公司简介

| BenchMark 评论摘要 | |

| 成立时间 | 5-10年 |

| 注册国家/地区 | 保加利亚 |

| 监管 | 可疑克隆 |

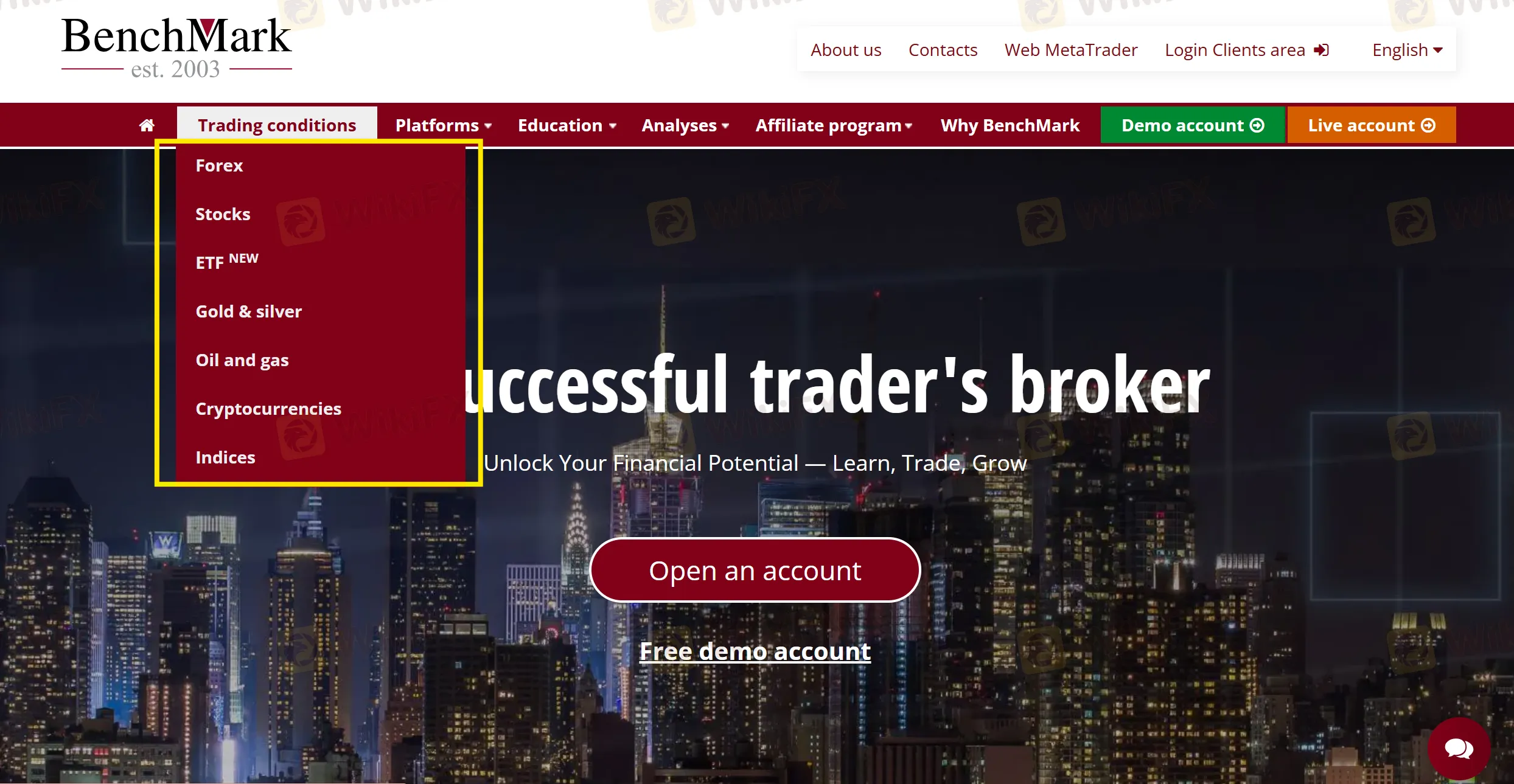

| 市场工具 | 外汇、加密货币、股票、ETF、金属、石油和天然气、指数 |

| 模拟账户 | ✅ |

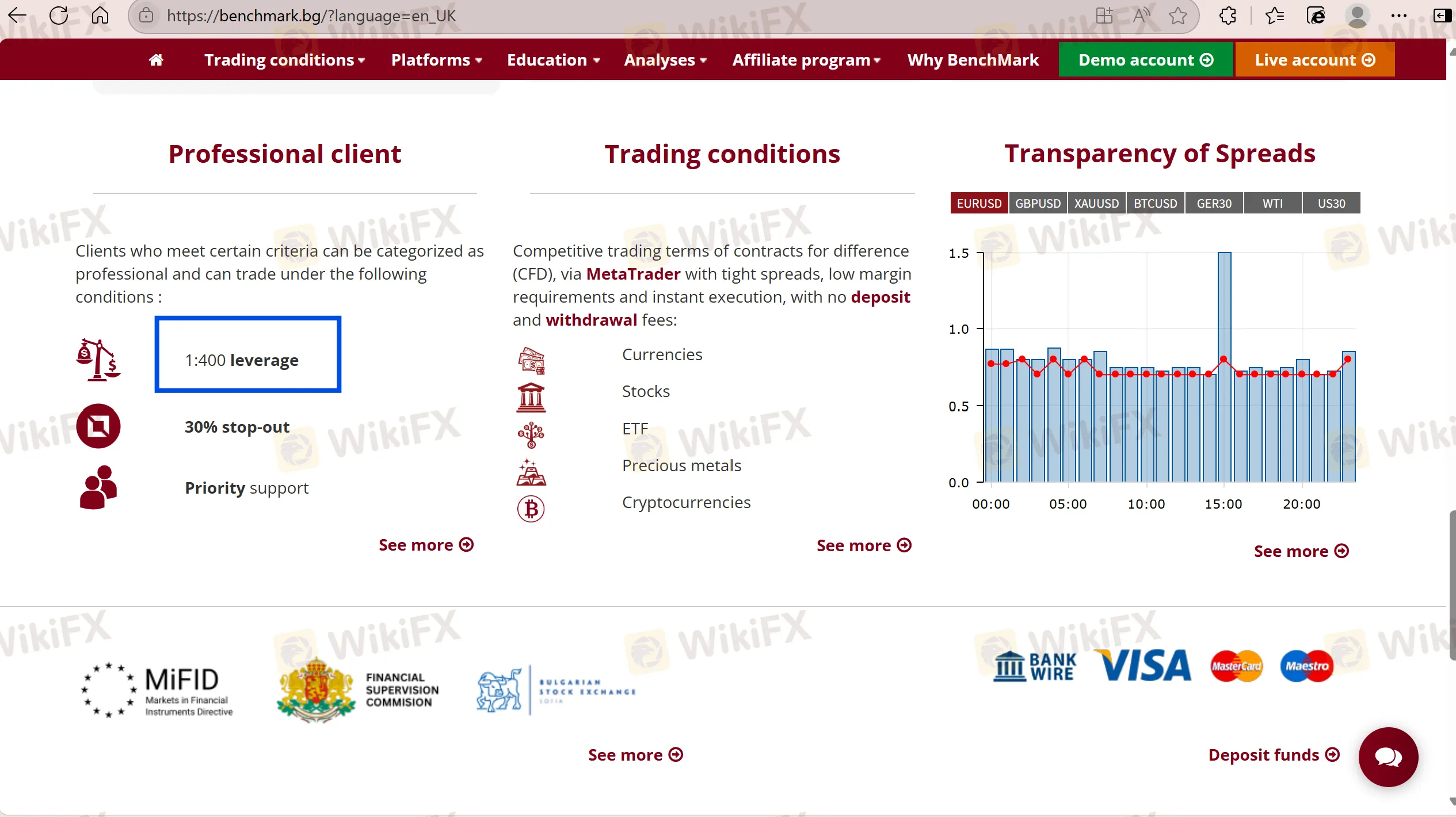

| 杠杆 | 最高1:400 |

| 点差 | 从0.6点起 |

| 交易平台 | MT4/MT5 |

| 最低存款 | / |

| 客户支持 | 电话:+359 2 962 54 05,+359 2 962 57 95 |

| 电子邮件:office@benchmark.bg,markets@benchmark.bg | |

| Facebook/Twitter/LinkedIn/TikTok/Instagram/YouTube | |

| 在线聊天 | |

BenchMark 信息

