Company Summary

| Quick Saxo Review Summary | |

| Founded | 1992 |

| Headquarters | Hellerup, Denmark |

| Regulation | ASIC, FCA, FSA, SFC, AMF, CONSOB, FINMA, MAS |

| Market Instruments | Stocks, ETFs, bonds, mutual funds, forex, futures, forex options, listed options |

| Demo Account | ✅(20 days with $100,000 virtual fund) |

| Account Type | Classic, Platinum, VIP |

| Min Deposit | $0 |

| Leverage | 1:100 |

| Spread | From 0.4 pips (forex) |

| Trading Platform | SaxoTraderGo, SaxoTraderPRO, SaxoInvestor |

| Payment Methods | Online Banking, Electronic Direct Debit Authorization (eDDA), Bank Transfer (Counter services or ATM) |

| Customer Support | 24/5 - phone, email |

| Regional Restrictions | The United States and Japan |

Saxo Information

Saxo is a Danish investment bank founded in 1992. It provides trading in stocks, ETFs, bonds, mutual funds, forex, futures, forex options, and listed options its proprietary trading platforms - SaxoTraderGo, SaxoTraderPRO, and SaxoInvestor. The bank operates in over 100 countries and has offices in major financial centers worldwide, including Copenhagen, London, Singapore, and Tokyo. Saxo Bank is regulated by several financial authorities, including ASIC (Australia), FCA (UK), FSA (Japan), SFC (Hong Kong), AMF (France), CONSOB (Italy), FINMA (Switzerland), and MAS (Singapore). The bank also has a banking license and is a member of the Danish guarantee fund for depositors and investors.

Pros & Cons

| Pros | Cons |

| • Wide range of financial instruments available | • US and Japan clients are not accepted |

| • No minimum deposit requirement | • No direct contact channels |

| • User-friendly trading platforms | |

| • Advanced trading tools and research | |

| • Regulated by top-tier financial authorities | |

| • 20 days' demo accounts with $100,000 virtual fund |

Is Saxo Legit?

Saxo has several entities that operate in multiple jurisdictions, heavily and globally regulated to provide a reassuring trading environment.

| Regulated Country | Regulated Entity | Regulated by | License Type | License Number |

| SAXO CAPITAL MARKETS (AUSTRALIA) LIMITED | ASIC | Market Making (MM) | 280372 |

| Saxo Capital Markets UK Limited | FCA | Market Making (MM) | 551422 |

| Saxo Bank Securities Ltd. | FSA | Retail Forex License | 関東財務局長(金商)第239号 |

| Saxo Capital Markets HK Limited 盛寶金融(香港)有限公司 | SFC | Dealing in futures contracts & Leveraged foreign exchange trading | AVD061 |

| Saxo bank A/S | AMF | Retail Forex License | 71081 |

| BG SAXO SIM SPA | CONSOB | Market Making (MM) | 296 |

| SAXO BANK (SCHWEIZ) AG | FINMA | Financial Service | Unreleased |

| SAXO CAPITAL MARKETS PTE. LTD. | MAS | Retail Forex License | Unreleased |

How are you protected?

Saxo is a regulated broker, with licenses from multiple reputable regulatory authorities and a long-standing history of providing financial services. The broker takes extensive measures to protect client funds, including segregating them from the company's assets and offering negative balance protection.

Additionally, Saxo offers various security features, such as two-factor authentication and encryption, to ensure secure trading.

More details can be found in the table below:

| Security Measures | Detail |

| Regulation | ASIC, FCA, FSA, SFC, AMF, CONSOB, FINMA, MAS |

| Segregated Accounts | Client funds are held in segregated bank accounts to protect them in case of insolvency |

| Two-Factor Authentication | As an extra layer of security for client accounts |

| SSL Encryption | The Saxo website and platform are secured with SSL encryption to protect user data |

| Investor Compensation Scheme | A member of the Danish Investor Compensation Scheme, which provides additional protection to clients in case of insolvency |

It's important to note that while these measures provide some level of protection for clients, there is always some level of risk involved in trading financial instruments, and clients should always be aware of the risks before making any trades.

Our Conclusion on Saxo Reliability:

Based on the information available, Saxo is a reliable and trustworthy broker. It is regulated by reputable authorities, has been in operation for several years.

