Company Summary

| CurrencyFair Review Summary | |

| Founded | 2008 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Service | Money transfer |

| Platform | Mobile APP |

| Customer Support | Contact form |

| Ireland: Colm House, 91 Pembroke Road, Ballsbridge, Dublin 4; +353 (0) 1 526 8411 (9am - 5pm Dublin/London time Monday - Friday) | |

| UK: No. 1 Poultry, London ECR2 8EJ; +44 (0) 203 3089353 (9 AM-5 PM Monday-Friday) | |

| Singapore: 15 Beach Road, 2nd Floor, Singapore 189677; +65 (0) 3165 0282 (5 PM - 1 AM Monday–Saturday) | |

| Hong Kong: Office 12100, 12/F, YF Tower, 33 Lockhart Road, Wan Chai, Hong Kong; +852 5803 2611 (5pm - 1am Monday - Saturday) | |

| Australia: Suite 26-109, 161 Castlereagh Street Sydney, NSW, 2000; +61 (0) 282 798 642 (8 PM - 4 AM Monday-Saturday) | |

CurrencyFair was registered in 2008 in Australia. On its platform, customers can send money overseas. Besides, this company has a long operation time and it is regulated in Australia.

Pros and Cons

| Pros | Cons |

| Long operation time | No live chat support |

| Regulated well | |

| Transparent fee structure |

Is CurrencyFair Legit?

Yes, CurrencyFair is regulated by Australia Securities and Investment Commission (ASIC).

| Regulated Country | Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| Australia Securities and Investment Commission (ASIC) | Regulated | Australia | Market Making (MM) | 402709 |

