Company Summary

Company Summary

Company Profile

Built by Traders. Trusted by Traders. Powered by Integrity.

At OTT Markets, we believe that trading should be transparent, fair, and focused on the trader‘s success, not the broker’s bottom line. That's why we've built a platform designed by traders for traders.

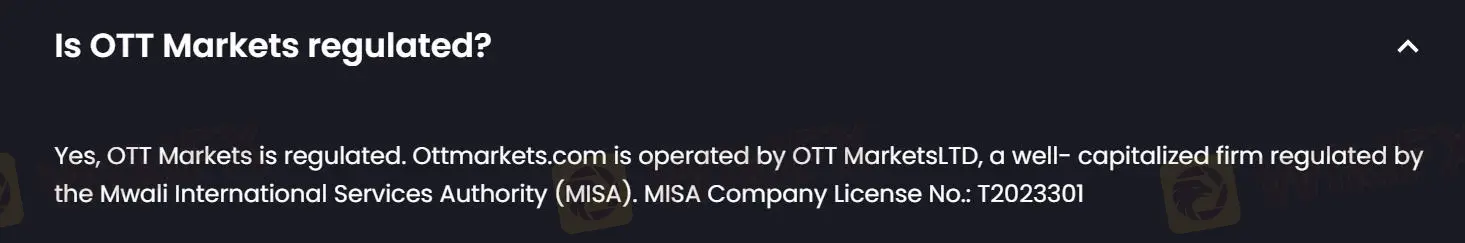

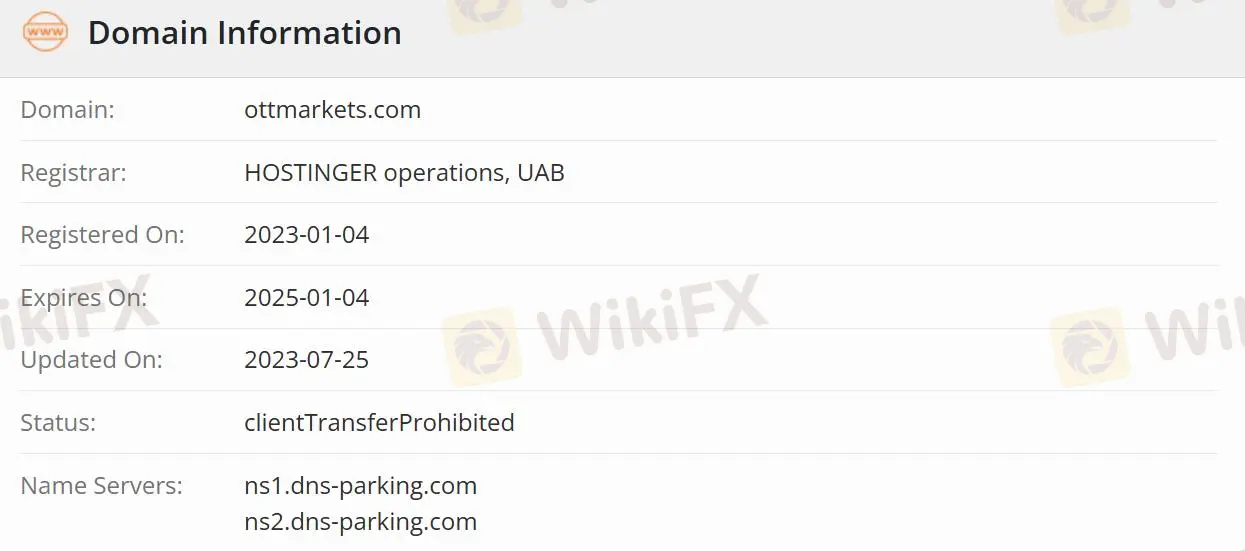

Founded in 2023, OTT Markets started with a clear mission: to offer a truly honest and performance-driven trading environment where retail and institutional traders alike can operate with confidence. We began with a license on the Comoros (Moheli Island) and have steadily expanded our legal and regulatory foundation. As of today, we operate under a Legal Opinion in St. Lucia. By Q1 2026, we will proudly hold our full brokerage license in Mauritius. This will mark a major milestone that will also allow us to introduce additional fiat payment gateways beyond cryptocurrencies.

This strategic development reflects our long-term vision to provide traders worldwide with institutional-grade trading conditions while maintaining full regulatory clarity and operational transparency.

What Sets OTT Markets Apart

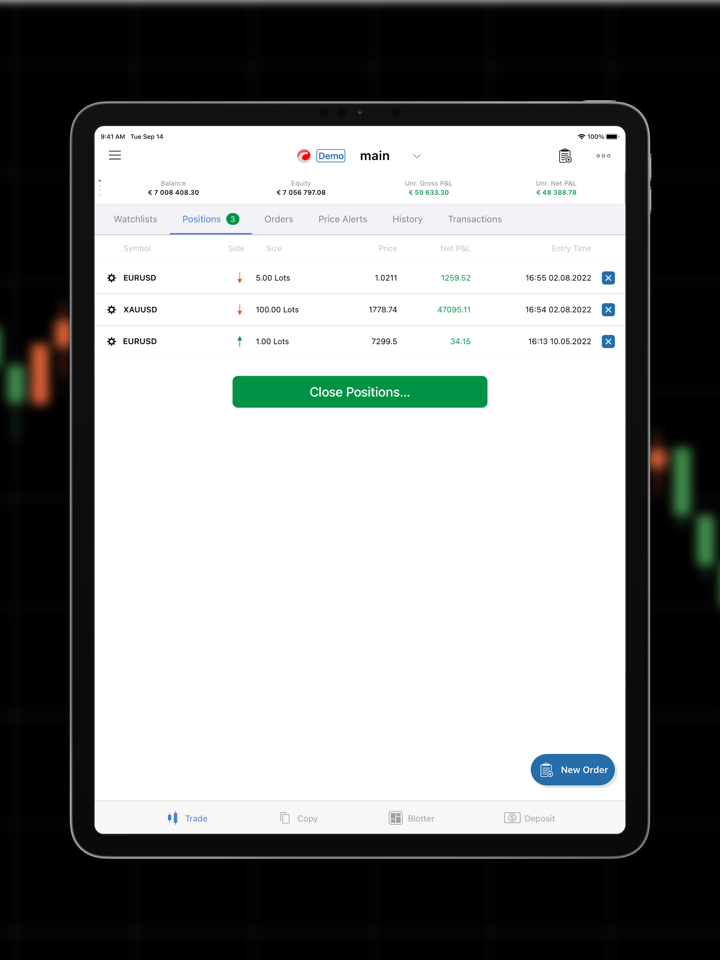

✅ 100% A-Book Execution

We never trade against our clients. All trades are executed directly in the market using the A-Book model. This eliminates any conflict of interest and ensures full alignment with your trading performance.

