公司简介

| 招银国际 评论摘要 | |

| 成立时间 | 2010 |

| 注册国家/地区 | 香港 |

| 监管 | SFC |

| 交易产品 | 股票、期权、期货 |

| 交易平台 | Yat Lung GloBal、SP Trader、Multicharts |

| 最低存款 | / |

| 客户支持 | 电话:(852) 3900 0888 |

| 社交媒体:微信 | |

| 实际地址:香港中环花园道3号冠君大厦45楼及46楼 | |

招银国际 信息

招银国际 成立于2010年,注册并设立于香港,是一家综合性金融机构。提供企业融资、资产管理、财富管理、全球市场和结构化金融等服务。提供股票、期货和期权交易,并配备三个交易平台供交易者使用。

优缺点

| 优点 | 缺点 |

| 受SFC监管 | 交易产品有限 |

| 3种交易平台 | 支付选项有限 |

| 提供多种服务 |

招银国际 是否合法?

| 监管机构 | 监管状态 | 监管国家/地区 | 监管实体 | 许可证类型 | 许可证号码 |

| 香港证监会(SFC) | 已监管 | 香港 | 招银国际 国际期货有限公司 | 从事期货合同交易 | ACQ651 |

产品和服务

招银国际 是一家综合性金融服务机构。其产品和服务包括企业融资、资产管理、财富管理、全球市场、结构化金融等。

为客户提供专业高质量的综合金融服务,如香港上市赞助和承销、上市公司配售和配股、财务咨询、债券发行服务、资产管理、直接投资、财富管理、股票买卖和交易等。

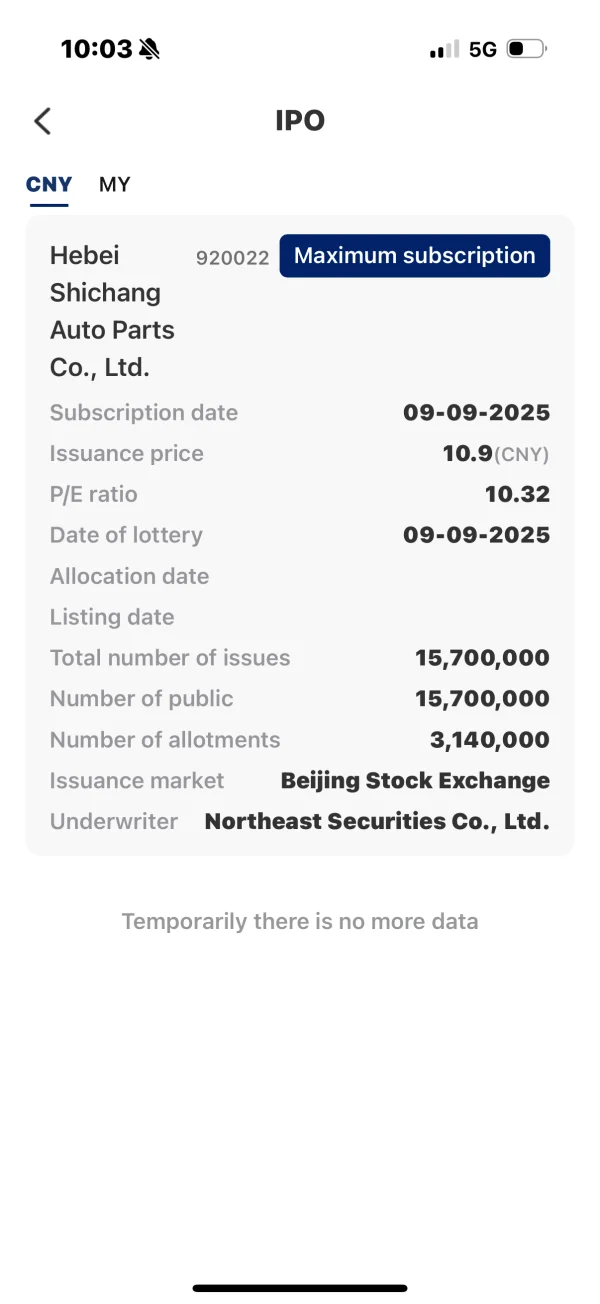

交易者可以交易股票、期权和期货。

| 交易产品 | 支持情况 |

| 股票 | ✔ |

| 期权 | ✔ |

| 期货 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 交易所交易基金 | ❌ |

账户类型

招银国际国际没有提供明确的账户类型。但是,对于个人证券账户开户,可以参考以下几种方法:

- 无需见证的在线开户(不适用于持有中华人民共和国居民身份证的人士):使用IOS/Android“易隆环球”APP的移动版本进行完全在线操作,无需见证。详情请参考以下网页:https://app.cmbi.info/appweb/knowledge/detail?id=395

- 线下开户:您需要亲自前往中国招商银行国际,位于香港中环花园道3号观光大厦46楼。或者您可以通过邮寄方式开户(不适用于持有中华人民共和国居民身份证的人士)。

- 如果您是招商银行的客户,请拨打调用 400-120-9555(内地)/(852)3761-8888(香港)或发送电子邮件至crm@cmbi.com.hk。

- 银证转账服务:该服务是公司与招商银行香港分行和招商永隆银行的合作,实现客户银行账户和证券账户之间资金的互相转移。通过该服务存入的资金将直接转入客户的证券账户,无需传真确认。

招银国际费用

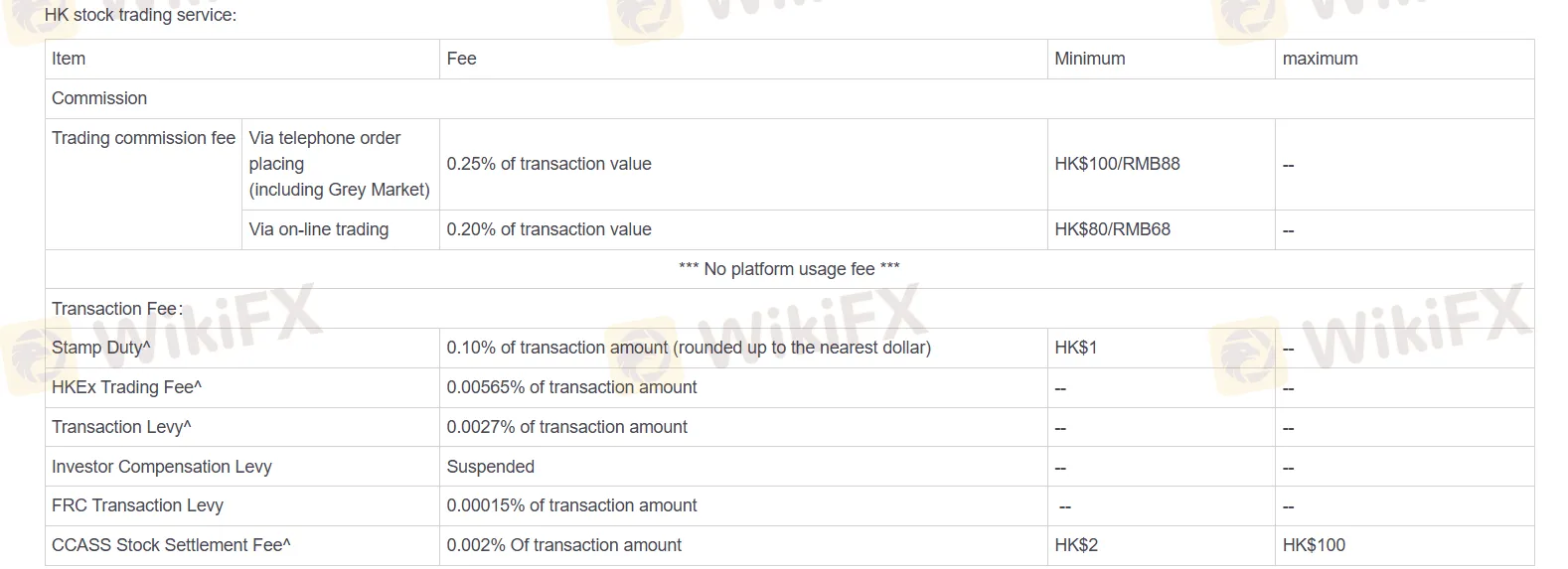

股票、期权和期货的交易手续费各不相同。这里以香港股票交易佣金为例。更详细的信息,请参考:https://www.cmbi.com.hk/en-US/commision#navs