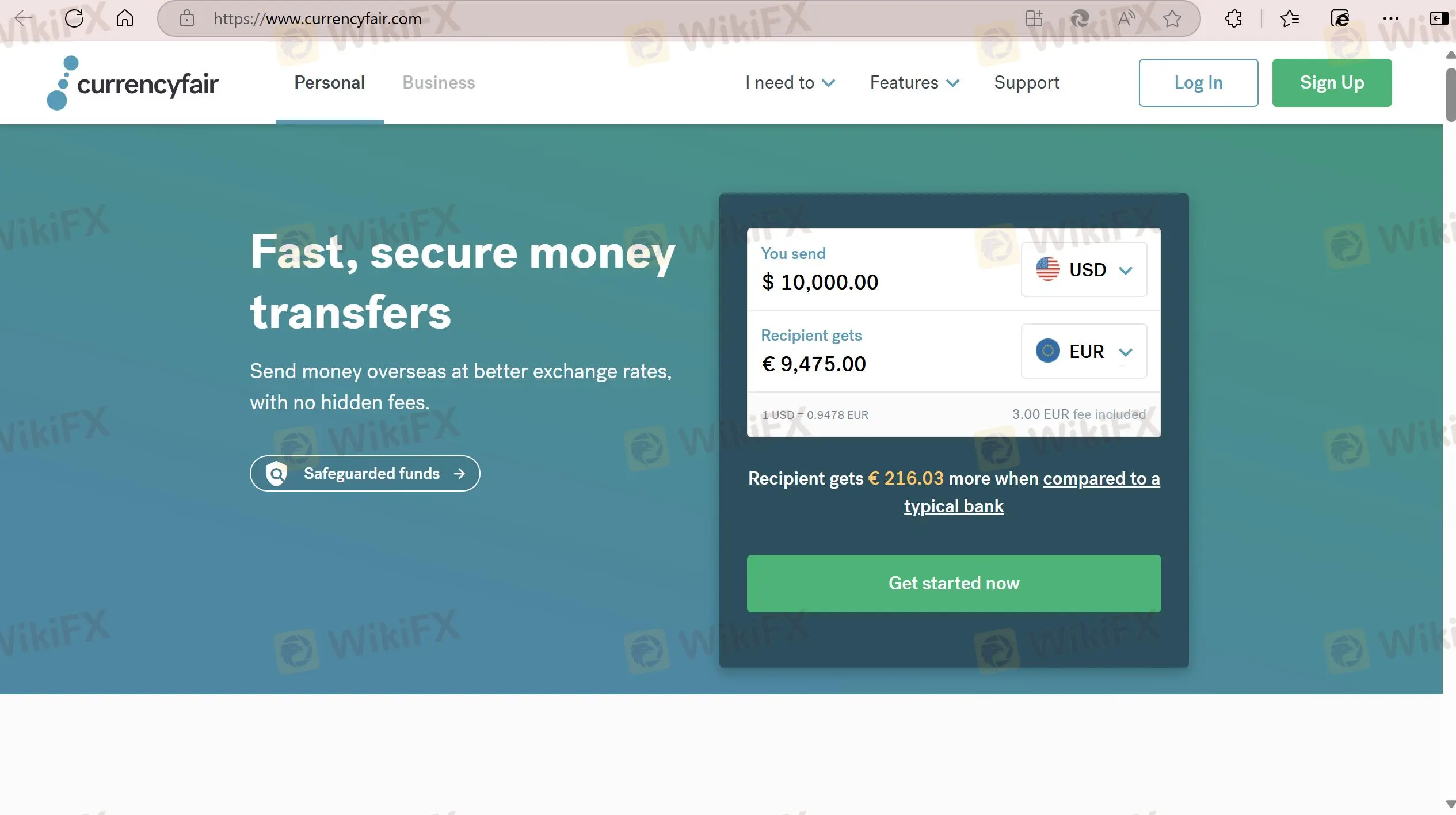

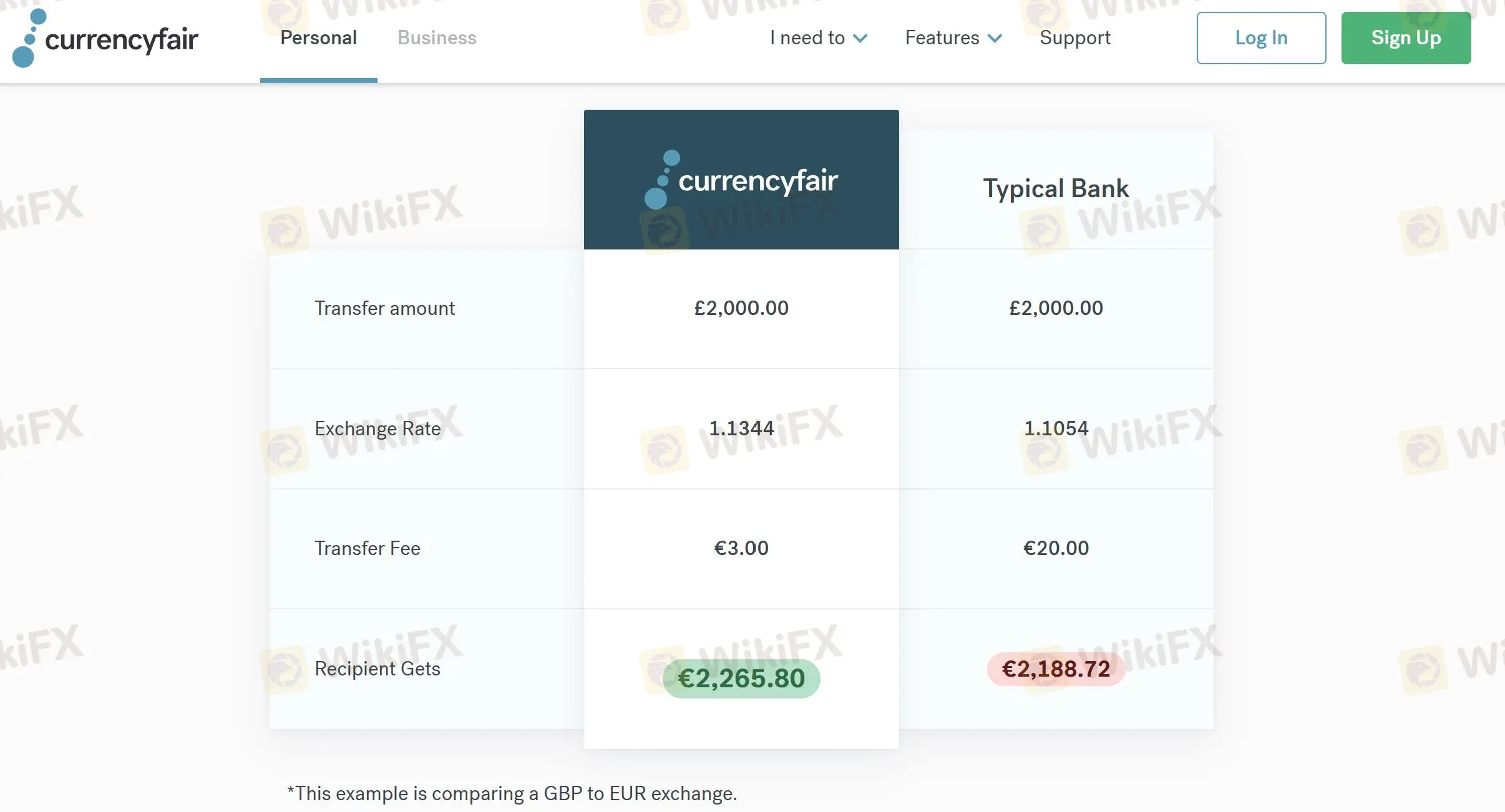

CurrencyFair Fees

| Transfer Amount | Exchange Rate | Transfer Fee | Recipient Gets |

| 2,000.00 GBP | 1.1344 | 3.00 EUR | 2,265.80 EUR |

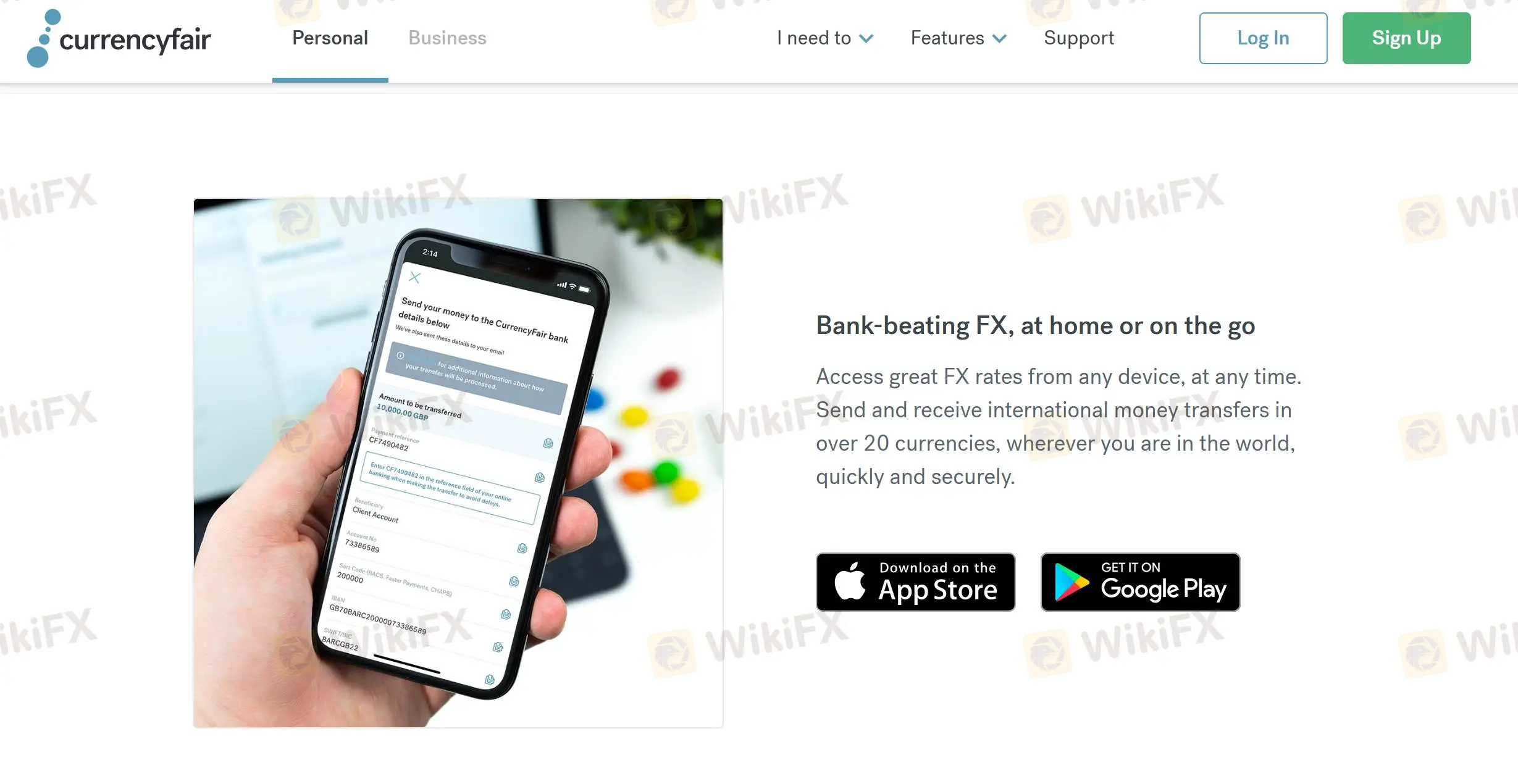

Platform

| Platform | Supported | Available Devices |

| Mobile APP | ✔ | iOS, Android |

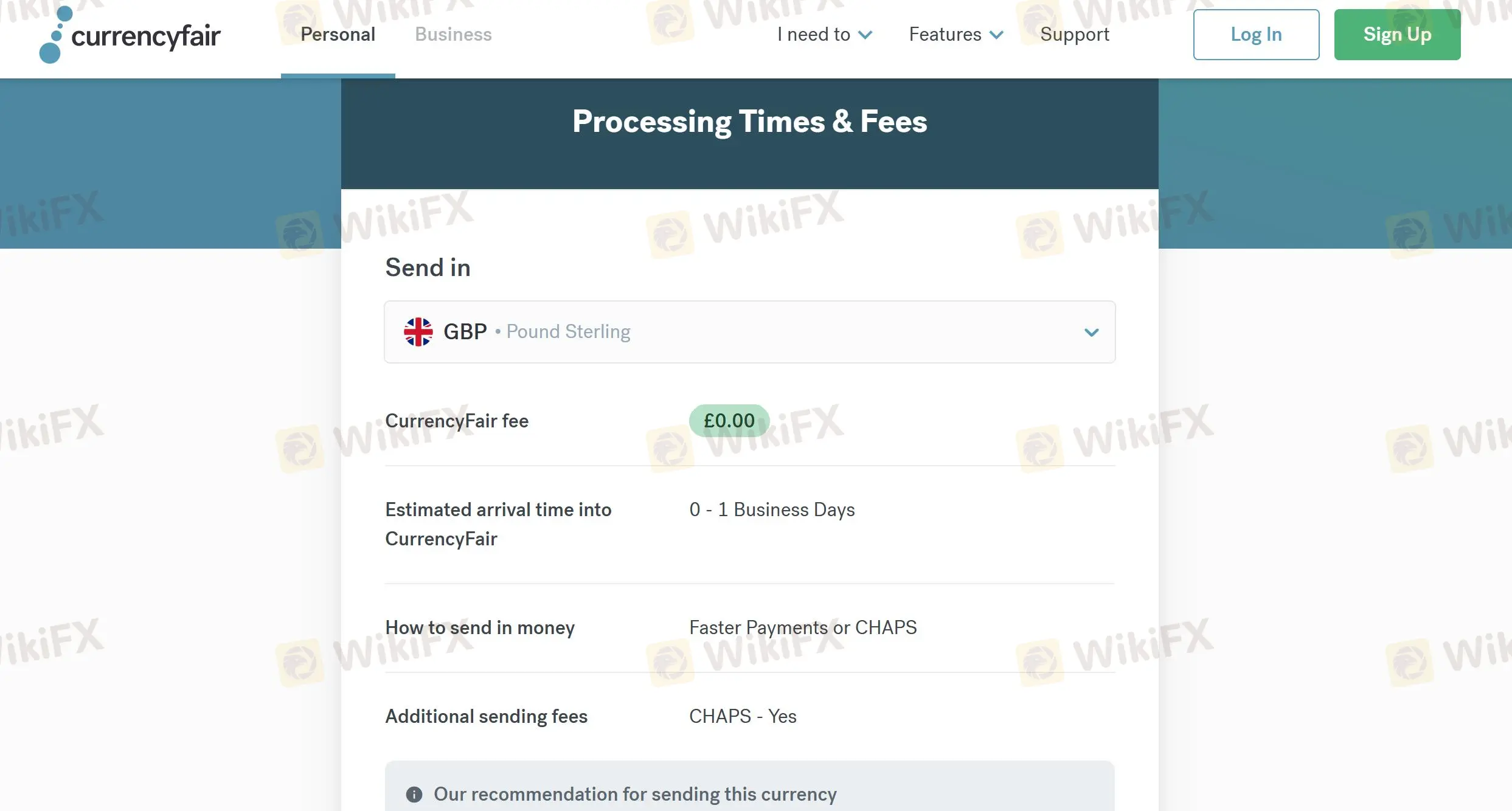

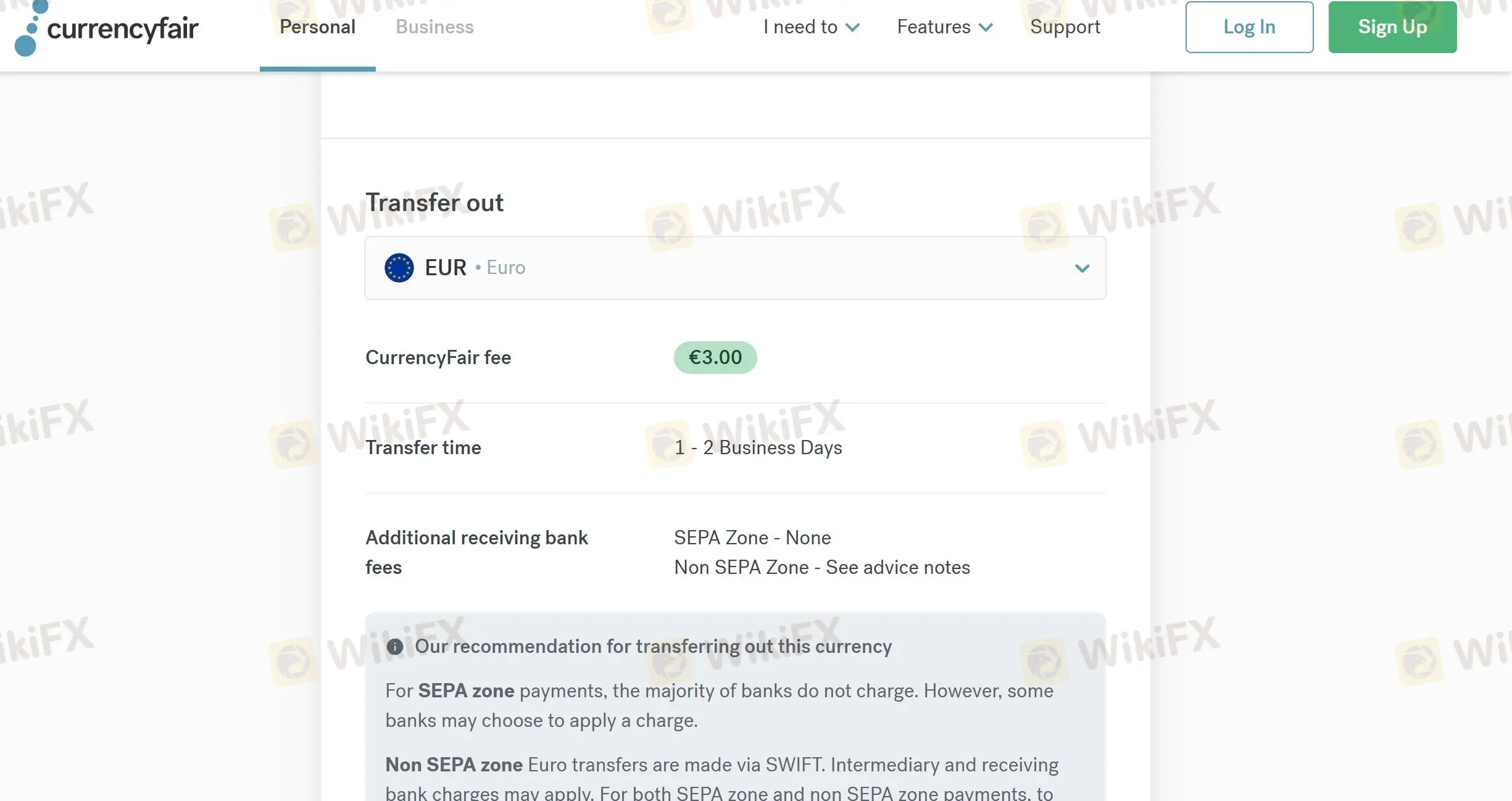

Processing Time and Fees

| Send in | Fees | Options | Time |

