公司简介

| 中衍期货评论摘要 | |

| 成立时间 | 1996 |

| 注册国家/地区 | 中国 |

| 监管 | CFFEX |

| 产品与服务 | 期货、经纪、投资、咨询、资产管理、基金 |

| 模拟账户 | ✅ |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | 中衍期货App、博易客户云、文华财经、亿盛极星、TradeBlazer |

| 最低存款 | / |

| 客户支持 | 在线聊天 |

| 电子邮件:office@cdfco.com.cn | |

| 电话:400-688-1117 | |

| 地址:中沿期货有限公司,北京市朝阳区东四环北路82号金长安大厦B座7层 | |

中衍期货信息

成立于1996年,中衍期货有限公司是中国金融期货交易所(CFFEX)监管的实体。然而,它只为中国境内客户提供服务,在国内衍生品市场中占据重要地位。它是中国证券监督管理委员会(CSRC)批准的一家综合性金融公司,专门从事国内商品期货经纪、金融期货经纪、期货交易咨询、资产管理以及证券投资基金销售的业务。

优点与缺点

| 优点 | 缺点 |

| 受CFFEX监管 | 缺乏透明度 |

| 专注于期货交易 | |

| 支持模拟交易 | |

| 多种交易平台 | |

| 悠久的运营历史 |

中衍期货是否合法?