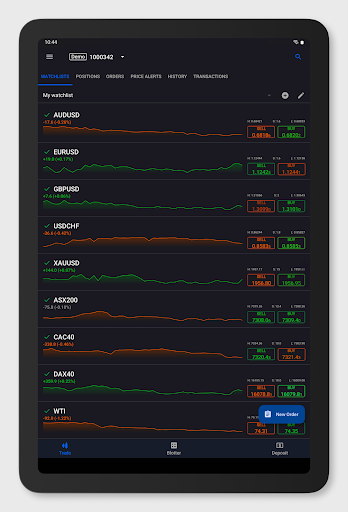

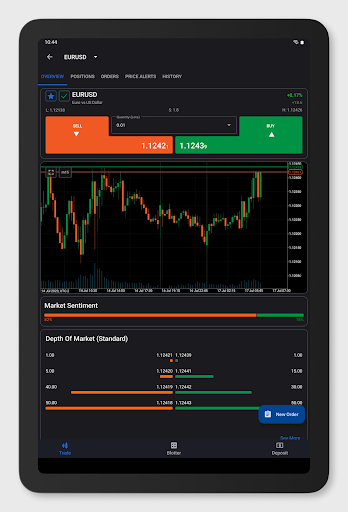

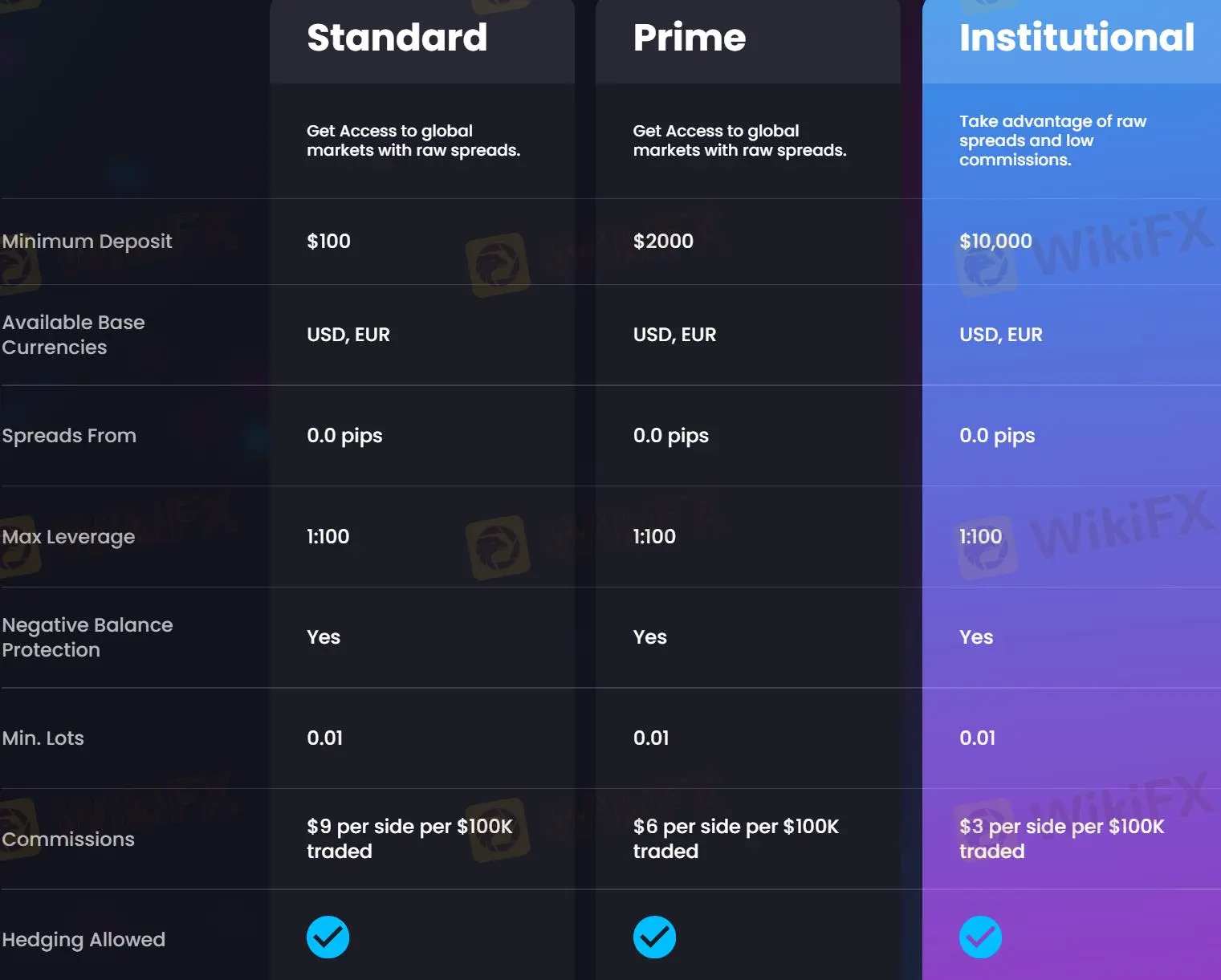

✅ True Raw Spreads and Low Commissions

We offer competitive raw spreads directly from Tier-1 liquidity providers and charge fair, low commissions. This means you keep more of what you earn.

