Company Summary

| Cathay Futures Review Summary | |

| Founded | 1993 |

| Registered Country/Region | Taiwan |

| Regulation | Taipei Exchange (TPEx) |

| Market Instrument | Futures |

| Trading Platform | / |

| Customer Support | Tel: 02-7752-1699 |

Cathay Futures Information

Cathay Futures, established in Taiwan in 1993 and regulated by the Taipei Exchange, is a company offering margin trading for both domestic and foreign commodities. The company provides access to futures trading on major international exchanges across Asia, Europe, and the Americas.

Pros and Cons

| Pros | Cons |

| Regulated by the Taipei Exchange | Unclear fee str |

| Access to major global exchanges | Limited contact channels |

| Long operation time |

Is Cathay Futures Legit?

Cathay Futures has a “Dealing in futures contracts & Leveraged foreign exchange trading” license regulated by the Taipei Exchange in Taiwan.

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| Taipei Exchange (TPEx) | Regulated | China (Taiwan) | Dealing in futures contracts & Leveraged foreign exchange trading | unreleased |

Cathay Futures Business

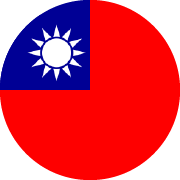

- Asian exchanges: Cathay Futures offers trading products across several major Asian Exchanges, including the Taiwan Futures Exchange (TAIFEX), Hong Kong Exchanges and Clearing Limited (HKEX), Japan Exchange (JPX), Tokyo Commodity Exchange (TOCOM), and Singapore Exchange (SGX).

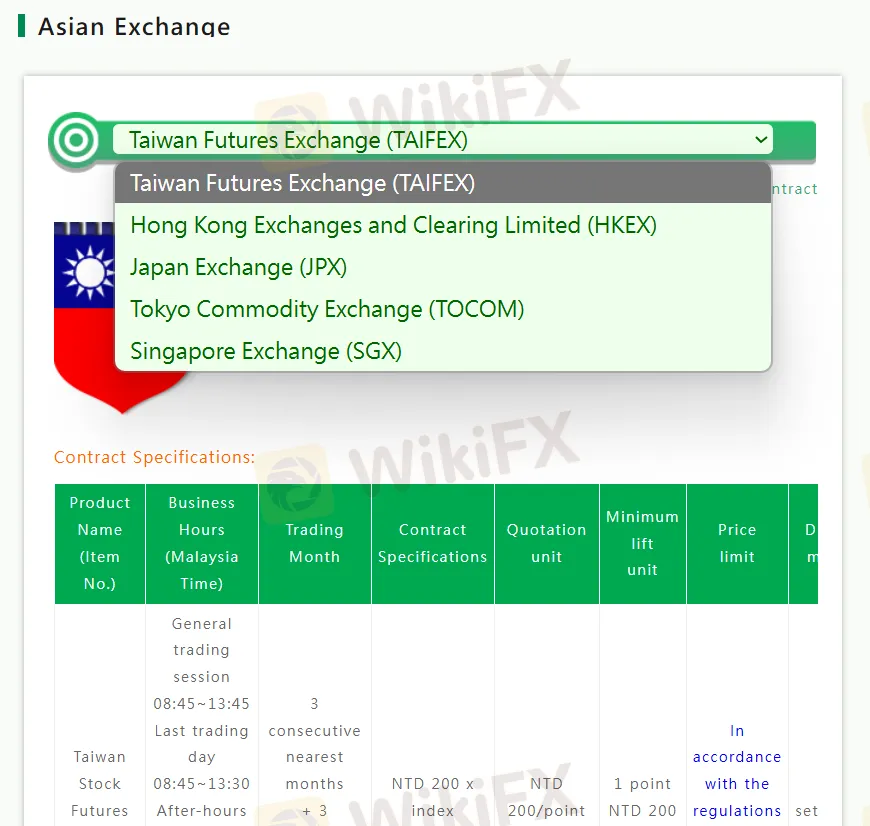

- European exchanges: Cathay Futures provides access to European exchanges like Eurex, the London International Petroleum Exchange (IPE), the London International Financial Futures (LIFFE), and the Intercontinental Exchange (ICE) for trading various futures and options.

