Company Summary

| Excent CapitalReview Summary | |

| Founded | 2021 |

| Registered Country/Region | United Kingdom |

| Regulation | FSA (offshore) |

| Market Instruments | Forex, Indices, ETFs, US Stocks, Commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:150 |

| Spread | 1.1 pips (EUR/USD) |

| Trading Platform | Excent Capital platform |

| Minimum Deposit | / |

| Customer Support | Live Chat |

| Email: support@excent.capital | |

| Phone: +248 437 3651, +44 2038 403 680 | |

| Social Media: LinkedIn, YouTube, Twitter, Instagram, Facebook, Telegram | |

| Regional Restrictions | USA, Iran, Spain, North Korea |

Excent Capital Information

Excent Capital is a trading platform founded in 2021, registered in the United Kingdom. It is offshore regulated by The Seychelles Financial Services Authority. The platform offers access to a diverse range of market instruments, including forex, indices, ETFs, US stocks, and commodities. Excent Capital provides a proprietary trading platform. Traders can benefit from leverage of up to 1:150, with spreads starting at 1.1 pips (for EUR/USD). A demo account is available for practice trading, but details about the minimum deposit requirement are not provided.

Pros & Cons

| Pros | Cons |

| Demo account available | Offshore regulation risks |

| Commission-free | Limited account info |

| Multiple tradable products | Regional restriction |

| Transparent spreads | Limited payment options |

| Live chat support |

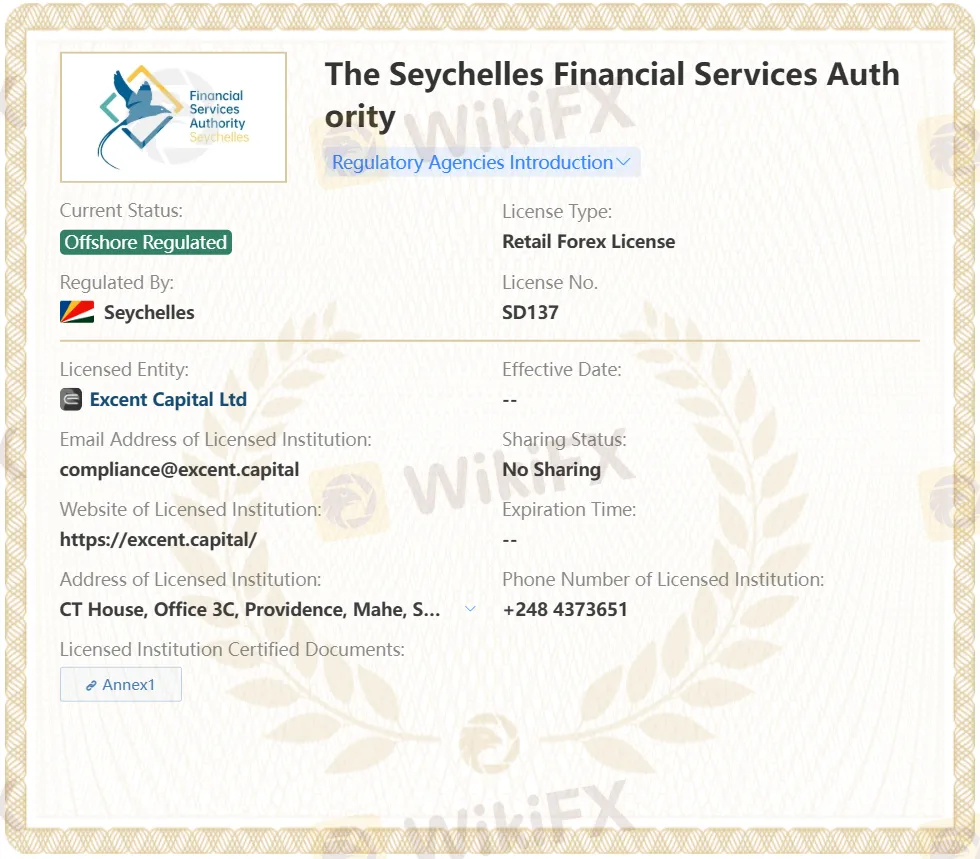

Is Excent Capital Legit?