中衍期货受CFFEX监管,许可证号为0197。

| 监管国家 | 监管机构 | 监管状态 | 受监管实体 | 许可证类型 | 许可证号码 |

| 中国 | 中国金融期货交易所(CFFEX) | 受监管 | 中国商品期货有限公司 | 期货许可证 | 0197 |

产品与服务

中衍期货主要专注于期货交易,并提供全方位的投资服务,如经纪、投资、咨询、资产管理和基金。

| 产品与服务 | 支持 |

| 期货 | ✔ |

| 基金 | ✔ |

| 经纪 | ✔ |

| 投资 | ✔ |

| 咨询 | ✔ |

| 资产管理 | ✔ |

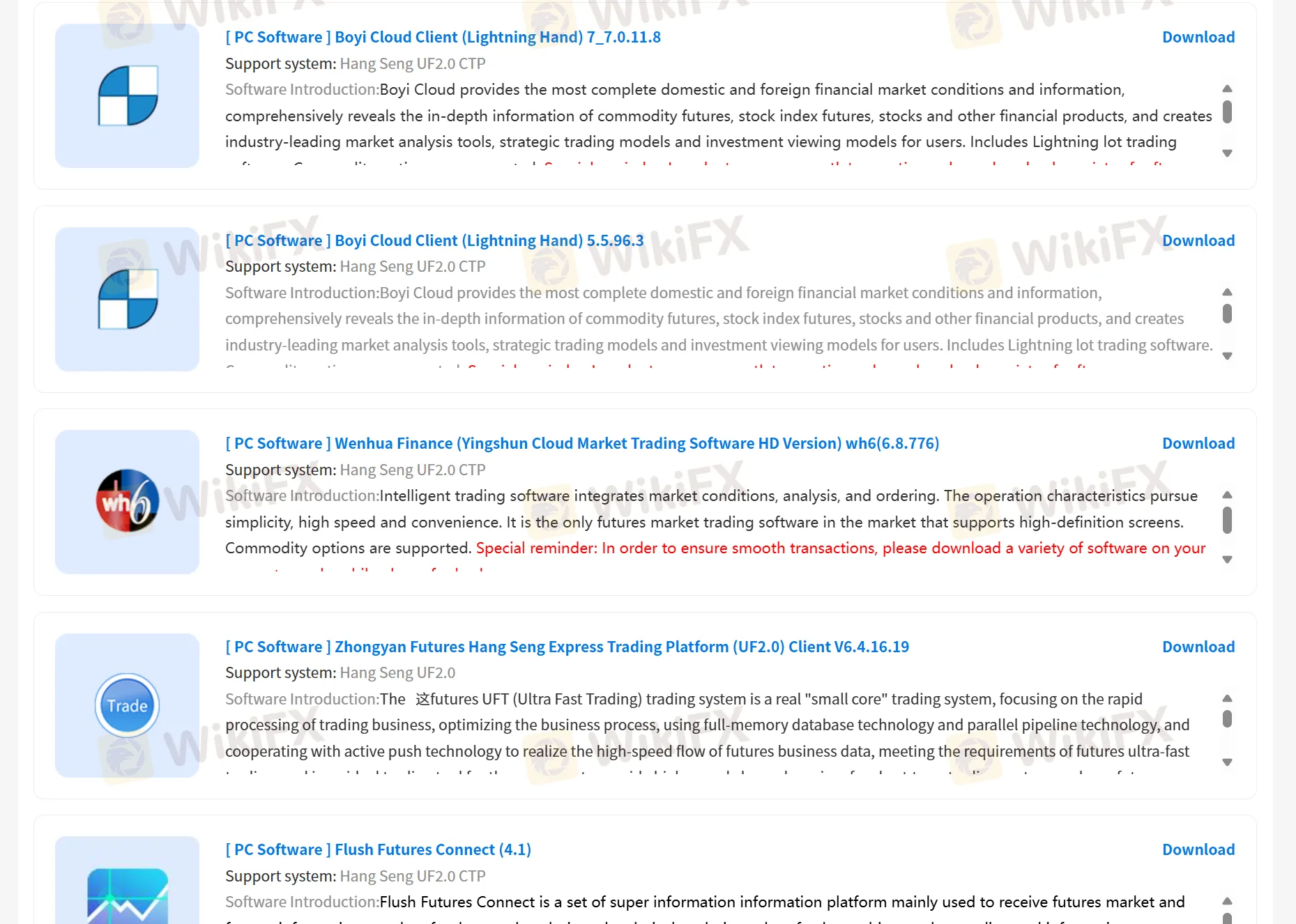

交易平台

中衍期货期货支持通过专有平台、中衍期货App、博易客户端云、文华金融、亿盛北极星和TradeBlazer进行交易。此外,还为客户提供模拟交易的机会。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| 中衍期货App | ✔ | PC,手机 | / |

| 博易客户端云 | ✔ | PC | / |

| 文华金融 | ✔ | PC | / |

| 亿盛北极星 | ✔ | PC | / |

| TradeBlazer | ✔ | PC | / |

扶众法援

香港

今年3月,我收到了好友申请,因为我也最近在一些论坛留言过,所以觉得应该是某名股友找我讨论。添加好友之后,立刻被拉进了内幕操作预备群,他们先是操作股票,还公布了自己在平台账户盈利了几倍的截图,让我有点信服。刚好天天在家闲来无事做便想赚点零花钱,我也就没有退群,群里面每天有老师都会分享这方面的知识,也有很多群友在里面跟着老师在做,看他们都是赚了的,我来了兴趣也就私聊老师也开了个户每天跟他们操作。 后来这个老师一直强调跟我说,资金越大危险越小,让我加大资金加到50万,可以给我推荐更加专业老师喊单跟着老师操作,老师会帮我看着单子,不需要自己太费心。我说我没有这么多,就先这样操作吧,后来有托过来说跟着老师做,老师专业,自己做会亏得,将信将疑商量着给我先安排老师,条件是先把资金加到50万多,后面再加。开始老师操作有赚有亏。后来亏到剩下10W多的时候我想试一下出金通道,发现一直没有到账。再次申请时却发现之前的申请已经被驳回了,完全不是出入金自由的模式,这个时候我意识到不对劲,和平台联系被告知我账号有风险暂不给与出金。和老师联系也是一样的话敷衍,接着又是给我发什么“出入金延迟通告”什么的原因一直搁置了一个多星期。

曝光

Cris Men

厄瓜多尔

我从未在提款或类似事情上遇到过任何问题

好评

Maximilian 111

尼日利亚

我经常在这里交易大宗商品。它提供透明的费用和出色的客户服务,这总是我坚定的选择。

好评

Vegas

哥伦比亚

中国衍生品期货有限公司。提供多种交易应用程序,以防交易错误,非常贴心。而且公司有正式的监管机构,交易信息公开透明,我非常放心。

好评