公司简介

| RRR Capital 评论摘要 | |

| 注册年份 | 2017 |

| 注册国家/地区 | 毛里求斯 |

| 监管 | 无监管 |

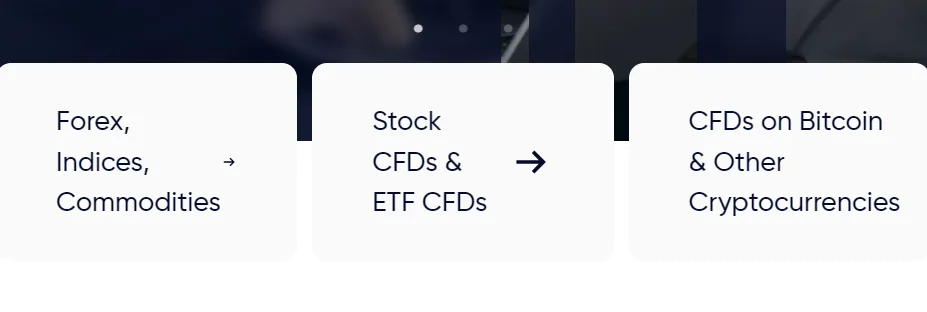

| 市场工具 | 外汇、指数、股票、加密货币、金属和能源 |

| 模拟账户 | ✅ |

| 杠杆 | 最高达1:500 |

| 点差 | 从1.5点起(标准账户) |

| 交易平台 | MT5 |

| 最低存款 | $100 |

| 复制交易 | ✅ |

| 客服支持 | support@rrrcapital.com |

| +23052970901 | |

| 联系表单 | |

| Facebook、Instagram | |

| 地区限制 | 美国、日本、朝鲜 |

RRR Capital 信息

RRR Capital 是一家为零售和机构客户提供衍生品交易服务的全球经纪商,包括外汇、大宗商品、指数、股票差价合约和加密货币。该平台提供多种账户类型以适应和复制交易功能,MT5交易平台助力交易。

优缺点

| 优点 | 缺点 |

| 多种交易工具 | 未受监管 |

| 灵活的账户类型 | 严格的地区限制 |

| 提供MT5 | 仅接受加密货币支付 |

| 点差低至0.2点 | |

| 提供复制交易 |

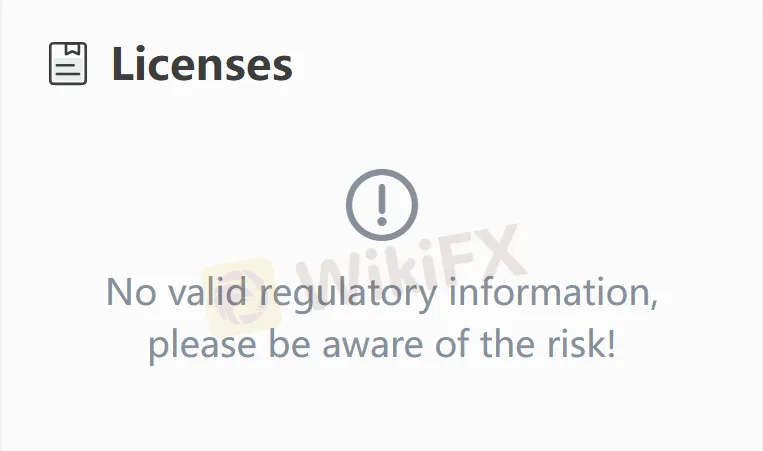

RRR Capital 是否合法?

RRR Capital 是无监管的。尽管该平台声称持有毛里求斯金融服务委员会(FSC)颁发的金融许可证(许可证号:GB23202044),交易者可以访问监管机构的官方网站以获取更多验证。

我可以在RRR Capital上交易什么?

