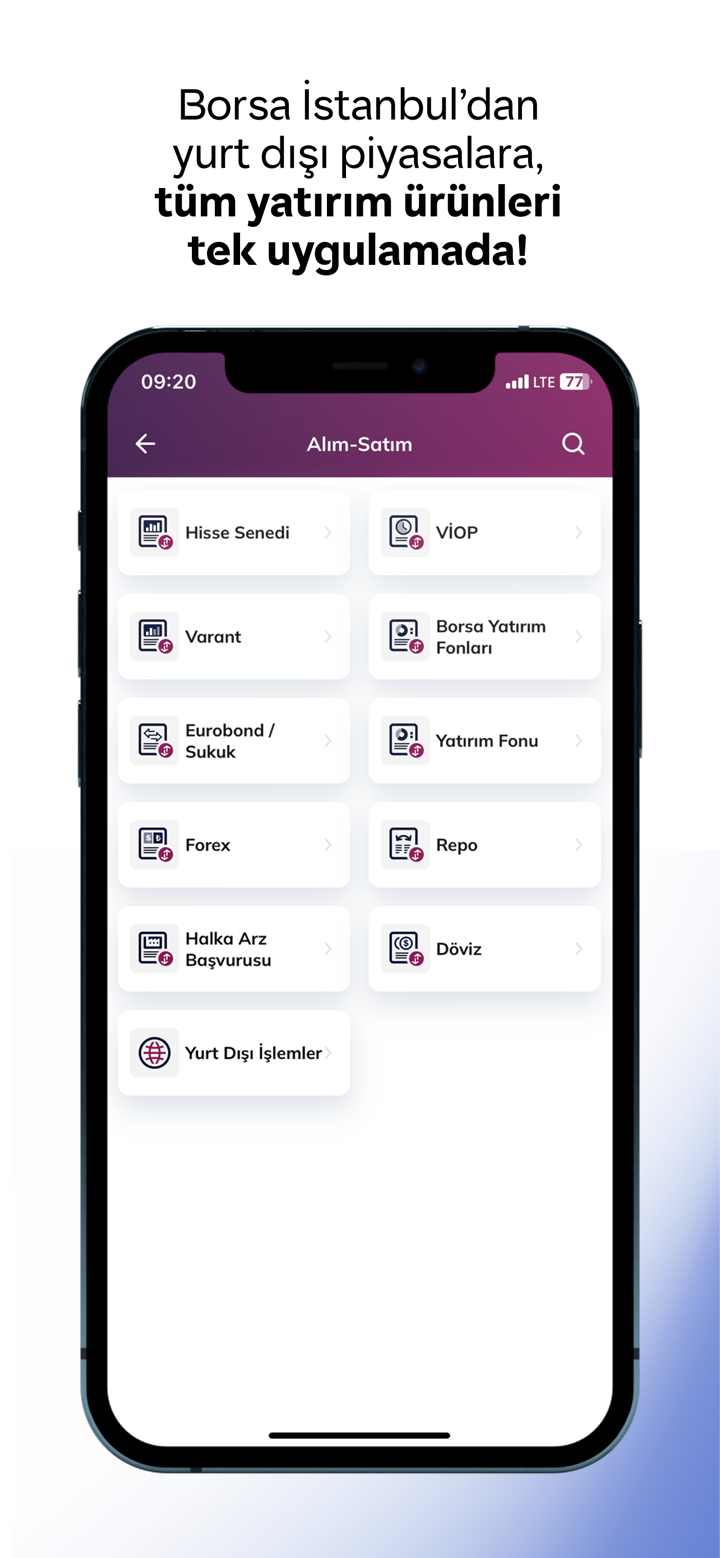

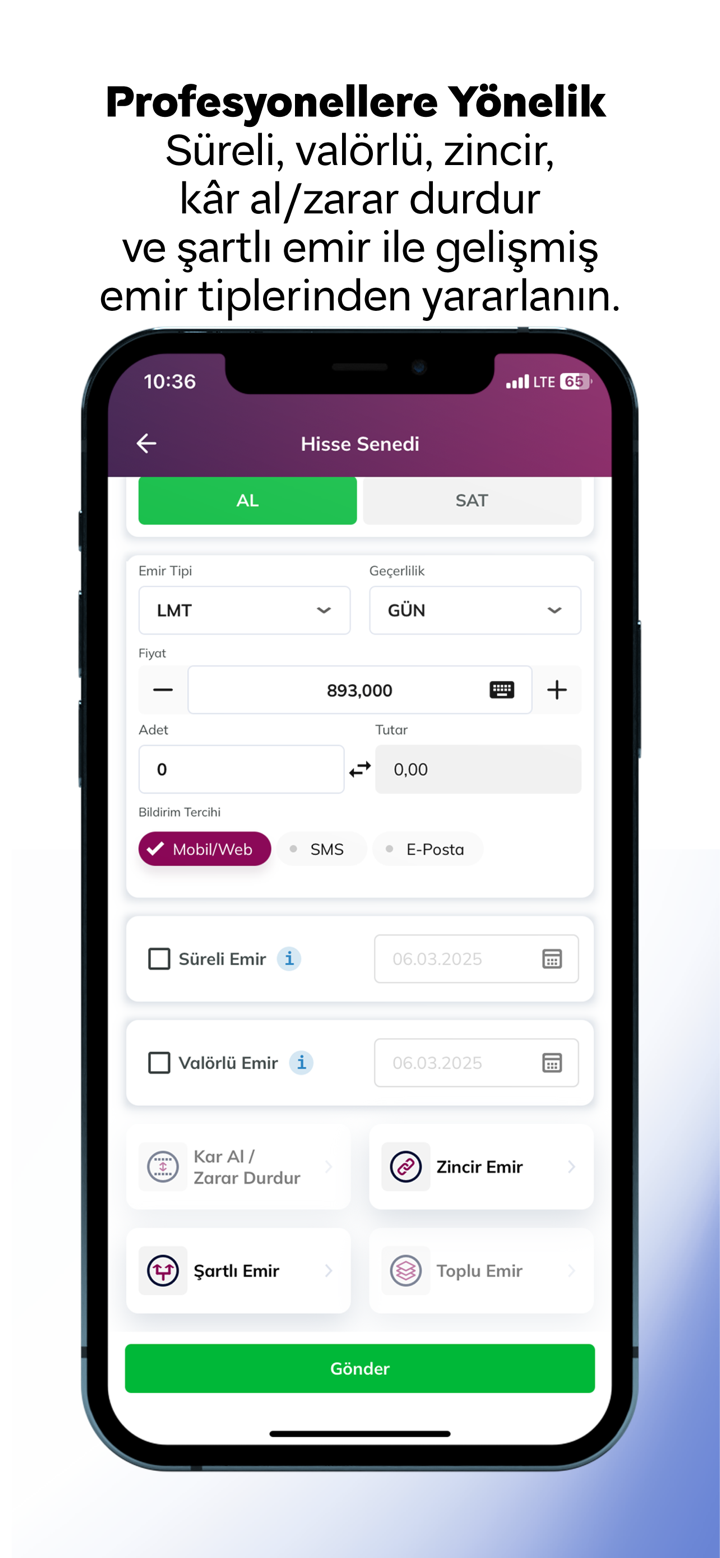

QNB FINANSINVEST offers various investment products and services, including investment products, stock transactions, forex, Overseas investment transactions, VIOP, debt instruments, warrants, over-the-country derivatives, mutual fund transactions, exchange traded fund transactions and investment consultancy.