Excent Capital is Offshore Regulated by the Seychelles Financial Services Authority, holding a retail forex license (SD137). You still need to be cautious, since offshore regulation may pose potential risks.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Seychelles | The Seychelles Financial Services Authority (FSA) | Offshore Regulated | Excent Capital Ltd | Retail Forex License | SD137 |

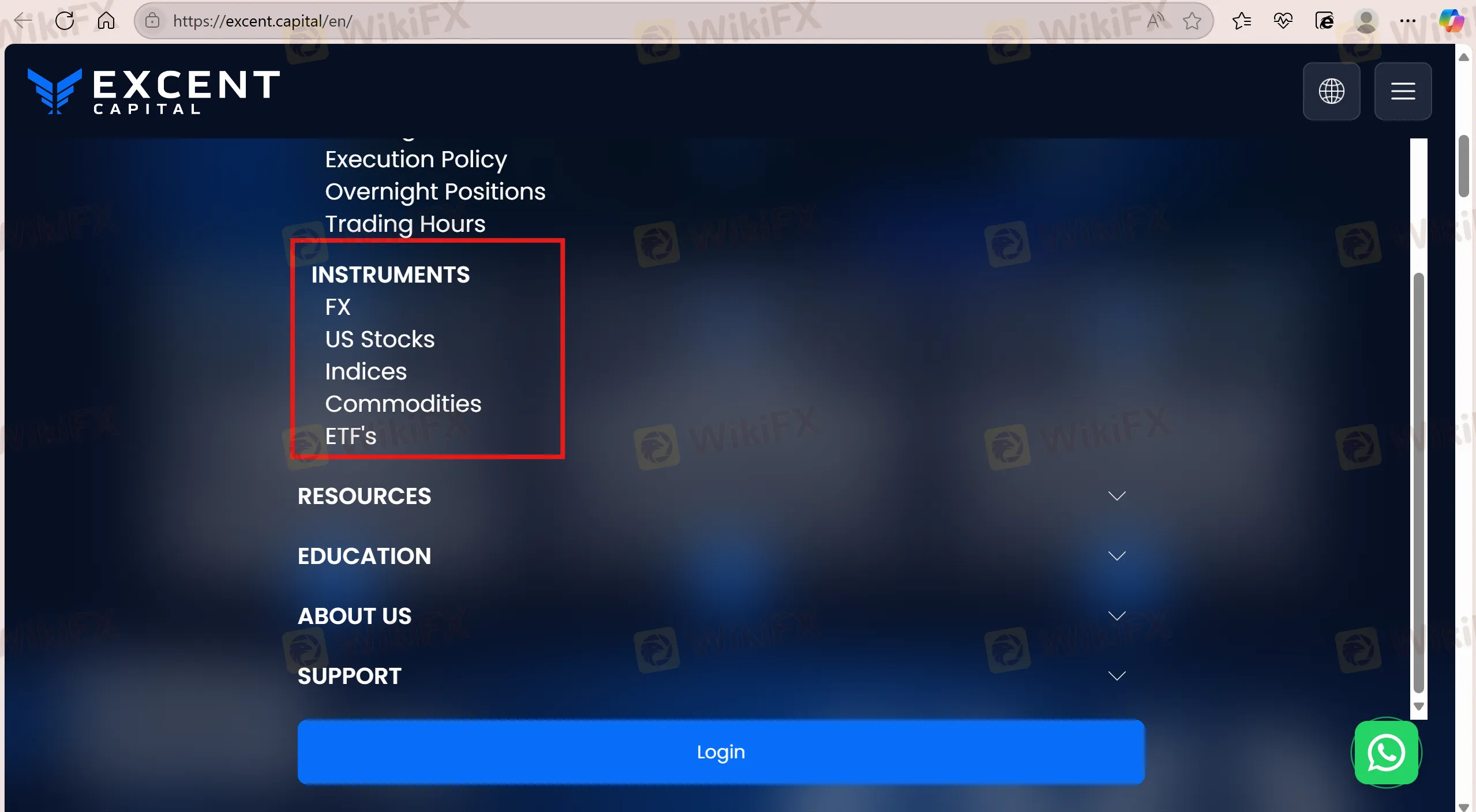

What Can I Trade on Excent Capital?

Traders on Excent Capital get access to market instruments like forex, ETFs, commodities, US stocks, and indices.

| Tradable Instruments | Supported |

| forex | ✔ |

| ETFs | ✔ |

| commodities | ✔ |

| stocks | ✔ |

| indices | ✔ |

| cryptocurrencies | ❌ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

| futures | ❌ |

Account Types

A demo account is available on this platform. However, there is minimal information regarding live accounts.