| 可交易工具 | 支持 |

| 外汇 | ✔ |

| 指数 | ✔ |

| 股票 | ✔ |

| 加密货币 | ✔ |

| 金属 | ✔ |

| 能源 | ✔ |

| ETF | ❌ |

| 债券 | ❌ |

| 共同基金 | ❌ |

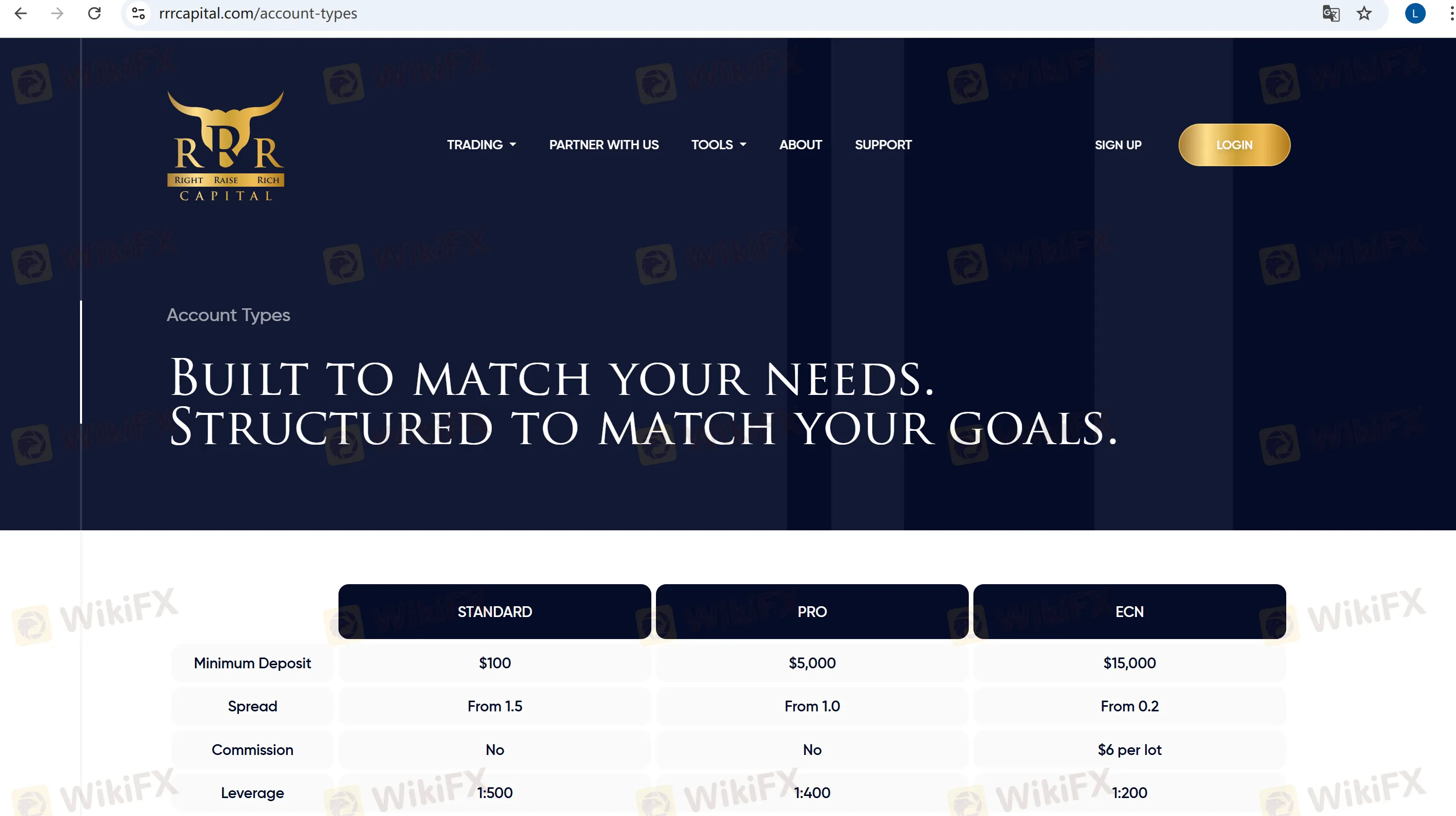

账户类型

该平台提供三种核心账户类型。标准账户适合初学者,ECN账户具有最低点差但需要支付佣金,VIP账户余额成本和杠杆。

| 账户类型 | 标准 | 专业 | ECN |

| 最低存款 | $100 | $5,000 | $15,000 |

| 点差 | 从1.5点 | 从1.0点 | 从0.2点 |

| 佣金 | 无 | 无 | 每手$6 |

| 杠杆 | 1:500 | 1:400 | 1:200 |

| 免息交易 | 10天 | 10天 | 免费 |

杠杆

RRR Capital 提供高达1:500的杠杆,适合风险承受能力强的经验丰富的交易者。

RRR Capital 费用

RRR Capital 提供低至0.2点的点差,ECN账户可获得,但每手额外佣金为$6。其他账户无佣金。此外,标准/VIP账户提供10天免息交易,而ECN账户拥有永久免息交易。