成立于2003年,隶属于BenchMark集团,BenchMark Finance是一家投资中介机构。专门提供跨国际市场交易金融工具的经纪服务,最大杠杆为1:400,包括货币对、股票、大宗商品、股指、基金、期货等。该公司还为资产(如股票、债券、赔偿票据和赔偿券)在保加利亚证券交易所进行交易提供便利。最低点差为0.6点。然而,由于其“可疑克隆”状态,BenchMark仍然存在风险。

优缺点

| 优点 | 缺点 |

| 提供模拟账户 | 可疑克隆许可证 |

| 24/5客户支持 | 缺乏账户信息 |

| 多种可交易工具 | |

| 支持MT4/MT5 | |

| 无存款和提款费用手续费 |

BenchMark 是否合法?

| 监管国家 | 当前状态 | 监管机构 | 许可证类型 | 许可证号码 |

| 可疑克隆 | 法国金融市场管理局(AMF) | 零售外汇许可证 | 75973 |

| 可疑克隆 | 德国联邦金融监管局(BaFin) | 零售外汇许可证 | 137382 |

| 可疑克隆 | 英国金融行为监管局(FCA) | 欧洲经授权代表(EEA) | 621564 |

| 可疑克隆 | 西班牙国家证券市场委员会(CNMV) | 零售外汇许可证 | 4100 |

我可以在BenchMark上交易什么?