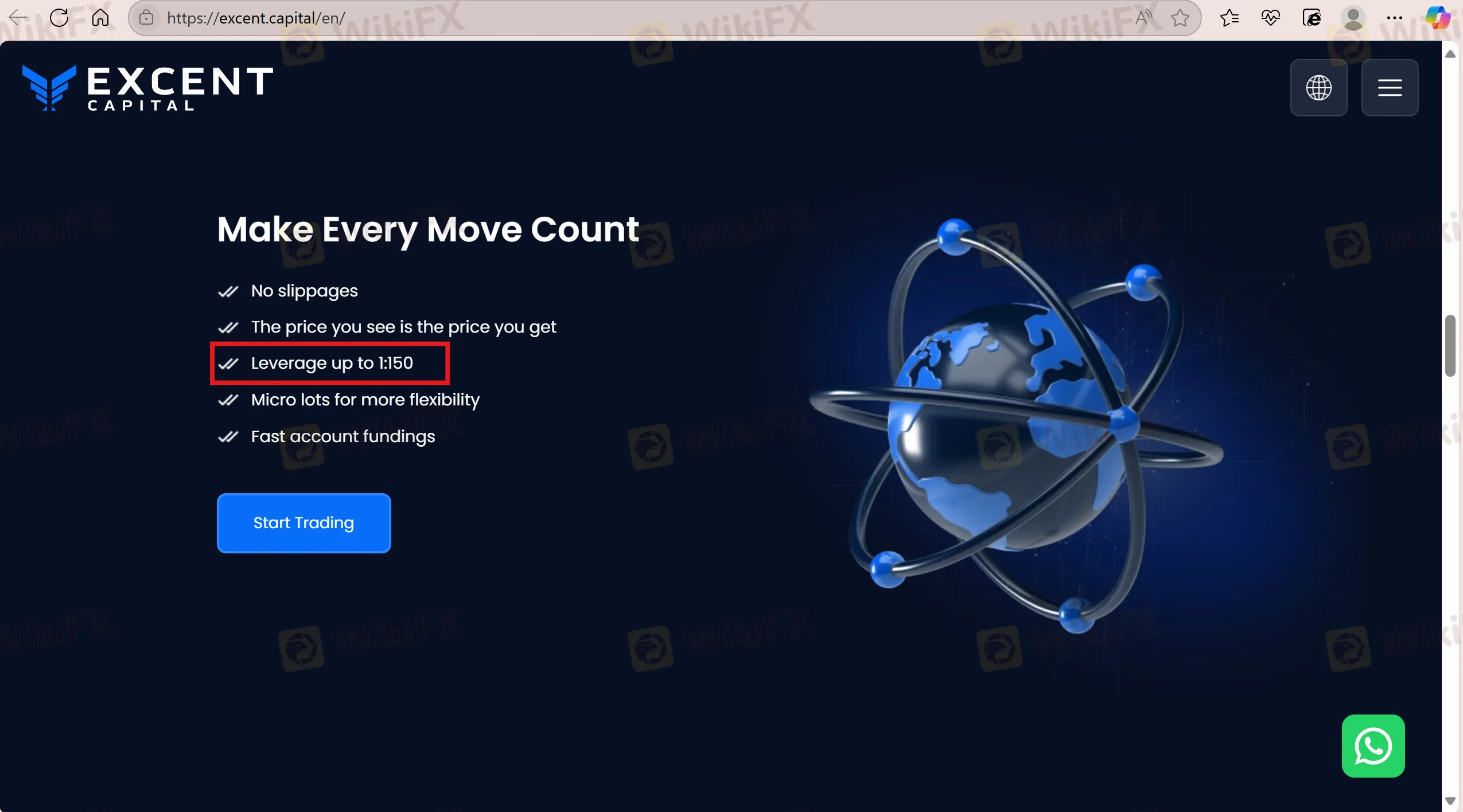

Leverage

Excent Capital offers leverage up to 1:150 on this platform.

