公司简介

| NOMURA 评论摘要 | |

| 成立时间 | 1994年 |

| 注册国家/地区 | 日本 |

| 监管机构 | FSA |

| 市场工具 | 国内股票、外国股票、投资信托、债券、外汇、房地产ST |

| 模拟账户 | / |

| 杠杆 | 1:25 |

| 点差 | USD/JPY: 2.8点 |

| 交易平台 | 野村资产管理应用程序("NOMURA"),资产管理应用程序("OneStock"),野村FX应用程序 |

| 最低存款 | / |

| 客户支持 | - 一般拨号:0570-077-000 |

| - 替代:042-303-8100 | |

NOMURA 信息

野村证券提供股票、投资信托、外汇交易和结构化房地产。其先进的交易系统和严格的监管控制服务于零售和机构客户。该公司的成本结构因服务渠道而异,分行利率远高于在线利率。

优点和缺点

| 优点 | 缺点 |

| 受FSA监管 | 分行交易的手续费较高 |

| 全包式交易应用和平台 | 与竞争对手相比,杠杆有限 |

| 众多可交易的工具 | 无模拟账户可用 |

NOMURA 是否合法?

是的,野村受到监管。日本的FSA在零售外汇牌照下监督其业务。许可证号码为关东财务局长(金商)第142号,有效日期为2007-09-30。

服务和产品

该经纪人提供本地和外国股票、投资信托、债券、外汇交易和保险产品等广泛的金融产品和服务。他们提供支持服务,包括活动促销、继承准备和智能手机应用。

| 可交易工具 | 支持 |

| 国内股票 | ✔ |

| 外国股票 | ✔ |

| 投资信托 | ✔ |

| 债券 | ✔ |

| 外汇 | ✔ |

| 房地产结构化产品(ST) | ✔ |

| 大宗商品 | ❌ |

| 加密货币 | ❌ |

| ETF | ❌ |

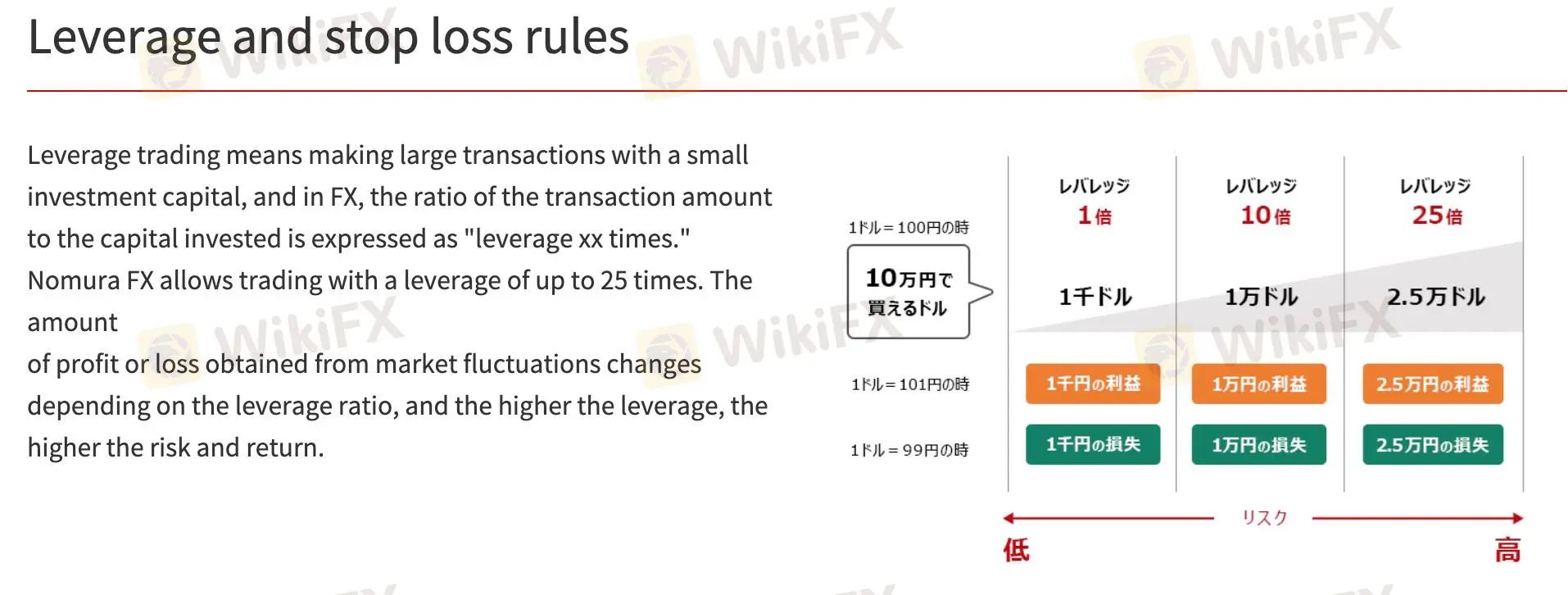

杠杆

Nomura FX允许交易者使用25倍杠杆进行更大规模的交易,以较少的资金。高杠杆提高了利润,但也增加了损失。Nomura FX的“止损规则”会在“保证金维持率”低于100%时自动平仓,降低了风险。交易者应该谨慎,因为突然的市场变动可能导致损失超过存入的现金,即使设置了止损。

NOMURA费用

Nomura的费率因服务而异,实体分行和仅在线交易的费率不同手续费。实体分行对国内股票交易收费远高于互联网账户。

| 费用类型 | 收费 |

| 股票转让至其他公司(<20股) | 基本费用:550日元 + 550日元/股(最低1,100日元)。 |

| 股票转让至其他公司(>20股) | 统一费用:11,000日元。 |

| 额外购买股票 | 每股330日元。 |

| 余额或交易证明 | 个人交易免费;每个账户多次交易收取1,000日元。 |

无手续费:Nomura FX不收取明确的交易手续费,而是通过点差获得收入。

掉期利率:交易者根据交易货币之间的利率差异可能获得或支付掉期点数。掉期点数根据市场条件波动。

货币兑换:对于非日元货币交易,可能需要额外的日元兑换点差。

| 货币对 | 点差(pips) |

| USD/JPY | 2.8 |

| EUR/JPY | 5.3 |

| GBP/JPY | 6.9 |

| AUD/JPY | 4.9 |

| EUR/USD | 2.9 |

交易平台

| 交易平台 | 支持 | 可用设备 | 适合何种交易者 |

| Nomura资产管理应用“NOMURA” | ✔ | iPhone,Android | 管理多种金融资产并寻求个性化交易工具的交易者和投资者。 |

| 资产管理应用“OneStock” | ✔ | iPhone,Android | 希望了解其资产概况,并具有资产诊断等附加功能的投资者。 |

| Nomura FX应用 | ✔ | iPhone,Android | 偏好在移动设备上进行直观和专注操作的外汇交易者。 |