Company Summary

| DREAM PULSE Review Summary | |

| Founded | 2009 |

| Registered Country/Region | Comoros |

| Regulation | Not regulated |

| Market Instruments | Forex, Commodities, Stock Index CFDs, Crypto CFDs |

| Demo Account | Not available |

| Leverage | Up to 1: 500 |

| Spread | From 0.0 pips |

| Trading Platform | MT5, WebTrader |

| Min Deposit | $0 |

| Customer Support | info@dpfx.net |

| +63 2 8376 9134 | |

DREAM PULSE Information

Dream Pulse is an offshore broker registered in Comoros, offering trading on forex, commodities, stock indices, and crypto CFDs via MT5 and WebTrader platforms. It provides high leverage up to 1:500 and low trading fees, but lacks valid regulation and transparency regarding swap rates and non-trading fees.

Pros and Cons

| Pros | Cons |

| Access to MT5 platform | Not regulated |

| High leverage up to 1:500 | Demo account not available |

| Low minimum deposit ($0 for most methods) | Unclear overnight swap fee information |

| Supports multiple payment options | Limited market instruments |

Is DREAM PULSE Legit?

DREAM PULSE is not a legitimate broker. It is registered in Comoros but has no valid regulatory license from any authority. Major global regulators like the FCA (UK), ASIC (Australia), and NFA (USA) also do not license it.

The domain dreampulse.com was registered on August 27, 2009, and will expire on August 27, 2025. It is currently in a locked status that prevents transfer.

What Can I Trade on DREAM PULSE?

Dream Pulse offers trading on forex, commodities, stock indices, and virtual currency CFDs. It claims to offer 100+ instruments in total.