| 费用 | 金额 | 最低收费 | 最高收费 |

| 佣金 | 电话订单(包括灰市):交易金额的0.25% | HK$100/RMB88 | -- |

| 网上交易 | 交易金额的0.20% | HK$80/RMB68 | -- |

| 印花税 | 交易金额的0.10% | HK$1 | -- |

| SEHK交易费 | 交易金额的0.00565% | -- | -- |

| 交易征费 | 交易金额的0.0027% | -- | -- |

| FRC交易征费 | 交易金额的0.00015% | -- | -- |

| CCASS股份结算费 | 交易金额的0.002%(基于合同订单) | $2 | $100 |

交易平台

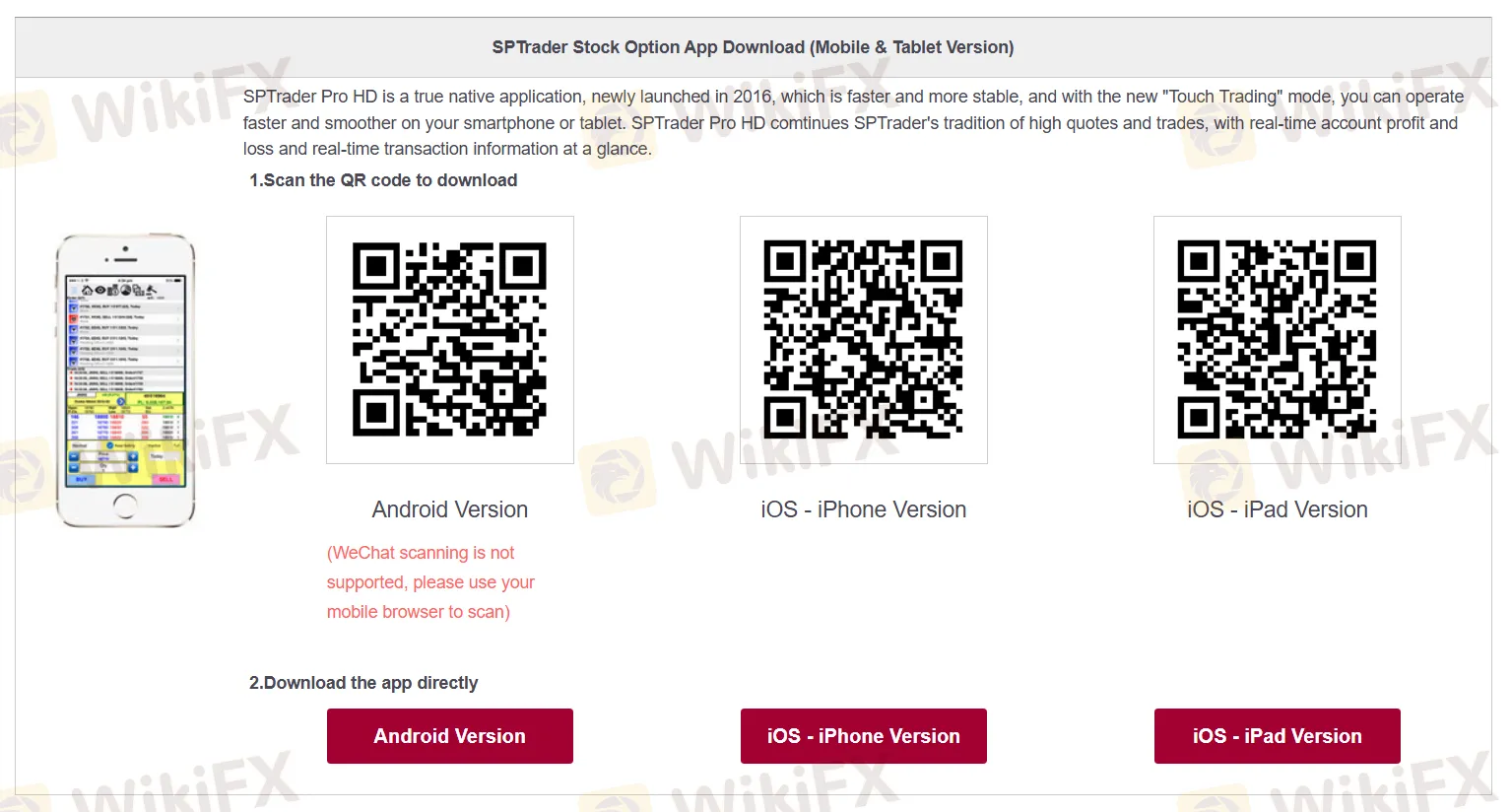

提供3种类型的交易软件,可交易股票、期权和期货,分别支持在台式机、手机和平板电脑上使用。

| 交易平台 | 支持 | 可用设备 |

| 一隆环球 | ✔ | 手机 |

| SP Trader | ✔ | 台式机、手机、平板电脑 |

| 多图表 | ✔ | 台式机 |

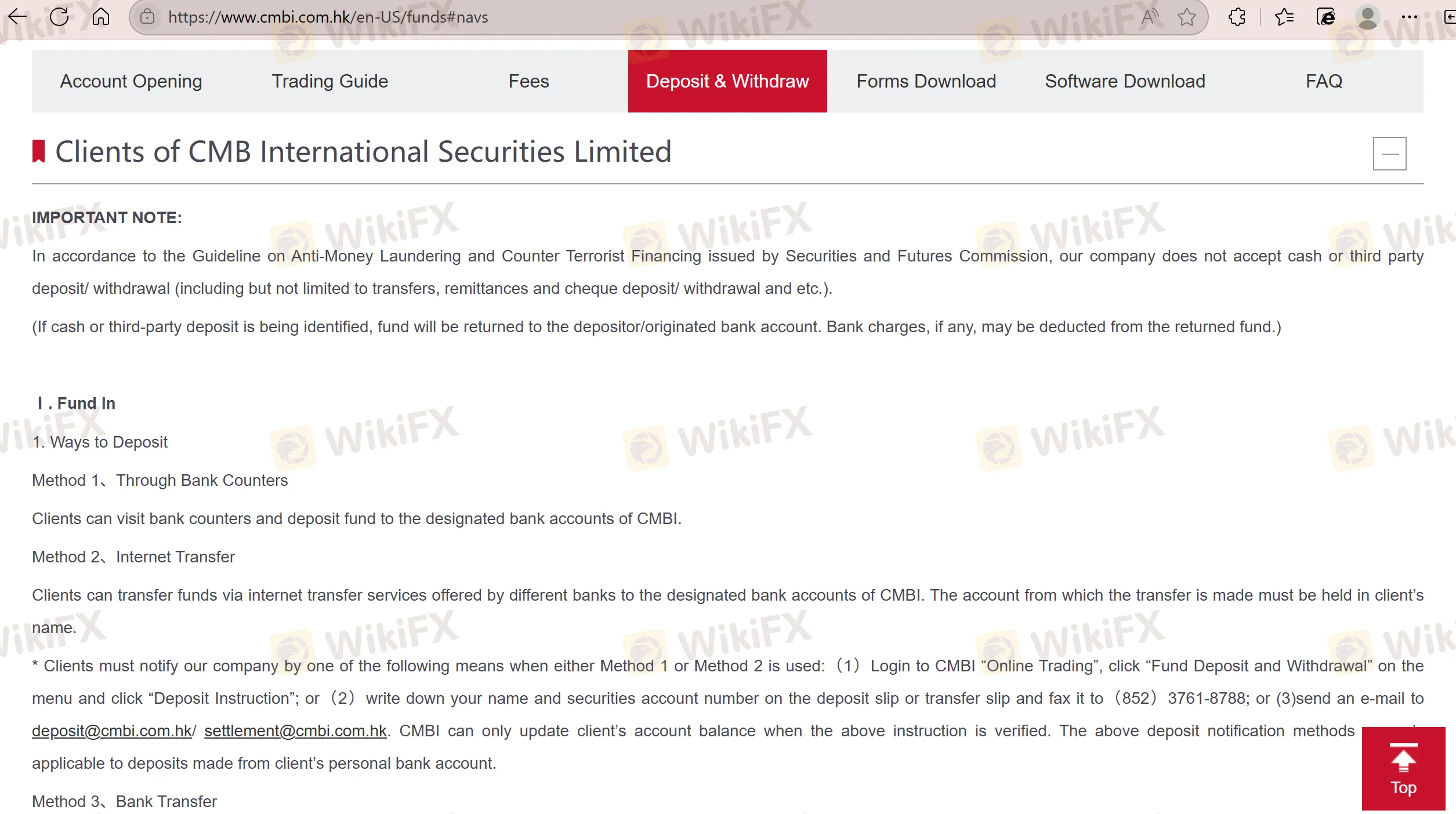

存取款

股票交易的存取款方式如下:

存款

通过银行柜台

客户可以前往银行柜台,向招银国际I的指定银行存款。

网银转账

客户可以通过不同银行提供的网银转账服务向招银国际I的指定银行转账。转账账户必须以客户名义持有。

客户在使用方法1或方法2时,必须通过以下一种方式通知我公司:(1) 登录招银国际I“在线交易”,点击菜单中的“存取款”并点击“存款指示”; 或 (2) 在存款单或转账单上写下您的姓名和证券账号,传真至(852) 3761-8788; 或 (3) 发送电子邮件至deposit@cmbi.com.hk/settlement@cmbi.com.hk。只有在验证上述指示后,招银国际I才能更新客户的账户余额。

银行转账

此方法仅适用于成功申请此服务的客户。只需访问招银国际香港分行网站,登录“家居银行服务”并转账。在任何交易日的上午8:30至下午4:00之间进行的转账将立即显示在客户的银行余额中(无需存款通知)在招银国际I交易系统。当转账超出上述时间段时,银行余额的更新将在下一个交易日进行处理。

取款

资金取款指示表

- 邮寄至香港中环花园道3号冠君大厦45楼;

- 传真至(852) 3761-8788;

- 发送电子邮件至settlement@cmbi.com.hk

请通过以下任一方式提交填写完整的“资金取款指示表”:

登录互联网交易系统(取款)

在网站上的“存取款”下选择“取款指示”。此方法适用于成功申请我们的互联网交易服务并向招银国际I提交账户信息的客户。

登录互联网交易系统(转账)

