Company Summary

| Capital 19 Review Summary | |

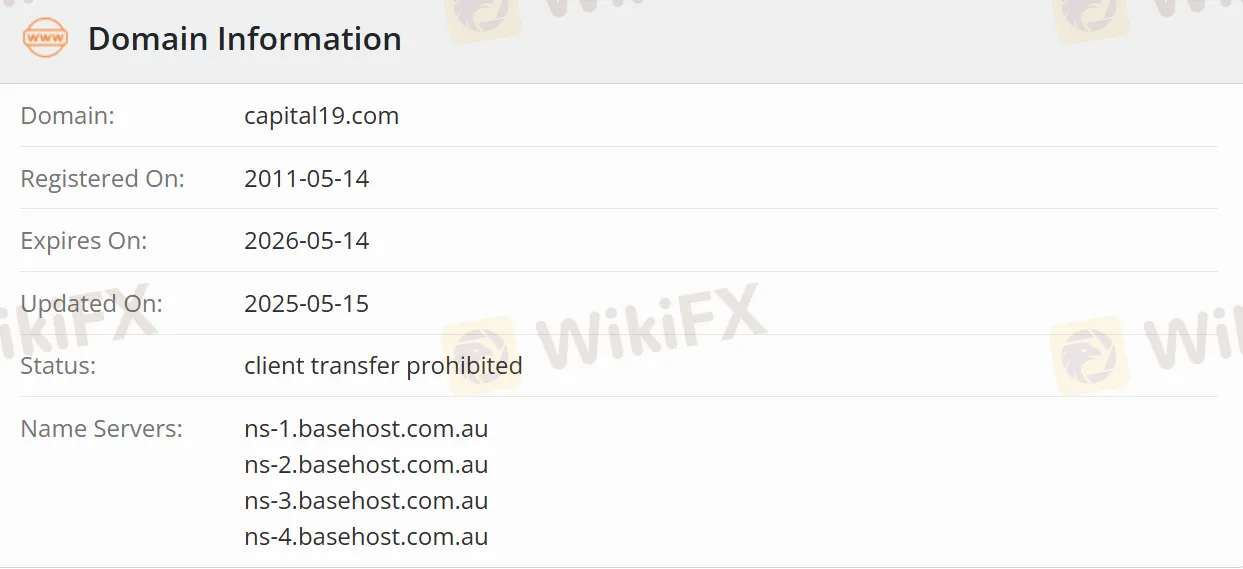

| Founded | 2011-05-14 |

| Registered Country/Region | Australia |

| Regulation | Regulated |

| Market Instruments | Stock and options trading |

| Demo Account | ❌ |

| Trading Platform | Trader Workstation (TWS) (Mobile, Web, and Desktop) |

| Customer Support | +61 2 9002 0360 |

| capital19@capital19.com | |

| Suite 303, 35 Lime Street, Sydney, NSW 2000 | |

Capital 19 Information

Capital 19 is a platform specializing in global stock and options trading, headquartered in Australia. The platform supports trading assets in 19 global markets (such as US stocks and Australian stocks), and provides professional mentor guidance, advanced trading tools, and diversified account types, suitable for both novice and experienced investors.

Pros and Cons

| Pros | Cons |

| Regulated | Higher fees in some markets (e.g., South Korean stock trading commission up to 1%) |

| Free professional guidance | High threshold for interest policies |

| Low-cost transparent fees | Unclear leverage information |

| Diversified investment portfolios |

Is Capital 19 Legit?

ASIC regulates Capital 19 with license number 441891. Its daily STP services are under safe regulatory supervision.

What Services Does Capital 19 Provide?

Capital 19 provides global market trading, covering stock and options trading in 19 markets such as the US and Australian markets, and supports cross-market investment. Traders can choose professional mentor services, which provide expert commentary, investment strategies, and third-party research reports to assist users in decision-making. In addition, four types of strategic portfolios (value-oriented, dividend-oriented, algorithmic, and monthly hotspots) are provided free of charge, and users can directly copy them to their accounts.

Account Type

Capital 19 offers individual accounts suitable for independent trading by personal investors, joint accounts that support multiple people managing investment portfolios together, corporate accounts catering to institutional clients for bulk trading needs, and trust/SMSF accounts that meet the compliance investment requirements of trust funds or self-managed super funds.

Capital 19 Fees

| Category | Trading Instruments/Conditions | Fee Structure |

| Trading Commission | US Stocks | Up to 1,000 shares: USD 20Over 1,000 shares: USD 20 + USD 0.02 per share (excess portion) |

| Australian Stocks | Up to AUD 10,000 trade value: AUD 15Over AUD 10,000: 0.15% of trade value | |

| Hong Kong Stocks | Up to HKD 40,000 trade value: HKD 120Over HKD 40,000: 0.3% of trade value | |

| Foreign Exchange Trading | All FX trades | Fixed fee + 0.09% of trade value (e.g., USD trades: USD 25 + 0.09%) |

| Interest Policy | Positive Cash Balances | USD: 1.33% on amounts > USD 10,000AUD: 1.34% on amounts > AUD 150,000Proportional interest for smaller accounts |

| Margin Loans | USD: 10.33% for loans < USD 100,000Interest rate decreases with higher loan amounts |

Trading Platform

Trader Workstation (TWS) supports mobile, web, and desktop platforms, with an intuitive and easy-to-use interface. It is suitable for both beginners and advanced investors.

| Trading Platform | Supported | Available Devices | Suitable for |

| Trader Workstation(TWS) | ✔ | Mobile, Web, and Desktop | Beginners and advanced investors |

Copy Trading

The platform offers a model portfolio copying function, allowing users to directly replicate the positions of professional teams into their accounts without manual operation. This is suitable for investors who prefer to follow predefined strategies.