회사 소개

| Cathay Futures 리뷰 요약 | |

| 설립 연도 | 1993 |

| 등록 국가/지역 | 대만 |

| 규제 | 타이페이 거래소 (TPEx) |

| 시장 상품 | 선물 |

| 거래 플랫폼 | / |

| 고객 지원 | 전화: 02-7752-1699 |

Cathay Futures 정보

Cathay Futures은 1993년 대만에서 설립되었으며 타이페이 거래소에서 규제를 받는 회사로 국내외 상품에 대한 마진 거래를 제공합니다. 이 회사는 아시아, 유럽 및 미국 전역의 주요 국제 거래소에서 선물 거래에 대한 접근을 제공합니다.

장단점

| 장점 | 단점 |

| 타이페이 거래소 규제 | 수수료 구조 불명확 |

| 주요 글로벌 거래소 접근 | 연락 채널 제한 |

| 운영 시간이 길다 |

Cathay Futures은 합법적인가요?

Cathay Futures은 대만의 Taipei Exchange에서 규제되는 "선물 계약 및 레버리지 외환 거래" 라이센스를 소유하고 있습니다.

| 규제 기관 | 현재 상태 | 규제 국가 | 라이센스 유형 | 라이센스 번호 |

| Taipei Exchange (TPEx) | 규제됨 | 중국 (대만) | 선물 계약 및 레버리지 외환 거래 | 미발표 |

Cathay Futures 사업

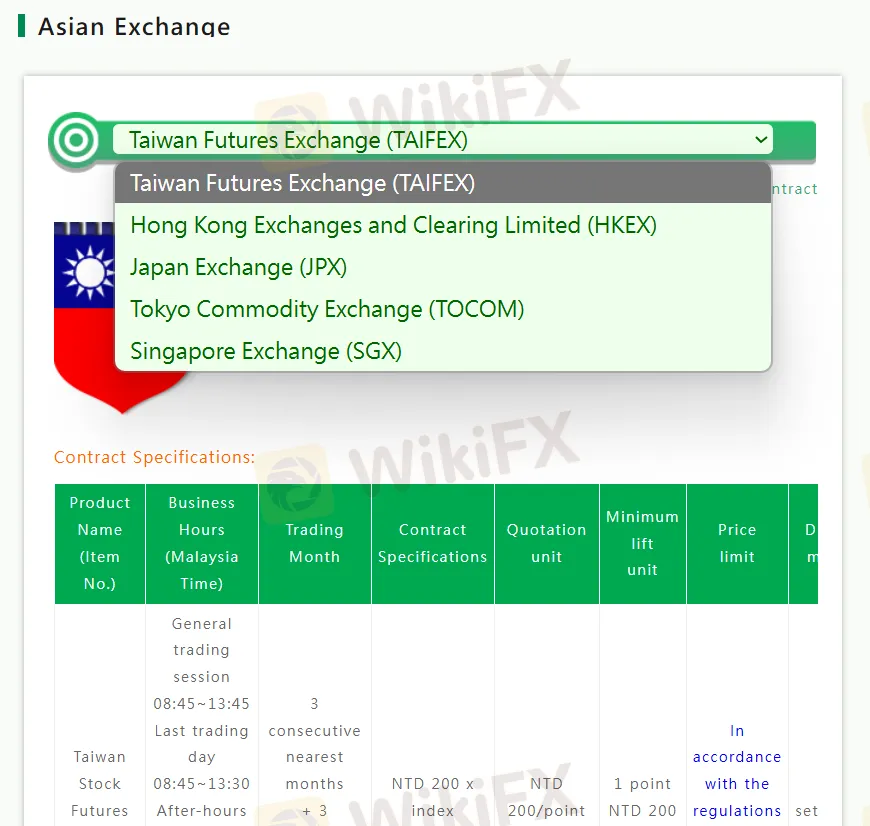

- 아시아 거래소: Cathay Futures은 대만 선물거래소 (TAIFEX), 홍콩 거래소 및 결제소 (HKEX), 일본 거래소 (JPX), 도쿄 상품 거래소 (TOCOM), 싱가포르 거래소 (SGX)를 포함한 주요 아시아 거래소에서 거래 상품을 제공합니다.

