FPG EURUSD Market Report January 2, 2026

On the EURUSD H1 chart, after previously staging a bullish rally from 1.1714 to 1.1807, price faced strong rejection near the peak, triggering a clear short-term trend reversal. Since then, EURUSD has

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

On the EURUSD H1 chart, after previously staging a bullish rally from 1.1714 to 1.1807, price faced strong rejection near the peak, triggering a clear short-term trend reversal. Since then, EURUSD has

Key Takeaways:Crypto markets remain range-bound, with total market cap capped below $3T, reflecting a failure to recover from Octobers sell-off amid weak risk appetite.Macro optimism is building for 2

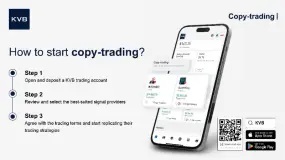

Copy trading has become a widely used method for traders who want to participate in the financial markets without managing every trade manually. By following experienced traders, investors can replica

Jan 2, 2026, PU Prime has announced the launch of “Champion in You,” a three-phase global brand campaign that places human experience at the center of trading, highlighting the personal journeys and m

The Federal Reserves Standing Repo Facility (SRF) saw its usage surge to USD 74.6 billion on the final trading day of 2025, marking an all-time high. At first glance, such a figure may trigger concern

Market OverviewOn December 31, 2025, the Federal Reserve expanded its Standing Repo Facility (SRF) operations to USD 74.6 billion, marking a sizable year-end liquidity injection. However, both risk as

MARKET ANALYSISUSDJPYUSD/JPY Intraday: bullish bias above 156.40.Pivot:156.40Our preference:Long positions above 156.40 with targets at 156.95 157.20 in extension.Alternative scenario:Below 156.40 lo

MARKET ANALYSISUSDJPYUSD/JPY Intraday: bullish bias above 156.40.Pivot:156.40Our preference:Long positions above 156.40 with targets at 156.95 157.20 in extension.Alternative scenario:Below 156.40 lo

MARKET ANALYSISUSDJPYUSD/JPY Intraday: bullish bias above 156.40.Pivot:156.40Our preference:Long positions above 156.40 with targets at 156.95 157.20 in extension.Alternative scenario:Below 156.40 lo

STARTRADER Starts the Year with A New Look and Feel1 January 2026, Global broker STARTRADER is unveiling a refreshed look and feel as part of its brand repositioning. Since its establishment, the comp

The financial history of 2025 will be remembered as the year The Great Decoupling met The Great Innovation. Global markets moved away from old monetary playbooks, pricing in a new era of geopolitical

On the AUDUSD H4 chart, after moving in a bearish channel from 10 to 19 December, the pair finally experienced a clear trend reversal in the form of a strong bullish move from 0.6602 to 0.6717. This b

FOMC‘s “Cautious Pivot” and 2026 Outlook; “Last Call” for US Dollar, Gold, Nasdaq100Yesterday’s release of the December FOMC minutes provided the final piece of the 2025 macro puzzle. Despite the Fede

On Tuesday, the US dollar index stabilized above the 98 level and ultimately closed up 0.213% at 98.22; The yield on US Treasury bonds has slightly increased, with the benchmark 10-year yield closing

Market Review According to ETO Markets monitoring, on December 30 (Tuesday), spot gold attempted a rebound but quickly lost momentum as the U.S. dollar strengthened. Gains narrowed through the session

MARKET ANALYSISGBPUSDGBP/USD Intraday: under pressure.Pivot:1.3495Our preference:Short positions below 1.3495 with targets at 1.3445 1.3425 in extension.Alternative scenario:Above 1.3495 look for fur

MARKET ANALYSISGBPUSDGBP/USD Intraday: under pressure.Pivot:1.3495Our preference:Short positions below 1.3495 with targets at 1.3445 1.3425 in extension.Alternative scenario:Above 1.3495 look for fur

MARKET ANALYSISGBPUSDGBP/USD Intraday: under pressure.Pivot:1.3495Our preference:Short positions below 1.3495 with targets at 1.3445 1.3425 in extension.Alternative scenario:Above 1.3495 look for fur

Introduction:Artificial intelligence has become one of the most influential forces reshaping the global economy in the modern era. Its impact is no longer limited to technological advancement; rather,

Metals Shakeout Wall Street‘s Tech Retreat: What’s Next for Gold Silver?The market spotlight today remains firmly on precious metals, even as global trading is subdued during the holiday season.Yest