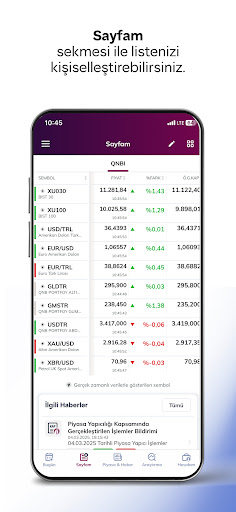

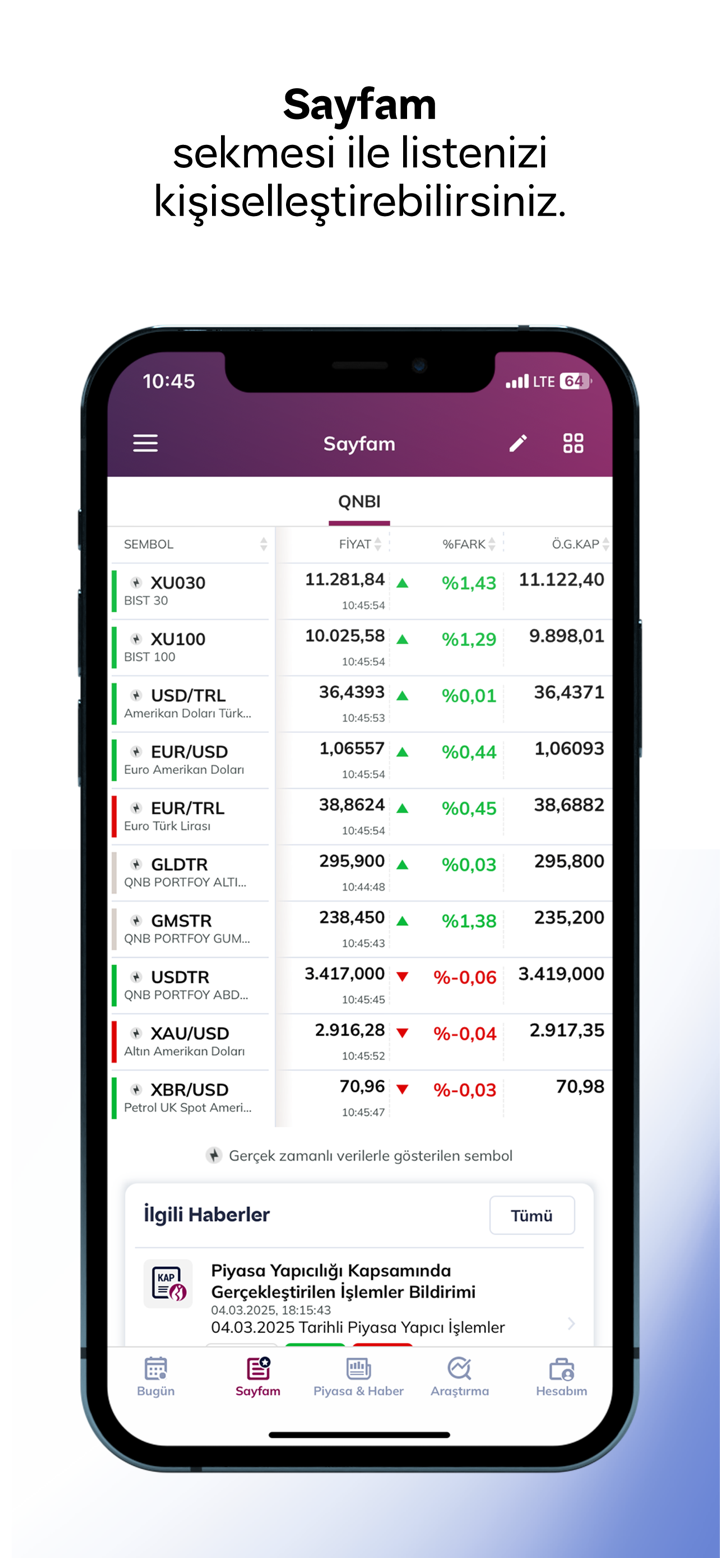

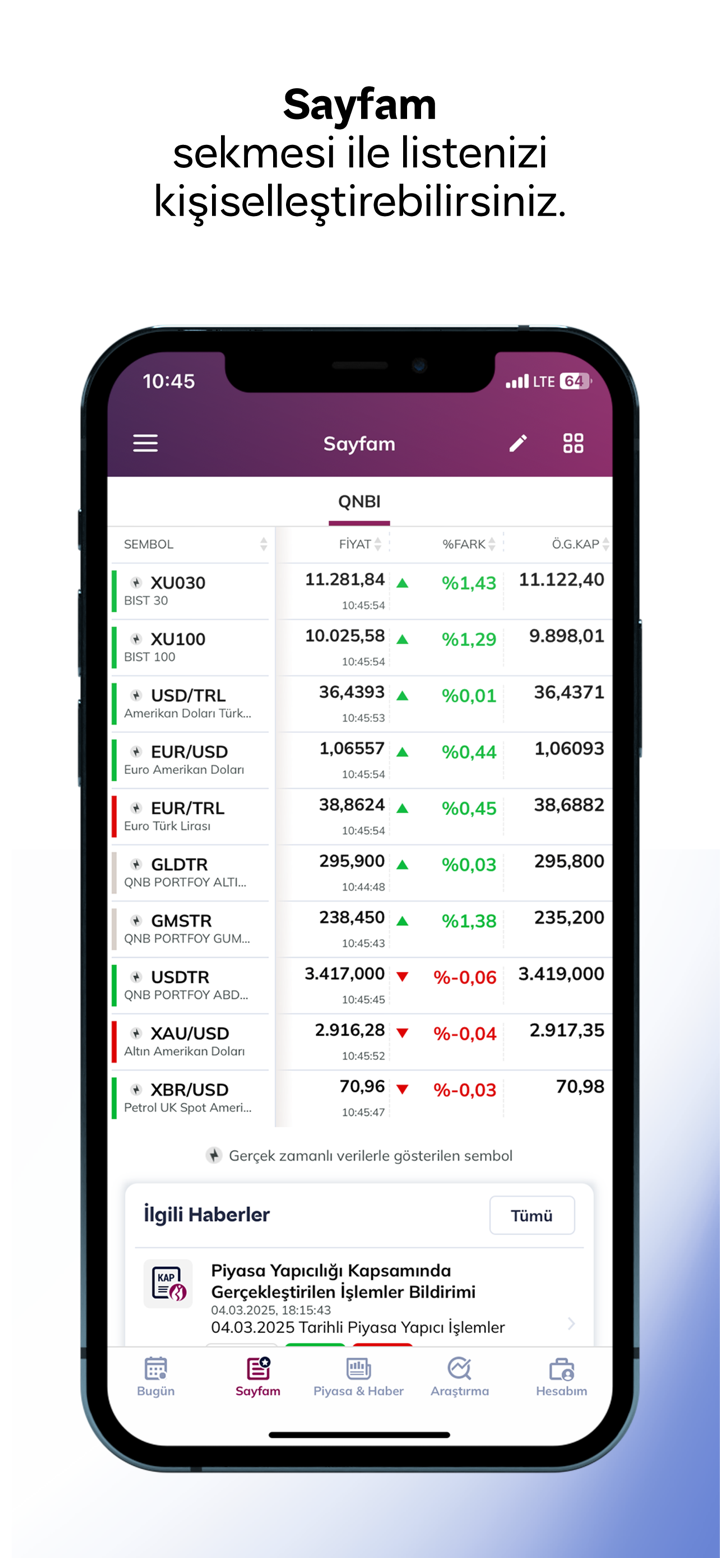

Forex: Currency pairs, commodities, indices, and Forex.

Investment products: Stock, VIOP, Mutual fund, Repo, Warrant, Exchange Traded Funds, Eurobond/Sukuk, Foreign Currency, Forex, Foreign Transactions, Public Offering Application.

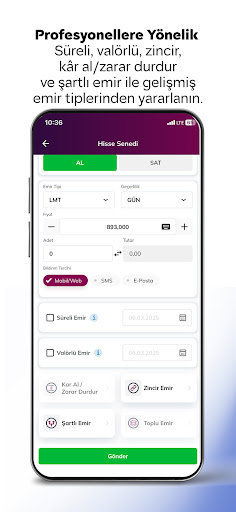

VIOP: Buy and sell contracts on stocks, stock indices (BIST-30), exchange rates (TL/Dollar, TL/Euro, Euro/Dollar), gold, commodities and electricity for a certain collateral/premium for hedging, investment and arbitrage purposes in line with expectations.

Overseas investment transactions: Foreign stocks, exchange-traded funds, eurobonds and sukuk products.

Debt instruments: Fixed-income products such as repo, treasury bills, government bonds, eurobonds, and private sector bonds.