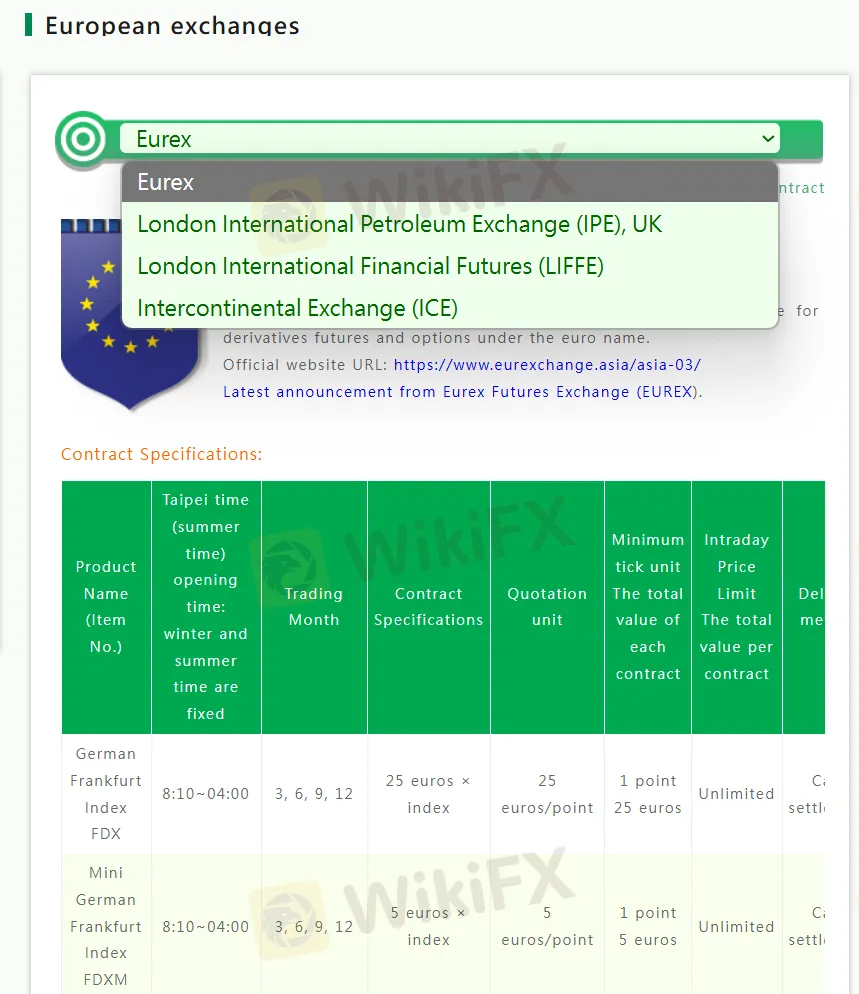

- 유럽 거래소: Cathay Futures은 유럽 거래소인 Eurex, 런던 국제 석유 거래소 (IPE), 런던 국제 금융 선물거래소 (LIFFE), 인터컨티넨탈 거래소 (ICE) 등에 액세스하여 다양한 선물 및 옵션 거래를 제공합니다.