✅ No Price Manipulation and No Gimmicks

Unlike many offshore brokers that operate under B-Book schemes and manipulate prices to increase client losses, OTT Markets delivers pure market pricing and clean execution. That's our promise and your competitive edge.

✅ Fast and Flexible Crypto Funding

All deposits and withdrawals are processed quickly and securely via cryptocurrencies. There are no limits, no delays, and you remain in full control of your capital at all times.

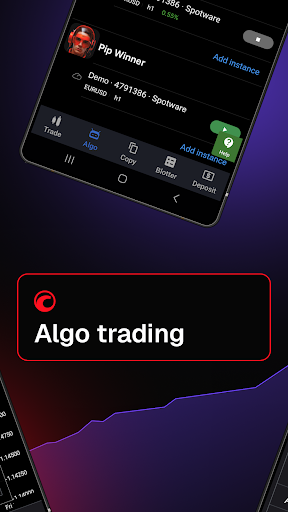

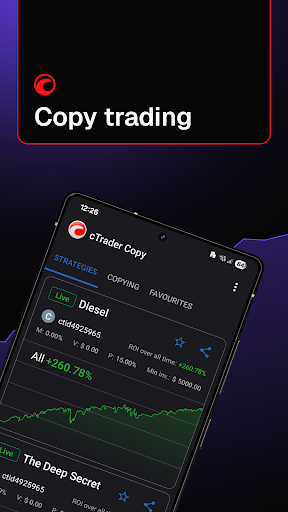

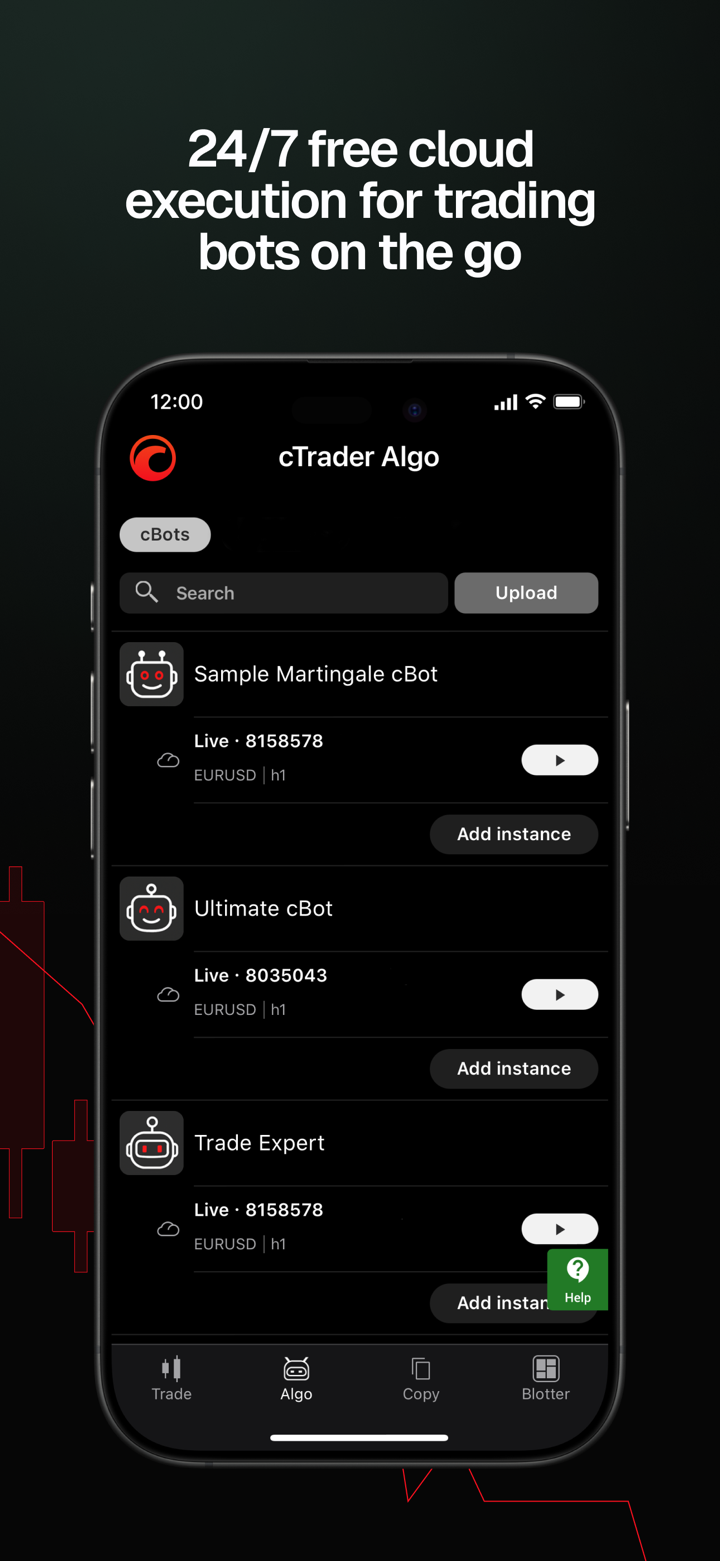

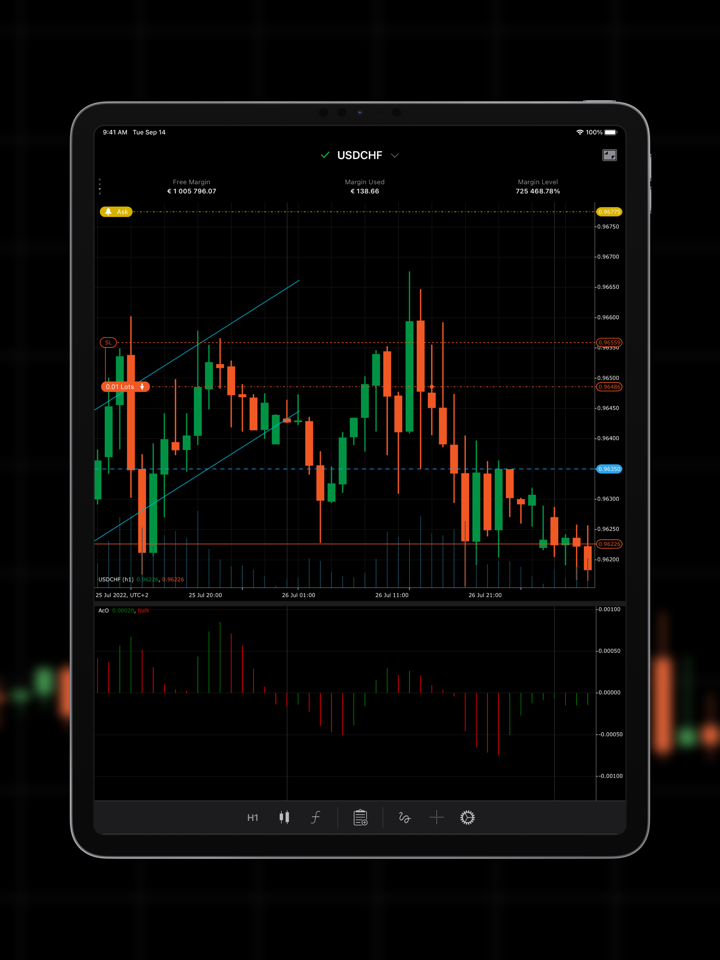

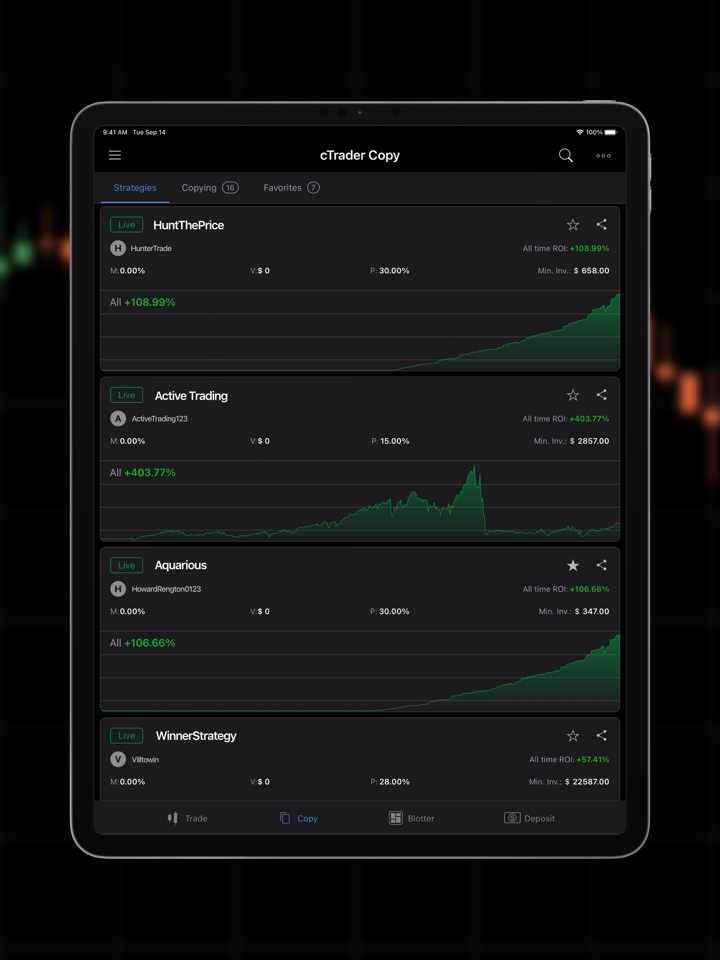

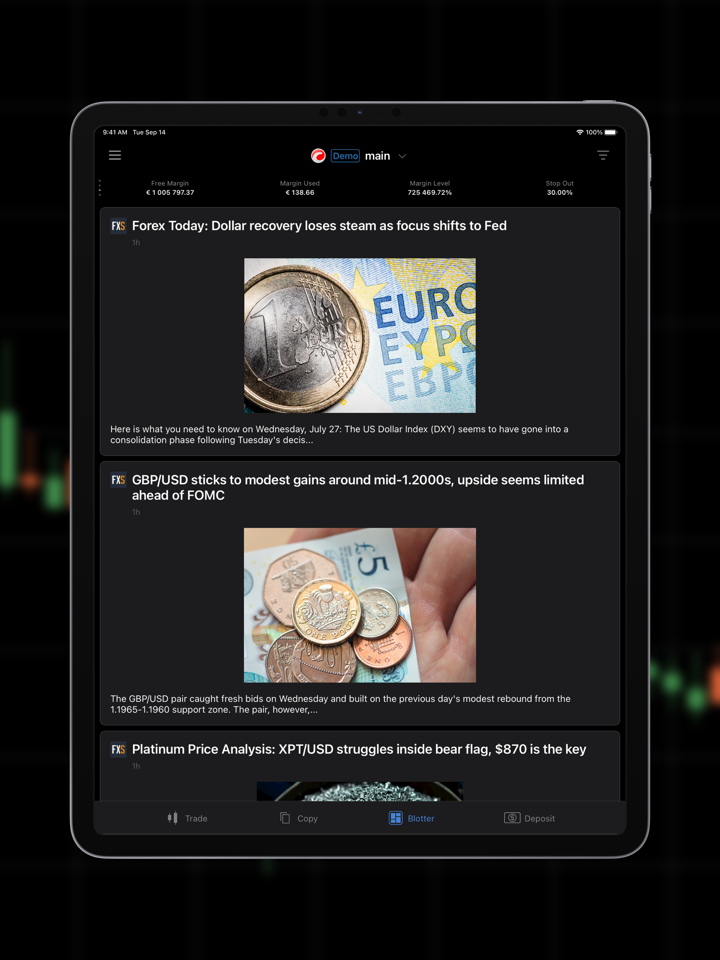

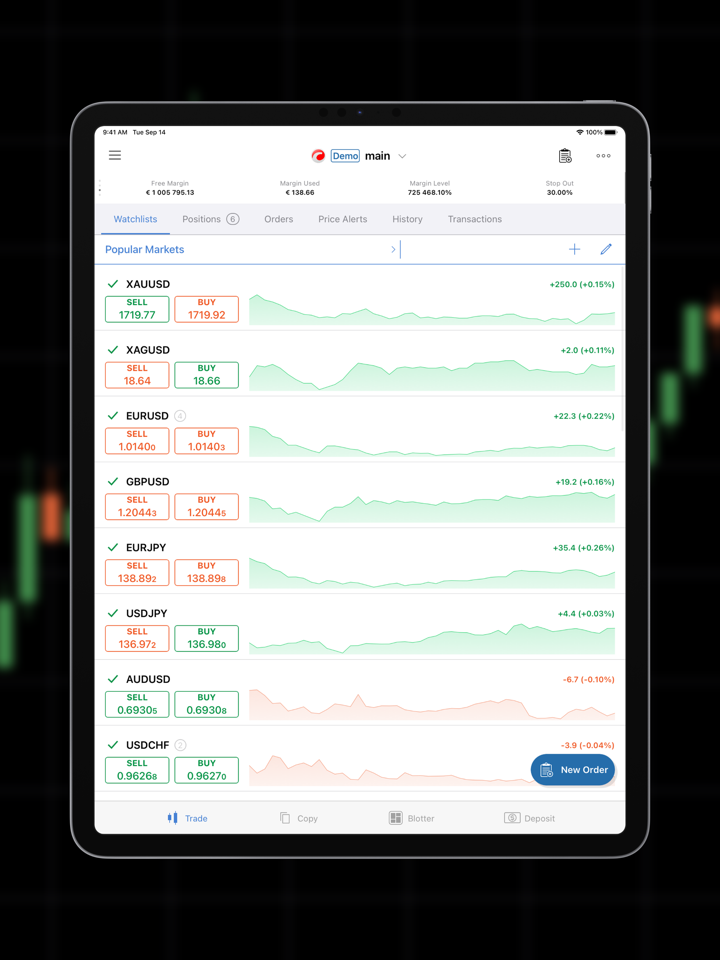

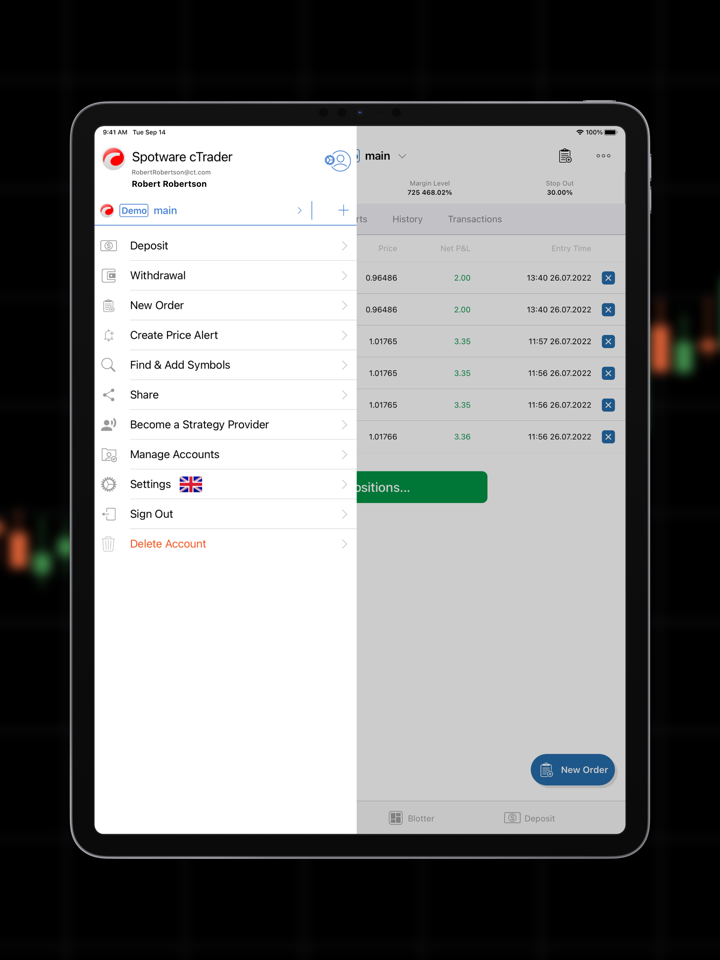

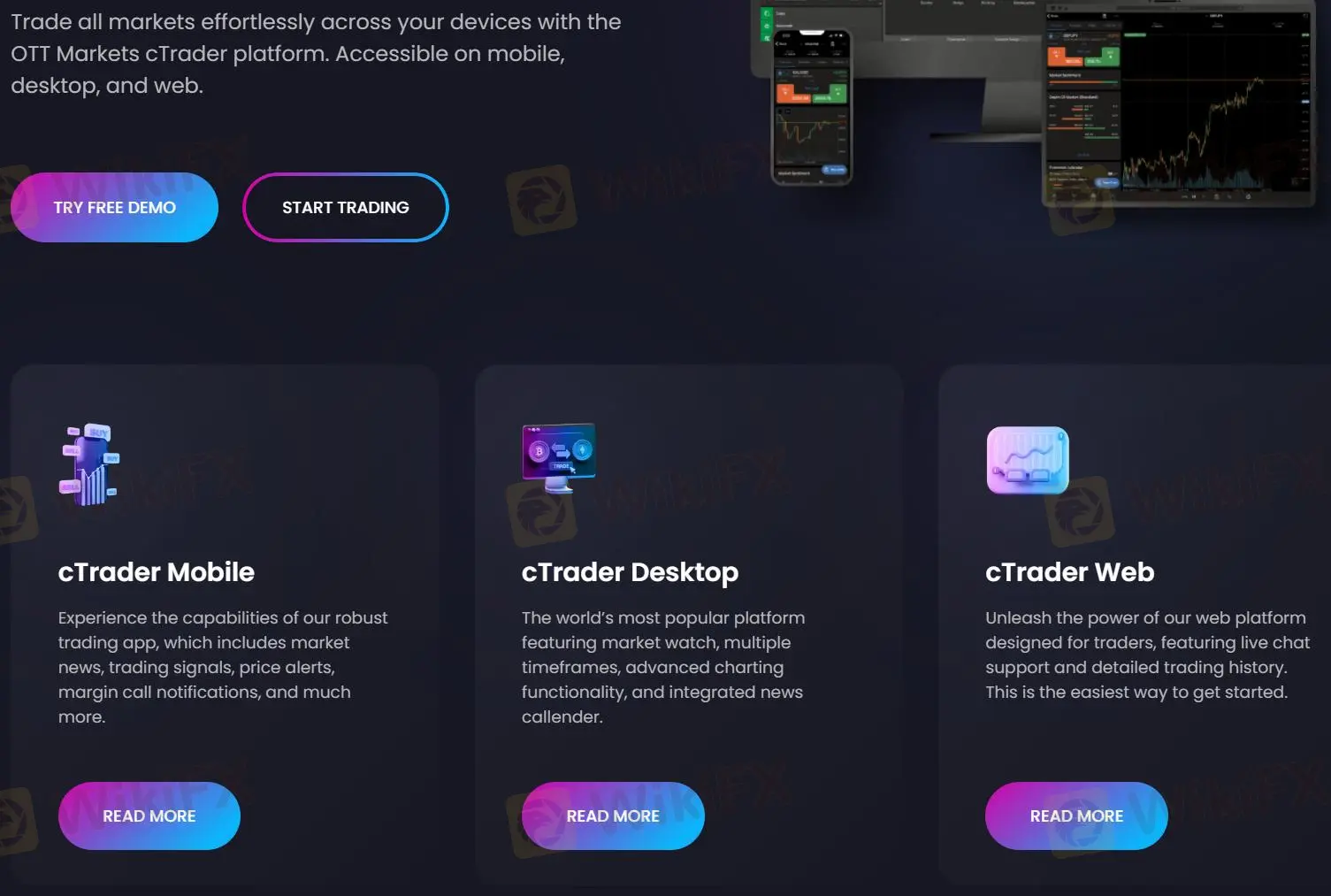