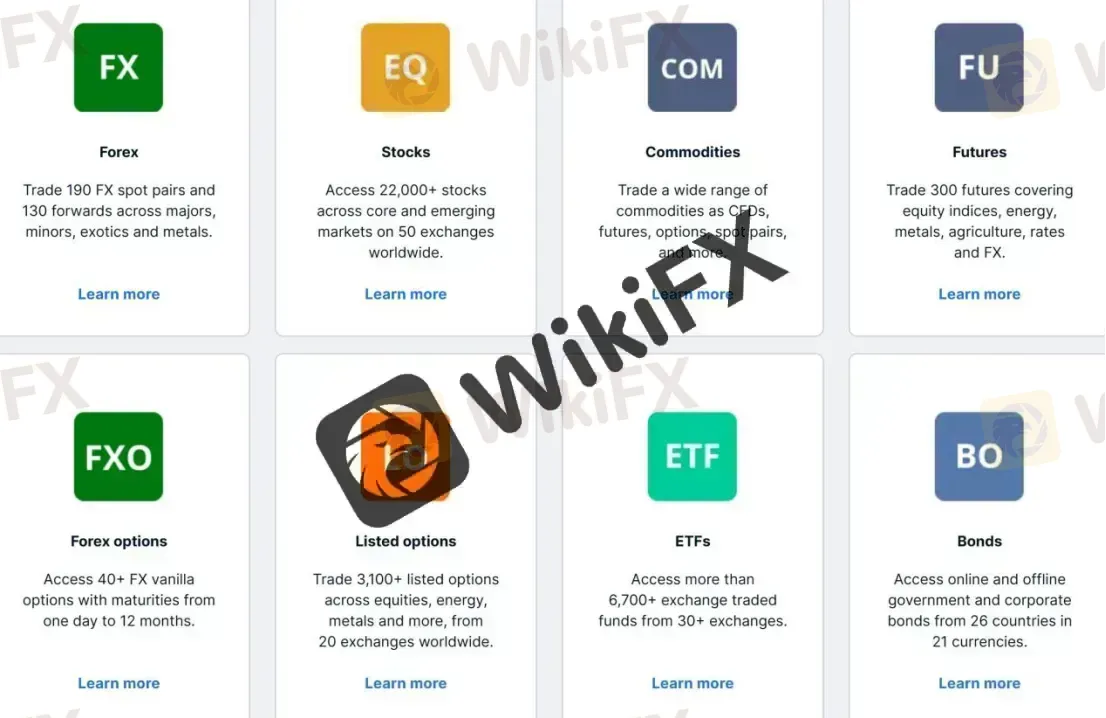

Market Instruments

Saxo offers a wide range of trading instruments across multiple asset classes, including

- Forex: More than 180 currency pairs, including majors, minors, and exotics.

- Stocks: Over 40,000 stocks from 36 global exchanges, including NYSE, NASDAQ, LSE, and more.

- Futures: Over 200 futures and options across a variety of asset classes such as commodities, indices, and bonds.

- Options: A wide range of options on stocks, indices, and futures.

- Bonds: Trade a wide range of government and corporate bonds, including sovereign bonds from developed and emerging markets.

- ETFs and CFDs: Access to over 3,000 ETFs and CFDs on indices, commodities, and stocks.

| Asset Class | Supported |

| Stocks | ✔ |

| ETFs | ✔ |

| Bonds | ✔ |

| Mutual funds | ✔ |

| Forex | ✔ |

| Futures | ✔ |

| Forex options | ✔ |

| Listed options | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| ETFs | ❌ |