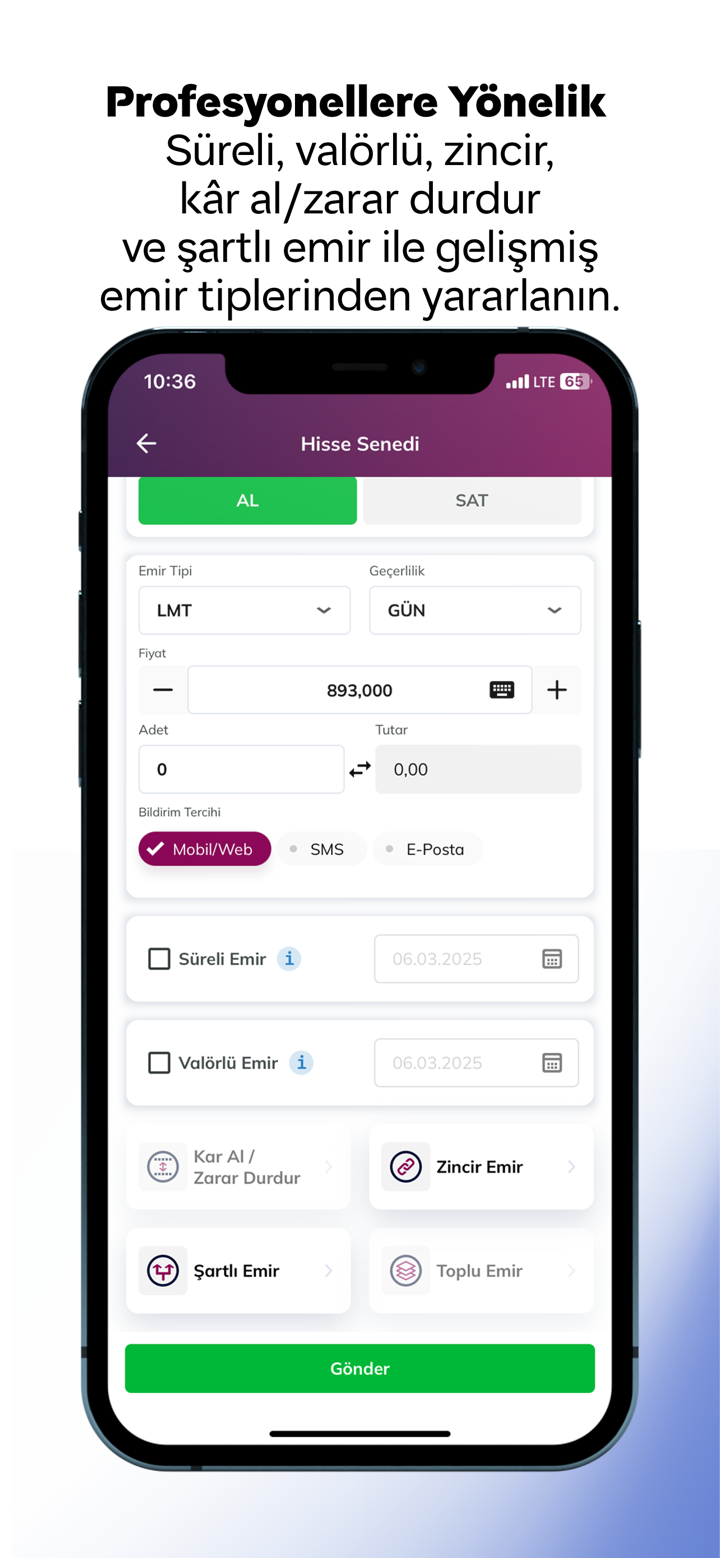

Over-the-country derivatives: Forwards, Swaps, Futures, Options and structured products.

Mutual fund transactions: Money market fund, private sector debt securities fund, short-term debt securities fund, debt securities fund, eurobond debt securities fund, first hedge fund, QNB portfolio first variable fund and ONB portfolio primary equity fund.

Exchange traded fund transactions: GOLDIST, USDTR, QOUR and GMSTR.