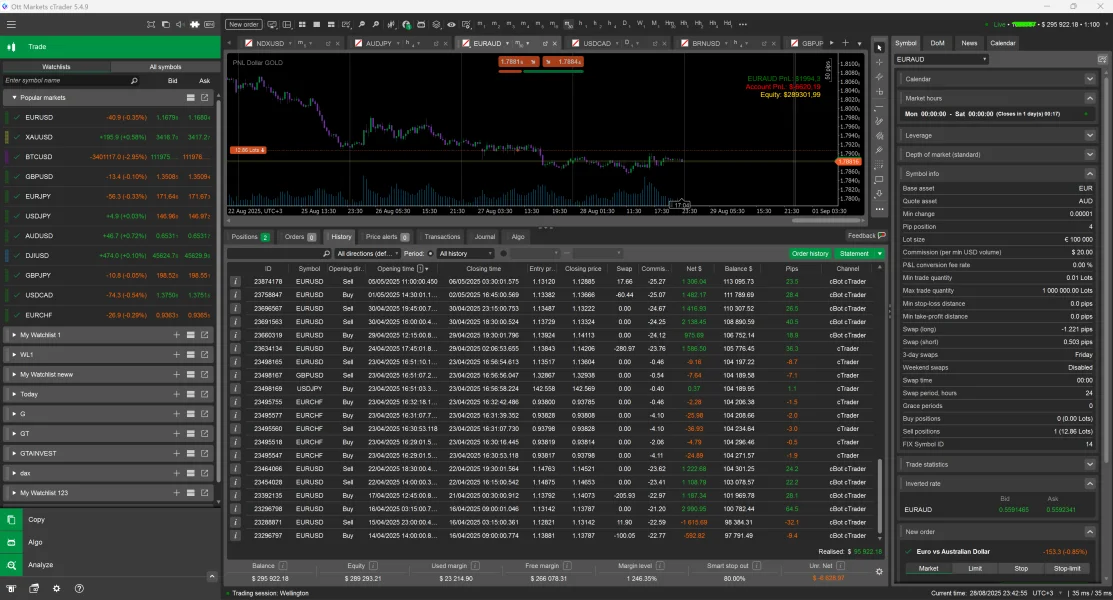

✅ Next-Gen Trading Technology

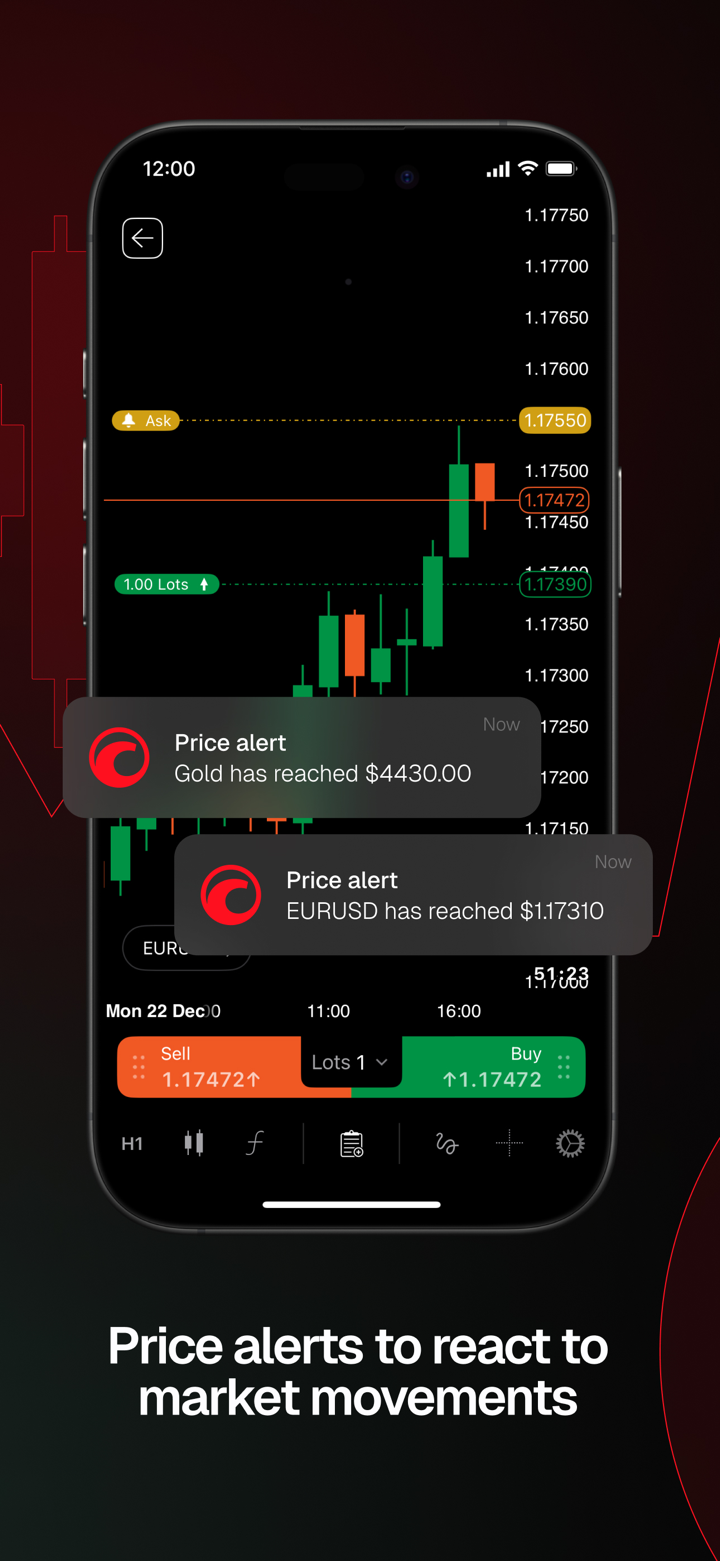

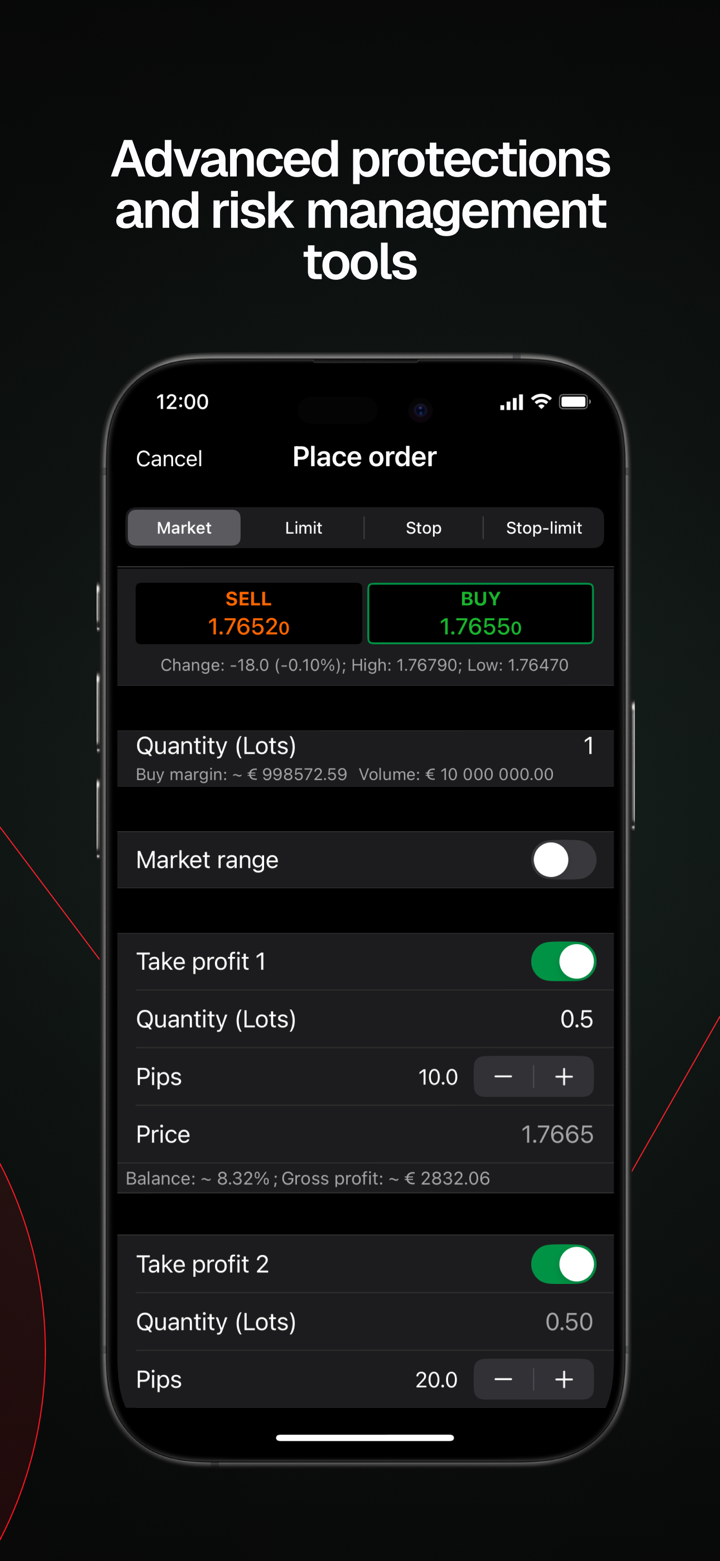

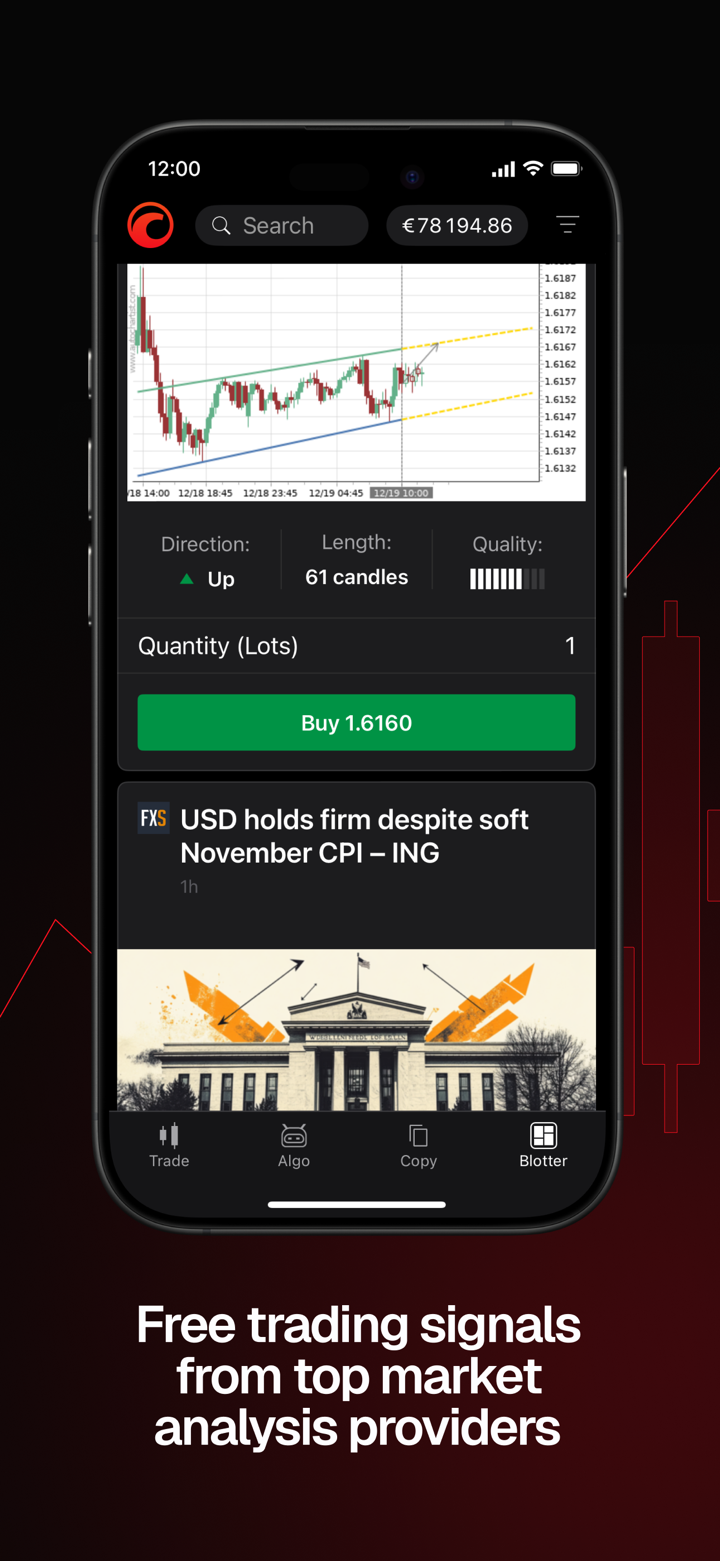

We provide access to the powerful cTrader platform, which is available on Web, macOS, iOS, and Android. It offers advanced order types, depth of market, transparent pricing, and algorithmic trading capabilities in a sleek and modern interface.