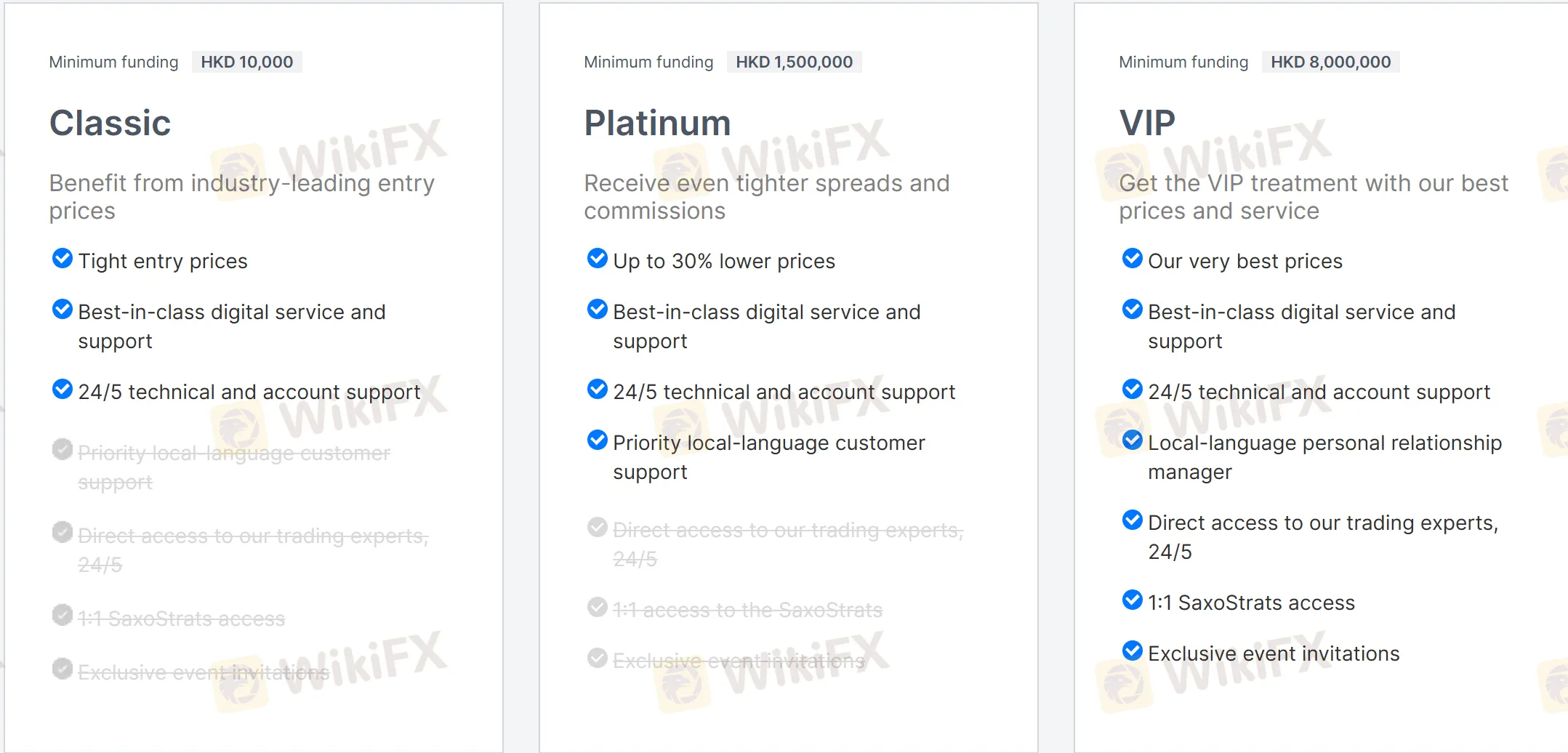

Account Type

Saxo offers a range of account types designed to suit the different needs of its clients. The account types offered by Saxo are:

- Individual Account:

| Individual Account Type | Min Deposit |

| Classic | HKD 10,000 |

| Platinum | HKD 1,500,000 |

| VIP | HKD 8,000,000 |

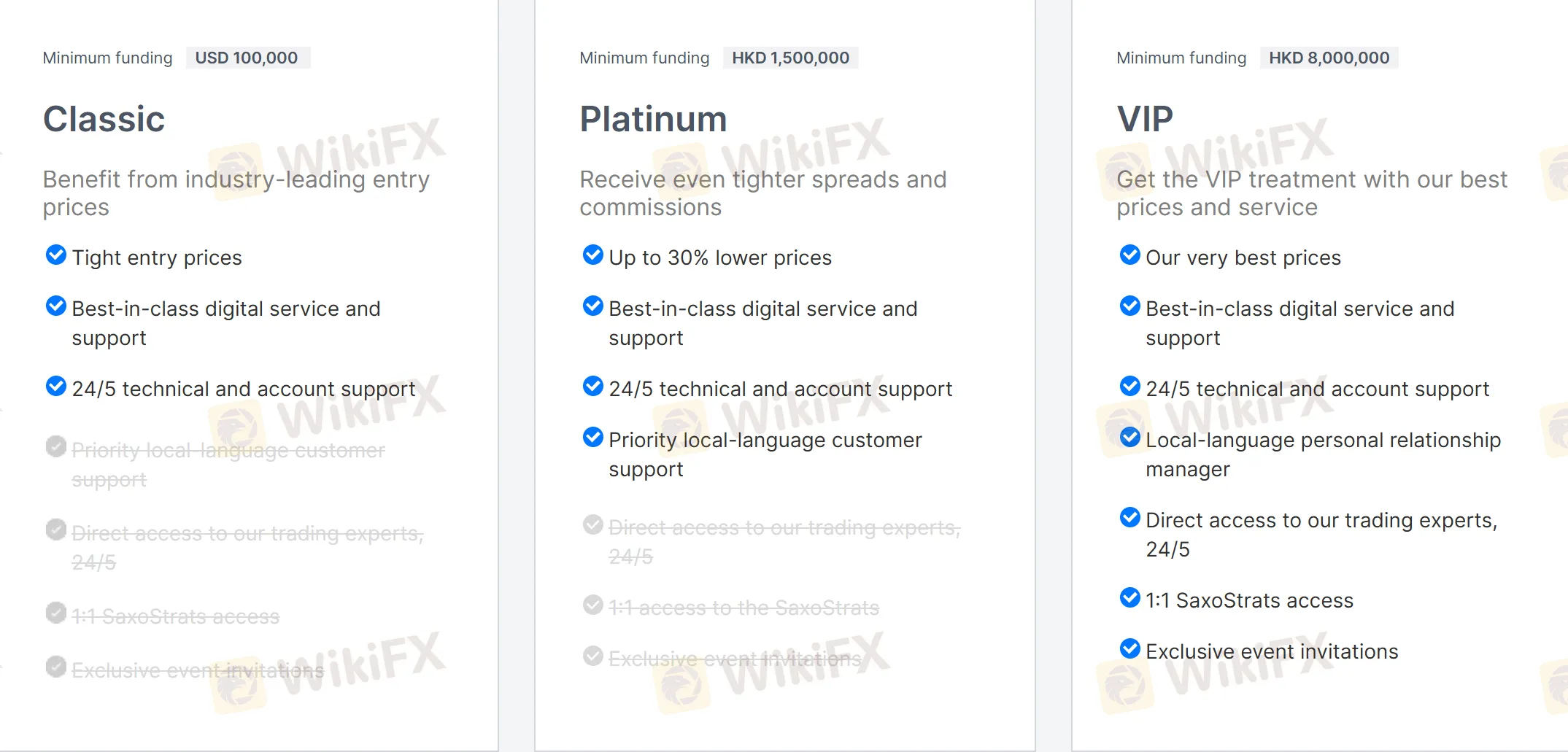

- Corporate Account: An account for companies, partnerships, and other legal entities.