在网站上的“转账”下使用“资金转账”选项。此方法适用于成功申请互联网交易服务并向招银国际I提交账户信息的客户。

FX2489918960

马来西亚

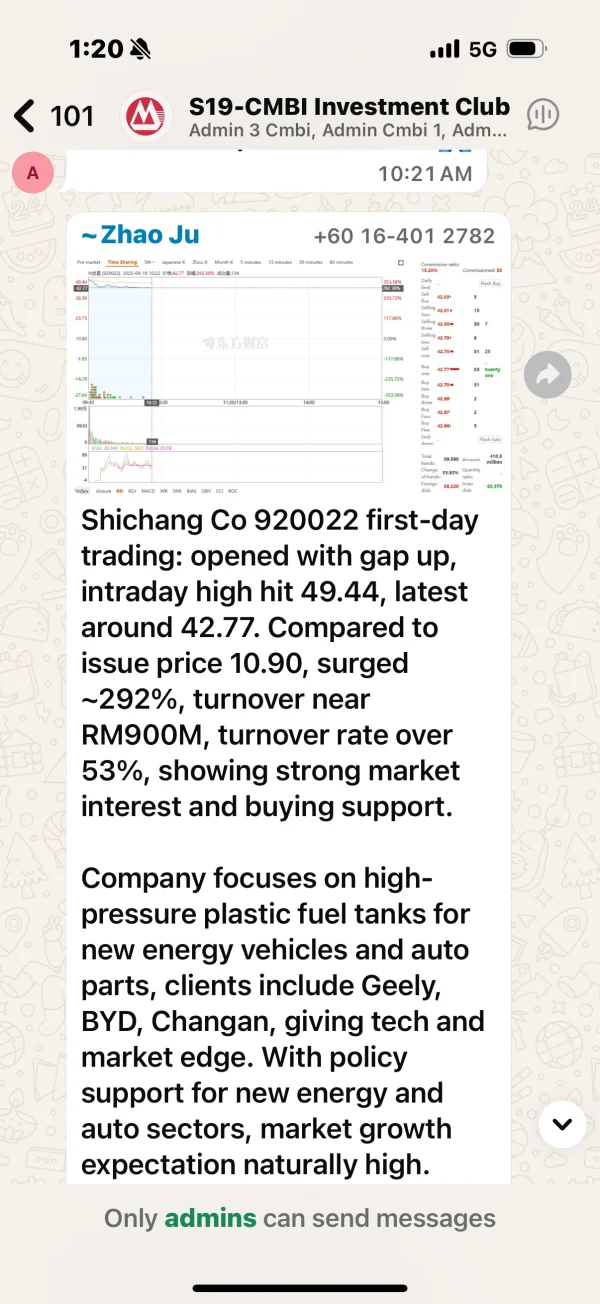

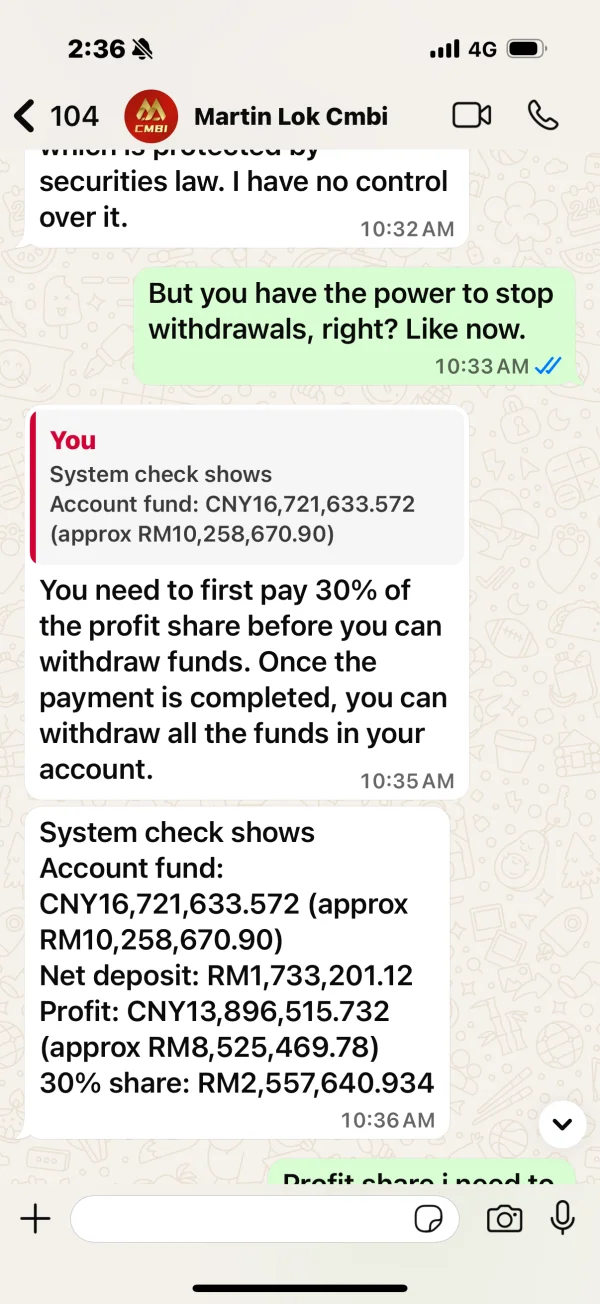

该公司与香港及中国内地多家企业及银行勾结,操纵中国股市。这家欺诈公司随后在交易后阻止用户提现。

曝光

龙瑞

香港

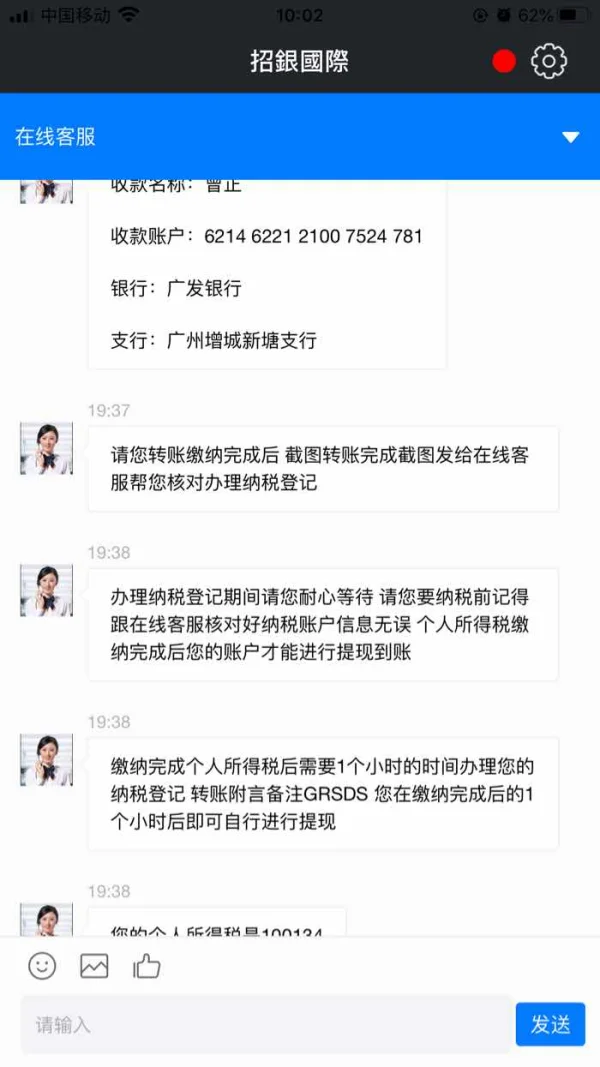

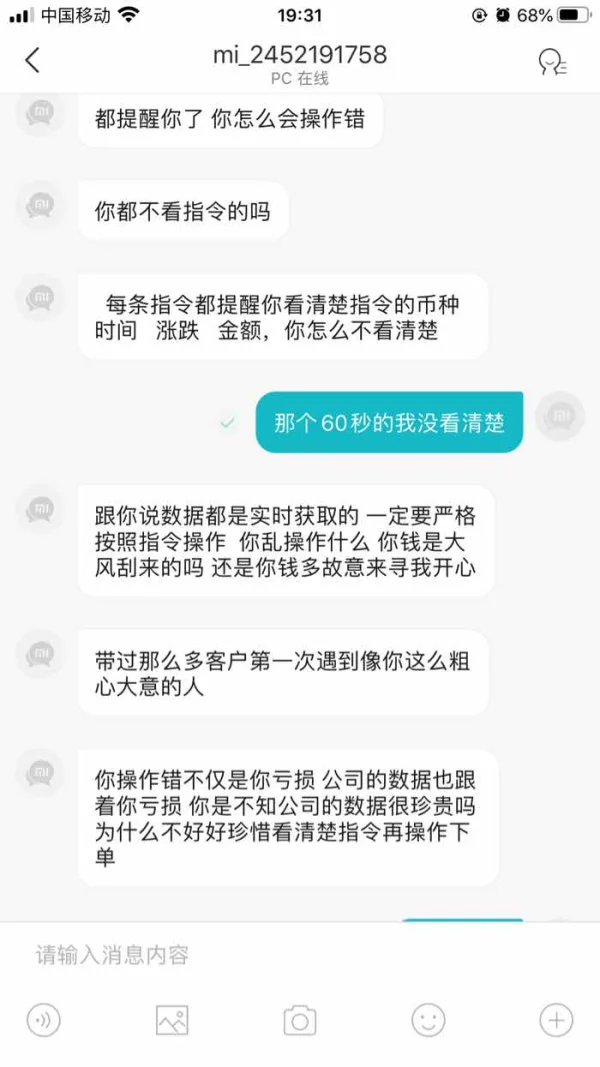

所谓的程序员一通轰炸下达的指令,亏了叫你重新充值,然后盈利以后要求交个人所得税才能提现,现实是残酷无情的

曝光

龙瑞

香港

各种要求你交费,交税,全都是借口就是不给你提现

曝光

西风古道

秘鲁

CMB 是我遇到过的最合法的金融公司之一。我在他们的平台上交易过股票并进行过一些金融交易,费用非常透明。此外,交易环境公平,没有黑幕。客户服务代表很准时,始终专业并且了解他们的东西。

好评

สมพง พระประแดง

泰国

该经纪人说要为交易提供奖金。交易一段时间后,提现不能提现。说经纪员工感染了covid不能做事我从去年就在等现在就下定决心

曝光