| Tradable Instruments | Supported |

| Forex | ✅ |

| Commodities | ✅ |

| Crypto | ✅ |

| CFD | ✅ |

| Indexes | ✅ |

| Stock | ❌ |

| ETF | ❌ |

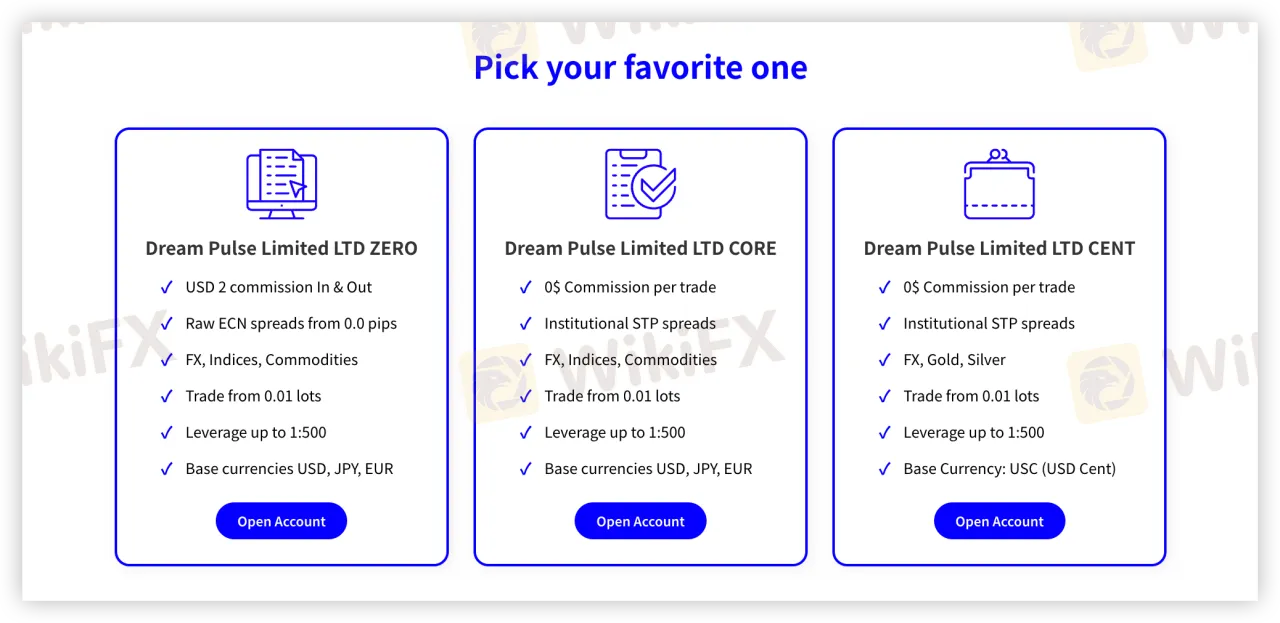

Account Types

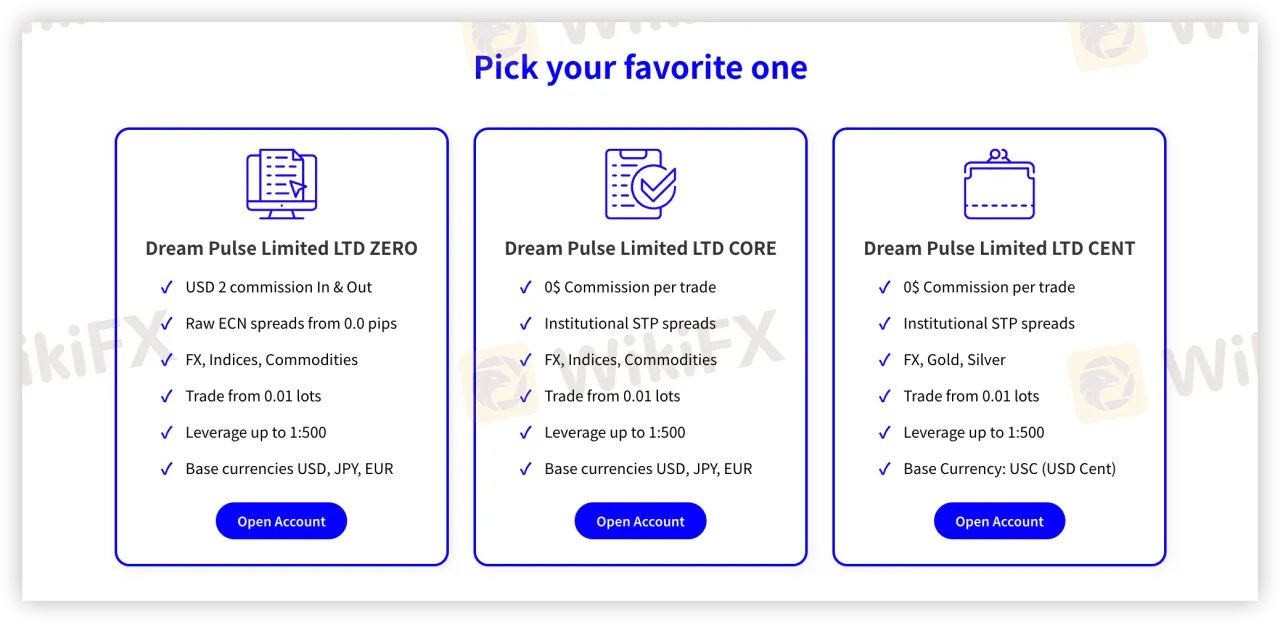

Dream Pulse offers three types of live accounts: ZERO, CORE, and CENT. There is no mention of demo accounts or Islamic accounts.

| Account Type | Suitable For | Commission | Minimum Lot Size | Leverage | Base Currency |

| ZERO | Experienced traders | $2 commission In & Out | From 0.01 lots | Up to 1:500 | USD, JPY, EUR |

| CORE | Experienced traders | $0 per trade | From 0.01 lots | Up to 1:500 | USD, JPY, EUR |

| CENT | Beginners | $0 per trade | From 0.01 lots | Up to 1:500 | USC (USD Cent) |

Leverage

Dream Pulse offers a maximum leverage of 1:500 across all account types.

DREAM PULSE Fees

Dream Pulses trading fees are relatively low compared to the industry average. The ZERO account offers raw ECN spreads from 0.0 pips with a $2 commission per side, while the CORE and CENT accounts provide institutional STP spreads with no commission.

| Product Type | Typical Spread (from) | Commission |

| Forex (Major Pairs) | 0.0 pips (ZERO account) | $2 per side |

| Forex (Major Pairs) | STP spreads (CORE, CENT) | $0 |

| Indices CFD | STP spreads | $0 |

| Commodities CFD | STP spreads | $0 |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| MT5 | ✔ | Windows, MacOS, iOS, Android | Beginner to advanced traders |

| WebTrader | ✔ | Browser (Desktop & Mobile) | Beginner traders needing easy access |