| Corporate Account Type | Min Deposit |

| Classic | USD 100,000 |

| Platinum | HKD 1,500,000 |

| VIP | HKD 8,000,000 |

- Professional Account: An account specifically for professional traders.

Each account type has its own unique features and benefits, such as lower pricing, higher leverage, and dedicated account managers. Saxo also offers a free demo account (20 days with $100,000 virtual fund) for clients to practice trading before committing to a live account.

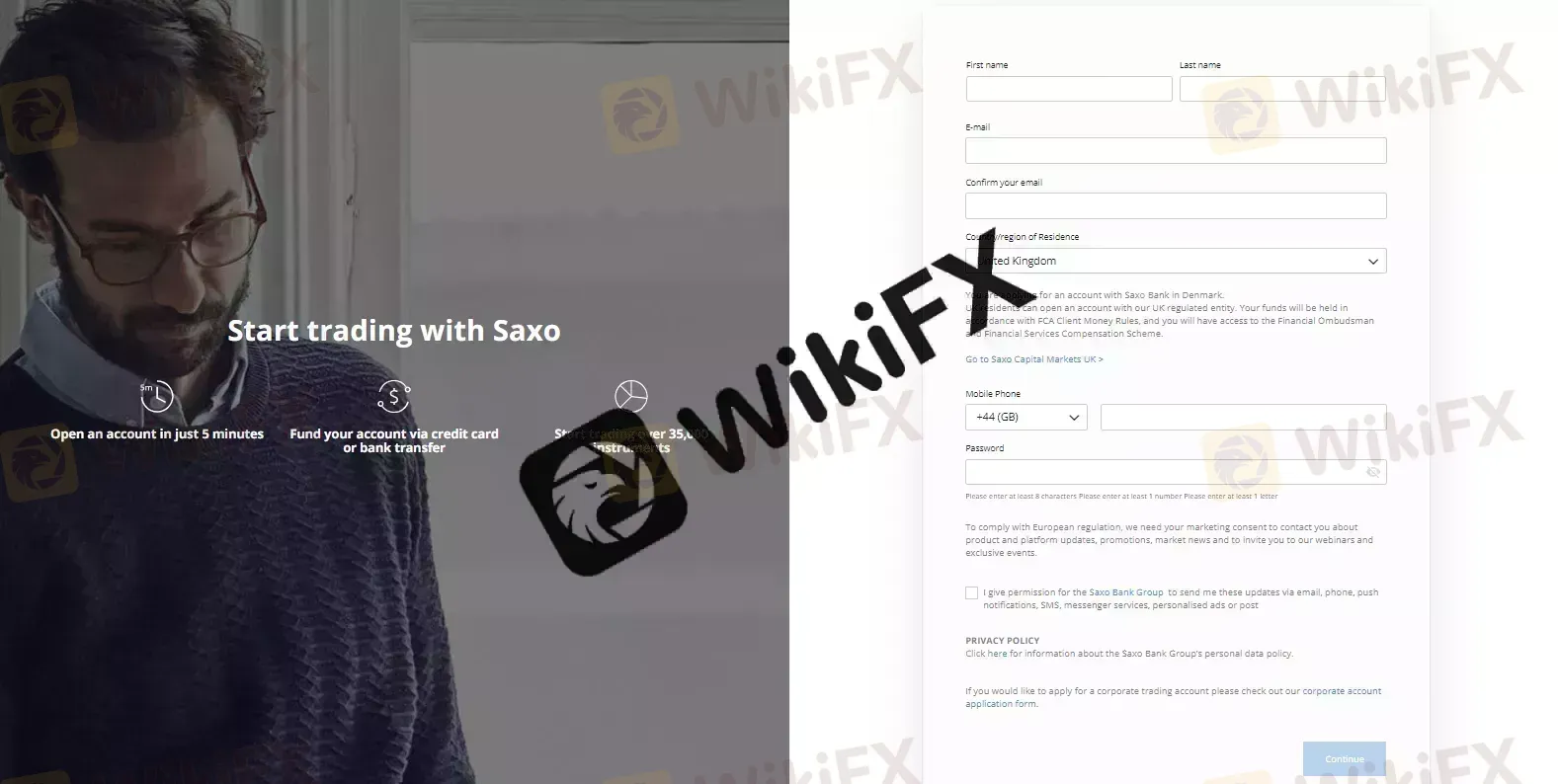

How to Open an Account with Saxo?