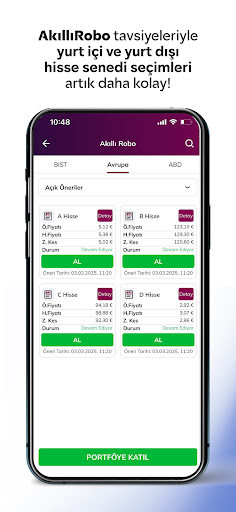

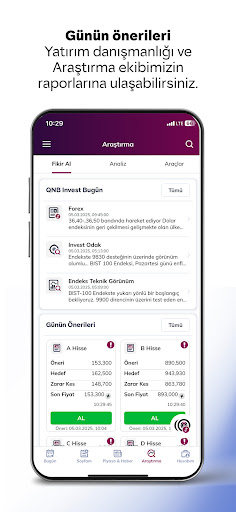

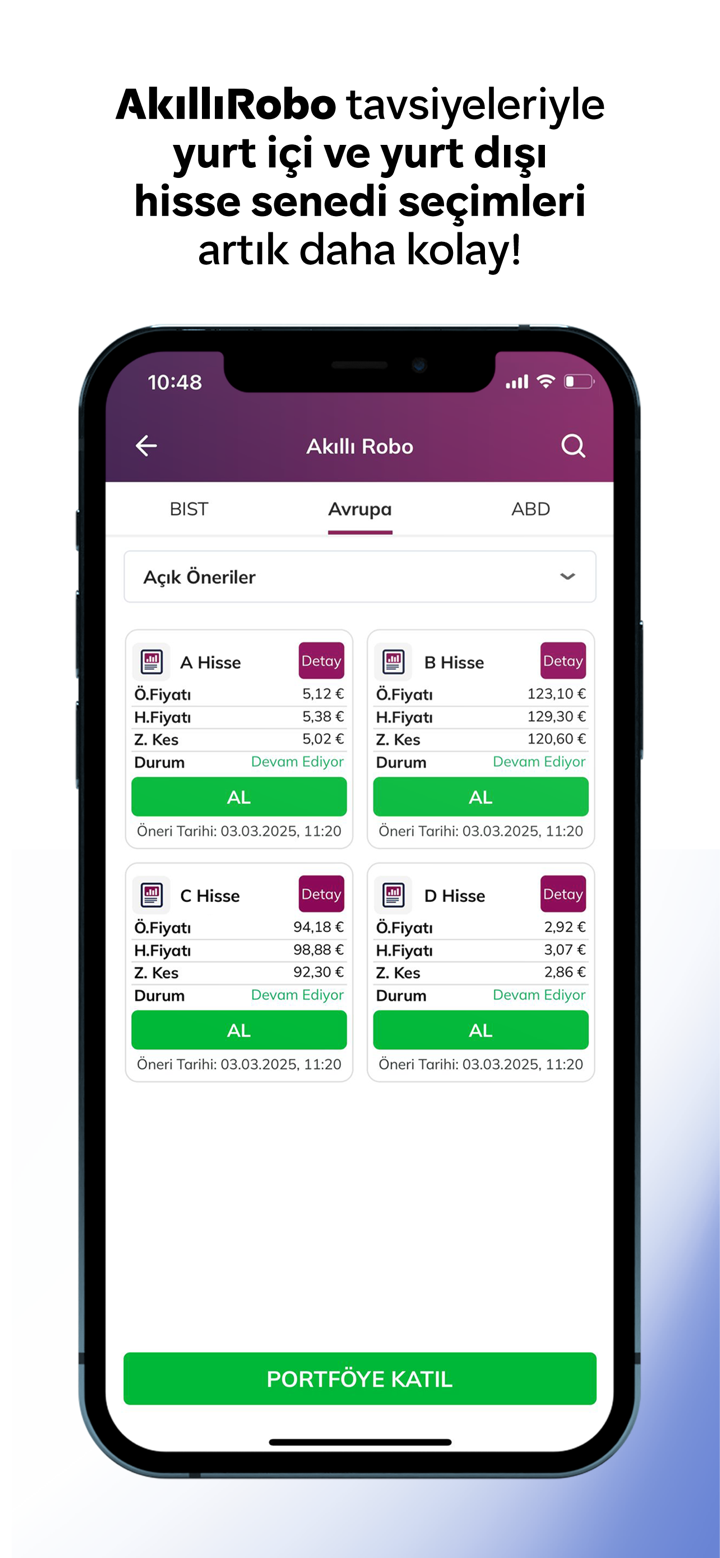