BenchMark 提供多种市场工具,包括外汇、加密货币、股票、ETF、金属、石油和天然气、以及指数。

| 可交易工具 | 支持 |

| 外汇 | ✔ |

| 石油和天然气 | ✔ |

| 股票 | ✔ |

| 加密货币 | ✔ |

| 金属 | ✔ |

| ETF | ✔ |

| 指数 | ✔ |

| 期权 | ❌ |

| 债券 | ❌ |

| 共同基金 | ❌ |

账户类型

BenchMark 有两种账户类型:模拟账户和实盘账户。模拟账户主要用于让交易者熟悉交易平台,仅供教育目的。

| 账户类型 | 支持 |

| 模拟账户 | ✔ |

| 实盘账户 | ✔ |

BenchMark 费用

点差为0.6点。点差越低,流动性越快。

杠杆

最大杠杆为1:400,意味着利润和损失放大400倍。

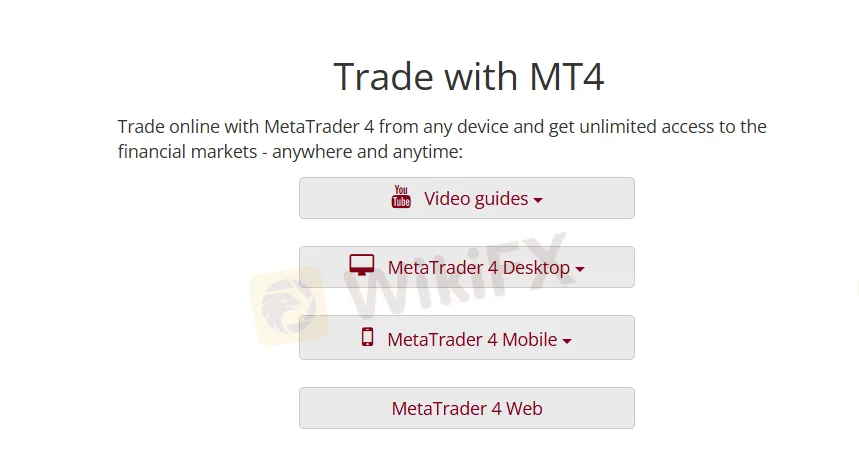

交易平台

BenchMark 与权威的MT4和MT5交易平台合作,可在桌面(Windows/MacOS)、移动端(Android/iOS)和Web进行交易。初学者更喜欢MT4而不是MT5。有丰富经验的交易者更适合使用MT5。MT4和MT5不仅提供各种交易策略,还实施EA系统。