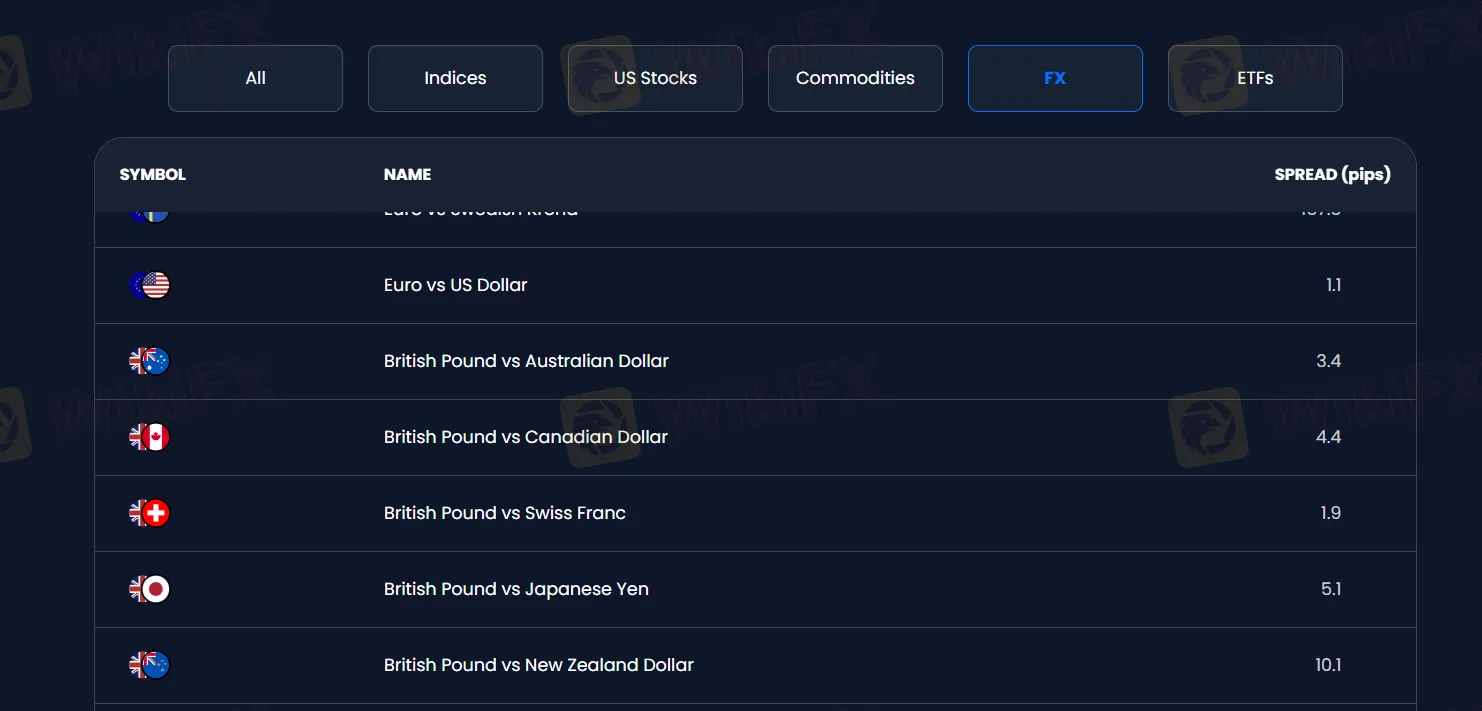

Fees

Excent Capital offers a transparent breakdown of spreads for each asset type and various currency pairs. For instance, in the forex category, the EUR/USD spread is 1.1 pips. In terms of fees, Excent Capital claims to prioritize transparency and fairness, offering a commission-free trading experience.