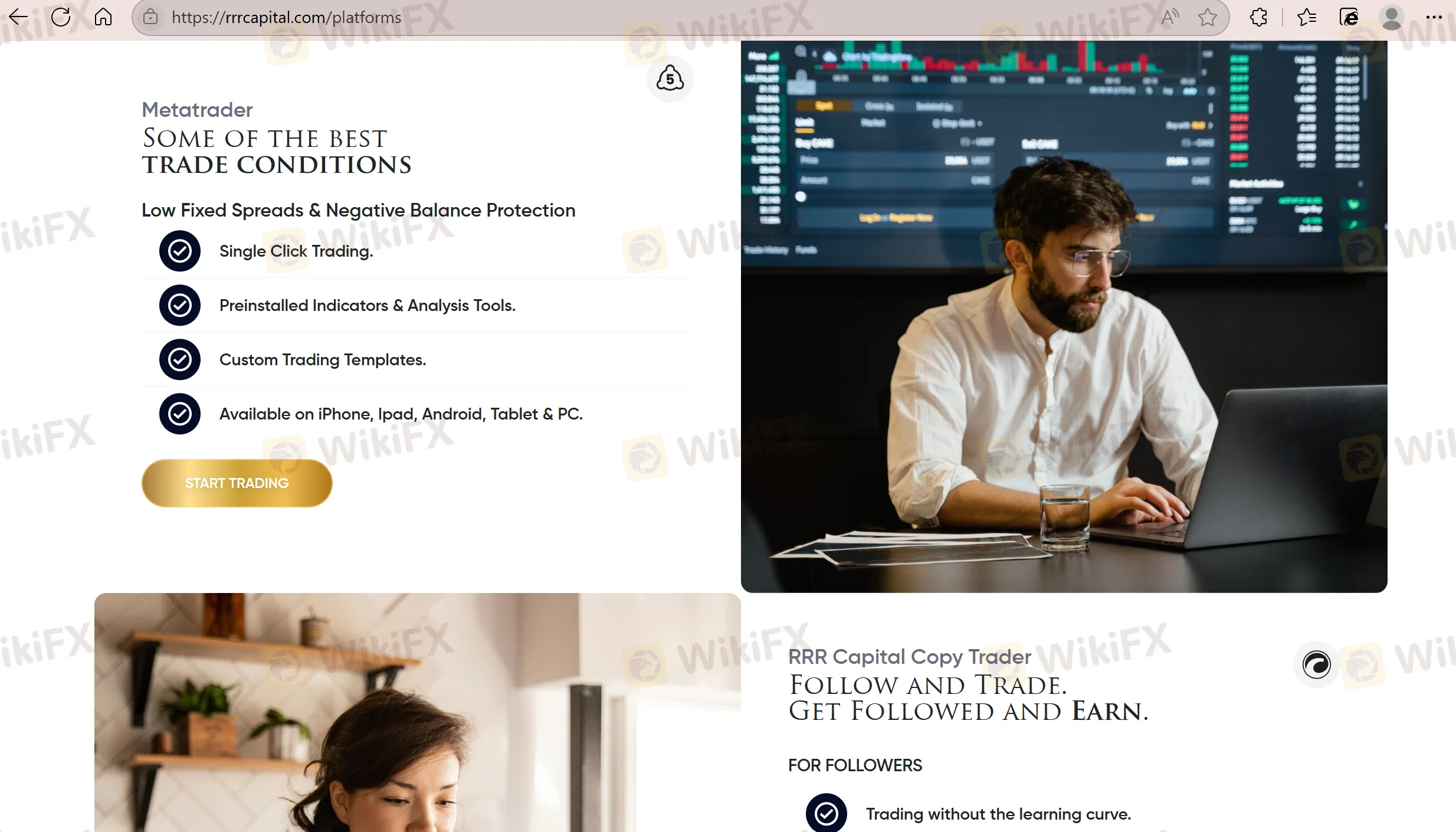

交易平台

RRR Capital 提供主要平台 MetaTrader 5,支持 PC、手机和平板电脑的多终端同步。

| 交易平台 | 支持 | 可用设备 | 适用对象 |

| MetaTrader 5 | ✔ | PC、手机和平板电脑 | 经验丰富的交易者 |

| MetaTrader 4 | ❌ | / | 初学者 |

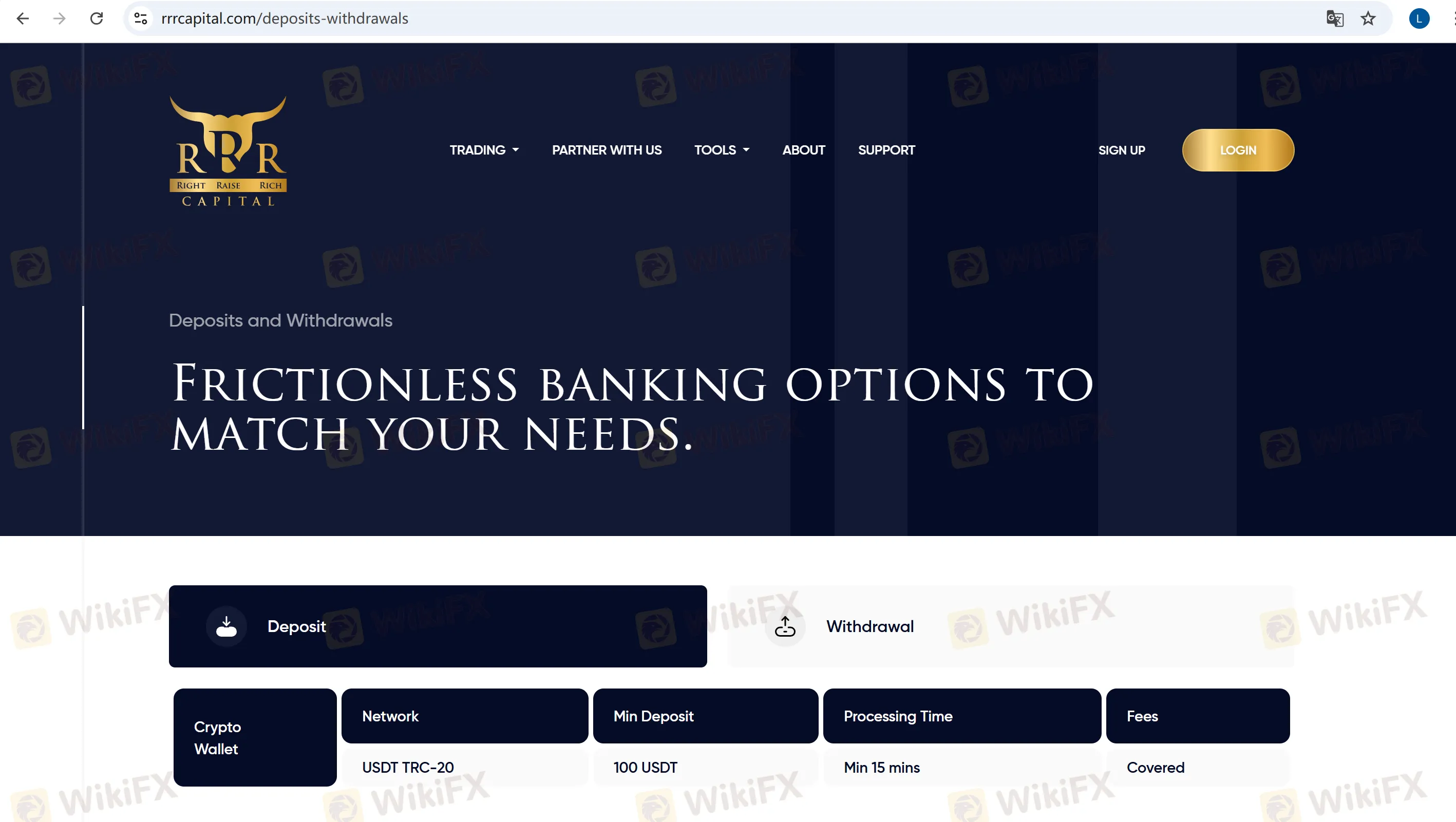

存款和取款

存款

RRR Capital 支持 USDT TRC-20 等加密货币钱包(最低 100 USDT,15 分钟内到账,平台承担 手续费)。此外,还提供本地银行转账和国际电汇。

取款

通过 USD TRC-20 加密货币钱包取款(最低 100 美元)将在 24 小时内处理。加密货币 存款必须通过原始路径取款;超过存款金额的部分可以通过替代方法取款(优先顺序:加密货币 → 本地存款 → 网上银行)。国际电汇和加密货币钱包的费用由用户承担(例如,币安美元转账费为 1%)。

复制交易

跟随者可以从 15 美元的最低存款开始跟随大师并自动复制交易,而交易大师需要存入 100 美元激活他们的 账户 并设置分润比例。

Mohamed Lewaa

越南

市场覆盖广泛,流动性足够深厚,适合所有风险偏好的交易者。

好评

Giorgos Lazos

新西兰

PRP Capital的MetaTrader平台速度慢,有时会停止工作。这很烦人,因为当它不工作时,我无法交易。设计很好,但使用起来没有我想象的那么容易。

中评

FX9030956552

法国

RRR Capital 拥有一个用户友好且设计良好的交易平台。搜索功能简单易用。界面高度可定制,并有清晰的费用报告。虽然如果您是交易新手,您可能会发现理解这些术语有点困难,但他们的优点是他们拥有出色的客户支持,可以帮助您做到最好。

好评

FX1127340201

荷兰

我对 RRR Capital 感到 100% 满意。当然,您知道客户支持非常重要。我与他们的客户支持体验是 100% 完美的。对我来说难以置信的好。

好评

chao

美国

标准账户的点差比我想象的要高,欧元兑美元有时会达到 5-10 点,除此之外,没有什么大问题。提款基本上没问题。

中评