Company Summary

| Standard BankReview Summary | |

| Founded | 1998 |

| Registered Country/Region | South Africa |

| Regulation | No Regulation |

| Market Instruments | CFDs, ETFs, Indices, Forex, Shares, and Metals |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Standard Bank Webtrader |

| Minimum Deposit | / |

| Customer Support | Email: securities@standardbank.co.za |

| Tel: 0860 121 555 (South Affrica) | |

| Tel: +27 11 415 6555 (International) | |

| Social Media: Facebook, YouTube, LinkedIn, Twitter, Blogger | |

Standard Bank Information

Standard Bank was established in 1998 and was registered in South Africa. It offers over 20,275 tradable instruments, including CFDs, ETFs, indices, forex, stocks, and metals, and supports trading through the Standard Bank Webtrader platform. Although it offers a variety of financial products and services without charging transaction fees, the company is unregulated and lacks detailed information about account features. Investors should exercise caution regarding its legitimacy and transparency. Additionally, deposits incur a US$0.05 fee, and settlements typically take two business days to complete.

Pros & Cons

| Pros | Cons |

| A variety of financial products | No regulation |

| Long operation history | Limited info on trading details |

| Various contact channels | Deposit fees charged |

Is Standard Bank Legit?

Standard Bank is not regulated, so traders need to exercise caution when trading.

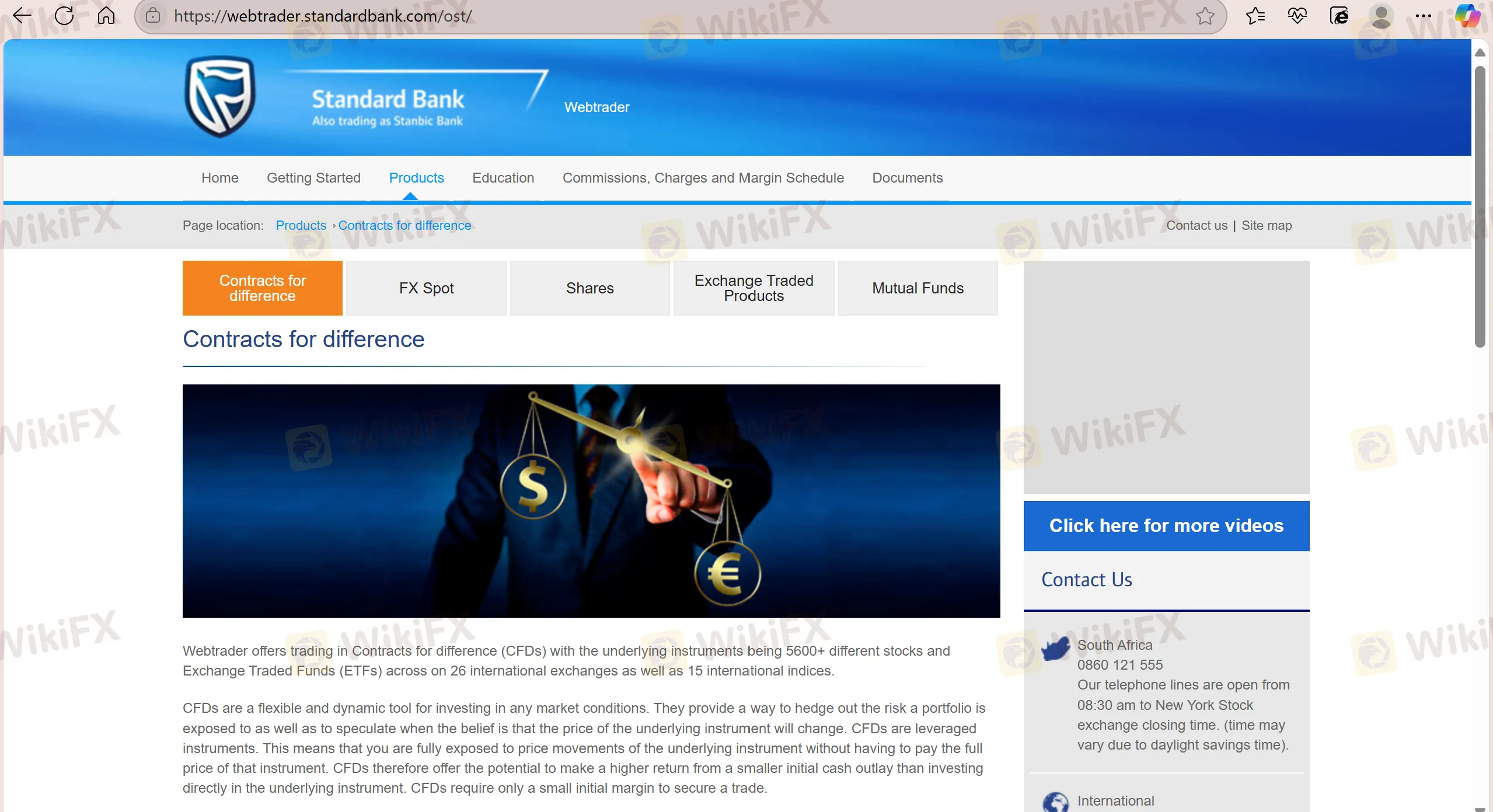

What Can I Trade on Standard Bank?

Standard Bank offers a wide range of over 20,275 trading instruments, including CFDs, ETFs, Indices, Forex, Shares, and Metals.

| Tradable Instruments | Supported |

| CFDs | ✔ |

| ETFs | ✔ |

| Indices | ✔ |

| Forex | ✔ |

| Funds | ✔ |

| Shares | ✔ |

| Metals | ✔ |

| Bonds | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

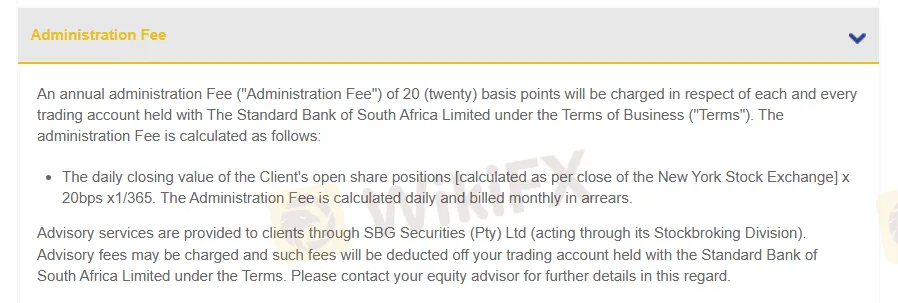

Fees

Administration Fee: 20 basis points will be charged.

Trading Platform

Standard Bank supports trading on the Standard Bank Webtrader platform. The platform does not charge transaction fees, and settlement is completed within two business days.

| Trading Platform | Supported | Available Devices | Suitable for |

| Standard Bank Webtrader | ✔ | Mobile, Web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

Customers can deposit and withdrawal mainly through bank transfer, and a fee of US$0.05 will be charged for deposits.