| Currency Pairs | Spread (pips) |

| Euro vs Japanese Yen | 2.5 |

| Euro vs Norwegian Krone | 23.1 |

| Euro vs New Zealand Dollar | 2.8 |

| Euro vs Polish Zloty | 50.3 |

| Euro vs Swedish Krona | 157.5 |

| Euro vs US Dollar | 1.1 |

| British Pound vs Australian Dollar | 3.4 |

| British Pound vs Canadian Dollar | 4.4 |

| British Pound vs Swiss Franc | 1.9 |

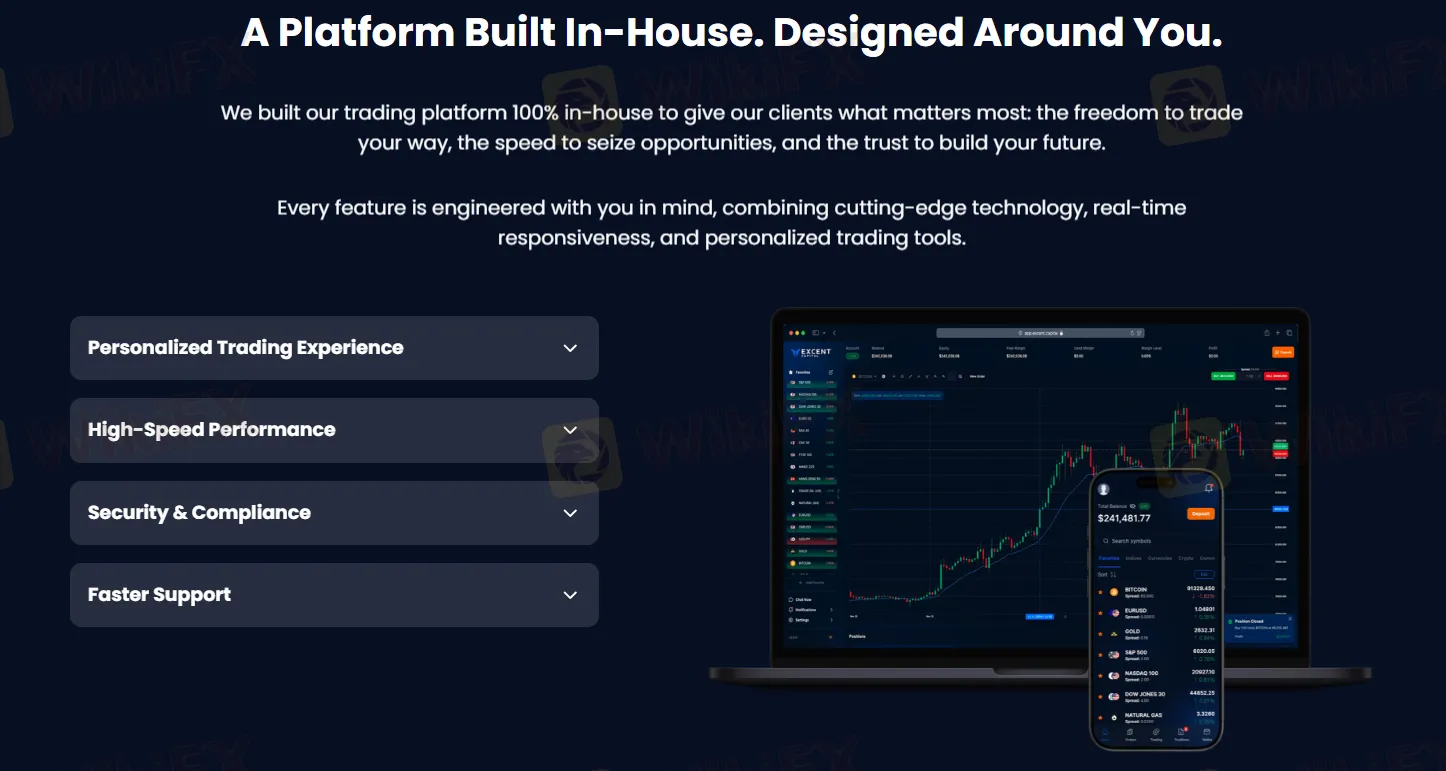

Trading Platform

Excent Capital claims to provide a 100% in-house platform. It is said to have features like Personalized Trading Experience, High-Speed Performance, Security & Compliance, and Faster Support.

| Trading Platform | Supported | Available Devices | Suitable for |

| Excent Capital platform | ✔ | Desktop, Mobile | / |

| MT5 | ❌ | / | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

Traders on Excent Capital get access to two payment options:

Credit/Debit Cards: Use a major credit or debit card for an immediate deposit.

Bank Transfers:

- Equals Money: Directly transfer funds from your local bank to Excent Capitals custodian bank in London, UK.

- Local Payment Partners: Use trusted local payment agents for easier local transactions, especially if international transfers are unfamiliar.

FX3763275781

Mexico

Excent Capital stands out as a dynamic and forward-thinking financial brokerage firm. Their commitment to transparency, innovation, and client success is evident in every interaction. Whether you’re a seasoned investor or just starting, Excent Capital offers a powerful trading platform backed by expert guidance and outstanding customer service. I highly recommend Excent Capital to anyone looking for a reliable, tech-savvy, and client-centric partner in the financial markets.

Positive

FX4105667176

Brazil

