公司简介

| nabtrade评论摘要 | |

| 成立时间 | 2-5年 |

| 注册国家/地区 | 澳大利亚 |

| 监管 | 未受监管 |

| 交易平台 | nabtrade(桌面/移动) |

| 领英、推特、YouTube、Facebook | |

nabtrade 信息

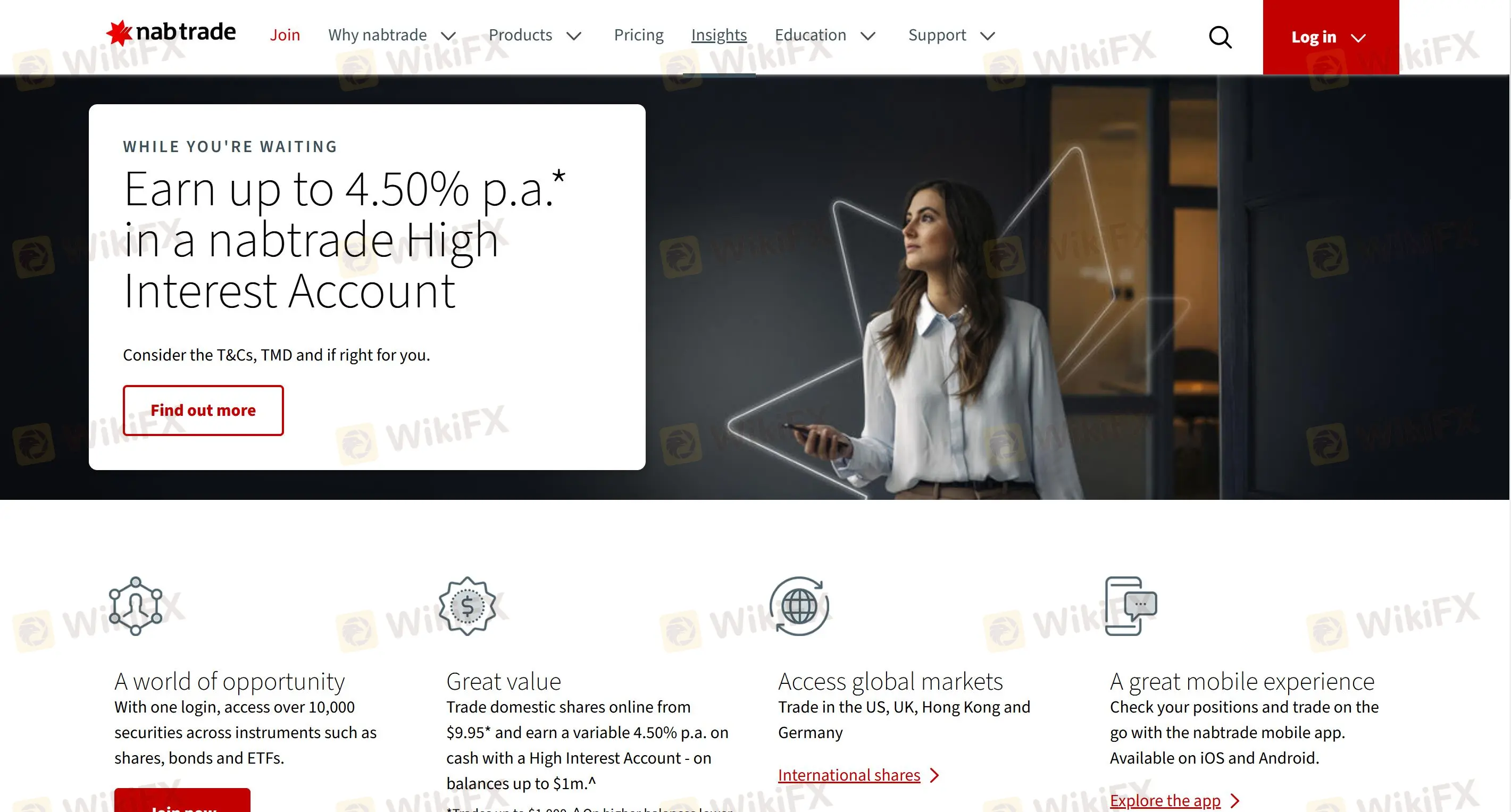

nabtrade 是一家投资平台,提供各种产品和资产类别,如股票、固定收益和现金以及管理投资。它还提供灵活期限为3至10年的NAB保证金贷款,起始金额为20,000美元,并享受2.0%的特别折扣。客户可以借款投资于多种选择,包括澳交所上市证券、国际股票和管理基金。

nabtrade 提供国内和国际股票的在线交易,最低为9.95美元*(国际股票加外汇交易所)

此外,nabtrade 使用高利率账户,可以获得每年4.50%的浮动现金利率-最高可达100万美元的余额。开设一个提供0.5%-1.85%年利率的现金账户,以结算国内和国际交易。

nabtrade 是否合法?

nabtrade 没有受到监管,相比受监管的平台来说,安全性较低。

账户类型

每个新的nabtrade客户可以开设国内交易账户、国际交易账户和综合现金账户,并可使用其他服务,包括nabtrade高利率账户、nabtrade IRESS Views、NAB保证金贷款和SMSF设立和管理服务。

| 账户类型 | 支持 |

| 国内交易账户 | ✔ |

| 国际交易账户 | ✔ |

| 综合现金账户 | ✔ |

交易平台

nabtrade 提供专有的桌面和移动交易平台,可直接访问各种产品,包括国内和国际股票、交易所交易基金、债券等,全部来自一个账户。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| nabtrade | ✔ | 桌面/移动 | 所有投资者 |