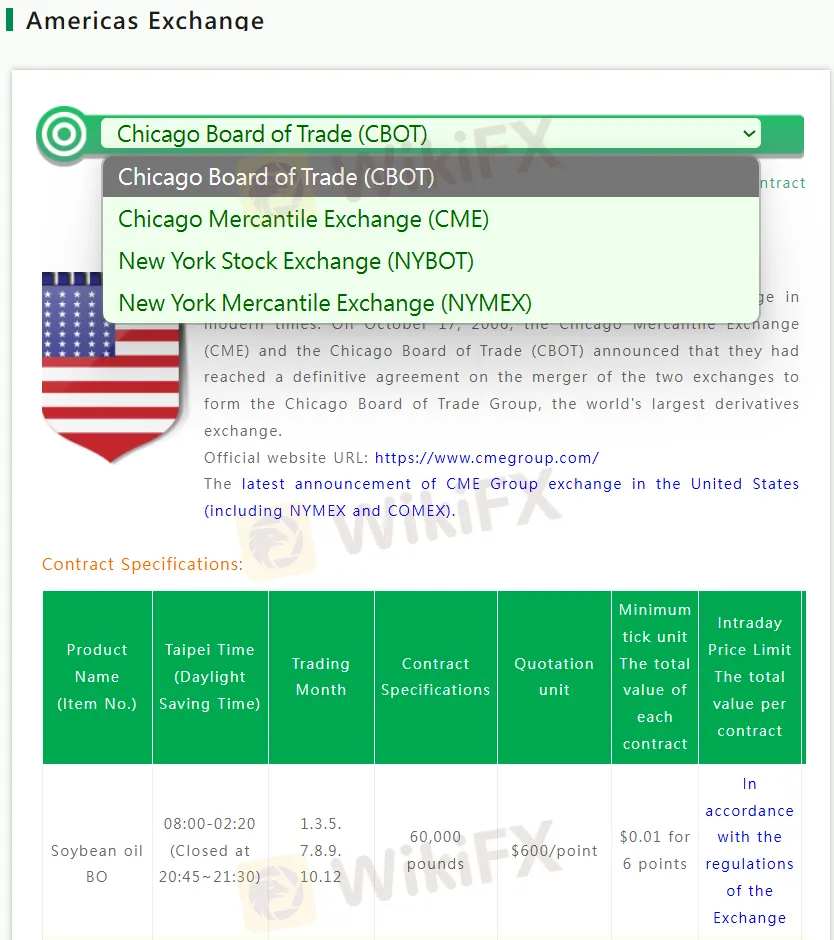

- Americas Exchanges: Cathay Futures offers trading products on major Americas exchanges, including the Chicago Board of Trade (CBOT), Chicago Mercantile Exchange (CME), New York Stock Exchange (NYBOT), and New York Mercantile Exchange (NYMEX).