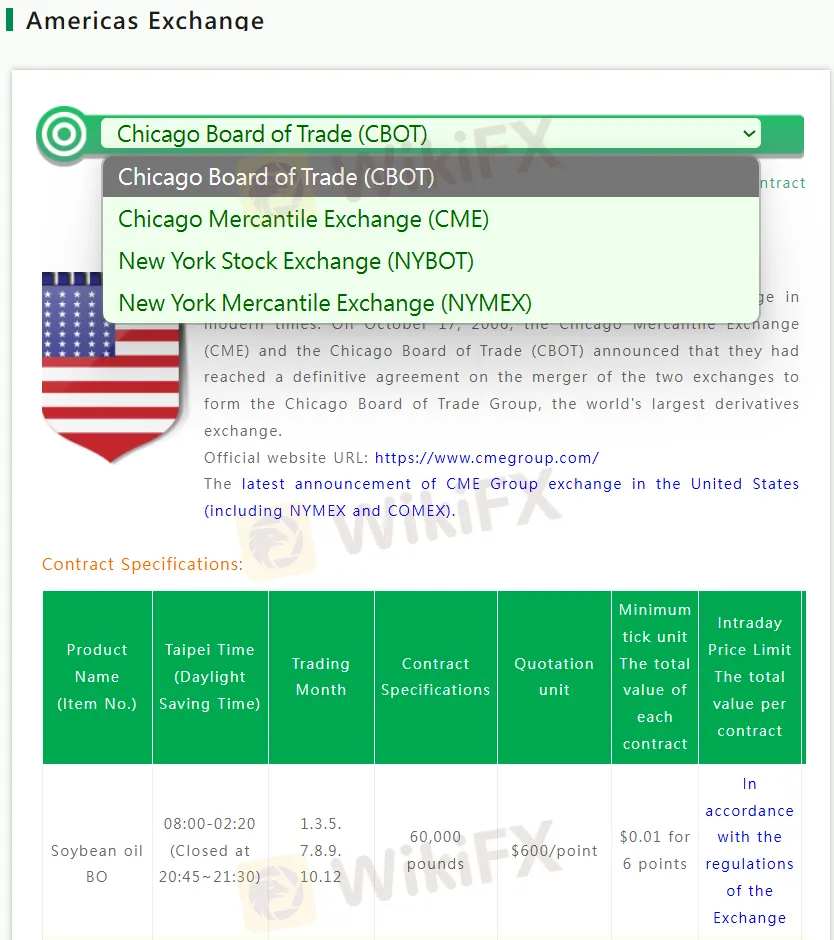

- 미국 거래소: Cathay Futures은 시카고 상업 거래소 (CBOT), 시카고 상품 거래소 (CME), 뉴욕 증권 거래소 (NYBOT), 뉴욕 상품 거래소 (NYMEX) 등 주요 미국 거래소에서 거래 상품을 제공합니다.

증거금

- 국내 상품 증거금: Cathay Futures은 다양한 대만 국내 선물에 대한 증거금 거래를 제공하며, 각 금융 상품에 따라 원래 증거금이 다릅니다. 예를 들어, 대만 주가 지수 (TX)의 원래 증거금은 NT$356,000입니다.

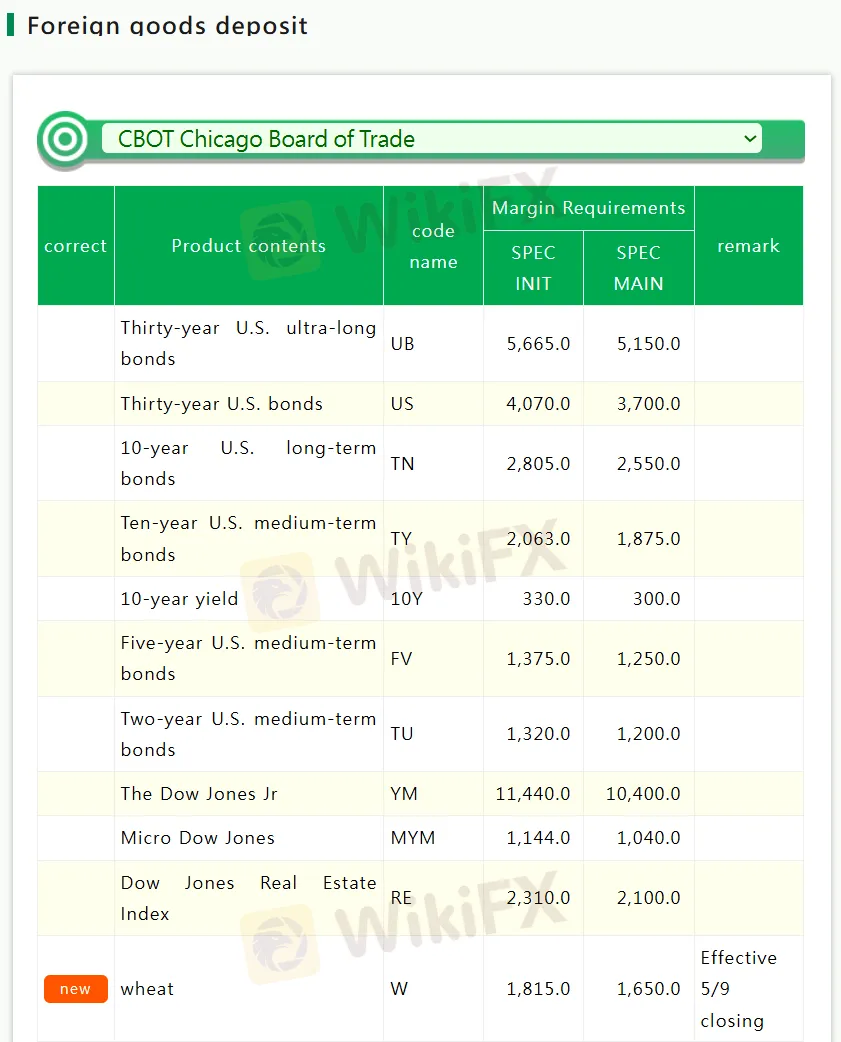

- 외국 상품 예탁금: Cathay Futures은 CBOT, 시카고 상품 거래소 등에서 거래 상품을 위한 외국 상품 예탁금을 제공하며, 각 금융 상품에 따라 증거금 요구 사항이 다릅니다. 예를 들어, 30년 미국 초장기 채권 (UB)의 초기 증거금은 SPEC INIT 5,665.0입니다.