They are regulated. The platform is easy to understand, and I’ve had no difficulties depositing or withdrawing my earnings.

Positive

FX1471945941

Singapore

Excent Capital provides a commendable trading experience. The platform is very user-friendly, easy to navigate, and packed with useful tools and features. The inclusion of a financial calendar and news update is certainly a time-saver. Moreover, the variety of products on offer is quite impressive. The customer support team deserves a special mention for their efficiency. They've been instrumental in resolving issues and providing support promptly. I'm quite satisfied with my experience and I'd certainly recommend it!

Positive

Dreams come True

Egypt

Considering Excent Capital's broad range of assets, it's disappointing to find no regulatory backing. While demo accounts and a web platform are positives, the $200 minimum deposit is steep. Traders should be aware of withdrawal fees, highlighting the risks associated with an unregulated broker.

Neutral

LSZ

New Zealand

Excent Capital seems to offer a variety of assets, but it's concerning that they lack regulation. The web platform and demo accounts are available, but the minimum deposit is relatively high at $200. Watch out for withdrawal fees, and be cautious due to the absence of regulation.

Neutral

H2O

Ecuador

I heard that Virgin Islands is also a known place to issue offshore forex licenses... We know that many forex companies will choose to apply for an offshore license to increase leverage, but just an offshore license is not enough.

Neutral

29666

Ecuador

I was surprised to find that this company does not have detailed information on spreads and commissions. In my opinion, not volunteering such important information means that they are not sure enough about their trading conditions.

Neutral