It takes only about five minutes and a short online form to open an account. Clients will need to submit the standard verification documents required by KYC and AML rules, but the procedure should be quick and easy, and they will have access to their account in minutes.

Leverage

Saxo offers leverage up to 1:100 for forex trading. Professional clients are entitled to leverage of 1:40 for the primary index, 1:33 for the secondary index, 1:33 for gold, 1:10 for equities, and 1:25 for commodities. Retail clients are entitled to leverage of 1:20 for the primary index, 1:10 for the secondary index, 1:20 for gold, 1:5 for equities and 1:10 for commodities.

However, the maximum leverage may vary depending on the instrument being traded and the client's location. It is important to note that trading with high leverage carries a higher level of risk, and traders should always exercise caution and use risk management strategies.

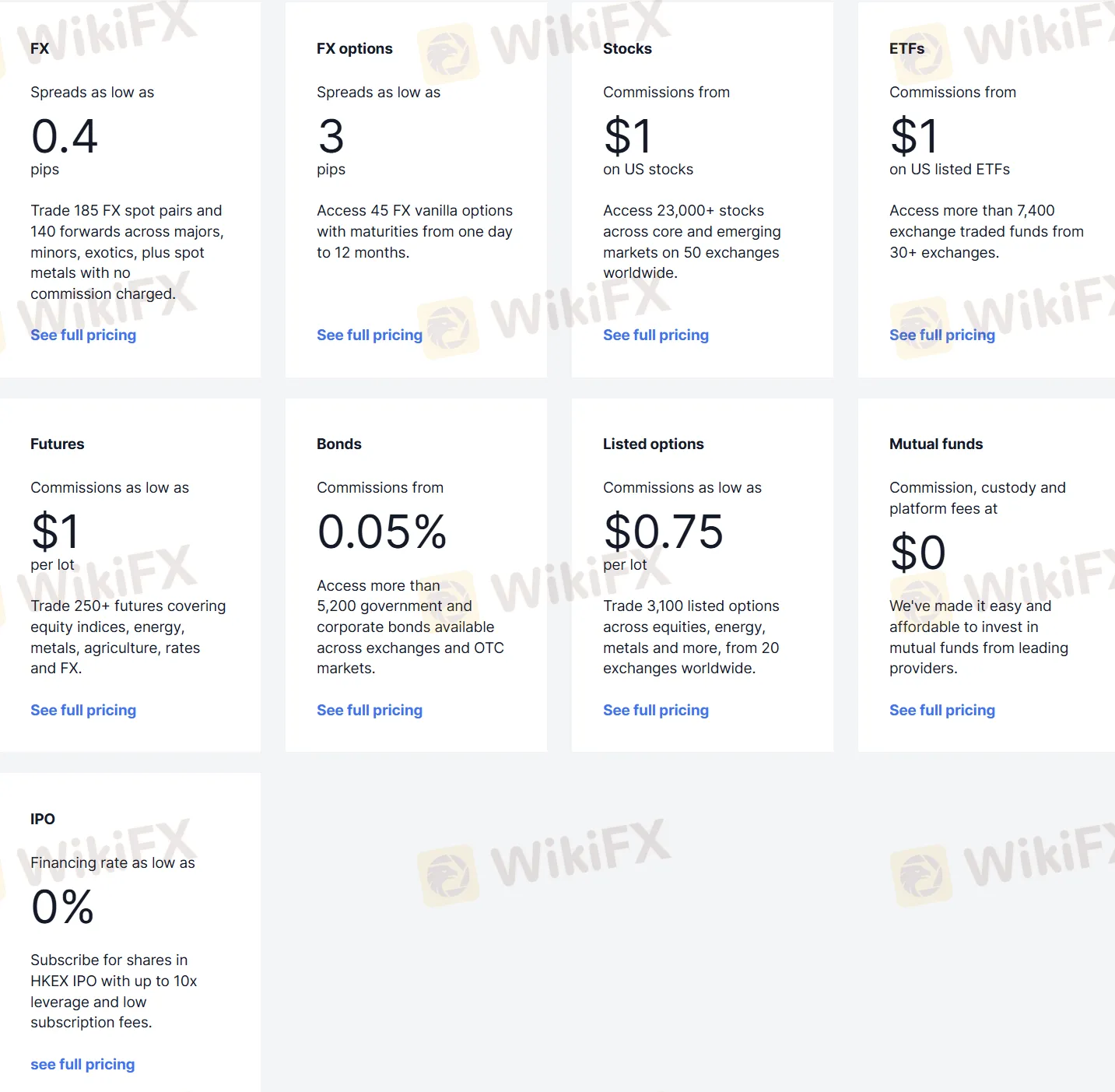

Spreads & Commissions

Saxo offers variable spreads, which means that the spreads can change depending on market conditions. The typical minimum spreads for popular instruments are as follows:

EUR/USD: 0.4 pips

USD/JPY: 0.6 pips

GBP/USD: 0.9 pips

AUD/USD: 0.6 pips

USD/CHF: 1.2 pips

USD/CAD: 1.5 pips

Saxo also charges commissions on some products, including stocks, ETFs, and futures. The commission fees vary depending on the specific market and the size of the trade. Commissions start from $1 on US stocks, US listed ETFs and futures. Bonds commissions start at 0.05%, listed options commissions start as low as $0.75 per contract, and mutual funds commissions are $0 for custody and platform fees.