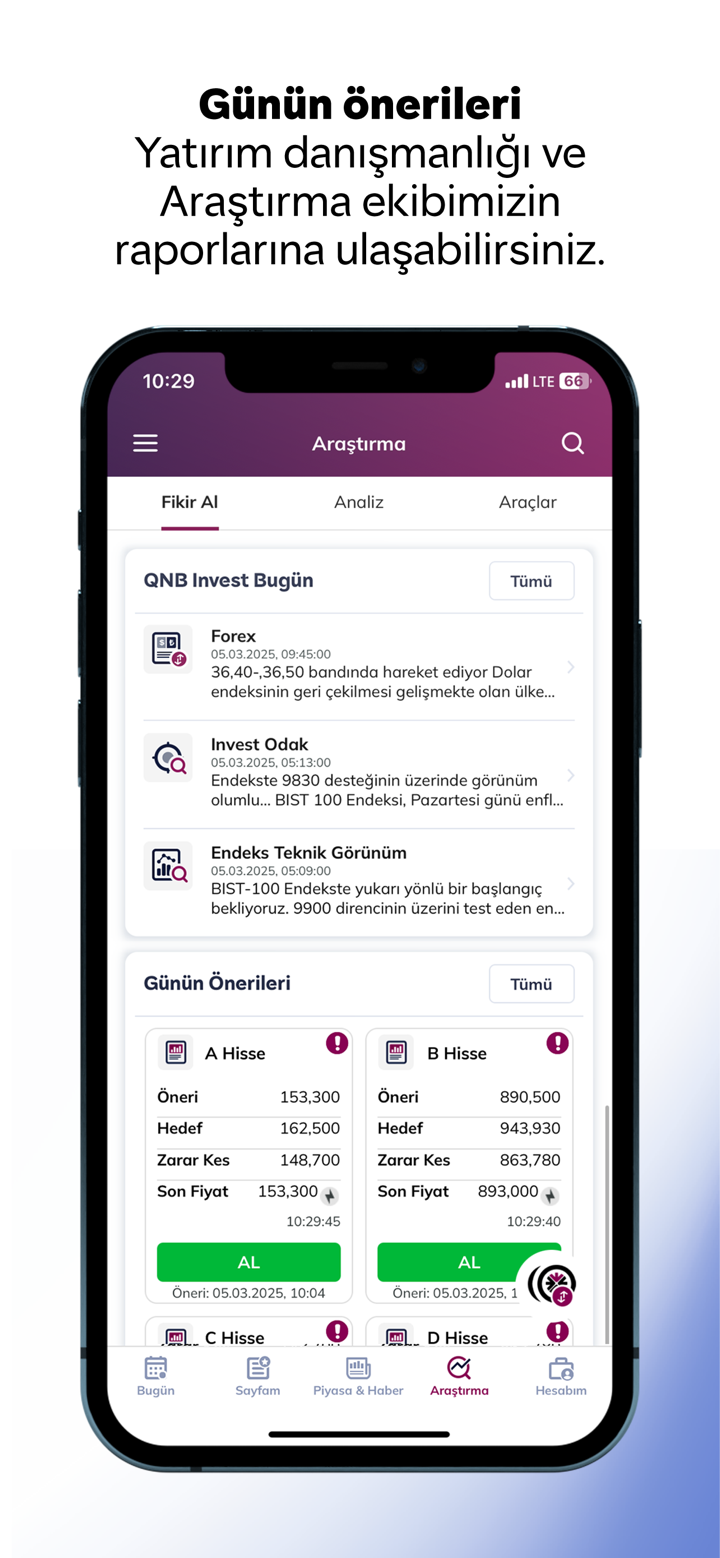

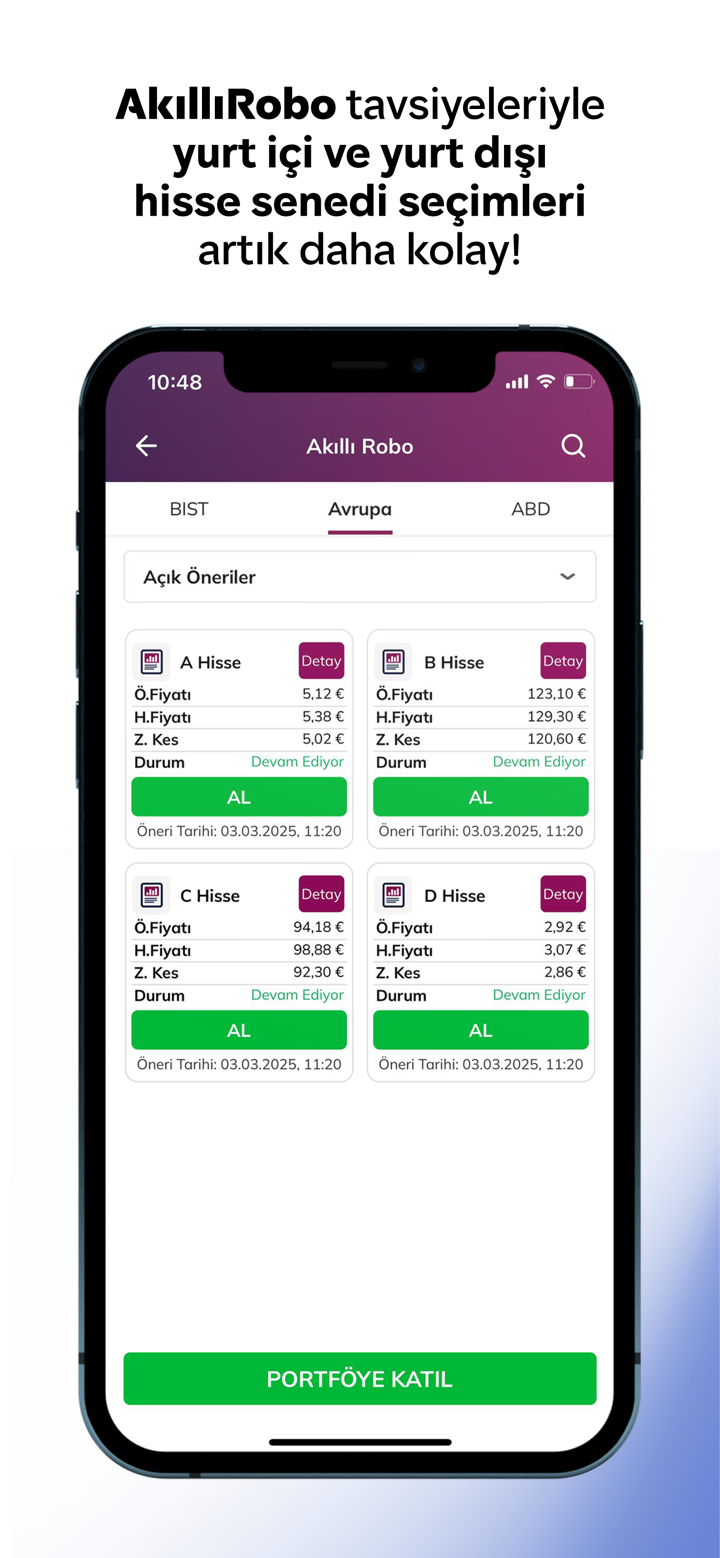

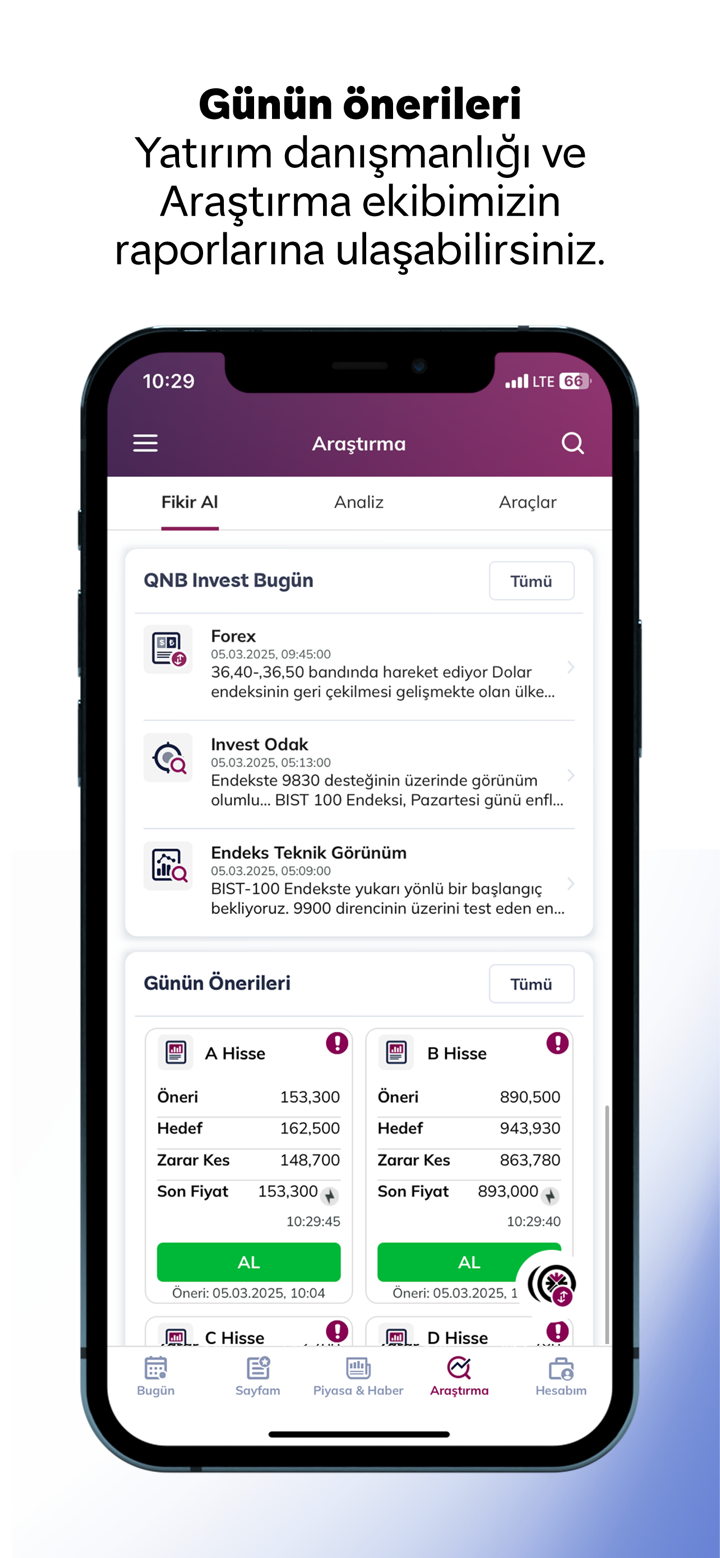

Investment consultancy: Stock trading recommendations, investment advisor, model protofolio and share support resistance.

