公司简介

| NCC Bank 评论摘要 | |

| 成立时间 | 1985 |

| 注册国家 | 孟加拉国 |

| 监管 | 无监管 |

| 产品与服务 | 零售银行、中小企业银行、公司银行、数字金融服务、非居民银行、卡片、离岸银行 |

| 平台 | NCC Always(互联网和手机银行)、NCC 首次代币发行N(公司互联网银行)、NCC Green PIN、NCC Sanchayee(数字化入职)、客户自助服务(CSS)、报表门户 |

| 最低存款 | 500孟加拉塔卡 |

| 客户支持 | 电话:09666700008 |

| PABX:8802-223381903-4,8802-223383981-3 | |

| 传真:8802-223386290 | |

| 电子邮件:info@nccbank.com.bd | |

| S钱包导入格T:NCCLBDDH | |

NCC Bank 信息

NCC Bank 是一家成立于1985年的孟加拉商业银行。它为个人、中小型企业、公司以及其他国家的客户提供广泛的银行服务。它提供出色的零售和公司银行服务,但不允许提供外汇或投资经纪服务。

优缺点

| 优点 | 缺点 |

| 历史悠久的银行 | 无监管 |

| 广泛的零售和公司服务 | 复杂的费用结构 |

| 强大的数字和移动银行平台 |

NCC Bank 是否合法?

不,NCC Bank 不是受监管的外汇或投资经纪商。孟加拉国证券交易委员会(BSEC)和孟加拉国银行不授予该公司提供外汇或投资服务的许可,即使其总部位于孟加拉国。