| GBP | ❌ | Faster payments or CHAPS | 0-1 business days |

| EUR | ❌ | SEPA Credit Transfer | 1-2 business days |

| USD | ❌ | Bank transfer | 1-2 business days |

| Transfer out | Fees | Time |

| EUR | 3 EUR | 1-2 business days |

| GBP | 2.5 GBP | 0-1 business days |

| USD | 4 USD | 1 business day |

FX1240839140

New Zealand

While sending money overseas, the fees at the banks are really high! Fortunately I have currencyfair, which enables me to make transfers fastly and save money. I know the security will be the concern of many, but currencyfair is safe!

Positive

程安 -陶

Argentina

So far, I think currencyfair is a great company, which makes my job a lot easier, because I often need to make cross-border transfers!

Positive

ONE I LOVE

Hong Kong

Their customer support is excellent, and this platform is easy to use. I've been using this services for more than one years, and I haven’t encountered any problems or issues. I recommend this company if you have any need of this kind of services.

Neutral

你好99363

Hong Kong

CurrencyFair does offer competitive rates better than banks. I remembered once I used this company to send my money from America to Australia, but something terrible happened, and it turned out it was CurrencyFair's intermediary bank made a mistake. Although this company claims that most of its international transfers are completed within 24 hours, while it depends on your luck, you see ?

Neutral