✅ Transparent Ownership and Clear Roadmap

We're not hiding behind fake names or offshore shell companies. OTT Markets is building a long-term brand with a clear roadmap. Our focus is on regulated expansion, real operational growth, and a deep commitment to our client base.

Our Vision Is Clear

We aim to build the most trusted, transparent, and trader-focused brokerage in the industry. Our approach combines institutional standards, personal support, and complete commitment to fair and honest trading.

Whether you're a beginner exploring algorithmic strategies or a professional deploying capital at scale, OTT Markets empowers you to unlock your full trading potential.

We don't just offer a platform.

We offer a partnership that is grounded in trust, powered by technology, and built for long-term success.

Join OTT Markets today and experience a brokerage that works with you, not against you.

Trade smarter. Trade fair. Trade OTT.

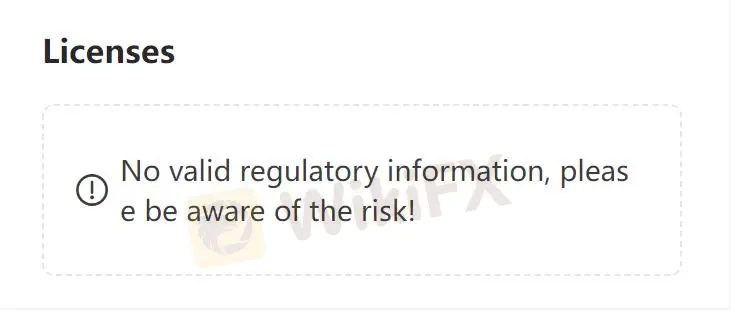

Licensing Timeline and Compliance Transparency

✔️ 2023: Licensed via Comoros (Moheli Island)

✔️ 2024: Operating with Legal Opinion in St. Lucia

🔜 Q1 2026: Full Mauritius License planned, enabling fiat payments and full global compliance