| MT4 | ❌ | - | - |

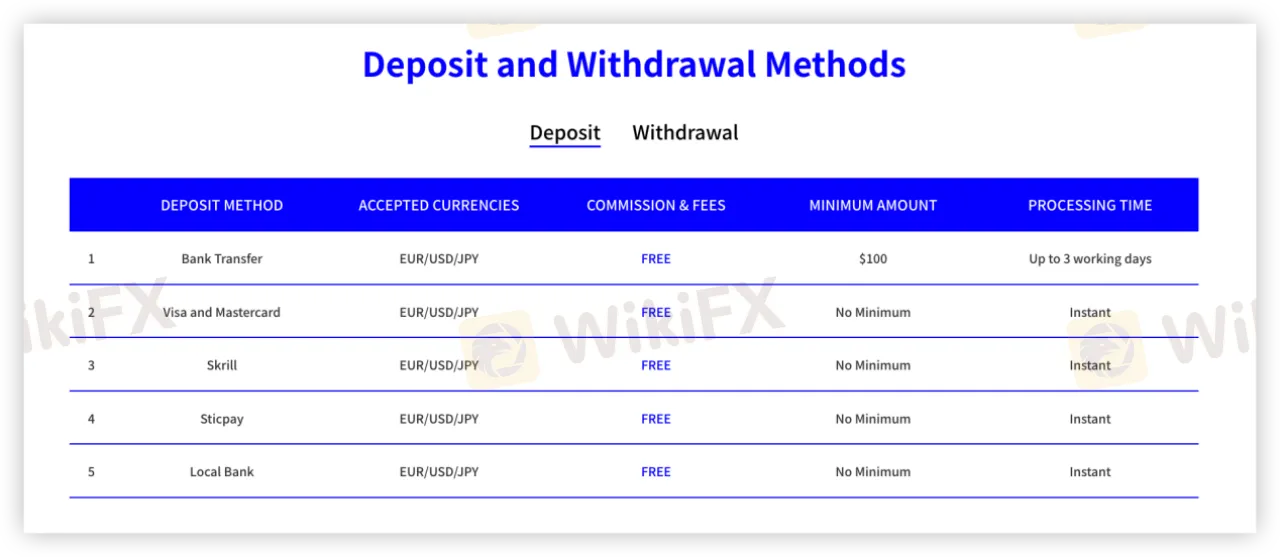

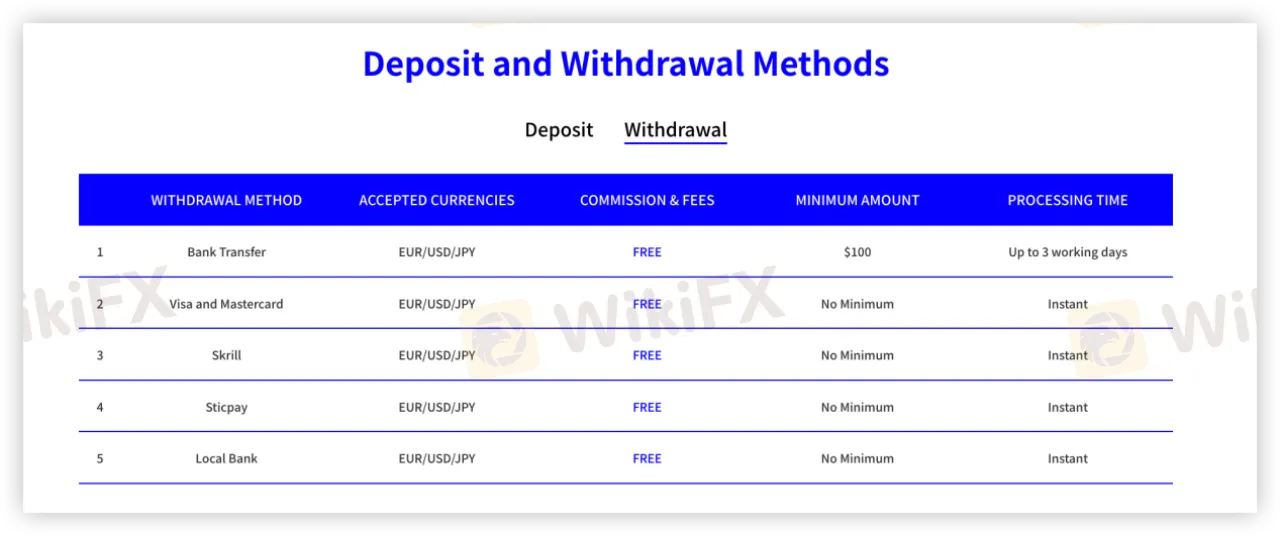

Deposit and Withdrawal

Dream Pulse offers multiple deposit and withdrawal methods, including bank transfers, Visa, Mastercard, Skrill, Sticpay, and local bank options, all supporting EUR, USD, and JPY currencies. The minimum deposit requirement is $100 for bank transfers, while other methods have no minimum limit.

| Method | Accepted Currencies | Min. Deposit/Withdrawal | Fees | Processing Time |

| Bank Transfer | EUR/USD/JPY | $100 | Free | Up to 3 working days |

| Visa and Mastercard | EUR/USD/JPY | No Minimum | Free | Instant |

| Skrill | EUR/USD/JPY | No Minimum | Free | Instant |

| Sticpay | EUR/USD/JPY | No Minimum | Free | Instant |

| Local Bank | EUR/USD/JPY | No Minimum | Free | Instant |