| 交易平台 | 支持 | 可用设备 | 适合人群 |

| MT4 | ✔ | 桌面/移动端/Web | 初学者 |

| MT5 | ✔ | 桌面/移动端/Web | 有经验的交易者 |

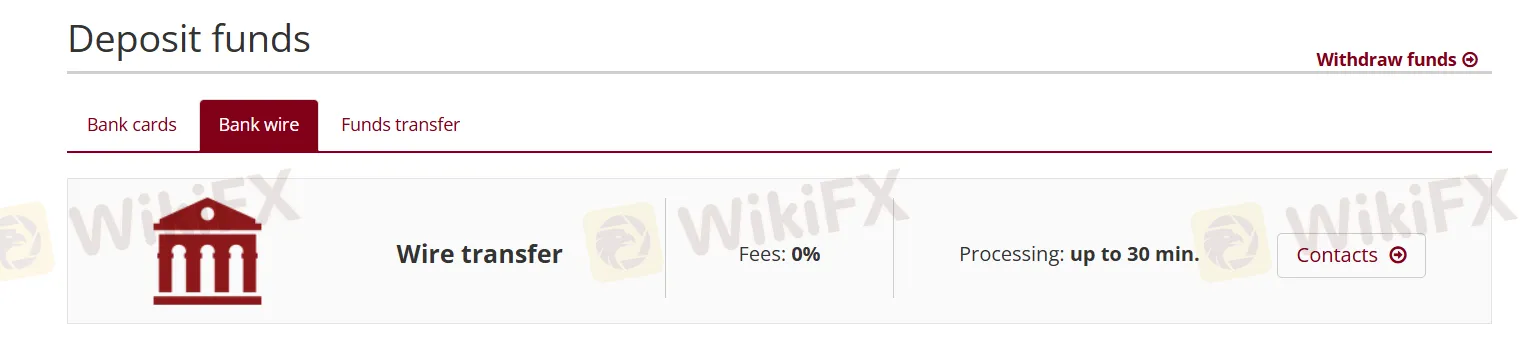

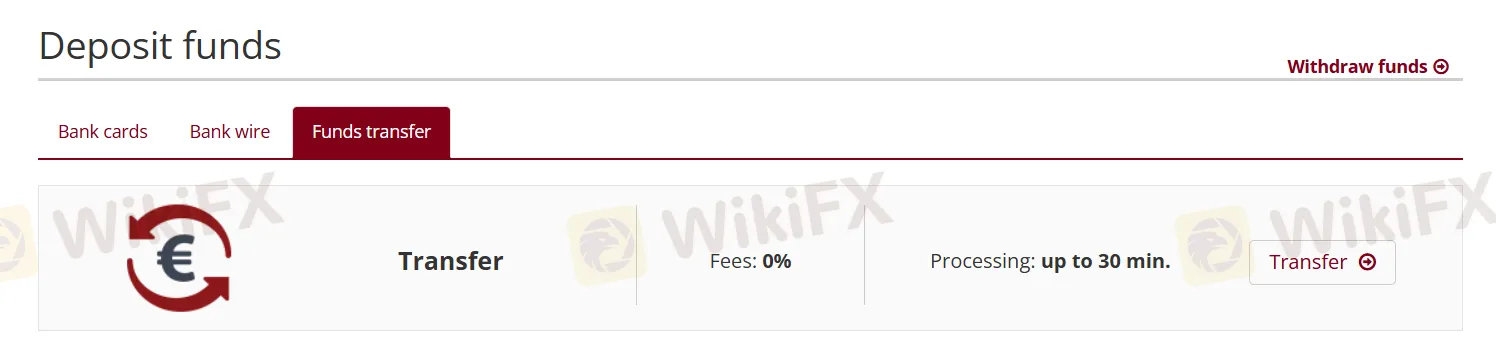

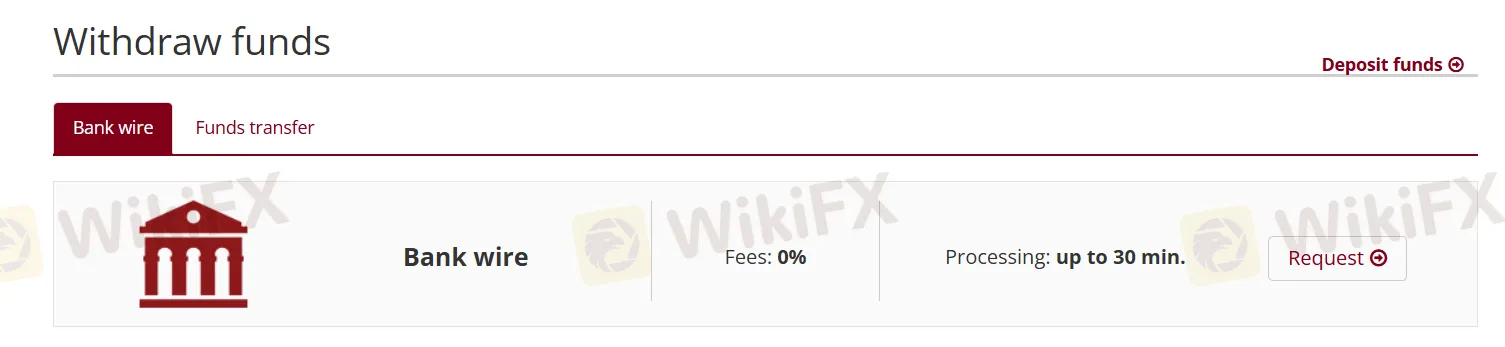

存款和取款

交易者可以通过借记/信用卡免费存入他们的账户,工作日全天24/7处理。电汇也是免费的,工作日在GMT时间07:00-14:45之间处理。客户账户资金转账随时接受,但在同一工作时间窗口内执行。对于提款,银行电汇可全天24/7提供,并在工作日GMT时间07:00-14:45之间处理。

| 存款方式 | 费用 | 处理时间 |

| 银行卡 | 0% | 最多30分钟 |

| 电汇 | 0% | 最多30分钟 |

| 转账 | 0% | 最多30分钟 |

| 提款方式 | 费用 | 处理时间 |

| 银行电汇 | 0% | 最多30分钟 |

| 转账 | 0% | 最多30分钟 |