Trading Platforms

Saxo offers its own proprietary trading platform called SaxoTraderGO. It is a web-based platform that can be accessed from any device with an internet connection. In addition, Saxo also offers SaxoTraderPRO, a desktop-based trading platform that is designed for advanced traders who require additional functionality.

SaxoTraderGO is highly customizable, allowing traders to arrange the interface to suit their preferences. It provides access to a wide range of trading tools and features, including charting tools, technical analysis indicators, and news feeds. The platform also includes a comprehensive range of order types, including market, limit, stop, and trailing stop orders.

SaxoTraderPRO is a professional-grade trading platform that offers advanced trading tools and features. It is designed for active traders and includes a range of tools that allow traders to monitor multiple markets and instruments simultaneously. The platform also includes advanced charting tools and a range of order types, including conditional orders and algorithmic trading capabilities.

Saxo also offers SaxoInvestor, which is a user-friendly trading platform suitable for beginner investors who are interested in a wide range of asset classes. It provides a simple and intuitive interface with basic research tools and features, making it easy for investors to buy and sell stocks, ETFs, bonds, and mutual funds. However, advanced traders may find the platform's lack of advanced tools and customization options limiting.

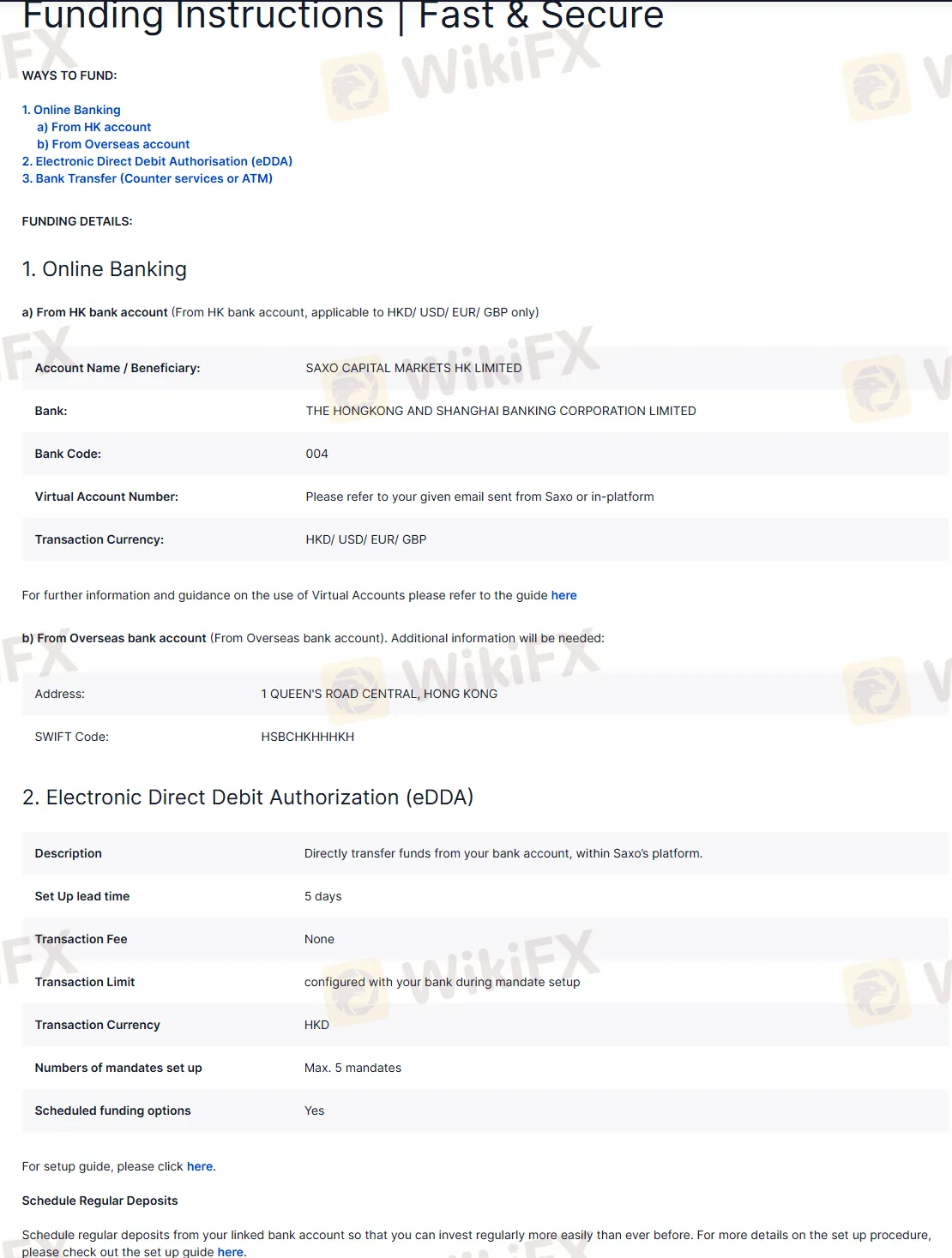

Deposits & Withdrawals

Saxo Bank supports several deposit and withdrawal methods, including Online Banking, Electronic Direct Debit Authorization (eDDA), and Bank Transfer (Counter services or ATM).