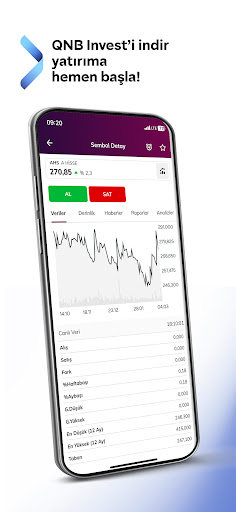

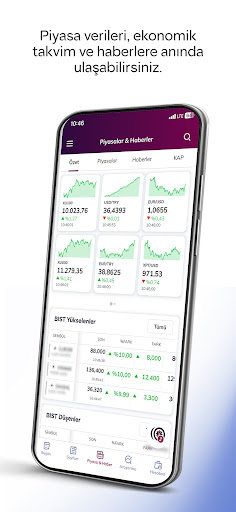

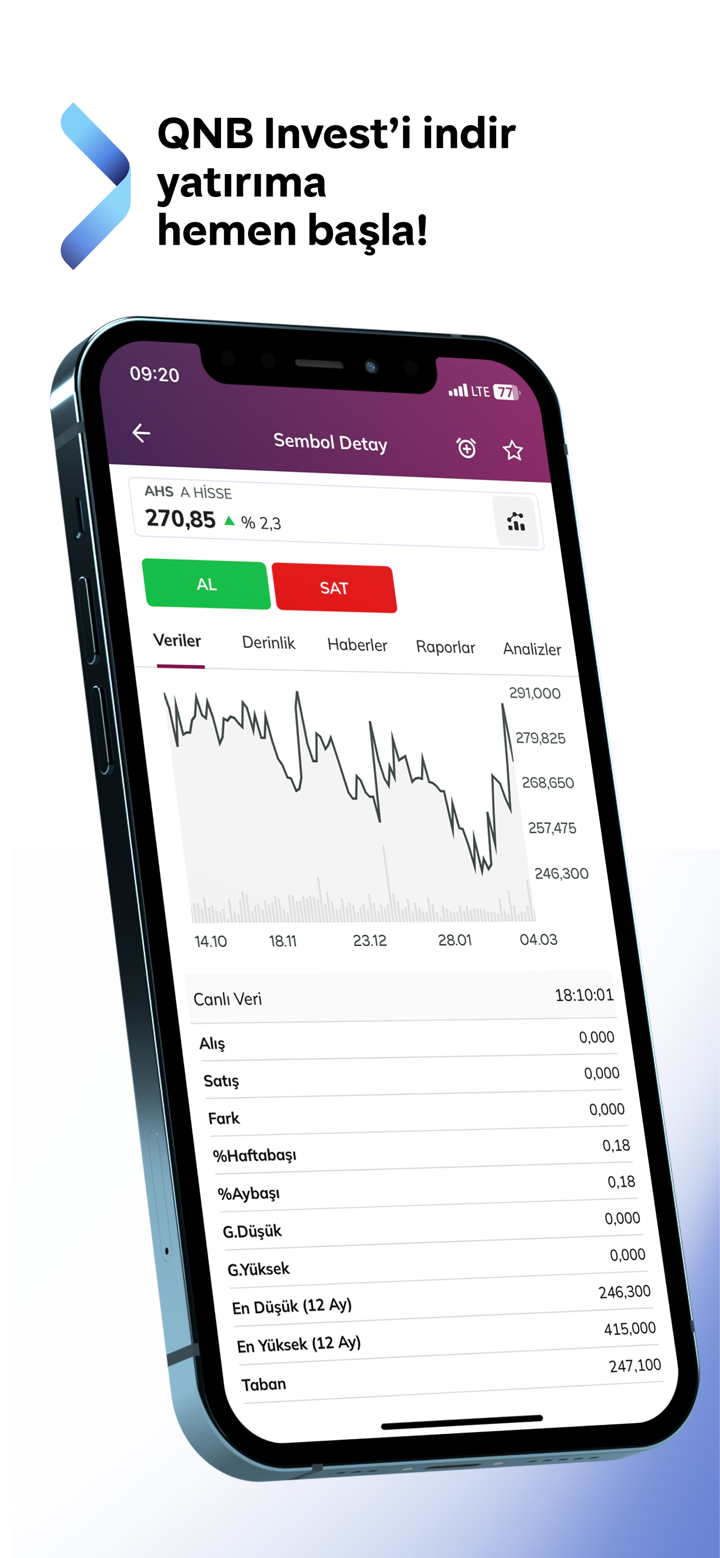

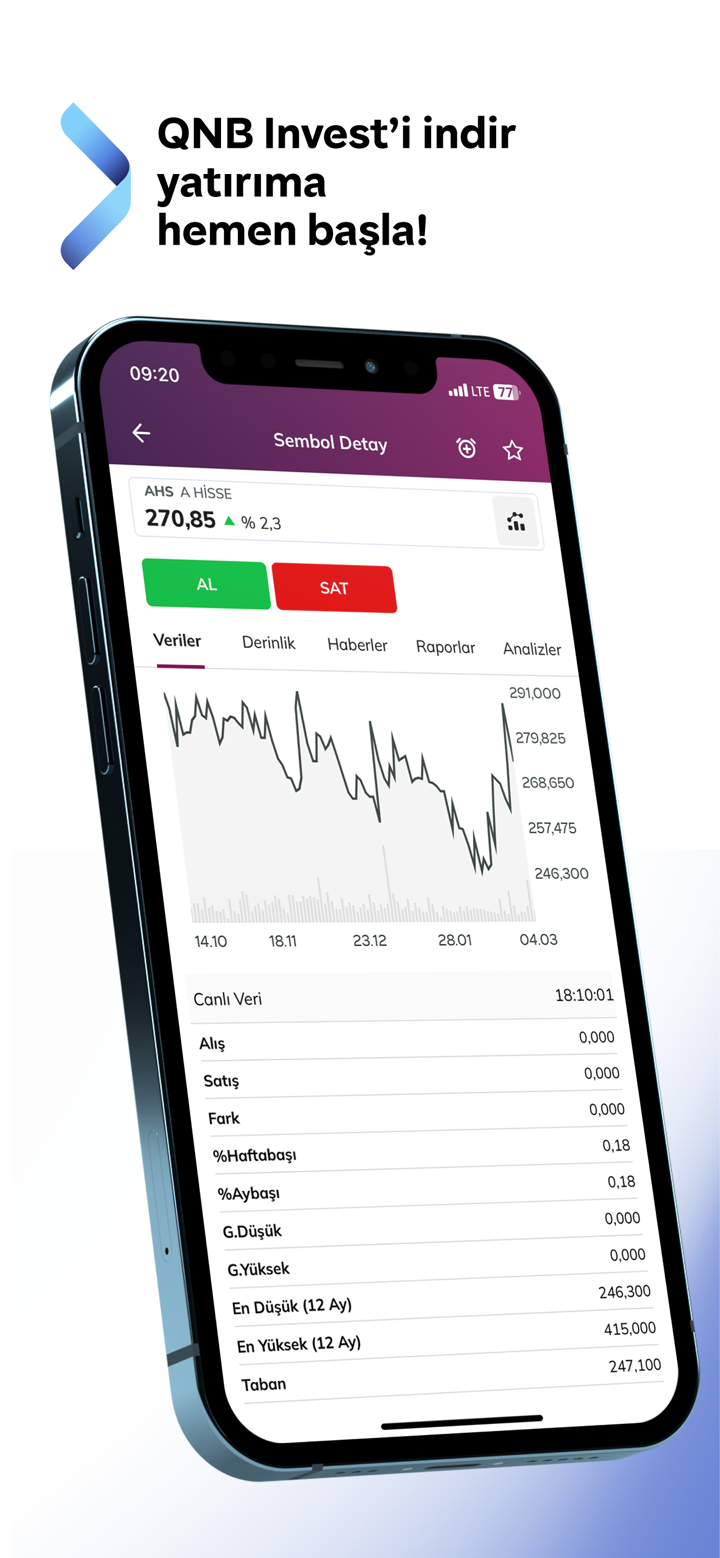