产品与服务

NCC Bank专注于个人、企业和其他国家的客户。它提供广泛的银行服务,如零售银行、公司银行、中小企业银行、数字金融服务、NRB(孟加拉国非居民)银行和卡服务。

| 产品和服务 | 支持 |

| 零售银行 | ✔ |

| 中小企业银行 | ✔ |

| 公司银行 | ✔ |

| 数字金融服务 | ✔ |

| NRB银行(海外客户) | ✔ |

| 卡 | ✔ |

| 指导性利率信息 | ✔ |

| 离岸银行业务部(OBU) | ✔ |

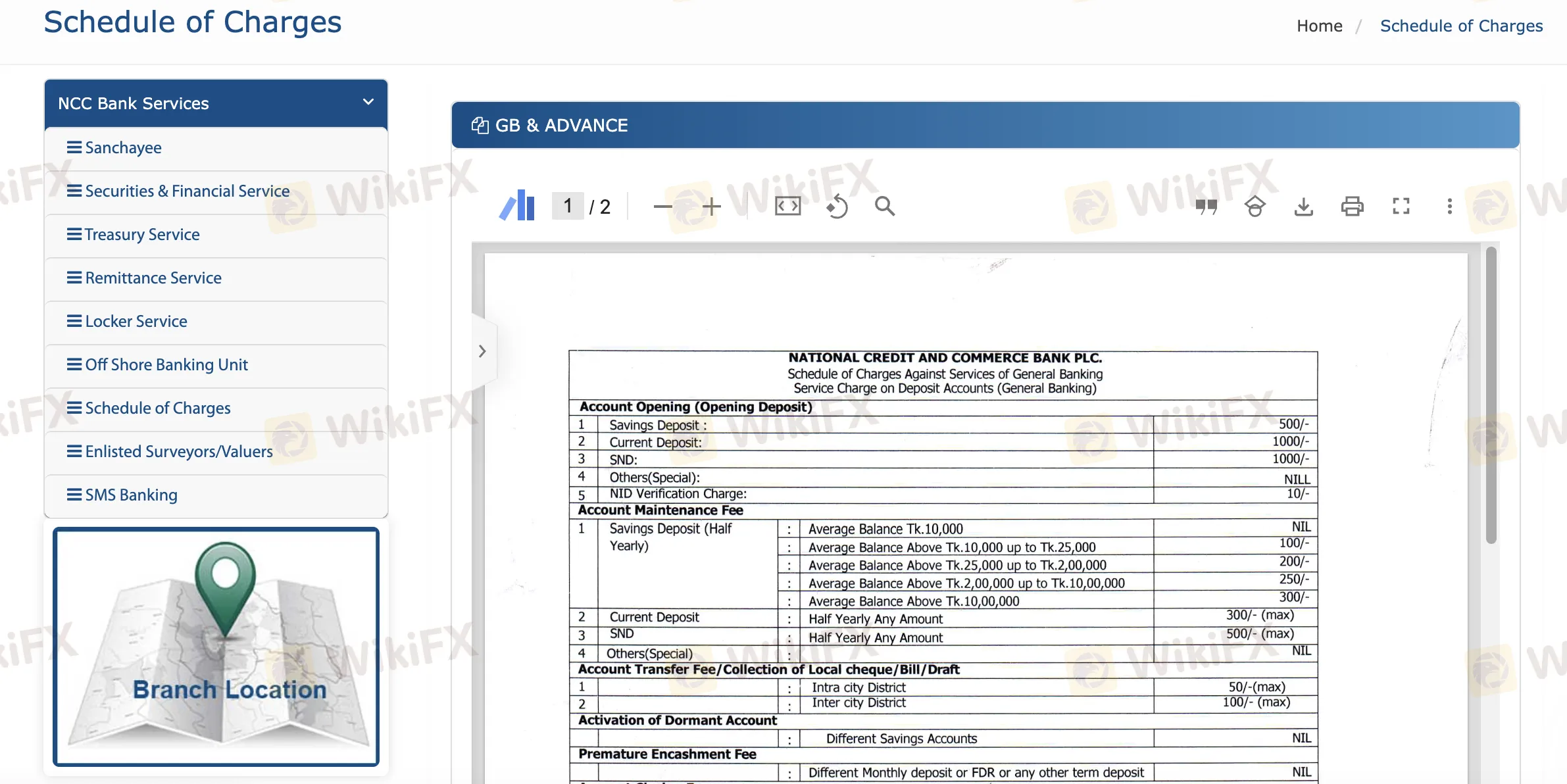

NCC Bank费用

NCC Bank的价格通常与该地区其他银行收费相比较合理。一些服务,如保持您的账户最新和进行简单交易,是免费或低成本的。然而,更专业的服务,如贷款、担保或重大交易,成本更高。

| 费用类型 | 金额/范围 |

| 开户费(储蓄账户) | 500孟加拉塔卡 |

| 开户费(活期账户) | 1,000孟加拉塔卡 |

| 账户维护费(储蓄账户) | 无至300孟加拉塔卡(半年一次,根据余额层级) |

| 账户维护费(活期账户) | 最高300孟加拉塔卡(半年一次) |

| 账户转账费(市内) | 最高50孟加拉塔卡 |

| 账户转账费(市际) | 最高100孟加拉塔卡 |

| 休眠账户激活 | 免费 |

| 账户关闭费(储蓄账户) | 200孟加拉塔卡 |

| 支票簿补发(遗失) | 每张支票7孟加拉塔卡 |

| 余额确认/对账单 | 100-200孟加拉塔卡(每次,过去一年记录) |

| 止付指令 | 每条指令100孟加拉塔卡 |

| 支付(PO) | 20-100孟加拉塔卡(根据金额) |

| DD, TT, MT | 20-300孟加拉塔卡(根据金额) |

| 贷款处理费 | 最高0.50%,最高50万孟加拉塔卡(最高15,000孟加拉塔卡);50万孟加拉塔卡以上0.30%(最高20,000孟加拉塔卡) |

| 贷款重组/重构 | 最高0.25%,最高10,000孟加拉塔卡(非CMSME) |

| 提前结清费 | 无(CMSME);最高0.50%(其他贷款) |

| 罚款 | 2% |

| 银行担保佣金 | 每季度0.30-0.50%,最低1,000孟加拉塔卡 |

| 在线费用(市内) | 免费(小额),50孟加拉塔卡(较大金额) |

| 在线费用(市际) | 免费(小额),100孟加拉塔卡(较大金额) |

平台

| 平台 | 支持 | 可用设备 |

| NCC Always(互联网和手机银行) | ✔ | PC,手机 |

| NCC 首次代币发行N(企业互联网银行) | ✔ | PC,Web |

| NCC Green PIN(卡激活和PIN) | ✔ | ATM,互联网银行,手机银行 |

| NCC Sanchayee(数字入职) | ✔ | Web,手机 |

| 客户自助服务(CSS) | ✔ | Web,手机 |

| 对账单门户 | ✔ | Web |