Conclusion

Overall, Saxo is a multi-asset broker that offers a comprehensive suite of trading tools and services to help traders achieve their investment goals. However, potential clients should carefully consider the fees before opening an account. Also, dont forget check their user reviews on the Internet.

Frequently Asked Questions (FAQs)

Is Saxo legit?

Yes. It is regulated by ASIC (Australia), FCA (UK), FSA (Japan), SFC (Hong Kong), AMF (France), CONSOB (Italy), FINMA (Switzerland), and MAS (Singapore).

Does Saxo offer demo accounts?

Yes.

Does Saxo offer the industry-standard MT4 & MT5?

No. Instead, it offers SaxoTraderGo, SaxoTraderPRO, and SaxoInvestor.

What is the minimum deposit for Saxo?

There is no minimum initial deposit to open an account.

Is Saxo a good broker for beginners?

Yes. It is a good choice for beginners because it is regulated well and offers various trading instruments with competitive trading conditions. Also, it offers demo accounts that allow traders to practice trading without risking any real money.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

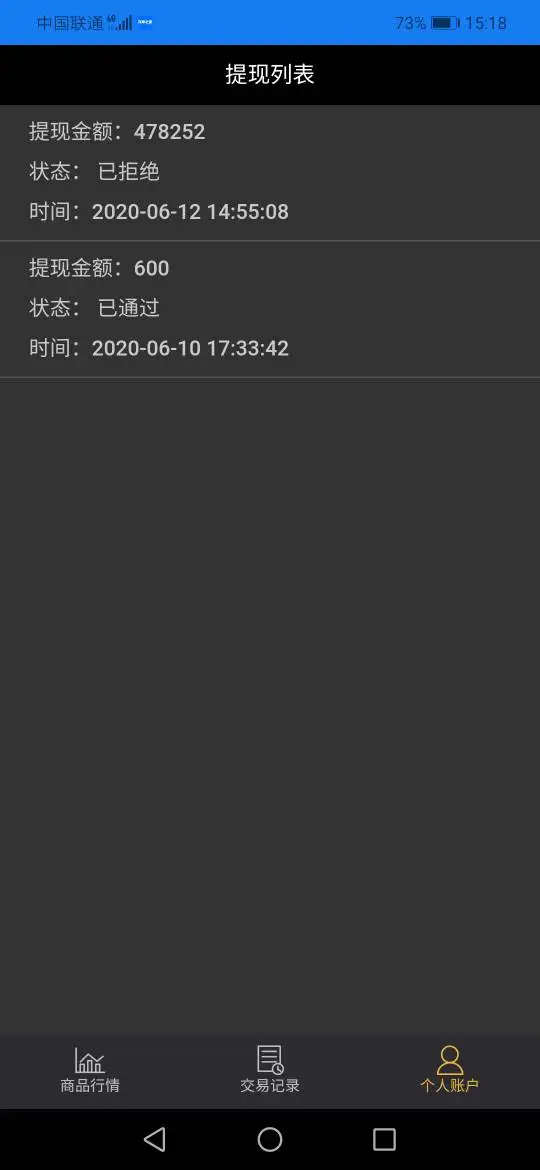

天空之翼

Hong Kong

The platform keeps asking me to charge a varied fee including individual tax, added-value tax and and risk margin, giving no access to withdrawal.

Exposure

景点+美食=你最好的选择

Hong Kong

I wanted to withdraw 470 thousand, while Saxo asked for a 20% margin. Having paid 100 thousand, I was still refused. Now the balance became 500 thousand or so. It is a rip-off.

Exposure

景点+美食=你最好的选择

Hong Kong

I was asked to pay a 20% margin, which is nearly 100 thousand yuan. After I did so, the withdrawal was still unavailable. I was conned.

Exposure

awakemime

Thailand

The system is stable with advanced tools and a clean interface, but unfortunately, Platinum and VIP accounts have high deposit requirements.

Neutral

Nguyen Dinh Bac 7

Vietnam

compact and intuitive design, very smooth operation, even beginners can quickly get used to it.