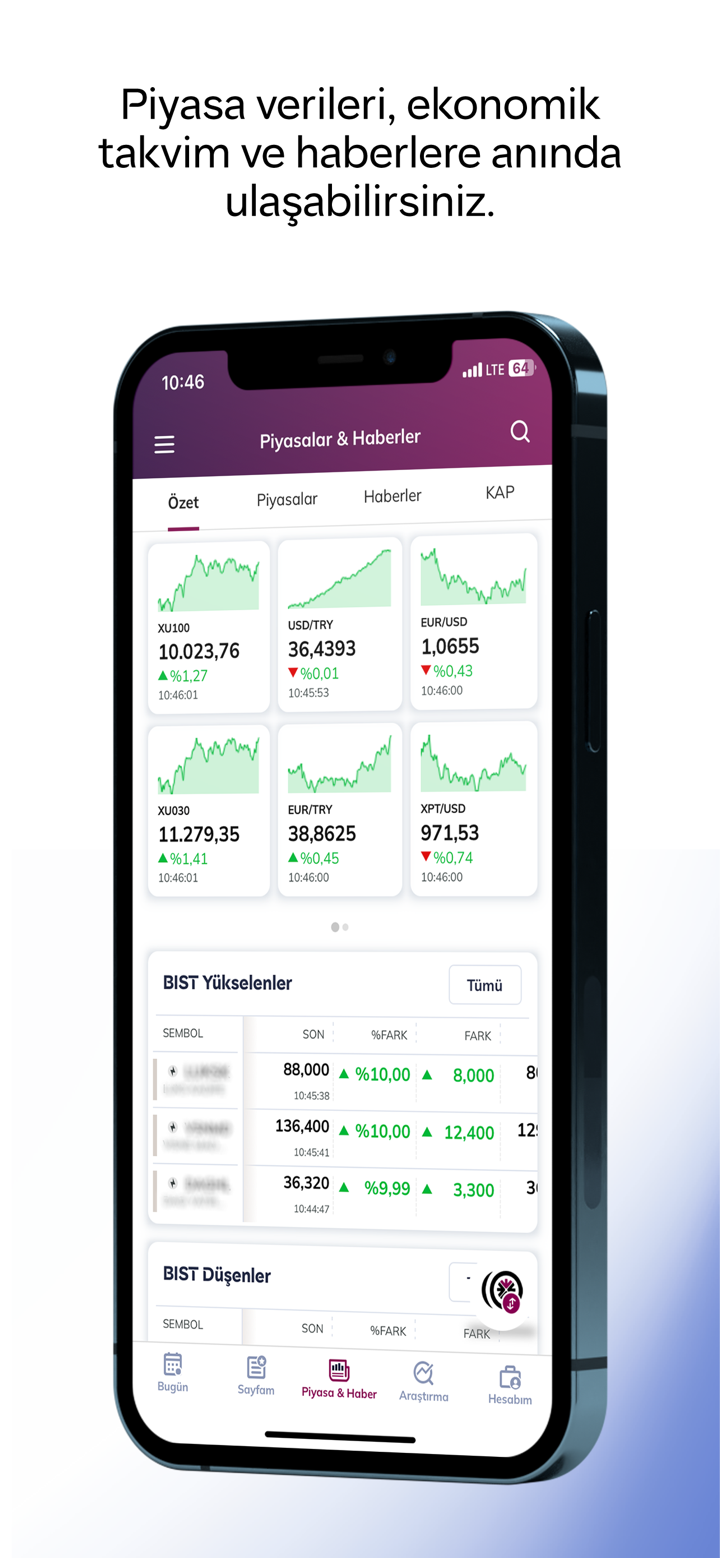

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| QNB Invest | ✔ | Web, Desktop, tablets, Android, iOS | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |