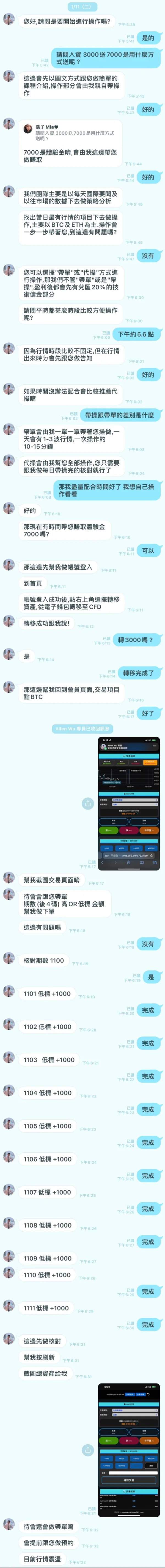

Company Summary

| JFDReview Summary | |

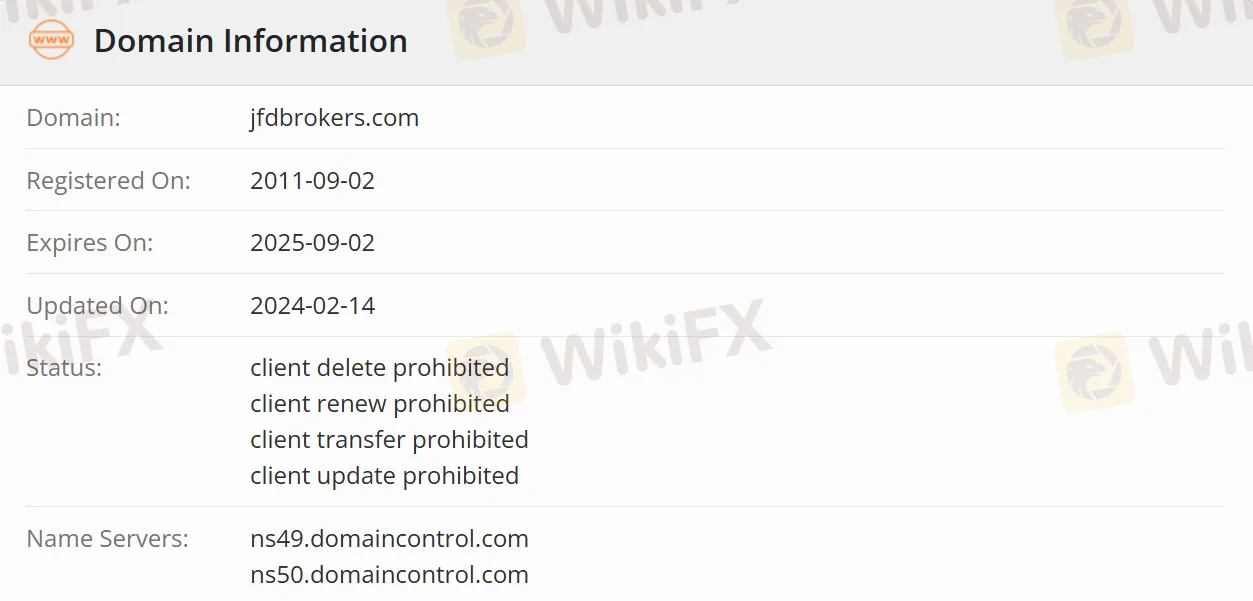

| Registered On | 2011-09-02 |

| Registered Country/Region | Cyprus |

| Regulation | Regulated |

| Market Instruments | Forex, Commodities, Stocks, Cryptocurrencies, Precious Metals, Indices, and ETFS/ETNS |

| Demo Account | ✅ |

| Leverage | Up to 1:400 |

| Spread | / |

| Trading Platform | MT4+ and MT5+ (Desktop, Web, and Mobile), stock3 |

| Min Deposit | 500 EUR/CHF/GBP/USD |

| Customer Support | Live Chat 24/5 |

| support@jfdbrokers.com | |

| +49 40 87408688 | |

| LinkedIn, Twitter, Facebook, Telegram | |

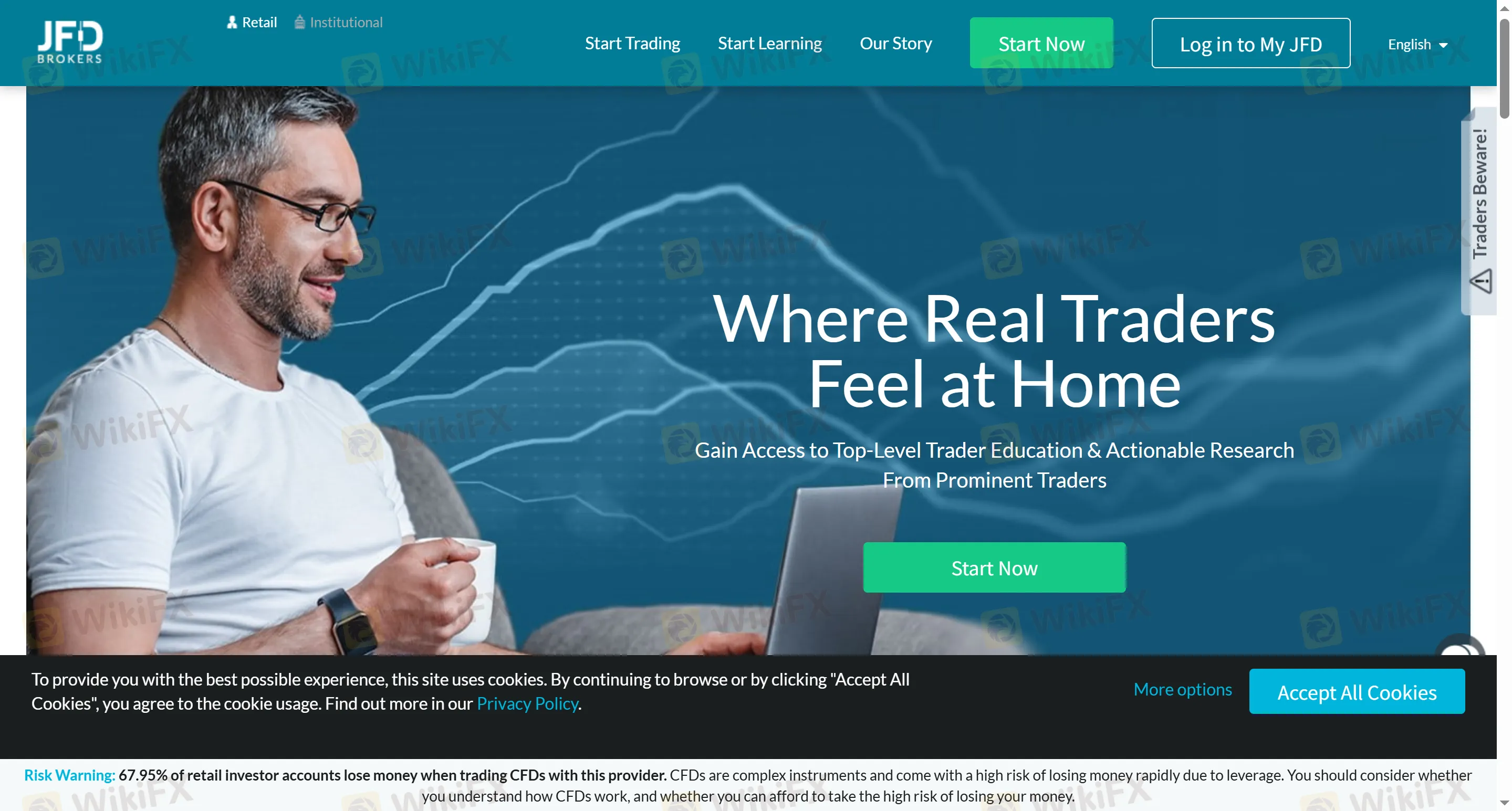

JFD Information

Founded in 2011 and headquartered in Cyprus, JFD Brokers is a global online trading brokerage. Its core business covers multiple asset classes, including forex, precious metals, stocks, and cryptocurrencies, supporting mainstream trading platforms such as MetaTrader 4/5 (MT4+/MT5+). Regulated by authorities like the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC), client funds are held in segregated accounts at top-tier credit institutions.

Pros and Cons

| Pros | Cons |

| Regulated (CYSEC) | Restrictions in some countries (e.g., China, the United States) |

| Over 1,500 trading instruments | High fees of up to 3.25% (for some payment methods) |

| Available on MT4+/MT5+ |

Is JFD Legit?

JFD is regulated by authoritative institutions such as CySEC and VFSC. It should be noted that VFSC is an offshore regulated license (No. 17933). Traders can check JFD's information on the CySEC website using license number 150/11.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| CYSEC | JFD GROUP LTD | Market Maker (MM) | 150/11 | Regulated |

| VFSC | JFD Overseas Ltd | Retail Forex License | 17933 | Offshore Regulated |

| FCA | JFD GROUP LTD | European Authorized Representative (EEA) | 580193 | Unsubscribed |

What Can I Trade on JFD?

JFD supports 9 major asset classes, covering over 1,500 instruments, including forex, precious metals, indices, stocks, cryptocurrencies, commodities, and ETFs/ETNs.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Precious Metals | ✔ |

| Indices | ✔ |

| ETFs/ETNs | ✔ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

JFD offers a single account system, and traders can also choose a demo account to test platform functions and strategies.

| Company | JFD Group Ltd | JFD Overseas Ltd |

| Margin Call Level | 100% | 100% |

| Stop Out Level | 50% | 50% |

| Negative Balance Protection | Yes | No |

| Account Base Currencies | USD/GBP/EUR/CHF | |

| Minimum Deposit | 500 USD/GBP/EUR/CHF | |

| Segregation of Funds | Yes | |

JFD Fees

Trading costs

| Commission on CFDs, FX & Metals | Yes |

| US Physical Stocks: 0.05 USD Per Share / Minimum Ticket Charge $3EU Physical Stocks: 0.15% off Order Volume / Minimum Ticket Charge 3EUR | |

| Commission on Physical Stocks | Spanish Physical Stocks: 0.20% of Order Volume / Minimum Ticket Charge 6 EUR |

| Overnight Financing / Swaps | Yes (excluding CFDs on Futures Contracts) |

| Overnight Financing costs | Yes, are calculated for CFDs on Stocks & Cash Indices: 3.25% +/-Respective Benchmark Rate. |

| Platform Fees | No |

Deposit and withdrawal fees

| Payment | Method | Fee |

| Deposit | Bank transfer (e.g., Sofort) | 1.8% + fixed fee |

| Online payment (e.g., Skrill) | From 0.25 EUR + 1.7%-3.25% | |

| Credit card | 1.95%-2.95% | |

| Withdrawal | Credit card | 0.25 EUR authorization fee + 2 EUR refund fee |

| Skrill/Neteller | 1%-2% (up to 30 USD) |

Inactivity Fee

If an account has no trading activities or deposits for three consecutive months, it will be considered inactive. A monthly inactivity fee of 20 EUR/USD/GBP/CHF (based on the account's base currency) will be charged. Accounts with no deposits are exempt from this fee.

Leverage

The default leverage for forex is a 3%-5% margin, equivalent to 20-33 times leverage. Professional clients can apply for a minimum margin of 0.25%, with a maximum leverage of 400 times.

Trading Platform

JFD offers MT4+ and MT5+, supporting desktop, web (no download required), and mobile versions. In addition, it also provides Stock3, a popular social trading platform in Germany.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4+ | ✔ | Desktop, Web, and Mobile | Beginners |

| MT5+ | ✔ | Desktop, Web, and Mobile | Experienced Traders |

| stock3 | ✔ | Web | All |

Deposit and Withdrawal

DepositThe minimum deposit is 500 EUR/USD/GBP/CHF. Deposit methods support bank transfers (SEPA/Sofort), online payments (Nuvei, Skrill, Neteller), and credit cards (VISA/MasterCard). The supported account currencies are EUR/USD/GBP/CHF, while deposits can be made in over 30 currencies (with automatic conversion).

Withdrawal

Withdrawals are prioritized to be returned via the original deposit method. Funds deposited via online payments will be refunded to the original online source first, and any remaining balance will be transferred via bank transfer. For European regions, the funds will arrive within 2-5 working days, while non-European regions take 4-7 working days.