Neutral

我叫磁力棒

United States

Recently, I have been studying online trading and came across Saxo, a trading firm. After using it for a while, I would like to share my thoughts. First, let's talk about the advantages. Saxo's trading platform has a clean and intuitive interface, making it easy to operate and suitable for beginners. It offers a wide range of trading tools and charting functions, providing various real-time data and technical indicators for market analysis and trading strategy development. Moreover, it offers a comprehensive range of trading instruments, including stocks, forex, futures, options, and more, catering to the diverse investment needs of different investors. The customer service team also responds promptly and can answer my questions in a timely manner. However, Saxo also has some areas that need improvement. In terms of trading costs, compared to some competitors, its fees and spreads are slightly higher, which can be a burden for frequent traders. The deposit and withdrawal process can be a bit cumbersome, and the time it takes for funds to be credited is sometimes not very stable, which can be a cause for concern. Additionally, although the platform provides support for multiple languages, there is still room for improvement in terms of accuracy and professionalism in some less commonly used languages. Overall, Saxo is a trading firm with a certain level of strength and uniqueness. It performs well in terms of trading platform and product diversity, but there is still room for optimization in terms of trading costs and the convenience of deposit and withdrawal. For investors who value trading experience and a wide range of product choices and are not too concerned about trading costs, it is a choice worth considering. However, if cost sensitivity is a priority, it may be necessary to weigh the options before making a decision. Therefore, I give it a moderate rating.

Neutral

Ethan1454

United Kingdom

Knowing that SAXO Bank is regulated by the Financial Conduct Authority (FCA) in the UK gives me peace of mind. I feel secure knowing that my funds are protected up to £85,000 through the Financial Services Compensation Scheme (FSCS).

Positive

HenryM

United Kingdom

I appreciate that SAXO Bank allows me to invest in a diverse range of markets, including stocks, ETFs, and bonds. This variety is appealing for my portfolio diversification. However, I do wish the transaction fees were lower, as they can be a deterrent for smaller investors like myself.

Neutral

James7312

United Kingdom

I’ve had a great experience with SAXO Bank’s customer service. They are responsive and knowledgeable, which has made my trading journey smoother. The UK-based support team has been particularly helpful, adding to my overall satisfaction with the broker.

Positive

Isabella2322

United Kingdom

While I enjoy the excellent trading tools and broad range of assets SAXO Bank provides, I’ve noticed that their fee structure is quite high for UK investors. This makes it less competitive compared to other brokers in the region. I recommend being aware of the costs involved before committing.

Neutral

FX2510300550

United Kingdom

I've found SAXO Bank to offer a sophisticated trading platform with a range of financial instruments. The user interface is sleek, which I appreciate as a new trader. However, I must admit that beginners might find it challenging due to the steep learning curve. Overall, I feel it has a solid reputation among experienced investors.

Positive

Daniel324

United Kingdom

I've been using Saxo Bank for a few weeks, and I’m thoroughly impressed with the platform’s capabilities and the level of service provided. The range of trading instruments available is vast, allowing me to trade everything from stocks and bonds to forex and commodities all in one place. The platform itself is robust and packed with advanced tools that cater to both novice and experienced traders. I particularly appreciate the customizability of the interface, which lets me tailor my dashboard to suit my trading style.

Positive

Mohamed Lewaa

Vietnam

The platform runs smoothly, and the user experience is top-notch.I rarely experience downtime or lag, making trading reliable

Positive

Vfghu

Belarus

It covers my needs - That's why I gave 5 stars. However, by the way, I face one problem for more than a year - I have communicated this to your support team but the problem remains. Every day, when I first start the (windows 11) Saxotraderpro app, it opens as a full screen and I have to adjust it twice in order to place it at a the particular part of the screen that is convenient for me.

Neutral

Khan1630

Pakistan

I have lost my 85000 pkr in this adress

Exposure

Jonathan Batista

Colombia

Nice plataform but, need a better costumer service.

Neutral

姗姗

Hong Kong

I paid a security deposit and asked to pay taxes, but I couldn’t withdraw money at all. I don’t know if I was cheated

Exposure

㭍

Indonesia

What Saxo dissatisfied me was that it did not provide 7/24 customer support. I am a part-time trader, and I basically trade on weekends. Sometime, I want to withdraw my money on Sunday or Monday, but they always let me wait and wait. I had it enough.

Neutral

linsingi

United States

My friend recommended it. It is regulated by so many regulators, which surprises me a lot. However, my past trading experience has taught me that investment has to be cautious, and I can no longer invest as vaguely as before. It is advisable that everyone, especially newcomers like me, get a full understanding and then decide!

Positive

老拙

Hong Kong

I have traded foreign exchange currency pairs on Saxo, and found that his point difference is indeed much higher than other platforms, but fortunately, the transaction is very formal. I have neither lost money nor made a profit on this platform. Overall it's okay for Samsung.

Neutral

Allaoui

Morocco

I can't withdraw money from my account, they are theft

Exposure

Wcnmdjpp

Hong Kong

The maximum leverage, spreads and trading platforms available at Saxo are all quite well, whch make me feel very surprised, but...the minimum initial deposit requirement is extremely high-up to $2,000...i’m just a forex beginner...i dont wanna bear too much risks, so im prefer to choose those brokers who offer lower deposit amount.

Neutral

卡布奇诺80913

Hong Kong

Overall, I am satisfied with the platform but there are several issues that need to be addressed. The platform was user-friendly and easy to use. But the new login page was not necessary as the old one is very good and nice… I love its platform, but its support and logging is quite lagging...

Neutral