Margin

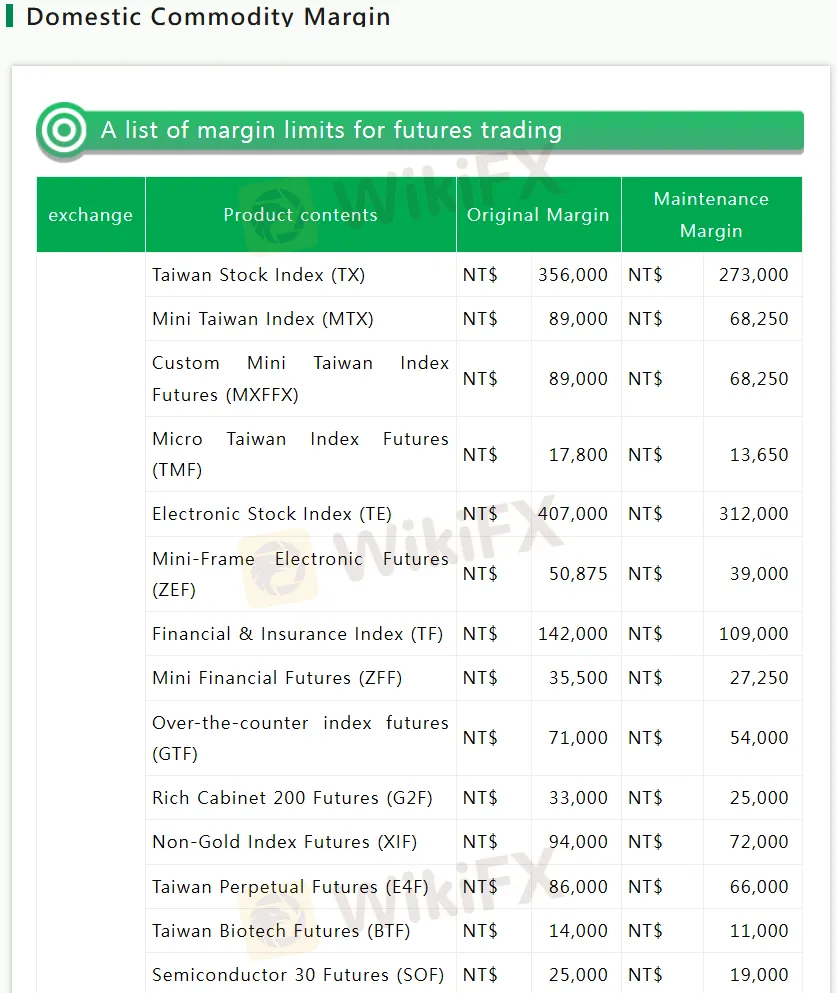

- Domestic Commodity Margin: Cathay Futures provides margin trading for diverse domestic Taiwanese futures, with original margins varying by financial product; for example, the Taiwan Stock Index (TX) requires an original margin of NT$356,000.

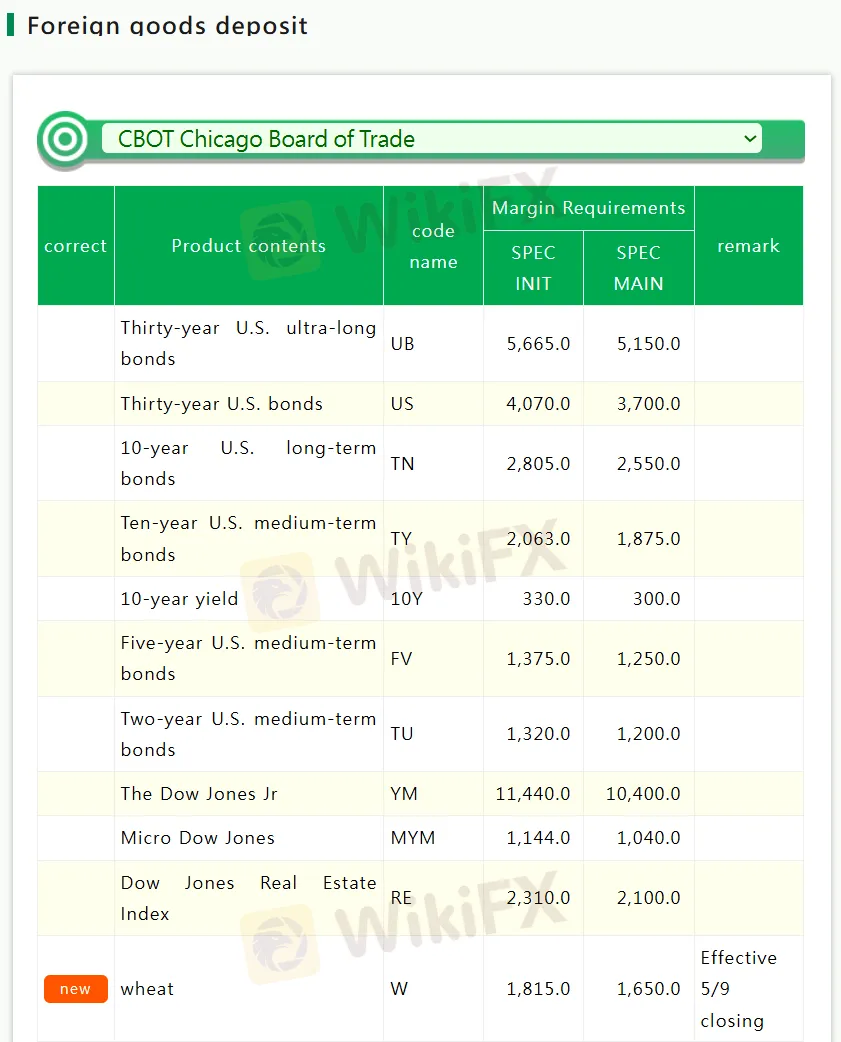

- Foreign Goods Deposit: Cathay Futures offers foreign goods deposits for trading products on the CBOT, Chicago Board of Trade, with margin requirements varying by financial product; for instance, the initial margin for Thirty-year U.S. ultra-long bonds (UB) is SPEC INIT 5,665.0.